Gold Investments 2007 Review and 2008 Forecasts

Commodities / Gold & Silver Jan 02, 2008 - 09:47 AM GMTBy: Gold_Investments

Gold Price Review

Gold Price Review

Gold closed 2007 at $834.50 per ounce. Gold closed at a new monthly high close (and near record annual high and all time non inflation adjusted high) as investors again sought the safe haven appeal of gold. And with the dollar falling sharply again (last week recording its worst week against the euro in more than a year) – precious metals were well supported.

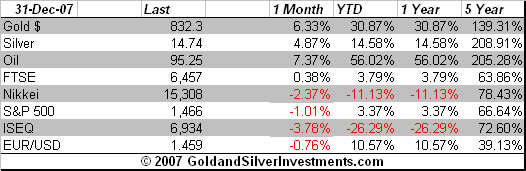

Gold had a weekly gain of 3.3%. The year-on-year gain was a very healthy 32%. Gold´s gain was the largest annual gain since 1979 (when its price doubled) and its seventh straight year of positive returns. Gold thus outperformed the majority of the world´s major stock markets once again.

The average gold price in 2007 was the highest ever, thus far. The average price thus surpassed the average price of 1980 and closed near record highs. Further proof if any were needed that this is no speculative blow off bubble rather the continuance of a real, sustainable multi year secular bull market.

At the London AM Fix on December 31th gold was trading at USD 836.50, GBP 417.62 and EUR 568.66.

It reached a new all time record in British pounds on December 29th at GBP 418.486 per ounce. It will likely do so in dollars and euros soon in 2008 and will likely again outperform other asset classes in 2008.

Fundamental Factors

All the demand factors that have made gold rally since 2001 remain in place and indeed some have intensified.

- The U.S. trade, budget and current account deficits remain near record highs and will likely lead to a weaker dollar and may even lead to the dollars status as the reserve currency of the world being challenged.

- Rising oil prices and peak oil. When we first wrote about peak oil in 2004 some dismissed it as a ´conspiracy theory´. Now the mainstream realises that peak oil is a reality and that higher oil and energy prices are a long term reality, especially with the emergence of the huge BRIC economies into the world economy.

- Record energy prices are leading to inflation and possibly stagflation. Adding to these real inflationary pressures are the as significant large increase in soft commodity and world food prices. As the peoples of Brazil, Russia, China, India and wider Asia aspire to the standard of living of the wealthy world, they are consuming far more meat, grains and other foodstuffs. This is coming at a time when climate change and drought is leading to lower yields for many soft commodities.

- Geopolitical risk and the "war on terror". Gold surged on the tragic news of Bennazir Bhutto´s assassination in Pakistan. Should radical Islamic factions take control in Pakistan they may gain control of nuclear weapons and pose significant risk to the U.S., U.K. and western world. Russia, Saudi Arabia, Iraq, Iran and Venezuela are some of the other many flashpoints which could create geopolitical instability and have ramifications for international markets.

- Record debt levels in much of the western world mean that consumers are not positioned to withstand any more adverse financial or economic conditions and this makes recessions in western economies more likely.

All these factors are leading to increasing global investor demand for safe haven assets & Central Bank demand for gold (China and Russia see below) in order to maintain full faith and provide stability to unstable currencies and monetary reserves. Sovereign Wealth Funds will also likely be diversifying into gold and this could be one of the big stories of 2008 with huge ramifications for the gold market.

This extra demand comes at a time when the supply factors are also very bullish:

- It is estimated that all of the above ground stocks of gold could fit into a 20 meter high cube. Gold is thus extremely finite.

- Gold production is stagnating and gold output in the leading gold producing countries continues to fall year on year despite higher gold prices leading geologists to wonder whether we have reached the point of peak gold production.

- It takes 10 - 15 years to take a mine to production.

- High energy prices making mining an expensive proposition.

- Environmental legislation stymies mine development.

- Many mines are in unstable countries and regions such as South America, Africa, the Middle East and Russia.

- Central banks sales have slowed and in some cases reversed; the Russian and Chinese central banks are two of the more significant buyers of gold in recent months.

