The U.S. Government Is Bankrupt

Interest-Rates / US Debt Jan 14, 2012 - 10:42 AM GMTBy: Casey_Research

Doug Casey, Casey Research writes: Everyone knows that the US government is bankrupt and has been for many years. But I thought it might be instructive to see what its current cash-flow situation actually is. At least insofar as it's possible to get a clear picture.

Doug Casey, Casey Research writes: Everyone knows that the US government is bankrupt and has been for many years. But I thought it might be instructive to see what its current cash-flow situation actually is. At least insofar as it's possible to get a clear picture.

As you know, the so-called Super Committee recently tried to come up with a plan to cut the deficit by $1.5 trillion and failed completely. To anyone who understands the nature of the political process, the failure was, of course, as predictable as it was shameful. What's even more shameful, though, is that the sought-after $1.5 trillion cut wasn't meant to apply to the annual budget but to the total budget of the next 10 years – a fact that is rarely mentioned.

Now whenever the chattering classes talk about cuts, it's always about cuts over the course of 10 years. Which is a dodge, partly because most of the supposed cuts will be scheduled for the end of the period, but also because new programs, new emergencies and hidden contingencies will creep in to offset any announced cuts. So the numbers below aren't a worst case; they're the rosiest possible scenario. People have thought I was joking when, asked how bad the Greater Depression was going to be, I answered that it would be worse than even I thought it would be. But I haven't been joking.

To sum up the situation, given its financial condition and the political forces working to worsen it, the US government is facing a completely impossible and irremediable situation. I'm going to try to illustrate that here. But because I'm a perpetual optimist, not a gloom-and-doomer, I'm also going to give you solutions to the purely financial problems – albeit with some good news and some bad news. The good news is, there actually are solutions. The bad news is that there is zero chance that any of them will be put into effect.

The problems are one hundred percent caused by the US government, not by bankers, brokers or the real estate industry – although they have been complicit. Recall what government is: an organization with a monopoly of force within a certain geographical area. Its purpose is, ostensibly, to protect the inhabitants of its bailiwick from the initiation of force. That implies three functions: an army to protect against aggressors coming from outside of its borders; police to protect citizens from aggressors inside its borders; and a court system to allow citizens to adjudicate disputes without resorting to force. Assuming you're going to have a government, it's important to limit it strictly, lest it get completely out of control – it's got a monopoly of force, after all – and overwhelm the society it's supposed to protect.

Here I want you to distinguish government from society. They are not only two totally different things, but are potentially antithetical to each other. This is because the essence of government is force, not voluntary cooperation. Everything that people think the government provides (beyond some forms of protection) is really provided by society or with resources the government has taken from society. It's critical to understand this, or you won't see the slippery slope the US is now sliding on.

Is there any chance that the US government can reform and go back to a sustainable basis at this point? I'd say no. Its descent started in earnest with the Spanish-American War in 1898, when it acquired its first foreign possessions (Cuba, the Philippines, Puerto Rico, etc). It accelerated with the advent of the income tax and the Federal Reserve in 1913. It accelerated further with World War I, when the government took over the economy for 18 months. The New Deal and World War II made the state into a permanent major feature in the average American's life. The Great Society made free food, housing and medical care a feature. The final elimination of any link of the dollar to gold in 1971 ensured ever-increasing levels of currency inflation. The Cold War and a series of undeclared wars (Korea, Viet Nam, Afghanistan and Iraq) cemented the military in place as a permanent focus of the government. And since 9/11, the curve has gone hyperbolic with the War on Terror. It's been said that war is the health of the state. We have lots more war on the way, and that will expand the state's spending. But the Greater Depression will be an even bigger drain, and it will likely destroy the middle class as an unwelcome bonus.

In all that time, from 1898 to today, there have been no substantial retrenchments of the US government, and the situation is getting worse, on a hyperbolic curve. Trends in motion tend to stay in motion until a genuine crisis changes them, and this trend has been gaining momentum for over a century.

Let's divide people into three classes – rich, poor and middle class. Rich people are going to be okay. They can bribe the politicians to change the laws, hire the lawyers to interpret the laws, the accountants to limit their liabilities, advisors to help them profit from distortions and travel agents to get them out of Dodge. They may get eaten later, but for the moment, don't worry about them.

The poor don't have much to lose, and the government is going to keep throwing benefits at them to keep them happy. That's a shame because it cements them to the bottom as poor people – but that's a topic for another day.

