How Big Money and Insiders Use Options to Manipulate the Stock Market

Stock-Markets / Market Manipulation Mar 09, 2012 - 05:12 AM GMTBy: Sam_Chee_Kong

Anything that has to do with investments will be subjected to risk and return. Normally, the higher the risk the higher will be the return. Is there any investment that will provide you the opposite, where the potential risk is reduced while the return will actually increased? The answer is YES and it is through Options.

Anything that has to do with investments will be subjected to risk and return. Normally, the higher the risk the higher will be the return. Is there any investment that will provide you the opposite, where the potential risk is reduced while the return will actually increased? The answer is YES and it is through Options.

Before we delve into how ‘Big money and Insiders’ use options to manipulate the Stock Market, I think we should educate ourselves on the inner workings of the options market so that we as an investor will also can benefit from the versatility that options can offer.

Understanding Options

The beauty about options is it offers limited downside (through premium) and unlimited upside potential (through profits). If you get too adventurous by speculating on ‘naked options’ or uncovered options then you are in deep trouble because your downside will be unlimited.

Another thing about options is that it enables you to play the market both ways and that is up or down. By buying a put option, you are hoping to for the price of underlying securities to go down. However, if the price of the security goes up, your losses will only be capped by the premium. If you are doing short selling on the physical securities, your downside will be unlimited because you don’t know what level the price of the securities will go up to. Hence it will give you sleepless nights.

Not knowing how to make money both ways in the market is like knowing how to drive ahead but don’t know how to reverse.

The thought of investing in Options actually terrified most people because to them anything that sounds sophisticated must be very risky. What is a stock option? A stock option gives the right to the to the owner to buy or sell a listed stock at an agreed upon price and an agreed future date. Stock options are contracts that consist of 100 shares of a particular stock.

Or we can put it in layman’s term, an option is simply a contract entered between two parties. One party is the buyer of the contract and the other is the seller of the contract.

For the sake of illustration, say you own a piece of land, and you want to sell it for $50,000. You can either sell it through the real estate agent or you can enter into an agreement (option) to allow someone to purchase your land for $50,000 for the duration of a year. You sell the agreement (option) to the person for a premium of $5000. During the duration of one year, the price of the piece of land may fluctuate. Under the terms of the contract, the purchaser has the right to exercise his right to purchase the land if the market price went up to say $70,000. You, as the seller will have to sell at the predetermined price of $50,000 plus the premium of $5000, which totaled up to $55,000. The buyer of the agreement will make $15,000 ($70,000 - $50,000 - $ 5,000) from this deal.

But what happens if the price of the property declined to $40,000 during the one year period. The purchaser of the agreement will have two options whereby;

- To purchase the price of the land at $50,000

- Abandon the deal and lose the $5000 premium

In this case the seller is the winner because even though the price of the land declined to $40,000, he will ended up being $5000 richer because the buyer did not exercise the option.

Types of Options

There are two types of options, either puts or calls options.

A put gives the holder the right to sell a specific number of shares (normally in 100 shares lot) at a fixed price and date in the future. A purchaser of a Put option is hoping for the stock price to go down.

Options are normally quoted in the following format;

1 IBM Jun 145 Put – Premium 9

Terminology explained

- 1 – number of contracts of 100 shares

- IBM – Underlying securities

- Jun – the expiry month

- 145 – the exercise or strike price

- Put – type of options

- 9 – denotes the premium paid by buyer to seller

Say an investor purchase the above option. What this means is it allows the investor the right to sell (put) 100 shares of IBM at $145 from now till June. For this privilege, the investor will have to fork out $900 ($9 x 100 shares) as a premium. The premium of $900 will be given to someone on the other side of the trade who already sold the contract.

A call gives the holder the holder the right to buy a specific number of shares at a fixed price and date in the future. A purchaser of Call option is hoping for the stock price to go up.

