Failure to Rig Gold Market During Dollar Devolution, Manifest Destiny Derailed: Treason from Within

Politics / Market Manipulation Jan 31, 2012 - 01:38 PM GMTBy: Rob_Kirby

Something very unusual recently occurred in financial journalism. If you are from or rely on the mainstream western financial press as your primary means of being informed – you surely wouldn’t have noticed – because this ‘oddity’ involved a real act of investigative journalism by one Lars Schall.

Something very unusual recently occurred in financial journalism. If you are from or rely on the mainstream western financial press as your primary means of being informed – you surely wouldn’t have noticed – because this ‘oddity’ involved a real act of investigative journalism by one Lars Schall.

Mr. Schall is a German freelance journalist who noted an ‘old quote’ of former Federal Reserve Chairman, Paul Volcker. Paul Volcker was the U.S. Treasury Department's undersecretary for international monetary affairs from 1969 to 1974 and became Fed chairman in 1979 – a post he held until 1987. More recently, Mr. Volcker has been a top economic advisor to President Obama. The quote that intrigued Mr. Schall was excerpted from Mr. Volcker’s memoirs and published in The Nikkei Weekly back on November 15, 2004:

"That day the United States announced that the dollar would be devalued by 10 percent. By switching the yen to a floating exchange rate, the Japanese currency appreciated, and a sufficient realignment in exchange rates was realized. Joint intervention in gold sales to prevent a steep rise in the price of gold, however, was not undertaken. That was a mistake.”

Schall wondered why Mr. Volcker – a man “widely revered” with a reputation for being a serious inflation fighter back in the 1980s – had never been questioned as to “why not rigging the gold market was a mistake."

So Schall decided to put the question [appended below] to Mr. Volcker himself:

Dear Mr. Volcker;

On November 15, 2004, The Nikkei Weekly published the following excerpt from your memoirs about the U.S. dollar revaluation that took place on February 12, 1973. You wrote:

"That day the United States announced that the dollar would be devalued by 10 percent. By switching the yen to a floating exchange rate, the Japanese currency appreciated, and a sufficient realignment in exchange rates was realized. Joint intervention in gold sales to prevent a steep rise in the price of gold, however, was not undertaken. That was a mistake."

As far as Chris Powell and I understand it, you are saying here that for the U.S. government not to rig the gold market was a mistake.

Is this indeed what you want to say? If so, why was it a mistake? And do you think the U.S. government has learned from that mistake ever since? In other words: does the U.S. government intervene in the gold market from time to time in order to support the dollar and other currencies against gold?

Furthermore, could you maybe explain to Mr. Powell and me how it would have looked like technically if you would have undertaken such a "joint intervention in gold sales to prevent a steep rise in the price of gold."

An answer from you, sir, for the public would be much appreciated!

Best regards,

Lars Schall.

To contact Mr. Volcker – it took Schall more than a week. He tried tracking him down / contacting him through associations which Mr. Volcker is a member or is affiliated:

1] The Group of Thirty

2] The Trilateral Commission

3] The White House

4] The Council on Foreign Relations [CFR]

Finally, Mr. Schall’s persistence paid off. On Jan. 26, 2012, Mr. Schall received this response [albeit short] from Paul Volcker regarding American intervention in the gold market - received via Anke Dening, Volcker's wife and long-time assistant:

"Dear Mr. Schall:

"The quotation you cite is about an event almost 40 years ago. It pertained to the possibility of speculation in the gold market leading to exchange rate instability at a critical point.

"The U.S. has not, to the best of my knowledge, intervened in the gold market for more than 40 years.

"Sincerely,

Paul Volcker."

The Significance of This

Volcker’s words TODAY show that – despite President Nixon closing the gold window back in 1971 – gold price action [speculation], or perhaps better stated, PUBLIC PERCEPTION of GOLD - still underpins exchange rates [ie. the sanctity of the U.S. Dollar as the world’s reserve currency].

In addition, Mr. Volcker’s statement that, “to the best of his knowledge, the U.S. has not intervened in the gold market in more than 40 years” is a patent lie. Mr. Volcker was Chairman of the Federal Reserve from 1979 – 1987. The Federal Reserve Bank of N.Y. is named in official U.N. documents as the “fiscal agent” for the U.S. Treasury in matters relating to gold swaps with the Bank of England executed in 1981 – just 2 years into his reign as Fed Chairman.

This underscores how vitally important gold always has been and continues to be in monetary affairs. Financial luminaries like Paul Volcker STILL LIE to this very day about their decades old nefarious activity in the gold market.

Sadly, the incident documented above is only the tip of the proverbial ice burg.

We now know that the U.S. has been involved in gold swaps since 1981 at the earliest. From a public accounting sense – they first acknowledged their existence back in May, 2007 [see James Turk’s account – contained in article here].