Bursting Property Bubbles and International Credit Crisis

We have long pointed out the many risks listed above. And these have been added to by the international credit crisis, falling property markets and significant slowdowns in the UK and US economies. We have pointed out that there is real global financial systemic risk that the market was failing to acknowledge and price in. This real systemic risk is only now being acknowledged by many market participants and has yet to be priced into markets (with many western stock markets remaining near multi decade all time record highs).

This will likely change in 2008 and the increasing risk aversion that made an appearance in late 2007 will likely become an important factor in markets in the coming few years.

Changed Macroeconomic Climate and Changing Investment Zeitgeist

There will be an increasing shift from wealth growth and search for yield to wealth preservation and protection. Blind pursuit of capital gains while ignoring potential risk (as was the zeitgeist of recent years) will become a thing of the past. Protecting one´s wealth and one´s principle will become paramount. Credit ratings will again become a very important factor to be considered when choosing where to place capital, invest and save. The aim to achieve ´return on capital´ will be replaced by a desire to ensure ´return of capital´.

Money supply continues to accelerate internationally with money supply growth of at least 10% in most industrialised nations. (The gold supply is increasing at 1.5% per annum and this is decreasing.) Stake building and bail outs of western financial institutions by creditors in the Middle East and Asia and huge and unprecedented cash injections by western central banks will add to the surging money supplies. This is very inflationary and with faltering housing markets, slowing economic growth is likely to lead to a serious bout of stagflation. Stagflation was what propelled the gold market to return some 3000% from 1971 to 1980 ($35 to $850 per ounce).

Deflation reminiscent of the 1930´s is being warned of by some, and hyperinflation reminiscent of Germany in the 1920´s is being warned of by others. In all these deleterious economic environments gold will likely outperform other asset classes as it has done historically.

Conditions today are undoubtedly more serious than in the 1970´s as we are confronted with both stagflation and an unprecedented credit, banking and derivative crisis. This was not the case in the 1970´s. Unfortunately, Northern Rock will be remembered as the first 'run on the bank' of the 21st Century and not the last.

"Weapons of Mass Financial Destruction"

Derivatives or "weapons of mass financial destruction" as Warren Buffet called them and particularly credit derivatives are the elephants in the room that are not being acknowledged. Many have yet to realise that it is not subprime lending that has caused the massive and unprecedented losses suffered by major financial institutions; rather it is the high risk derivatives and "investment vehicles" that mortgages and many other forms of debt have been "securitised" or packaged into. These instruments while useful in managing and distributing risk when used responsibly can also, when used irresponsibly, obscure risk and leave the market dangerously exposed.

The U.S. Office of the Comptroller of the Currency recently released their Q3 Quarterly Derivatives Report. Incredibly one financial institution alone, J.P. Morgan, had a derivative book that increased from 80 Trillion at Q2 to 91.7 Trillion in notional at Q3 [this includes 7.77 Trillion worth of Credit Derivatives]. J.P. Morgan has done surpisingly well in recent months considering. $10 Trillion is nearly the size of the entire U.S. economy or value of all the goods and services traded in the U.S. on an annual basis.

These derivatives have led to the financialisation of the global economy where the value of all productive labour in creating goods and services is now dwarfed by these untested trillions of dollars worth of derivatives which have created unprecedented liablilities for western financial institutions and the traditional lenders of last resort - the western central banks.

The OCC also reported that the notional amount of derivatives held by insured U.S. commercial banks increased $19.7 trillion in the quarter to a record $172 trillion. The third quarter derivatives total is 36 percent higher than in the same period in 2006. Credit derivatives, the fastest growing product in the derivatives market, increased 19 percent during the quarter to a notional level of $14.0 trillion, 77 percent higher than a year ago. Credit default swaps are the dominant product in the credit derivatives market, representing 98 percent of total credit derivatives.

The OCC reported that the net current credit exposure, the primary metric the OCC uses to measure credit risk in derivatives activities, rose $53 billion during the quarter to $252 billion.

These new, exotic and largely untested financial products called derivative contracts are concentrated in a very small number of institutions. The largest five banks hold 97 percent of the total notional amount of derivatives, while the largest 25 banks hold nearly 100 percent.

Gold Deriviatives and the Gold Carry Trade

The Bank for International Settlements (BIS) reported that "total gold derivatives over the three-year period rose from $359 billion at end-June 2004 to $1,051 billion at end-June 2007, or in tonnes at period-end gold prices, from 28,200 to 50,250."

