Gold, Silver and the U.S. National Bird

Commodities / Gold and Silver 2012 Feb 20, 2012 - 02:47 PM GMTBy: Ned_W_Schmidt

Benjamin Franklin originally recommended the turkey as the national bird for the U.S. Today, we imagine that after considering the situation being created by the current regime in Washington he might recommend the ostrich as a more appropriate national symbol. With its head buried in the sand to avoid facing critical issues, the U.S. may be ignoring the vulnerabilities in today's world. For those that are not familiar with the old story of the ostrich with its head in the sand, we submit the following picture of the proposed new U.S. national bird.

Benjamin Franklin originally recommended the turkey as the national bird for the U.S. Today, we imagine that after considering the situation being created by the current regime in Washington he might recommend the ostrich as a more appropriate national symbol. With its head buried in the sand to avoid facing critical issues, the U.S. may be ignoring the vulnerabilities in today's world. For those that are not familiar with the old story of the ostrich with its head in the sand, we submit the following picture of the proposed new U.S. national bird.

Today the harmony of the world is threatened by two issues, Iran's nuclear weapon program and the U.S. debt situation. Neither matter is being effectively addressed by the regime in Washington. These two issues alone make ownership of Gold vital to investors today.

Iran: To date, the near juvenile efforts of the Washington regime have had no meaningfully positive impact on Iran's effort to develop nuclear weapons. In essence, policy is if Iran will not play by our rules, we will just take our toys and go home. Take that! Washington seems unwilling to take serious actions to stop Iran's nuclear weapon program till a "mushroom cloud" arises from a weapon's test.

The financial ramifications of Iran detonating a nuclear weapon can only be imagined. The only financial insurance against such an event is Gold. However, that Gold should perhaps be held in locations such as North America, Australia, or Hong Kong with limited vulnerability to the radioactive ramifications of Washington's support for an Iranian nuclear weapon.

U.S. Debt Bomb: After years of seemingly endless talk, nothing serious has been done to defuse the debt bomb of the U.S. All efforts to reign in U.S. government spending without doing damage to the U.S. economy have been rejected by the regime in Washington. Today talk is of possibility that Greece might still be expelled from the Euro area. Might that be an omen? Might the U.S. be expelled from the global financial system for an ostrich-like fiscal policy?

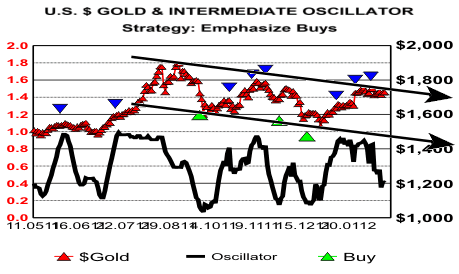

While Gold is the only financial insurance to protect an investor from the ostrich mentality in Washington, we still should recognize the obvious trends in the market. Gold, like Silver, is in a bear market. Investors should only buy Gold when deeply over sold, not when the small children at hedge funds are playing in the futures market.

While Gold has much further to travel in this bear market, Silver may be approaching the final stage of the bear market in which it has been for near a year. The phase immediately ahead, however, may create far more mental agony than that thus far experienced. To date, the pain can only be described as moderate compared to that which is possible.

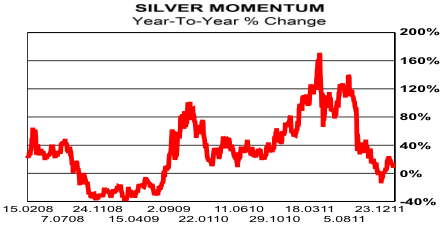

Following chart plots the year-to-year percentage change of the price of $Silver. That Silver experienced a complete collapse of price momentum is fairly obvious.At this point the reality of the year-to-year percentage change turning negative must be addressed. Two questions arise from that development.

First, what might be the reaction of potential investors to such a development? Negative momentum such as Silver is experiencing normally acts as "investor repellant". Money is not drawn to such situations, but rather it avoids investments experiencing such negative momentum.

Second, can we discern any guidance from the past experience? Perhaps the answer is yes, but only in the vaguest of ways. In the 2008-9 period the collapse of the Federal Reserve induced credit bubble created an extreme situation. The year-to-year percentage change went to almost -40% for near a year.

Current markets for precious metals are more like simple market exhaustion from an overly exuberant run. For that reason, the coming experience may be far less painful. While no good technical rules really exist for such approximation, a simple and naive approach might initially serve adequately. For a start, Silver might face "half" of the 2008-9 trauma.

That approach would suggest that perhaps the year -to-year percentage change could reach about negative 20% for six months. Admitting the frailty in such a forecast, at least it suggests a tunnel with an end.

By Ned W Schmidt CFA, CEBS

Copyright © 2011 Ned W. Schmidt - All Rights Reserved

GOLD THOUGHTS come from Ned W. Schmidt,CFA,CEBS, publisher of The Value View Gold Report , monthly, and Trading Thoughts , weekly. To receive copies of recent reports, go to www.valueviewgoldreport.com

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.