Back in May 2007 the US Treasury quietly made a subtle change to its weekly reports of the US International Reserve Position, which includes the US Gold Reserve. This change was first made on May 14th, 2007. The May 14th entry – FOR THE FIRST TIME - said the US Gold Reserve is 261.499 million ounces “including gold deposits and, if appropriate, gold swapped” [emphasis added].

Why Governments Use Gold Swaps?

In a gold swap, American gold [or gold believed to be held by America, gold yet to be mined or possibly gold of a lesser quality than COMEX / LBMA good delivery bars] could be pledged as collateral for physical, good-delivery, foreign gold holdings which are then sold into the market to cap the gold price. Gold swaps – when employed by the U.S. government – are a means of DECEIVING MARKETS and CAPPING PRICES, thereby making the U.S. Dollar appear more robust.

A History of Lies and Deceit

Back in 2001, GATA discovered a reference to gold swaps – uttered by FOMC General Counsel Virgil Mattingly - in the minutes of the January 31-February 1, 1995, meeting of the Federal Reserve's Federal Open Market Committee and pressed the Fed, through two U.S. senators, for an explanation.

Fed Chairman at the time, Alan Greenspan, denied that the Fed was involved in gold swaps in any way. Greenspan went so far as to produce a memorandum written by J. Virgil Mattingly, in which Mattingly denied making any such comments. (See http://www.gata.org/node/1181.)

Alan Greenspan is also on record, back in 1999 – telling Rep. Ron Paul UNDER OATH – that since the 1930s - the Fed is not involved, nor are they permitted to be involved in the gold market:

1999 – Humphrey Hawkins Testimony

2/24/1999 – Ron Paul responding to Alan Greenspan

Dr. PAUL: Thank you, Mr. Chairman.

Mr. Greenspan, a lot of economists look to the price of gold as an indicator and as a monetary tool. It has been reported that you might even look at the price of gold on occasion.

Last summer on a couple of occasions here when you were talking before the committees on securities and on derivatives you mentioned something that was interesting. You said that central banks stand ready to sell gold in increasing quantities should the price rise, which I thought was rather interesting.

Then I followed up with a letter to you to ask you whether or not our central bank might not be involved in something like that, in the gold market. And you did answer me and stated that since the 1930's the Federal Reserve has had no authority to be involved with the gold markets.

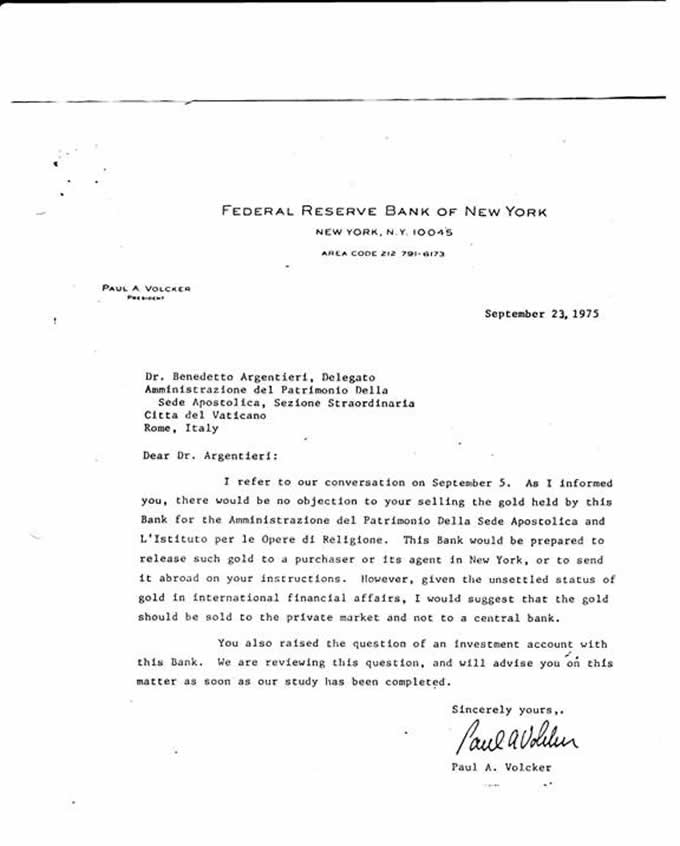

Mr. Greenspan’s sworn testimony directly contradicts uncontested evidence entered in legal proceedings – DOCUMENTING the involvement of the New York Fed in gold dealings with the Vatican Bank circa 1975 – specifically, documents bearing the signature of none other than [then] N.Y. Fed President, Paul Volcker:

It is a shameful fact that luminaries can and do LIE about their nefarious, subversive activity in markets which “ARE” the very foundations of our monetary system. They do so ‘wrapped in the flag’ so-to-speak. They LIE to the press and they premeditatedly LIE UNDER OATH to Congress – and they do so with impunity.