The real danger is to the middle class, and it's a serious matter because the US is a middle-class society. These are people who try to produce more than they consume and save the difference in order to grow wealthier. That formula has worked well up to now – but almost everybody saves dollars. What happens, however, if the dollars are destroyed? It means that most of what they saved disappears, and most of the middle class will disappear with it, at least for that generation. They'll be very unhappy, and they'll be up for some serious changes. I'll come back to those later.

The Budget

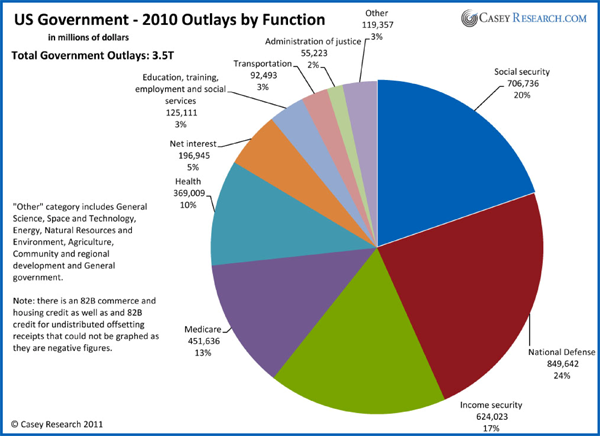

Take a look at the following pie chart of US government spending. It's cut into 10 slices, by function. The government used to break down and report its spending according to agencies – Defense Department, so much; Department of Agriculture, this much; FTC, that much. They've de-emphasized that and now seem to prefer reporting by function, because most of the agencies do many things. Actually, with thousands of agencies, departments, divisions, bureaus, units and contractors, it's impossible to figure out exactly who does what in the government. It's so large, so irresponsible and so unmanageable that the only solution is to abolish things wholesale. Bureaucracy naturally grows unless it's pulled out by the roots; reform, or pruning it back, is doomed to failure.

Justice

The chart shows a tiny little yellow sliver, 2% of the pie, equaling $55 billion, for administration of justice. That's the police and the courts – by far government's most important functions, but also by far its smallest expenditure. That's a lot of money, but how much of it is really necessary? Of the 2.3 million people currently incarcerated and the tens of millions more who are ex-convicts, parolees or otherwise "in the system," most are there because of victimless crimes, mainly drugs. In the Constitution, only three federal crimes are mentioned – counterfeiting, piracy and treason. Dope isn't there. Now there are over 5,000 categories of federal crime. Most of them should be abandoned to the states. So the most important function of the federal government could be cut back hugely.

Defense

This is the red chunk, 24%, equaling about $850 billion. The very title of this part of the budget is an Orwellian misnomer. Until 1946, there was a War Department (for declared wars) and the Department of the Navy (for miscellaneous foreign adventures). Regrettably, the Defense Department doesn't defend the US so much as its own budget. By having troops all over the world, they're actually attracting danger to the US. As you know, the US spends more on so-called defense than the rest of the world combined; in effect, it's bought a gold-plated hammer that makes everything start to look like a nail. Are there dangers in the world, and bad people? Absolutely. But bankrupting yourself while developing new enemies isn't an optimal response.

A bit of perspective is in order. World War II, by far the biggest war in history, is said to have cost 288 billion 1940 dollars. Today that's only a third of TARP. Of course, those were 1940 dollars, equal to perhaps about 4.1 trillion of today's units. One other thought about the military budget and where it's going: You may recall that, for a while after the Soviet Union collapsed, there was talk about a "peace dividend" of $50 billion. It seemed like a lot of money at the time, but it evaporated like water on a hot skillet.

Americans seem to love their military, if only because it's a part of the government that seems to work (at least when cost is no object), and it doesn't seem corrupt (at least below the level of the Pentagon). They'll be loath to cut military spending and hard pressed to do so with new wars clearly on the way. So it's likely to grow. That said, 90% of this piece of the pie should be eliminated before it’s too late.

