Robert Prechter Reveals Why he Embraced the Wave Principle

InvestorEducation / Elliott Wave Theory Jan 05, 2012 - 03:39 AM GMTBy: EWI

Robert Prechter is the widely recognized authority on the Elliott Wave Principle.

Robert Prechter is the widely recognized authority on the Elliott Wave Principle.

Read how he learned about the Wave Principle and why he embraced it in the edited excerpt from his book Prechter's Perspective below (Q&A format):

Question: What was it about Elliott that captured your attention?

Robert Prechter: I had seen some mentions of the Wave Principle in a few market newsletters and a couple of obscure books, and I decided that either this was someone's elaborate fantasy or it was an amazing discovery. I wanted to reject it from what evidence I could find or include it as part of my growing arsenal of technical analytical methods.

Q: How long did it take you to develop your "eye" for discerning these waves?

RP: About 30 minutes -- when I plotted my first hourly chart covering a few months. Apparently, there is such a thing as an eye for patterns. One person told me he had trouble finding the fives and threes. The key is to keep a chart. Most people have no trouble seeing the Principle at work.Q: You accepted it just like that?

RP: When you begin to see the five-wave impulses and the three-wave corrections unfold over and over, it does not take long for you to say either "I see, but I refuse to believe it," or "This is obviously what's happening; let's see how far it continues." It took about a year and a half of applying it until I knew that Elliott was absolutely right. I'm pretty hard-headed, and it takes substantial reason for me to accept a new idea. By that time, I decided I had seen what amounted to proof. I then said to myself, "This is unbelievable. How come no one is commenting on this? The market is pulling back to points he said it should pull back to in the patterns. It is rising up to levels he said it should, in ways he said it should."

Q: What was it that convinced you?

RP: The Wave Principle proves itself when you merely keep a chart. Once I did that, I recognized what was going on rather quickly. The wave patterns are repetitive and at times, over protracted periods, they are easily discernible.

--------------------

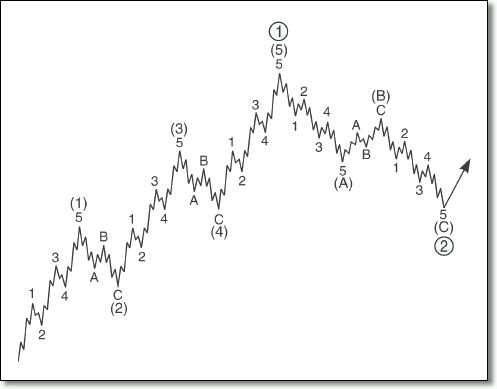

The basic Elliott wave pattern consists of impulsive waves (denoted by numbers) and corrective waves (denoted by letters). An impulsive wave is composed of five subwaves and moves in the same direction as the trend of the next larger size. A corrective wave consists of three subwaves and moves against the trend of the next larger size.

As the chart below shows, these basic patterns link to form five- and three-wave structures of increasingly larger size.

The Elliott Wave Principle helps to identify turning points in the trends of financial markets.

It does not provide certainty, yet the Wave Principle does provide a way to assess the probabilities of possible future paths of a given financial market.

Learn more in the free Elliott Wave Basic Tutorial The Elliott Wave Basic Tutorial is a 10-lesson comprehensive online course with the same content you'd receive in a formal training class -- but you can learn at your own pace and review the material as many times as you like! Get 10 FREE Lessons on The Elliott Wave Principle that Will Change the Way You Invest Forever |

This article was syndicated by Elliott Wave International and was originally published under the headline Why Choose the Wave Principle?. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Francisco Almeida

05 Jan 12, 16:26 |

He forecast gold would fall 40% when it was 1200.

He forecast gold would fall 40% when it was 1200. |