Gold Increases In Value During Inflation or Deflation Scenarios

Commodities / Gold and Silver 2012 Feb 08, 2012 - 08:16 AM GMTBy: GoldCore

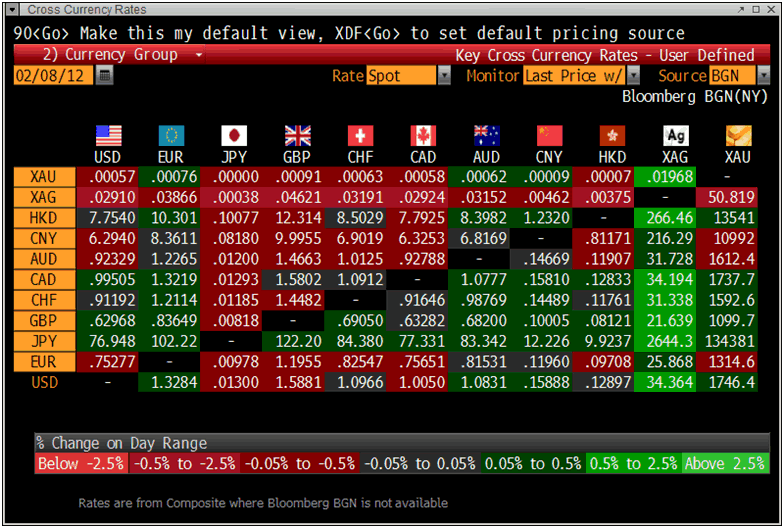

Gold’s London AM fix this morning was USD 1,743.00, EUR 1,315.17, and GBP 1,095.95 per ounce.

Gold’s London AM fix this morning was USD 1,743.00, EUR 1,315.17, and GBP 1,095.95 per ounce.

Yesterday's AM fix was USD 1,720.00, EUR 1,308.98, and GBP 1,087.56 per ounce.

Cross Currency Table – Bloomberg

Gold has again seen the pattern of recent days, months and years of strength in Asia followed by weakness in Europe. Gold’s 1.5% gain yesterday came as Ben Bernanke spoke regarding the slow US economy and need for continued loose monetary policy.

Gold broke through a resistance level of $1,750/oz in Asian trading as investors continue to hope for a Greek debt interim solution after the series of recent missed deadlines and gold appears to be consolidating above $1,740/oz.

Tuesday’s decision was postponed again, as Greek’s grapple to accept austerity and reform measures in exchange for a 130 billion euro loan from the EU and IMF.

Gold Spot $/oz – 3 Days (Bloomberg)

A conclusion to the deal may see a short term dip in gold bullion prices, hurting the safe haven appeal for gold momentarily. Greece is the one country getting headlines in the Eurozone today; however the other PIIGS will have their own restructuring to deal with soon.

Mohamed El-Erian, CEO and co-chief investment officer of bond fund giant PIMCO, said investors should be underweight equities while favoring "selected commodities" such as gold and oil, given the fragile global economy and geopolitical risks.

Over the long term gold will reward investors who own gold as part of a diversified portfolio. Trying to time purchases and market movements is not recommended – especially for inexperienced investors.

New research from Credit Suisse and London Business School entitled ‘The Credit Suisse Global Investment Returns Yearbook 2012’ continues to be analysed by market participants.

The 2012 Yearbook investigates data from 1900 to 2011 and looks at how best to protect against inflation and deflation, and how currency exposure should be steered. The chief findings are that bonds do well in deflation and benefit from currency hedging, and equities are not a perfect inflation hedge, but benefit from international diversification.

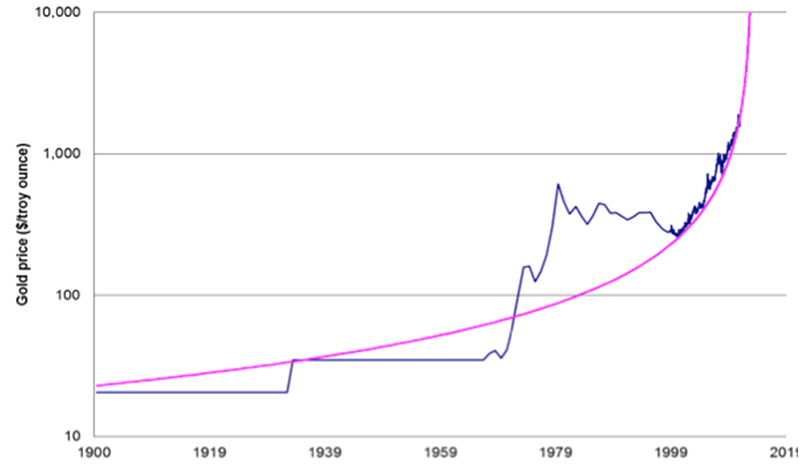

Gold Price ($/troy ounce)

The report shows that gold offers a timely inflation hedge and long term holders of gold should expect a positive correlation to inflation – gold is one of only two assets since 1900 to have positive sensitivity to inflation (of 0.26).

