NO Economic Decoupling Instead Greater Interdependence - 2008: The Year of Reckoning ?

Economics / Global Financial System Jan 07, 2008 - 05:46 AM GMTBy: Brent_Harmes

What lies dead ahead for our economy.- The main stream press is finally waking up to the economic realities that are starting to affect us here and now. The January 7, 2008 Forbes magazine has an article by Ernest Zedillo, (former President of Mexico and current Director of The Yale Center for the study of Globalization) titled, 2008: Year of Reckoning . This article is written by a very studied and intelligent man that has seen first hand the effects of currency and borrowing problems. He sees major problems dead ahead for the global economy and I think he absolutely hits the nail on the head with his analysis. Here are a few quotes from that article along with my comments:

What lies dead ahead for our economy.- The main stream press is finally waking up to the economic realities that are starting to affect us here and now. The January 7, 2008 Forbes magazine has an article by Ernest Zedillo, (former President of Mexico and current Director of The Yale Center for the study of Globalization) titled, 2008: Year of Reckoning . This article is written by a very studied and intelligent man that has seen first hand the effects of currency and borrowing problems. He sees major problems dead ahead for the global economy and I think he absolutely hits the nail on the head with his analysis. Here are a few quotes from that article along with my comments:

“The remarkable expansion in world output since 2003 has existed in tandem with so called global imbalances-huge current account deficits in the U.S. matched by surpluses practically everywhere else.”

Translation for non-economists: Everybody is doing great now because other countries have been willing to sell us real products such as cars and plasma screen TV's in exchange for money that the US is just making out of thin air. This has caused the global economy to boom as we massively consume and they have the” privilege” to massively produce stuff for us (in exchange for this blizzard of money we are making).

“But for every apprehensive view of global imbalances, there have been one or more explanations of why those imbalances are not only good but sustainable.”

No one really wants this imbalance to end. We enjoy the cheap goods and they are enjoying the opportunity to employ their people and build new factories and cities so we make up stories about “why it is different this time”. The problem is that these imbalances are growing at an increasing rate. It is just not sustainable forever, and it has already been going on for years.

“Recently, however, the basic assumption underlying this belief has been called into question, as market confidence in a wide array of assets offered in U.S. financial markets abruptly collapsed. The meltdown of the subprime mortgage market, big banks moving huge exotic assets into their balance sheets and looking desperately (and expensively) for fresh capital, and the Federal Reserve cutting interest rates and seeking new ways to inject liquidity into markets are all part of the credit-crunch drama.”

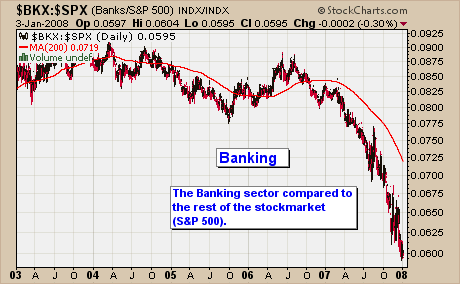

In fact the end of “forever” might be now. The whole unbalanced financial system is getting a test. A very big test. Here is a chart of the banking sector compared to the S&P 500 index. It is comparing the performance of the banking sector to the overall market.

Since our entire economic system is based on debt don't expect any meaningful recovery until this is well on its way back up. There is no sign of that yet, not even a hint.

“A slowdown in the U.S. economy for 2008 now appears inescapable. And the probability of a serious recession cannot be ignored.”

The data sure backs this bad news up, but what can we do to protect ourselves? I think the answer lies in the next paragraph.

“There's only so much that can be done with monetary policy without risking serious undesirable consequences, such as fueling inflationary expectations or creating severe moral hazard.”

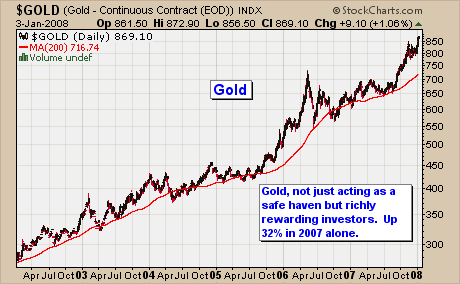

In fact they are already using monetary policy too much, in fact that is what caused this bubble in the first place (too much currency being created). I would argue the price of gold and silver are saying that “inflationary expectations” and “severe moral hazard” are already being anticipated, if not here already. You see, in this environment there are very few financial “safe havens” to run to except the precious metals (which absolutely thrive in these environments).

Here is the chart of gold.

Last year alone gold rose 32% in U.S. Dollars.

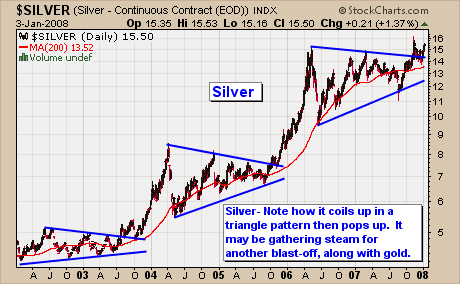

And the chart of silver is also racing higher.

“The task will prove equally daunting in other places. It is not true that other significant economies have been decoupled from the American economy. In fact, thanks to globalization, national economies have become more interdependent. This has been positive for growth but has also entailed downsides and has exacerbated policy challenges” [underlining added]

This is a huge point and I believe absolutely correct. When we start running into economic problems (like now) and start dragging the rest of the world down with us, their economies will indeed be strongly affected and they will try to rescue their economies by also printing excess money and debasing their own currencies, in fact many are already doing this. This will lead back to the “inflationary expectations” and “moral hazard” problem that gold is anticipating with our economy. But with one MAJOR difference. This time the whole world will be buying the precious metals because we will all be experiencing the same problems at the same time. And it looks like that time could be starting soon . Expect some major volatility in everything, including the precious metals, and hang on. This time the precious metal bull is going to be absolutely massive, and it is just getting warmed up.

By Brent Harmes

Subscribe or Manage Your Newsletter Subscription Here | Buy Gold and Silver Online

Copyright © 2008 Brent Harmes

GoldSilver.com offers vault storage accounts at Brinks Security in Salt Lake City, Utah. The minimum investment required for vault storage account is 20 ounces of gold or 1,000 ounces of silver. For more information call us at: 702-799-9000

Disclaimer : All claims made by GoldSilver.com should be verified by the reader. Investing is not suitable for everyone and readers are urged to consult with their own independent financial advisors before making a decision. Past performance is not necessarily indicative of future results. GoldSilver.com will not be liable for any loss or damage caused by a reader's reliance on information obtained in any of our newsletters, special reports, email correspondence, or on our website. Our readers are solely responsible for their own investment decisions.

Brent Harmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.