No More Safe Havens, Avoid Counterparty Risks

Commodities / Gold and Silver 2012 Jan 17, 2012 - 08:06 AM GMTBy: William_Bancroft

In this brief article about Safe Havens for investors we look at equities, bonds, and the current situation within the financial system, before asking whether gold bullion is being overlooked. We look at the degree of participation by institutional investors in the gold market and notice that they seldom invest in gold.

In this brief article about Safe Havens for investors we look at equities, bonds, and the current situation within the financial system, before asking whether gold bullion is being overlooked. We look at the degree of participation by institutional investors in the gold market and notice that they seldom invest in gold.

John Plender writes in yesterday’s FT that the pool of “super safe assets” is shrinking, whilst legal and advisory firms around the world scramble to prepare their clients for the implications of new currencies (or should I say old currencies returning in new guises).

Mr Plender considers whether “investment performance this year will hinge even more than in 2011 on making the right judgement on the evolution of Europe’s sovereign debt crisis… where a weak banking sector undermines the sovereign sector and vice versa”.

We are told that whilst the emerging markets have failed to perform as a haven, with the MSCI Emerging Markets Index falling 20.6% last year, only the highest quality bonds can be considered as insurance against the potential storm.

Searching for safety

The problem is that the range of depth of these potential high quality bond markets is shrinking.

The non-financial sector is sitting on huge cash piles, but not issuing much debt to fund investment. Good quality corporate debt is not as available as institutional investors would like, and certainly not with the depth of market they require. Mr Plender informs us, “global triple-A rated corporate issuance was down to $218bn in 2011 compared with $450bn in 2006”. Within this total, “US companies issued only $9bn compared with $140bn in 2006”.

All the while the apparent huddle of sovereign borrowers investors can bank on is being eroded by these financial tides; rather like the sea lapping at a group of sand castles. The debt pressures in Europe are still the proverbial tinder box within the global financial system, although other highly indebted entities, states, and municipalities might be enjoying a temporary respite from Mr Market’s revealing spotlight.

Whilst the UK gilt market and US treasury market are suggested for capital searching for a safe home, negative real yields abound. Things are still bad enough that many investors are willing to pay nations such as Germany to borrow from them, although Mr Plender urges that even Bunds cannot be regarded as safe.

The US treasury market is also not currently as liquid as global investors need, with the Federal Reserve buying so many treasuries itself as part of QE (are we QE2, 3, or ‘constant’ now?).

The problem is that market participants “are demanding more and higher quality collateral, which leads to further shrinkage in the pool of safe assets”. This is occurring as Merkozy’s policy of endless muddling is being put to its most severe test.

Can we take this analysis further?

Mr Plender is on the money with much of his analysis, which updates us on just how few corporate or sovereign bonds are really safe these days. However, one thing strikes us as peculiar within Mr Plender’s analysis.

In his discussion of super safe assets he only considers financial assets whose value depends on the performance of a counterparty.

These assets only have any value if the other side does what they promised. Bonds and debt instruments are only of value when the borrower pays you interest, and eventually returns the principal. Otherwise investors suffer through default.

As students of the Austrian school, and perceiving levels of significant and potentially unsolvable stress in the financial system, we find this notable.

In an environment of negative real rates and heightened systemic risk, should investors not look to other financial assets that hold no default risk?

When counterparties have little faith in each other, why not look to assets outside of the financial system?

What about gold bullion?

It seems imprudent to us not to even think about this. Gold and silver bullion have served as safe havens, and the ultimate form of money for millennia. Central banks are certainly discovering their allure once more, in what we perceive to be a great resetting of precious metals within the monetary system. Even now gold mostly makes up a pitiful percentage of central bank reserves.

So why should institutional investors not look at gold or silver?

Institutional investors could be deemed a herd of elephants within the global capital markets, yet they have not even dipped their toe into gold. Insurance firms and pension funds are not part of the gold market.

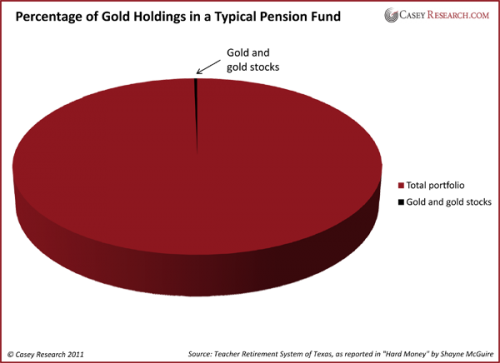

Shayne McGuire of the Teacher Retirement System of Texas, found the typical pension fund holds about 0.15% of its assets in gold. He estimates another 0.15% is devoted to gold mining stocks, giving us a total of 0.30% – that is, less than one third of 1% of assets committed to the gold sector.

This chimes with findings from one of our favourite research houses, Casey Research.

We suspect that some of this institutional money will come searching for gold over the next few years as more ‘safe havens’ fail to perform. Due to the gold market’s relative size, this could have an outsized effect on the gold price. This is to be expected should large pools of capital try to squeeze into a small market.

Avoid counterparty risk

However, even if gold was to maintain a constant price level throughout this year, we would prefer to hold a significant part of our wealth in gold bullion, than lend to the sovereign and corporate debt addicts of the world.

The lack of counterparty risk defines gold (and silver, gold’s volatile and some say better looking little sister). This lack of default risk shines for us right now.

We suspect it will continue shining for a good few years to come, even though there may be bumps in the road to test gold investors along the way. The Swiss banking tradition has always understood gold in this way, and advised its clients to always keep around 10% of their portfolios allocated to gold. Some Swiss advisers urge more, and in this case we listen to the bankers of the world.

For an asset to be “super safe” surely having significant default risk is unacceptable?

Ready to buy gold and silver? Get started in minutes…

Will Bancroft

For The Real Asset Company.

Aside from being Co-Founder and COO, Will regularly contributes to The Real Asset Company’s Research Desk. His passion for politics, philosophy and economics led him to develop a keen interest in Austrian economics, gold and silver. Will holds a BSc Econ Politics from Cardiff University.

© 2011 Copyright Will Bancroft - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.