The Best Ever Stock Market Indicator

InvestorEducation / Technical Analysis Jan 15, 2012 - 10:15 AM GMTBy: PhilStockWorld

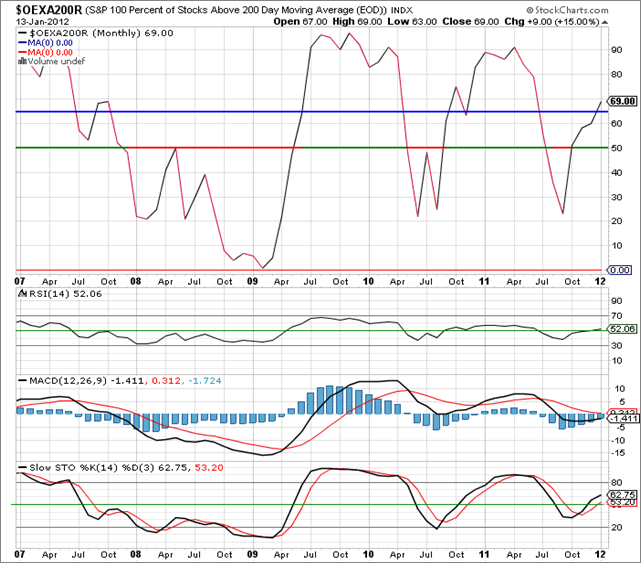

Courtesy of Doug Short. The $OEXA200R (the percentage of S&P 100 stocks above their 200 DMA) is a technical indicator available on StockCharts.com that can be used to forecast conservative entry and exit points for the stock market.

Courtesy of Doug Short. The $OEXA200R (the percentage of S&P 100 stocks above their 200 DMA) is a technical indicator available on StockCharts.com that can be used to forecast conservative entry and exit points for the stock market.

See Is This the Best Stock Market Indicator Ever? for a discussion of this technical tool.

The chart below is current through the January 13 close.

After a major S&P correction, the conditions for safe re-entry into the market are when:

a) $OEXA200R rises above 65%

And two of the following three also occur:

b) RSI rises over 50  c) MACD cross (black line rises above red line)  d) Slow STO (black line) rises over 50

Interpretation:

OEXA200R remained encouragingly above 65% all week and ended at 69%. Of the three secondary indicators:

- RSI is above 50 and positive.

- MACD has not yet crossed into positive territory.

- Slow STO is above 50 and positive.

Conclusion:

The market has become tradable. However, traders must stay on their toes and keep the following Commentary in mind.

Commentary:

All eyes remain on Europe. Simply put, it is a Pandora’s Box of completely unknown proportions. Europe could muddle through. Or, problems could already be at such a saturation point that a single unfortunate event could be the trigger for another financial avalanche. We simply don’t know. What we do know is:

- There is more than 457 billion euros of Euro zone government debt due to be repaid in the first quarter of 2012. Can Europe withstand that stress?

- The euro continues its downward trajectory against other currencies.

- Sovereign credit rating downgrades occurred late Friday. Greece and her creditors are eyeball-to-eyeball.

- No one has the slightest idea what the derivative exposure of European banks is nor the extent of the bail outs they will most likely need.

- A regional recession seems a foregone conclusion, as does the unraveling of the Euro zone and euro in some form, relatively controlled or not.

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2012 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.