Stock Market New Dow High, Is Dow Theory No Longer Useful?

Stock-Markets / Dow Theory Feb 23, 2012 - 12:52 AM GMTBy: Tim_Wood

The price action earlier this month carried the Dow Jones Industrial Average above its May closing high. This has occurred in the wake of the so-called "Dow theory sell signal" from back in August when the averages closed below their June lows. How could this be? Is Dow theory no longer valid? Is Dow theory no longer useful? What went wrong?

First, I want to address this by saying that there is no such thing as a "Dow theory sell signal." Our Dow theory founding fathers would anticipate trend changes based on very short-term structural changes, sentiment, phasing, values, their feel for the market, etc. and they would establish their positions based on those developments in anticipation of a trend change. This is obvious when you read their writing. There was no ring of a bell that gave them a buy or sell "signal." Secondly, what most people confuse with a so-called buy or sell signal is actually what is referred to as a Dow theory primary trend change. This occurs when both the Industrials and the Transports closed either above or below their previous secondary high or low point. The Dow theory founding fathers no doubt anticipated these primary trend changes, established positions ahead of these changes and used the actual occurrence of the primary trend change as confirmation that their previously established positions were correct. As a rule, if one waits on the primary trend change, a big piece of the move has already occurred and the trend change that occurred in August is a perfect example.

Now, with this all said, I also wrote in an article published here the very week of the October low, that not all Dow theory trend changes were created equally, that the August trend change was questionable and even gave a list of the years in which other bearish Dow theory primary trend changes had occurred, but which did not lead to a major market top. I also explained then that the leading Dow theorist during the late 1940's and into the 1960's was E. George Schaefer and that he was the first Dow theorist to use other technical studies to filter the Dow theory primary trend changes during the secular bull market of the 1942 to 1966 secular bull market. The reason I questioned the August trend change and felt that it was a fake out was because of my statistical based trend quantification studies. I knew, based on these other statistical based studies that the May high likely had not marked THE top and I told my subscribers, in October, that we should expect a move back above the May high. I also knew at the July top, based on my statistical and trend quantification studies, that an intermediate-term top had been seen and was able to warn my subscribers of that top and of the anticipated decline. So, yes, Dow theory is indeed a valid market tool and I am by no means dumping on Dow theory here. But, as E. George Schaefer discovered during the 1942 to 1966 secular bull market, you must use other technical studies to guide you because the fact is, as history clearly shows, not all Dow theory trend changes are created equally and if you don't have the tools to decipher the entirety of the technical landscape, blindly following a late occurring trend change can be a costly mistake. Imagine if one had taken the August Dow theory trend change at face value and had gotten short upon the occurrence of that trend change. Well, here we sit 5 months later at a new post 2009 high.

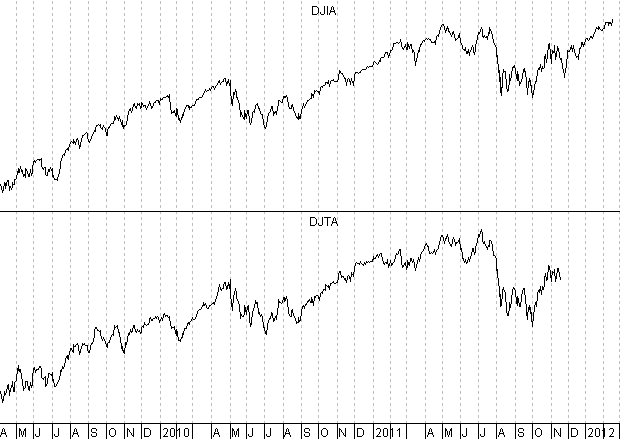

Below is the current chart of the Industrials and the Transports. Officially, the orthodox bearish primary trend change that occurred back in August remains intact. In looking at this chart there is little doubt that it would have been costly to have followed that trend change. Short-term, it is clear that the Transports are lagging the Industrials, which has created a Dow theory non-confirmation. If you would like to know more about the ongoing developments with Dow theory, the rally that is believed to separate Phase I from Phase II of the ongoing secular bear market, my trend quantification work or the developments surrounding the DNA Markers, this is all covered in my monthly research letters. For now, we have a Dow theory non-confirmation in place, the August Dow theory trend chance is still officially intact, but at this point so is the advance out of the October low.

I have begun doing free market commentary that is available at www.cyclesman.info/Articles.htm The specifics on Dow theory, my statistics, model expectations, and timing are available through a subscription to Cycles News & Views and the short-term updates. I have gone back to the inception of the Dow Jones Industrial Average in 1896 and identified the common traits associated with all major market tops. Thus, I know with a high degree of probability what this bear market rally top will look like and how to identify it. These details are covered in the monthly research letters as it unfolds. I also provide important turn point analysis using the unique Cycle Turn Indicator on the stock market, the dollar, bonds, gold, silver, oil, gasoline, the XAU and more. A subscription includes access to the monthly issues of Cycles News & Views covering the Dow theory, and very detailed statistical-based analysis plus updates 3 times a week.

By Tim Wood

Cyclesman.com

© 2011 Cycles News & Views; All Rights Reserved

Tim Wood specialises in Dow Theory and Cycles Analysis - Should you be interested in analysis that provides intermediate-term turn points utilizing the Cycle Turn Indicator as well as coverage on the Dow theory, other price quantification methods and all the statistical data surrounding the 4-year cycle, then please visit www.cyclesman.com for more details. A subscription includes access to the monthly issues of Cycles News & Views covering the stock market, the dollar, bonds and gold. I also cover other areas of interest at important turn points such as gasoline, oil, silver, the XAU and recently I have even covered corn. I also provide updates 3 times a week plus additional weekend updates on the Cycle Turn Indicator on most all areas of concern. I also give specific expectations for turn points of the short, intermediate and longer-term cycles based on historical quantification.

Tim Wood Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.