A normal Call option look like the following;

1 Microsoft Nov 300 Call – Premium 15

a) 1 – number of contracts of 100 shares

- Microsoft – Underlying securities

- Jun – the expiry month

- 300 – the exercise or strike price

- Call – type of options

- 15 – denotes the premium paid by buyer to seller

Achieve Low Risk but High Return

This option allows the purchaser of the option the right to buy (Call) 100 shares of Microsoft at $300 from now till November. For this, the purchase had to pay $1500 ($15 x 100 shares) as the premium.

For this case if the price of Microsoft shares goes up above $300 say to $350, the purchaser can then exercise his option by buying at $300 and sell it at $350. The net profit will be $50 x 100 shares = $5000 and then minus off the premium which is $1500. Hence, net profit will be $3500 and so by investing $1500 the investor is able to realize a profit of $3500, which is more than 200%. If the price goes down below $300, the investor will not exercise the option and will lose his premium, which is $1500.

So this is what we call the limited downside ($1500), but unlimited upside (more than $3500) if Microsoft share price goes above $350.

Factors affecting Options Pricing

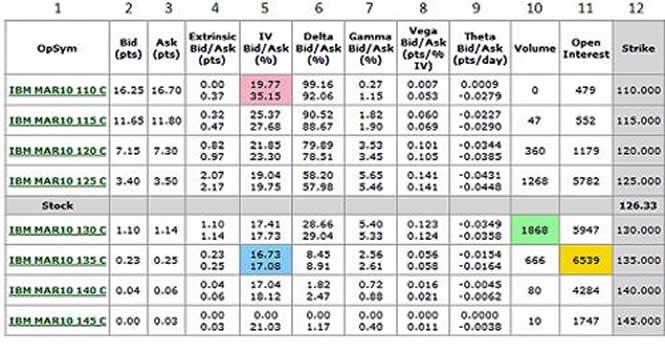

The following table shows a typical listing of an option data.

Below is a description of the above table;

1. Opsym Option Symbol

2. Bid buy price

3. Ask sell price

4. Extrinsic time premium to expiration

5. IV future volatility calculated by Black-Scholes Model

6. Delta see below

7. Gamma see below

8. Vega see below

9. Theta see below

10 Volume Volume

11. Open Int. Total amount of contracts that have been open but not offset

12. Strike Strike or Exercise Price

Five Factors affecting option pricing

Basically there are five factors that are affecting the options pricing and they are;

1. The current stock price and strike price

If you have purchase the below Call option, the amount of profit is determined by the amount in which the Stock price exceed the exercise price.

A normal Call option look like the following;

1 Microsoft Nov 300 Call – Premium 15

a) 1 – number of contracts of 100 shares

- Microsoft – Underlying securities

- Nov – the expiry month

- 300 – the exercise or strike price

- Call – type of options

- 15 – denotes the premium paid by buyer to seller

Say if Microsoft is now trading at $320 then you will have a profit of $20 ($320-$300) x 100 shares, which is equivalent to $2000. Therefore, the Call option will be more valuable if the Stock price is increasing and less valuable if the Exercise price is increasing.

Put options behave exactly the opposite of Call options. If you have purchase the below Put option, the amount of profit is determined by the amount in which the Exercise price exceed the Stock Price. Buying Put options is like performing a ‘Short Selling’ of the underlying security. When you buy a put option at $145, to make a profit IBM share has to decline so that you can buy back at a cheaper price to cover your short position. The difference is the profit.

1 IBM Jun 145 Put – Premium 9

Terminology explained

- 1 – number of contracts of 100 shares

- IBM – Underlying securities

- Jun – the expiry month

- 145 – the exercise or strike price

- Put – type of options

- 9 – denotes the premium paid by buyer to seller

Say if the IBM share is now trading at $135 then you will have a profit of $10 ($145 - $135) x 100 shares, which is equivalent to $1000. Therefore, the Put option will be more valuable if the Stock price is decreasing and less valuable if the Exercise price is increasing because profit is equivalent to Exercise price – Stock Price.