They LIE because they do not want the notoriety that accompanies being the authors of a system of FALSE VALUES which have undermined free market capitalism.

They don’t act alone – they act in concert with their vassals – fellow conspirators in banking, government and media - who help project the appearance of authenticity on arbitrarily contrived, often counter-intuitive, market outcomes.

It is the assignment of FALSE VALUES – and the IRON CURTAIN of LIES and DECEIT maintaining them - in our increasingly inter-dependent, global markets, which is at the root of our global economic malaise. This is also the root cause of the growing global resentment toward the Anglo-American Banking Axis.

Former Fed Chairman Paul Volcker is well known, on-the-record, having repeatedly declared gold to be "the enemy."

Respectfully, Mr. Volcker – gold is NOT YOUR ENEMY.

The TRUTH is your true enemy.

For anyone who has recognized this subversion of free market capitalism for what it is – and particularly to those who feel helpless and think that this can or will go on forever – the world is and has been noticing. What the rest of the world has not possessed – up until now, short of TOTAL WAR – is a resolution mechanism to restore a modicum of honesty back into international commerce.

Global Resolution Mechanism Being Pieced Together

This is why countries around the world are increasingly announcing trade deals which circumvent the U.S. Dollar settlement mechanism. The world community has gained knowledge and understanding regarding treasonous financial acts committed in America’s name against humanity.

Not surprisingly, a new international court – one that deals specifically with financial crimes against humanity – has been opened in The Hague, Netherlands. As Bloomberg News reported Jan. 15, 2012:

New Court at The Hague to Arbitrate in Global Financial Disputes

Financial firms and investors in complex cross-country disputes can turn to a new tribunal in The Hague, the latest of six international courts in the Netherlands.

“National courts and ad hoc arbitration until now haven’t succeeded in unambiguous, authoritative jurisprudence,” Jeffrey Golden, chairman of the management board for the new Panel of Recognized International Market Experts in Finance, said in a statement. The arbitration and mediation service, known as Prime Finance, will officially open today.

“This court can be used by large financial institutions, such as banks and large asset managers, and eventually also by states that have a dispute with financial institutions,” Bernard Verbunt, a lawyer at Simmons & Simmons in Amsterdam who specializes in banking and financial services disputes, said by telephone.

The tribunal, at the Peace Palace in The Hague, can call upon almost 100 experts to arbitrate or mediate in cases involving derivatives and structured financial products.

The panel was set up by the World Legal Forum following a meeting of lawyers, financial experts, regulators and central bank representatives from the U.S., Europe, and Asia in 2010.

So while the big wheels of international justice may move very slowly – they do turn all the same. While the American banking and political apparatus has been reluctant to right their wrongs – the world community has been biding their time and planning. The really big question at this point is, “when does America bottom out?”

Are You a Believer?

It was back in April 2007 when Dallas Fed President, Richard Fisher, reminded us all that the U.S. Dollar is a,

“‘faith-based currency’ … like the euro, the yen, the British pound and other currencies.” A so-called “fiat” currency, “it is backed only by the federal government’s power to raise the revenues needed to meet its obligations and by the rectitude of the U.S. central bank.”

Sadly, the U.S. Dollar’s gatekeepers have not shown themselves to be accountable or worthy of the people’s trust.

Ruminating over the answer to this question, “when America bottoms out,” I’m reminded of a post by my compatriot and a true American Patriot, Bill Rummel at the Charleston Voice. He recently recounted the prescient words of Marcus Tullius Cicero regarding the danger of internal subversion. In a speech to the Roman Senate, as recorded by Sallust, Cicero said:

"A nation can survive its fools and even the ambitious. But it cannot survive treason from within. An enemy at the gates is less formidable, for he is known and he carries his banners openly against the city. But the traitor moves among those within the gates freely, his sly whispers rustling through all alleys, heard in the very halls of government itself. For the traitor appears no traitor; he speaks in the accents familiar to his victim, and he wears their face and their garments and he appeals to the baseness that lies deep in the hearts of all men. He rots the soul of a nation; he works secretly and unknown in the night to undermine the pillars of a city; he infects the body politic so that it can no longer resist. A murderer is less to be feared. The traitor is the plague."

Got physical gold yet?

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is proprietor of Kirbyanalytics.com and sales agent for Bullion Custodial Services. Subscribers to the Kirbyanalytics newsletter can look forward to a weekend publication analyzing many recent global geo-political events and more. Subscribe to Kirbyanalytics news letter here. Buy physical gold, silver or platinum bullion here.

Copyright © 2012 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.