Only inflation-linked bonds had more - 1.00, as expected.

By contrast, when inflation rises 10%, bond returns have fallen an average 7.4%; Treasuries fell 6.2%, and equities lost 5.2%. Property fell by between 3.3% and 2%.

Importantly, gold managed to increase its value across both extreme inflationary and deflationary scenarios.

The academics from LBS analysed 2,128 individual years in 19 major countries (1900-2011), finding gold rose 12.2% in the most deflationary years - when average deflation was 26%.

Also of note is the fact that gold also rose marginally in the most inflationary of those years, when CPI was jumping on average by 18%.

The only negative in the report regarding gold was the fact that gold’s returns from 1900 to 2011 were poor - with real returns of only 1.3% a year, compared to shares’ 5.4% (MSCI World USD) and bonds' 1.7%.

However, it is important to note that of course equities outperformed gold.

It would be astonishing if they had not as gold was money & fixed at $20 per ounce until 1933 and $35 per ounce until 1971. Therefore, it is not a fair or noteworthy comparison.

More importantly, in recent history and in the modern era since 1971, when the Gold Standard ended and gold became freely traded, gold has outperformed the benchmark S&P 500.

One of the authors of the report, Paul Walsh said the lesson for investors was that while equities are still better long term investments – equities lost 12% of their real value in years when average annual inflation was highest (at 18%).

"Gold has given returns that are not very high, but when you have had inflation, gold has been a good asset to have” he said.

While the report noted that gold has been volatile – it is important to note that gold is only marginally more volatile than global equity benchmark indices (less volatile than emerging market indices and far less volatile than individual shares) and this volatility is only since the end of the Gold Standard in 1971 when gold became not just money but a tradable asset.

Credit Suisse Research On Gold Interpreted Very Differently

There appears to be significant discrepancy in how the research is being analysed and interpreted by different journalists.

The Wall Street Journal ( ‘Investing for Inflation (and Deflation)’ ) wrote how the report was broadly positive on gold showing that:

“since 1900, gold gave an average 1.1% real annual return for U.K. investors. On average, gold performed positively during periods of inflation and modest deflation and performed well in severe deflations.

Not bad. But it came with a substantial cost.

One, it doesn’t yield anything, all those gains came in price performance. Two, it came at the expense of considerable market volatility. Overall, bonds and bills did worst with inflation and best with deflation. Equities weren’t much of an inflation hedge, though housing and gold largely kept pace with inflation. The only surefire inflation hedge is index-lined bonds.

Though with these, there’s the risk of government default.

In terms of outright performance, equities delivered by far the biggest real annualized returns, 5.4% against 1.7% for bonds and about 1% for bills and housing. But this return came only because investors were willing to accept substantial risks.

The standard deviation for equities was nearly 18%. They may not have been much of an inflation hedge and they demand strong stomachs from investors, but equities were the best way to invest over the very long run.

Whether they continue to be over the next century is another question entirely.”

While Reuters (”Gold not a reliable inflation hedge-study” ) interpreted the report’s findings regarding investing in gold in a more negative manner:

“Gold prices have been too volatile to play a reliable role as a hedge against inflation, a study of financial assets over the past 112 years showed on Tuesday.

While inflation does not reduce gold's real value, it has no yield or income flow and the precious metal has given a far lower long-term return than equities.

In the period since 1900, gold gave a real return of 1.1 percent in sterling terms and its value fluctuated widely, the study published by Credit Suisse and London Business School's Elroy Dimson, Paul Marsh and Mike Staunton.”

Bloomberg reported:

“ While gold can be viewed as a hedge against inflation, the metal has given a “far lower” long-term return than equities, according to a study by the London Business School and Credit Suisse Group AG.

“For that reason it is unlikely that institutions seeking a worthwhile long-term real return will invest heavily in gold,” authors of the report e-mailed today said. “The purchasing power of gold has fluctuated over a wide range.”

The Financial Times (“Investors are turning to equities” ) reported:

“Gold offers better defences against both inflation and deflation than shares. But its price is very volatile, and for years at a time it failed to live up to its promise, falling as inflation soared. The truth is that investors worried about inflation have no good options.”

At Goldcore, we are privileged to also have access to excellent research on gold from Trinity College Finance Professor, Dr Constantin Gurdgiev, who wrote an academic paper with Dr Brian Lucey, also of Trinity College Dublin, showing gold is a proven hedging instrument and safe haven.