Thus despite massive de-hedging by gold mining companies in recent years, the amount of gold derivatives outstanding continues to increase significantly. 50,250 tonnes is some 1/3 of all the gold ever mined and more than what the world´s central banks are meant to have in reserve. This could lead to a huge unwinding of these derivatives in a massive short squeeze.

Informed observers are right to be concerned about the ramifications of the unwinding of the ´Yen Carry Trade´ (it hasn´t gone away you know). The ´Gold Carry Trade´ may have similar dramatic consequences.

Unfortunately, it seems likely that should the credit crisis worsen in the coming weeks and months as seems very likely these highly leveraged derivatives will be seen for what they truly are - "financial weapons of mass destruction". They may well lead to a systemic crisis of unprecedented proportions in western financial markets.

Globalised and Integrated Economy Creates Advantages and Risks

Modern globalised economies have become increasingly integrated building up greater interdependencies then at any time in human history. This interdependency while highly efficient in providing enormous productivity gains also exposes us to entirely new set of macro economic risks. These risks are not insurmountable but the current oversight and monetary management systems are ineffectual in delivering remedies. A cursory analysis of the fumbling and uncoordinated way the central banks of the world managed the current credit crisis bears this out. Indeed many of the institutions in existence today have been designed to manage local economies and their specific local problems. This new globalised economy requires a management solution that is far bigger, robust and more comprehensive then has ever been developed before. Some believe that we need a pan global oversight body that can coordinate responses between local central banks in a orchestrated fashion. The current political environment is far from conducive to such an effort on many fronts. International trade developments has left local fiscal and economic policy in the dust. Until the politicians realise that all of our local economies are interdependent and thus require a global management solution we will ride a potentially ever turbulent economic cycle that could exasperate political difficulties in the future.

The Real Saven Haven Asset

Gold is an asset with real intrinsic and tangible worth which is not dependent on the performance of corporations, financial institutions or governments or on the health of the wider economy. It is a finite monetary asset and the ultimate safe haven asset and it will again become the wealth preservation asset of choice.

Bonds are not a safe haven in an inflationary environment. Most bonds are near all time record highs in terms of price and most bonds will likely perform abysmally in the coming years as they did in the 1970´s. With governments printing money on an unpredented scale bonds will likely only offer protection in the short term. A bond is only as sound as the currency it is denominated in and thus one assumes significant currency risk in owning bonds.

Now more than ever every single individual, family, company and pension fund should have a healthy allocation to gold in order to hedge against and protect from the coming "age of turbulence" as Alan Greenspan has called it.

Precious Metal Predictions 2008

Gold

For the myriad strong fundamental reasons outlined above we believe gold will reach the pschological level of $1,000 per ounce in 2008. It could rally as high as $1,400 and will likely finish 2008 above $1,000 per ounce. While this may seem like a large move it would only be a less than 25% increase in price. Given the current macroeconomic and geopolitical climate this seems more than likely. However, markets can fall as well as rise and past performance is no guarantee of future returns. Crystal balls are possessed by none.

The inflation adjusted high of some $2,400 per ounce looks increasingly like it will be achieved in the next 3 to 5 years.

While we believe gold remains a great and essential investment, whether gold rises, trades sideways or even falls is not what is important. What is important is that all investors do not pay lip service to diversification. Now more than ever real diversification into gold is absolutely essential.

Silver

We remain bullish on silver and continue to believe it will outperform gold due to the extremely strong supply demand fundamentals. We believe silver will surpass $20 per ounce in 2008 and could reach as high as $25 per ounce.

PGMs

We are bullish on platinum but less so on palladium. Both could be subject to demand destruction in the event of a significant slowdown in the global economy. They do not offer the safe haven attraction that gold and silver (to a lesser extent ) do. A recession or depression would affect demand for jewellery in platinum´s case and affect industrial demand for both PGM´s. However, a small allocation to both is prudent in order to be properly diversified.

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@goldinvestments.org Web www.goldinvestments.org |

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Fair Use Notice: This newsletter contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of financial and economic significance. At all times we credit and attribute the copywrite owner and publication.

We believe this constitutes a 'fair use' of any such copyrighted material as provided for in Copyright Law. The material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for economic research purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

Gold Investments Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.