Social Security

This is the big blue chunk, at 20%, for about $706 billion. People who receive it don't like to hear this, but Social Security is a classic Ponzi scheme, where late entrants are essential to pay early entrants. But it's worse than a Ponzi scheme because it's involuntary. It's justified by alleging "it's for their own good." But that's a lie, because it actually discourages saving on the part of the poor in two ways. First, it makes many believe saving is unnecessary because they figure they'll have Social Security to rely on when they're old. Second, it takes 6.2% off the top of an employee's pay, plus another 6.2% from his employer, up to $106,800 of earnings. That's over $13,000 every year that can't be saved. Further, it doesn't go into some mythical "lock box." It goes into the government's general revenue, and payments come out of general revenue. It's not somehow "set aside" anymore, as was once the case, when it went to buy a special class of government bonds. Even when that was the case, it was a fraud. Those bonds never represented savings; they just represented future tax revenues that would need to be extracted from future generations.

If the government insisted on making citizens save – itself a bad idea that I don't have space to dissect here – it should be in the form of an individually owned IRA. Chile has had these for 30 years, and as a result today the average Chilean has more net wealth than the average American. They have real assets in the form of shares, not a liability in the form of government debt.

What, then, is going to happen to Social Security? Right now, 12% of the US population are 65 or over, therefore eligible for Social Security. By 2030, that number is going to rise to 23%; about two workers will be supporting each retiree. That's probably impossible, but I doubt we'll have to confront the eventuality because the system is unlikely to last that long. It's a real time bomb, however, because few Americans any longer have sufficient savings to support them in their dotage. So don't look for any cuts here. It's become an insoluble problem.

Income security

This next-biggest item equals $624 billion, for 17% of the budget. It's a catchall of many different programs from many different agencies that could more accurately be termed "welfare spending." It includes food stamps for over 45 million. Unemployment benefits for perhaps 12 million more. Housing assistance for millions more. Pensions for federal employees and a myriad of other welfare benefits.

Can much of this $624 billion be cut? I would say it should be cut to zero. It's a morally corrupting influence and a financially bankrupting one. But because unemployment is going much higher and the standard of living is going much lower, there's not much chance of any cuts here. People now fervently believe this is what government is for – entirely apart from the fact that the unemployed and the poor are voters.

Medicare

At $451 billion, 13% of the budget, this item is growing the most rapidly. What should happen to Medicare? The answer, of course, is that it was the height of hubris and stupidity for the government to have created this cancerous monster – but that doesn't address the current issue. This isn't a question that lends itself to a technocrat's answer; even more than other categories of spending, it's a philosophical proposition. Let's address it from that direction.

What, historically, have men done upon reaching a certain age, when the body starts to desert you and you become an active liability to your fellows as well as to yourself? In pre-industrial cultures, the honorable course was to wander out into the wilderness (while you were still able), make your peace with reality and die. Eskimos would step out onto an ice floe and disappear. An especially loved or valuable person would be cared for – a good incentive to be loved and of value. Only a coward, a degraded and despicable person, would attempt to hold on to life at the active expense of others.

Of course we now live in relatively rich industrial cultures. But, I submit, the moral principles are the same. We now have savings, and if you save up enough, and if you want to dissipate your assets by putting yourself in a hospital bed, surrounded by strangers, with a tube up your nose for ten years before you kick the bucket – it's your money. But you certainly shouldn't require other people to do that for you – which is what Medicare is about.

The answer is to take care of yourself. If you think advances in technology can keep you alive to age 200, save the money to pay for it. Assuming you don't care enough for your progeny to leave them anything.

As with Social Security, the demographics for Medicare are disastrous. Again, 12% of the population now is over 65, but by 2030 it will be 23%, so, everything being equal, spending is going vastly higher. But it's much worse than that because of skyrocketing medical costs. Note that there is no necessity, in a free market, for medical costs to rise. Rather, they should be expected to fall, like the cost of most technology. But as medicine becomes ever more regulated and (theoretically) available to everyone, just the opposite will happen. This is one reason the FDA should be renamed the Federal Death Authority. By raising the prices of new drugs and devices literally tenfold, it probably kills more people every year than the Defense Department does in a decade.

Health

At $369 billion, 10% of spending, this is another Orwellian misnomer. People are, understandably, willing to pay most anything to preserve their health. But the government's spending has almost zero to do with health. Health is something you and only you are responsible for. You maintain it by proper diet, exercise and general lifestyle – plus a dollop of good genes. It's inaccurate and deceptive to call medical care health care. Medical care is needed for emergencies, but it's a poor substitute for health care.