Dr Constantin Gurdgiev opinion regarding this research on gold follows:

"While gold price volatility and correlations reversals with other assets do occur and can be detrimental to short- and at times even medium-term hedging, data shows that in the long run, gold is the instrument providing the best risk cover for investors concerned with preservation of wealth.

This is not to say that other assets, held in a diversified portfolio are inferior to gold in terms of either returns, risk-adjusted returns, or in terms of providing hedging opportunities over medium and short-term investment horizons. However, no other asset class provides as many hedging opportunities as well as safe haven outlets vis-a-vis other asset classes and inflation, as gold.

While gold does not deliver a dividend yield, unlike equities, gold does not suffer from survivorship bias.

It is also important to note that many equities do not provide regular dividends, either. Observed returns on equities are often estimated under the assumption that an average investable portfolio originally allocated is identical to that held on average at the time of closing portfolio simulations.

Instead, many equities fail with a downside value of zero. Gold, throughout the centuries, remains there - unchallenged by risks of delisting, bankruptcy and even, with modern storage options, repudiation and expropriation.

In addition, physically held gold is not a claim on a residual value of the underlying undertaking, as equities are, but a fully owned asset with no risk of subordination of the claim. Thus, investors in equity are subject to risks of dilution and ultimately, of total principal loss. These risks are not associated with gold ownership.

No matter how one slices the data, a diversified portfolio of equities, gold, fixed income and other asset classes, coupled with strict passive rules for loss management and profit booking in the case of investors pursuing mixed strategies, is the best alternative available to ordinary investors in the current markets.

Until some dramatic financial instrumentation invents an asset that holds real value in the face of many incremental and catastrophic risks, while supplying high degree of liquidity, portability and safety of ownership, gold will remain a core component of a well-diversified portfolio.”

Dr Constantin Gurdgiev is Adjunct Professor of Finance with Trinity College, Dublin, and non-executive member of the Investment Committee of Goldcore, Ltd."

OTHER NEWS

(Bloomberg) -- European Union governments are moving toward stiffer sanctions on Syria, including a freeze on the central bank’s assets and a ban on imports of phosphates and precious metals, an EU official said.

A consensus exists in the 27-nation bloc to toughen the sanctions against President Bashar al-Assad’s regime, with details to be ironed out in time for approval on Feb. 27 by EU foreign ministers, the official told reporters in Brussels today on condition of anonymity.

Taking sanctions on Iran’s central bank as a model, the EU is working to craft the Syrian monetary curbs so as not to hobble Syria’s trade completely, the official said.

A cutoff of phosphates imports will shut down a key source of revenue for the regime because Syria relies on European customers for 40 percent of its phosphates sales, the official said.

The official gave no figures for Syria’s income from gold and other precious metals slated for the ban.

By contrast, a proposal by one EU government for a ban on commercial flights to and from Syria has found little support, said the official. He didn’t identify the government behind the idea.

Brussels (DPA) -- EU sanctions on Syria to target central bank, gold and phosphates

European Union foreign ministers are expected to approve a new round of sanctions against Syria in two weeks' time, targeting its central bank and exports of phosphates and gold, a diplomat said Wednesday.

The EU was also preparing a meeting with the Arab League and the United Nations, replicating one of the panels set up last year in response to the crisis in Libya, the source said, while at the same time excluding any military option.

"Syria is not Libya," he said.

Russia and China blocked a critical United Nations Security Council resolution last week, reportedly out of concern that it could give leeway for a military intervention of the type that was mounted in Libya on the basis of another UN resolution.

"The Lybian precedent is on everybody's mind," the EU diplomat said, adding that India, Brazil and South Africa, as well as some Arab states, had expressed "reserves" on the issue.

EU diplomats were working to freeze the Syrian Central Bank's assets and to ban EU imports of Syrian phosphates, gold and other precious metals, the source indicated.

"A suspension of these imports would have quite a strong economic effect," he said.

One EU country was even suggesting a ban on commercial flights to Syria, but the proposal was contentious, the diplomat said, pointing out that it might complicate deliveries of humanitarian assistance.

The new sanctions would likely have an impact "on the daily economy" of Syria but "we are left with very little options," the EU source said, referring to President Bashar al-Assad's defiance in the face of mounting international isolation.

Since March, when the Syrian regime started a bloody crackdown against opposition protesters, the EU has included dozens of Syrian officials - including al-Assad - in a visa ban and asset freeze list, and imposed arms and oil sector embargoes on the country.

The EU is also preparing contingency plans for the evacuation of more than 1,000 Europeans in Syria, and is due to allocate 3 million euros (4 million dollars) in humanitarian aid, another senior source from the bloc said.

For breaking news and commentary on financial markets and gold, follow us on Twitter.

SILVER

Silver is trading at $34.31/oz, €25.85/oz and £21.58/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,646.00/oz, palladium at $701/oz and rhodium at $1,400/oz.

NEWS

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.