Gold Mega Move Underway, Stay With It!

Commodities / Gold & Silver Jan 04, 2008 - 06:09 PM GMTBy: Aden_Forecast

As we enter 2008, gold is hitting a new record high. That's a great way to kick off the new year and it looks like there's a lot more to come. Why?

As we enter 2008, gold is hitting a new record high. That's a great way to kick off the new year and it looks like there's a lot more to come. Why?

This commodity upmove is over six years old, yet it's still young and it'll likely last another decade before it's over. The falling dollar has certainly given the commodities a boost and there's really no reason why the dollar will strengthen next year, which is a positive sign for the commodities.

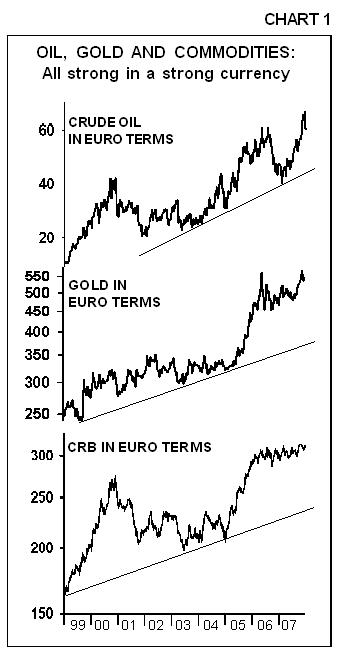

But it's important to keep in mind that this is not just a reflection of the weak dollar. Most telling is to see the commodities in a strong currency, like the euro. Chart 1 shows this clearly. Be it oil, gold or the commodity index, they are all rising in a strong currency.

This is most impressive because it shows that a true commodity upmove is underway.

GOLD RISE IS SOLID

Gold is now at a new high in U.S. dollar terms. It's also at record highs in other currencies.

This reflects a strong rise, yet most people don't realize that gold's at a record high within an almost seven year old bull market! Gold's been up every year since 2001, and 2007 was not an exception. Gold gained 31% in 2007, yet most investors do not own gold. That's going to change. As higher gold prices begin to attract attention, investors will notice and they'll jump in too. That's when gold will start soaring. That's not happening yet, but it will and probably sooner rather than later.

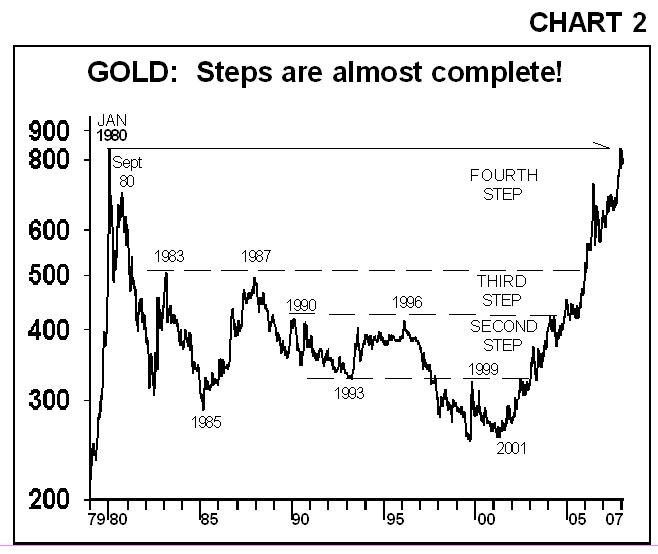

Steps about complete

If gold stays above $850 it will have completed its fourth step of the bull market. Chart 2 shows that gold entered the fourth step in December 2005, when it broke above $500. That in itself was a milestone and gold started to break away from the dollar. Gold has been rising steadily since then. By staying above $850, the steps will be complete and gold will be entering a new stronger phase of the bull market.

Gold stronger than many markets

Gold has a lot going for it. It's strong compared to several currencies, and it's stronger than the stock and bond markets.

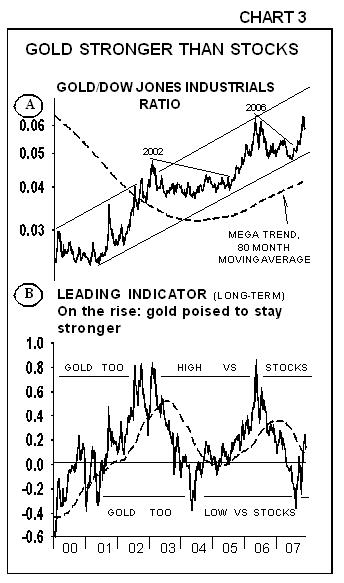

Chart 3A shows that gold has been stronger than the Dow Industrials since 2000. This was a major change and the trend in the ratio clearly favors gold on a mega trend basis. The ratio reached an intermediate low last July while the indicator (B) was at a gold too low area. Both have been rising since then showing that gold has been outperforming stocks and it's poised to stay stronger.

There are many reasons why gold's bull market has further to run, and the ongoing political and financial uncertainty in the world are just two important reasons why. Recent events in Pakistan have further reinforced this.

Gold is a safe haven, which is why demand is rising. Even though gold's bull market turns seven years old in February, it's strong and solid, and a buy and hold strategy is the best way to make the most profits… ride the mega-major wave to completion and keep in mind that the long-term trend has a lot further to run.

By Mary Anne & Pamela Aden

Mary Anne & Pamela Aden are well known analysts and editors of The Aden Forecast, a market newsletter providing specific forecasts and recommendations on gold, stocks, interest rates and the other major markets. For more information, go to www.adenforecast.com

Aden_Forecast Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.