So where does all this money go? Part of it is Medicaid, for people too young to qualify for Medicare and too poor to pay their own bills. Many are the morbidly obese types you've seen fighting for bargains at the Black Friday sales at Walmart. Some funds go to buy a scooter for an oldster – you've seen the ads on TV, an excellent scam for the companies marketing them. If health is what is wanted, the answer lies partly in abolishing public housing and food stamps; some people might actually go out and exercise. The whole thing is corrupt from top to bottom.

Where is this item going? If Obamacare goes into effect, vastly higher. Medicare and Medicaid are exact templates for Obamacare.

Education, training and social services

Here we have $125 billion, but that's only 3% of the budget. Most of it is direct school expenditures and school subsidies. Of course education is a good thing, but I don't feel out of line saying that most government schooling amounts to indoctrination – or just day care. It should be abolished and education left to parents (who are more interested in their kids than any bureaucrat) and to communities, churches and entrepreneurs.

Much of the money is for higher education, most of which is doled out in places where kids go to misallocate four to six years of time, pick up bad habits, acquire destructive notions from professors and incur a pile of debt that they can't get rid of. Between the bad ideas and the debt, they graduate as serfs – psychologically from their classes, financially from having to pay for the experience. Education, like health, is something every individual must acquire on his own; throwing other people's money at schools to keep kids sitting at desks is counterproductive. Taking a hard science, math, medicine or engineering course in school is one thing; taking courses in political science, English and gender studies is something else. 90% of the universities and colleges in the US should, and would, go bankrupt without federal aid. But since it's anathema to cut education funding, there's no help from this quarter.

Transportation

$92 billion per year, 3% of the budget, is a lot to spend for highways that are falling apart; the interstate highway system should be privatized and run as toll roads. The government railroads, Amtrak and Conrail, are disasters; they, too, should be privatized. Air traffic control, which the FAA provides with technology from the '50s, should be the province of the airlines or of privately owned airports.

The TSA is part of this slice, and it's expanding. It now has sixty thousand employees providing "security theater" not just at airports but bus stations, highways and NFL football games, where you have to be examined at the gate.

General government

Note the violet slice labeled "other," for $119 billion, or 3% of the budget. This catchall includes general science, space and technology, natural resources, environment, agriculture, community and regional development. Other than the police agencies, the military and the courts, this category encompasses most of the government's traditional – which is not to imply necessary – functions and services.

Let's look at a few random items, mostly for amusement, since it would take a large book to even summarize the government's budget. It's a vast array of miscellany, including flood insurance nobody else will sell you because you chose to build your house on a flood plain. It encompasses the $2.7 billion Bureau of Indian Affairs, which has forever been the most corrupt agency in the government but still exists 125 years after the frontier was closed. It includes the FCC, with its $1.2 billion budget (a trivial cost relative to the economic distortions it pays for). Although the agency serves no useful purpose, its average employee makes $147,000 per year; but then the average government employee makes $74,311 per year, which itself is 40% more than the average private-sector employee. The FDIC, which provides stickers on bank doors to bolster confidence in failed institutions, has $3 billion of assets left to insure over a trillion dollars in deposits.

The General Government slice also includes the national parks and administration of the roughly one-third of the US that is directly owned by the US government. Of course all that should be privatized; it's dead capital. The US government should not be in the real-estate business or any other business – like the Post Office, which currently runs an $8 billion annual deficit. Perhaps some of its employees would "go postal" if its assets were sold off, but many would qualify for a job at FedEx or UPS. It includes NASA, which has devolved into just another turf-protecting bureaucracy, slowing down the development of the private space industry. It should be sold; I doubt they could get much for it, but that beats a $14 billion expenditure every year.

Interest

The US government made net interest payments of $196 billion, for only 5% of the budget. It seems like a reasonable enough figure, financing so many laudable projects, and small by comparison to other categories. As I've indicated above, the other categories of spending are likely to grow – but interest will explode. I expect, in the next few years, it will become by far the largest category of spending, possibly larger than the next two largest put together, even while most of the others grow like cancers.

The reason is simple. Right now interest rates are at extremely low levels. That's partly because few people want to borrow in today's uncertain climate. But it's also because rates are being suppressed by the government. They want to "stimulate" the economy with low rates – so people can borrow more and they can avoid default for a while longer. And the US government is itself, by far, the world's largest debtor. They have $15 trillion in official national debt, on which they are paying $200 billion per year in interest. Most of that debt is short term, with less than a year to maturity. At some point very soon, they won't be able to roll over most of that $15 trillion, in addition to floating $1.5 trillion of new debt incurred each year, at anywhere near current interest rates.

