Junior Gold Stocks Rebound from Lows

Stock-Markets / Gold & Silver Stocks Jan 30, 2012 - 07:19 AM GMTBy: Jordan_Roy_Byrne

The junior sector had a very difficult year in 2011 but has led the recent recovery (at least statistically) in the precious metals sector. Two of our favorite exchange traded funds, GDXJ and ZJG.to are up 30% and 25% respectively. That exceeds GDX (large caps) which has rebounded 15%. These are significant gains but barely put a dent in the low valuations for the sector. Ratio analysis shows us how undervalued the smaller gold stocks are yet an examination of history shows this is not out of the ordinary at this point in a bull market.

The junior sector had a very difficult year in 2011 but has led the recent recovery (at least statistically) in the precious metals sector. Two of our favorite exchange traded funds, GDXJ and ZJG.to are up 30% and 25% respectively. That exceeds GDX (large caps) which has rebounded 15%. These are significant gains but barely put a dent in the low valuations for the sector. Ratio analysis shows us how undervalued the smaller gold stocks are yet an examination of history shows this is not out of the ordinary at this point in a bull market.

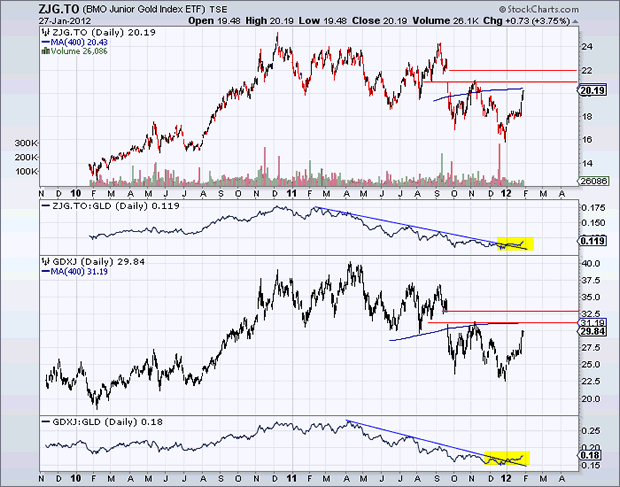

First lets take a technical look at the juniors. We show ZJG.to and GDXJ in the chart below. ZJG.to is a Canadian junior ETF which is comprised of entirely gold companies while three of the top ten companies in GDXJ are silver companies. ZJG is nearing resistance at 20-21 while GDXJ is nearing resistance at 31-33. More importantly, both markets have broken out of their downtrends against Gold.

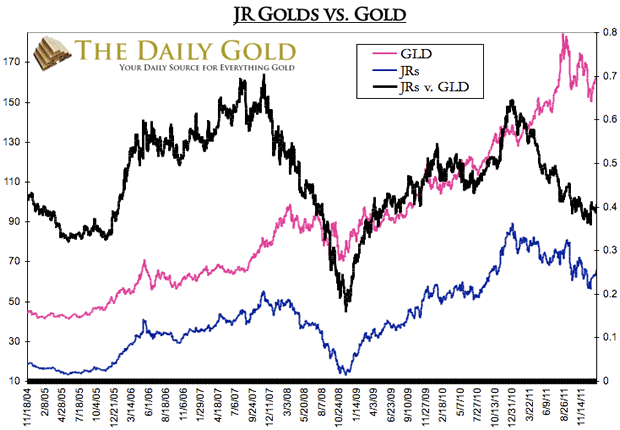

Next we show a plot of our junior gold index (call it JGI), GLD and a ratio of JGI against GLD. Note that the ratio, which peaked at 0.7 in 2007, is currently at 0.4. JGI is presently at 66. Should Gold eventually break to new highs and JGI/GLD rise back to 0.7, then junior gold stocks would gain more than 100%. With large producers reporting record cash flow and profits, it is only a matter of time before all gold equities reach higher valuations against Gold itself.

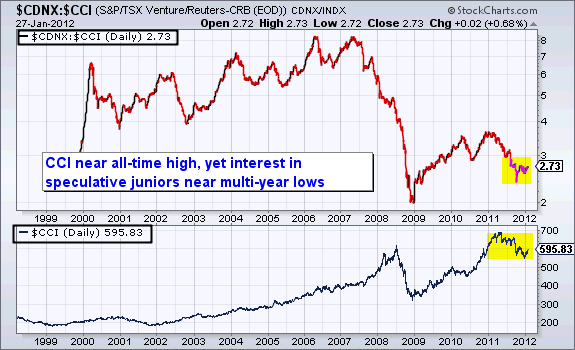

Our Junior Gold index as well as the other junior indices do not include the "true junior" companies which are of the microcap variety. The CDNX is basically an index for these types of companies. Most but not all of the companies within the CDNX are gold and silver related. Thus, in the chart below we decided to compare the CDNX to the CCI (continuous commodity index). The CCI is somewhat close to an all-time high while the ratio of the junior companies to the CCI is close to multi-year lows. With commodities not far off all time highs, one would expect the junior companies to be trading at higher levels.

Lately we've been writing about how gold stocks are faring in comparison to previous equity bull markets. The comparison argues that gold stocks should fare well this year and well into 2013. Even though this bull market is in its 12th year, it remains a few years away from the start of a bubble. In a bubble, valuations expand far beyond fundamentals and it continues for several years. In order for this to happen, valuations must be low prior to the start of the bubble.

From early 1992 to 1995 the price to earnings ratio (PE) on the Nasdaq fell from 50 down to 20. Over the next two years, the PE ratio climbed from 20 back to 50. Then in the second half of 1997, the PE ratio surged past 50 and never looked back.

From 1973 to 1983, the PE on the Nikkei (Japan) ranged from mostly 15 to 23. After 1983, the PE ratio surged to new highs and eventually peaked at 70.

It is clear that prior to a market bubble, valuations are compelling. Not stretched or fair, but compelling. After all, a bubble needs time to develop and then have its final blowoff stage. Prior to the start, valuations begin to move from the low side to the high side. Then as the bubble really gets going valuations break to new records and surge to extremes.

Months ago we wrote about how the PE for large cap gold stocks was near a 10 year low. Now we see that the speculative side of the precious metals sector, (the juniors), is trading at near basement valuations. This is 12 years into a bull market. Not five or eight. It will take time for valuations of precious metals companies to move back to the high end of the range. Companies that grow their business and add value could perform fantastically thanks to a likely increase in the valuation of the sector.

If you'd like professional guidance in riding this bull market and uncovering the winning companies then consider learning more about our premium service.

Good Luck!

Jordan Roy-Byrne, CMT

Trendsman@Trendsman.com

Subscription Service

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.