You’d Have To Be Crazy To Start a Global Business in the USA – As a Public Company

Politics / US Politics Jan 23, 2012 - 03:17 AM GMTBy: Ron_Holland

I'll bet you don't know that I may be the first person in recorded history to move voluntarily from the warm beach and golf resort of Hilton Head Island, South Carolina to cold and snowy Toronto, Canada. But Steve Wynn and many other entrepreneurs forced to deal with the multitude of regulatory agencies at the federal, state and local level would likely agree. America’s growing number of bureaucrats – all with their hand out to exchange fees for paperwork – can make it impossible to compete in the global economy from the US.

I'll bet you don't know that I may be the first person in recorded history to move voluntarily from the warm beach and golf resort of Hilton Head Island, South Carolina to cold and snowy Toronto, Canada. But Steve Wynn and many other entrepreneurs forced to deal with the multitude of regulatory agencies at the federal, state and local level would likely agree. America’s growing number of bureaucrats – all with their hand out to exchange fees for paperwork – can make it impossible to compete in the global economy from the US.

"The climate for business is frightening here," he says, and that's why he's moving half his operation to Macau. – Steve Wynn, the entrepreneur who led the rebirth and explosive expansion of the Las Vegas Strip in the early 1990's.

I’ve been retired for some time from the investment business after years working as the president of a broker/dealer licensed in 47 states. And up until a few weeks ago, I lived just a few steps from a warm-water beach; when not writing on financial and freedom topics, I enjoyed everything the Hilton Head resort lifestyle had to offer. Now I’m in the process of moving to cold Toronto, where I will walk my dog in zero-degree weather instead of on a sunny beach. You might think I’m crazy to have made the move, but read on.

Peace of Mind Rather Than Tax Savings – Although Americans who live and work offshore do receive substantial tax exclusion if they meet certain requirements this isn’t why I’m moving offshore. In addition, offshore working American’s get to take a credit against US taxes for foreign taxes paid in most major nations. This helps to offset the big disadvantage of being an American citizen as the US is the only major nation in the world that taxes its citizens on their worldwide income

Frankly I’m excited to pay equal or higher taxes to a new nation that never attempted to draft me to fight in Vietnam, doesn’t harass me or my wife when getting on a plane or crossing a border and has never made my life miserable. Also Canada is sort of like Switzerland as the nation isn’t exactly the terrorist magnet of the world like the US and their economy is booming and its sovereign debt level is reasonable.

Hair Or the Lack Of It Never Bothered Me – This move to Canada began with a chance meeting in a plane with my friend Ian. Back in September of last year, I was heading down the isle of a plane far from where either of us lived, and I heard a "Hi Ron." I wasn't expecting to meet anyone I knew on the flight, but just to my left sat Ian and his wife – except it didn’t quite look like Ian, and I wasn’t sure why. We exchanged the usual pleasantries, and I made my way back to my seat. I sat there for a few minutes trying to figure out what was different about him. Then I realized what it was … he used to be bald on top, but now he had a new crop of natural hair on the top of his head.

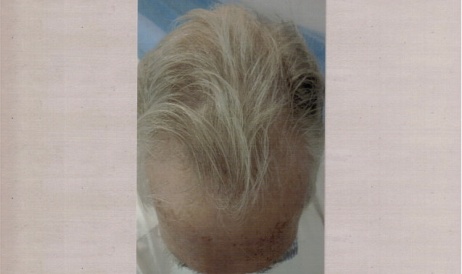

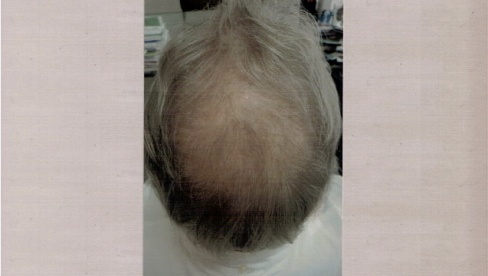

Take a look for yourself at my 66-year-old friend and his before and after photos. And he's only half way through the therapy!

8 months into the 2-year therapy process, these are the impressive results:

So I’m swapping Hilton Head for Toronto because I saw the opportunity of a lifetime with a company that has developed a medical therapy for restoring natural hair growth. It produces what millions of people long for – live, growing hair. And the therapy has been demonstrated to be effective for 85% of men and more than 92% of women based on thousands of treatments.

They want to turn the hair treatment system into a business and plan to dominate the world market for hair restoration and hair loss prevention. I guess I should say "we" because I’ve been named the company’s CEO. You’ll still get my regular editorials on freedom, liberty and free-market alternatives on LewRockwell.com, theDailyBell.com and other free-market websites, but I couldn’t pass this opportunity up.

How I Lost the Argument To Locate the Company Headquarters in the US

After all, I’ve been to Canada many times and it does get really cold up there and not a palm tree anywhere. I gave it my best and they countered with CNBC’s "The World’s Best Places to Live in 2011" showing me where Toronto was 15th in the world.

I knew I had them, responding "only 15th, well what American cities rank higher than Toronto in the ratings." They responded with "no American cities even made it in the top 15" even though CNBC sponsored the slide presentation.

I followed up with ease of air travel to and from the US as I know our airfares are often less expensive than Europe and Canada and this will be an international business. That was a mistake as many of the company partners and associates are from outside America. They responded with "try flying into the US without an American passport as they often treat us like criminals." Well I had to agree with them here as I fly in and out often and it is a different story for those in the long lines for non-American passport holders.