At some point, we'll see rates go to the levels of the early '80s, when The Long Boom started. And probably even much higher. But even at 12%, the interest cost alone would be $1.8 trillion per year – a completely unbearable amount. But it's also both inevitable and imminent.

As unnecessary, corrupt and destructive as almost all of the federal budget is, I suppose the government could get by for a good number of years to come, on some basis. As Adam Smith accurately put it, there's a lot of ruin in a nation. But as the current financial crisis in Europe is illustrating, debt can bring it all to a head very quickly. The US is only slightly behind the Europeans. The same is true of China and even truer of Japan.

Denouement

My point is to make it very apparent that there really is no conventional solution to the US government's financial crisis. It's reached a stage where the government will have to start defaulting on some of its obligations. You decide which. The only questions are political; the economics are quite clear. Nothing will be done, as the Super Committee showed. I believe they would have done something if they thought it possible and knew how.

Actually, the situation is much more serious than what I've briefly illustrated. We've only discussed one aspect of the income statement, which itself is enough to bring down the whole structure, and soon. We haven't discussed the government's balance sheet. Estimates vary, but the US government has direct and contingent obligations that go far beyond its $15 trillion in accumulated borrowing. The present value of its Medicaid, Medicare, Social Security, veterans, financial insurance and numerous unfunded liabilities might be another $200 trillion. Nobody knows, and it's probably impossible to calculate.

So, the US government will go bankrupt. That's not the end of the world. Lots of governments have gone bankrupt, some of them numerous times – like almost all of them here in South America, where I am at the moment.

In fact, there's a temptation to look forward to it eagerly. After all, the state is the enemy of any decent human. One might hope that when they bankrupt themselves, maybe we will get to live in a libertarian paradise. But that's not likely the way things will come down; rather, just the opposite. Not all state bankruptcies are just temporary upsets. Most of the great revolutions in history have financial roots. Great revolutions are more than just unpleasant and inconvenient; they're extremely dangerous.

The French Revolution of 1789 was brought on by the financial collapse of the French government. It was a good thing to depose Louis XVI, but things didn't get better – they got much, much worse with Robespierre and then Napoleon. In Germany, the destruction of the German mark in 1923 set the stage for the Nazis – and then the Depression ushered them in. The collapse of the Czar's regime in Russia in 1917 seemed to be good news at first – but then things got worse, and they stayed worse for a long time.

The fact is that when a government collapses, especially when the government is providing all the things the US government does today, people want somebody to fix it; they want their goodies back. It's well known that over 50% of the US population are net recipients of state largess. And the degree of state support and involvement in the US is far, far greater than it was in France, Russia or Germany. After a period of chaos, it's always the people who are most political, who have the most rabid statist ideas who get the public's attention and rise to the top.

It seems highly likely that the US will get a savior, someone full of bravado, who assures the booboisie that he can straighten things out – if he is given sufficient power. Perhaps it will be an arrogant windbag like Gingrich, perhaps some general. The government won't wither away; it will reassert itself. I don't see any way around it, actually. We are already moving into a police state (evidenced most recently by the Senate's Nov. 2 vote allowing the military to indefinitely incarcerate anyone they accuse of terrorism). But at least it's a police state with a fairly high standard of living, one with Walmarts, McDonalds, and SUVs – at least for the time being.

But rest assured that if the situation evolves the way I expect, the standard of living will drop steeply, financial markets are going to become chaotic and the US will become a quite repressive place for some time – at least as long as the War on Terror lasts. I will bet you money on this. In fact, I am betting money on it.

So what can you do about it? Well, actually, there is nothing you can do about it. At least as far as changing the course of history is concerned. The best you can do is to speculate intelligently on further, new distortions that will be cranked into the system, as well as others that are inevitably going to be liquidated.

It seems to me that this is a trend that can no longer be turned around. The US government's budget is, in fact, the biggest thing in the world; it won't be turned around, because it is like a gigantic snowball rolling down a hill. It will only stop when it smashes into the village at the bottom of the valley. The best thing you can do is capitalize on it as well as you can and get out of its way while you do.

[If Doug is right and this trend cannot be reversed, the time to start preparing for what's ahead is right now. This free investor briefing will help you get started.]

© 2012 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.