Anyway, we continued to argue bureaucracy, tax-rates, crime, friendly law enforcement, victimless crimes, the Patriot Act and how the American sovereign debt, the dollar and how the nightmare of our political institutions – except for the Ron Paul Campaign – threatens every American citizen and business. I lost the argument so I’m now moving to Canada to become CEO of a new start-up company with a viable solution for people suffering from the effects of unwanted hair loss and baldness – both males and females.

Some Thoughts On Start-up Companies

"Start-ups can be like porn in a way: they can be fun and interesting, but most of the time pretty disappointing… another analogy is a lottery ticket." – Lorien Gabel, chief of start-up Pingg

Normally I would agree with Gabel (quoted above). Although investing in start-ups can buy you a lot of excitement, most of them end up doing absolutely nothing that's profitable. They're like buying a lottery ticket. Having won over $4,500 many years ago playing quarter slots while waiting for my wife to dress for dinner, I know you can win, but it doesn't happen often.

But on the other hand, as Apple, Amazon and other winners have shown, if you have a unique product or service that people really want and are way ahead of the competition, your odds of winning big go way up, especially if you get in early. I believe our hair therapy system is certainly unique, I've seen it work, and it totally out-delivers against the competition.

The global hair restoration market is huge. Although most men and women want a full head of hair, by age 35, two-thirds of American men suffer some degree of hair loss, and by age 50 nearly 85% have thinning hair (male pattern baldness). Half of all women suffer from thinning hair, usually beginning after age 50.

How many readers wish they had invested early in a ground-floor opportunity with Apple? Or consider Peter Thiel, the co-founder of PayPal, and his $500,000 angel investment in Mark Zuckerberg’s Facebook in 2005. It is now worth better than $2 billion.

A 2012 Opportunity – I see a real cure for baldness as potentially a very profitable opportunity for early investors like myself. Of course there are risks. Delay in regulatory approval is the first one I think of. But the biggest one is something you can't measure – the unforeseeable. That's why I took the CEO job as I I want to be in a position to deal with any problems that might get in the way.

I wish I had bought gold at $400 an ounce or silver at $5.00 or bought Apple in the early years. Life is full of profitable trades if one has the foresight, opportunity and ability to act. How about oil futures at $15 a barrel, or if I had seen where the Internet or cell phones were headed? Still, timing and control are everything in investing, and as part of top management here I can use my energy and experience to make things happen. And as for timing, this is about as early as an accredited investor can get involved.

Actually the United States will lose all the way around with this venture, at least for now. No American will be able to access the treatment in the US before we receive FDA approval, which will probably take years unless they travel outside the country. This delayed business in America will result in lost tax revenue for a federal government that is desperate for revenue.

Second, many hair-loss suffers will wish to seek immediate treatment rather than waiting on regulatory approval in their home countries. Fortunately, some countries, including popular international travel destinations, have positioned themselves as centers for innovation by avoiding paralyzing regulations.

So we are planning to open our first clinic in Panama by May of this year, to be followed by Mexico, Grand Cayman and the Bahamas. Then we will replicate the model in other regional markets around the world until regulatory approval is received in the U.S., Canada and Europe.

As for our corporate structure, well there is some irony in the whole thing. See it turns out that America is still a great place to incorporate a PRIVATE company, as long as you have a team of quality international tax advisors with truly international experience. There are plenty of legally compliant tax treaties that can dramatically reduce their corporate tax burden for any company with the wherewithal – financially and otherwise – to avail itself of those benefits.

But back to the central point of I am trying to make here … the fact is that as an American company you can build a large company without crossing the regulatory lines that bring you into the public company sphere. This makes America still a favorable place to be for people seeking to build value and who need to bring in an expanding base of value-added financial partners (investors) to help make the vision a reality.

My partners have convinced me that the great American Dream experienced and praised by our fathers and grandfathers is still alive today. Simply put, it is OK to build around an American private equity base, but you have to go outside America to really maximize the opportunity from an after-tax perspective. It is somewhat complicated, as anyone who fills taxes with the IRS surely knows, but suffice it to say that when you are dealing with Intellectual Property (IP) that has in no way ever been developed in the US, it is imperative not to bring the IP into the US if you wish to retain offshore tax status.

And since we believe the market for the millions of people that will embrace a REAL solution to their hair loss problem is extremely profitable, it makes sense to maintain the incorporation only in the US and all other operations outside – other than US domestic-based operating clinics once the FDA approves the core drug, assuming they do approve it.

In summary, I believe a cure for baldness combined with our tax-advantageously-designed business plan positions our little company to be one of the greatest businesses opportunities of my lifetime. And I, along with a quality team of self-starters are prepared to make the journey a long, enjoyable and fruitful experience for all.

If you are losing hair and want to learn more or an accredited investor wanting to know more, feel free to contact me for more information at the e-mail in my bio below.

Until my next editorial, I’ll probably be freezing but feeling free and prosperous in Canada. And by the way, vote for Ron Paul as if he becomes president this just might be my ticket home. In the meantime, I’m going to find out just what a cure for hair loss might be worth.

Ron Holland [send him mail], a retirement consultant, works in Zurich and is a co-editor of the Swiss Mountain Vision Newsletter. He is the author of the special report, "Get Ready To Escape the Obama Retirement Trap" and you can email him for the complete report.

© 2012 Copyright Ron Holland - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.