The relationship between the Stock price and the Option price (premium), is measured by the Greek symbol Delta (Δ) . The Delta value indicates how much the Option price will move in response to a movement in the Stock price. If an option with a Delta value of 0.5, it indicates that a 1 cent movement in the Stock price will result in a ½ cent move in the Option price.

So, the higher the value of the Delta (Δ) , the closer will be the will be the movement of the Option price in relative to a change in the Stock price.

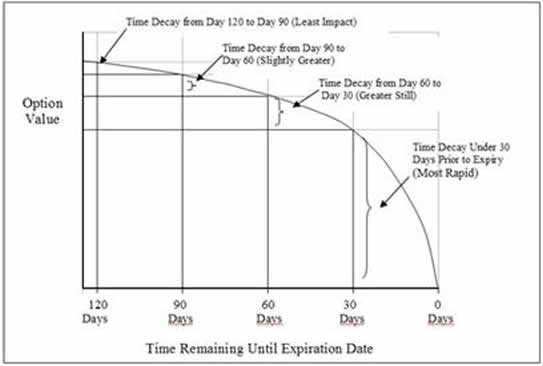

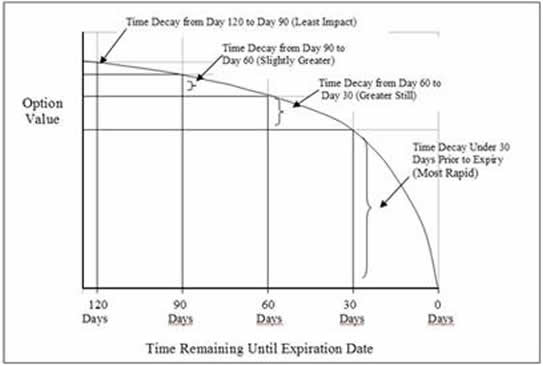

2. Time to Expiry Date (Time Decay)

As you can see from the above chart, the longer the time to expiry, the more valuable will be the option. Hence, an option with 120 days left to expiry will be more valuable than an option that has only 30 days to expiry. The holder of a 120 days to expiry option has more exercise opportunities than a holder of 30 days to maturity option.

Time decay is measured by the Greek symbol Theta (θ). The nearer to expiration date, the higher the Theta value and vice versa. The Theta value is an indication on how much a stock option’s value will lose by each day. A theta value of -0.02 indicates that the option will lose 2 cents per day.

So for the duration of a week, the option will lose a total of 14 cents because both Saturday and Sunday will also be included in the calculation even though there is no trading during those days.

3. Volatility of the Stock Price

The Volatility of a Stock is measured by the Standard Deviation of the return provided by the stock in a year and normally express in percentage terms. In other words the volatility of a stock price is a measure of how uncertain we are about the future movement of its price. As volatility increases the profit or loss of a particular stock also increases due to the wild swings of the stock price. How does this affect an options investor?

If a stock price increases, it will benefit the owner of a Call option while at the same time it will be detriment to the owner of a Put option.

Similarly, if a stock price decreases in its value, it will benefit the owner of a Put option and it will be detriment to the owner of a Call option.

The volatility of the Stock option can be measured with the Greek symbol Vega (υ).

If Vega is high then the stock option is very sensitive to changes to Volatility. Changes Vega value is determine by the changes in the volatility, which is expressed by every 1 percentage point. Suppose we have the following scenario;

- Vega value of 0.20

- Stock price at 2.00

- Volatility is at 15%

If the volatility increases from 15% to 16% then the stock price should move up 20 cents which will then be $2.00 + 0.20 = $2.20. Vega value of options with long expiry date (>= 90 days) tends to be larger than options with shorter expiry date (<= 30 days) because the implied volatility for long expiry options tends to be lower and hence risk.

4. Interest Rates movements

Movement in interest rates affects the stock price and hence the options price as well. Whenever there is an increase in the interest rate, stock prices tend to fall. A fall in stock prices will have detrimental effect to Call options. Holders of Call options will certainly lose out because if the exercise price is lower than the stock price then they will suffer losses. Holder of Put options will stand to gain when stock price decreases because their exercise price will be higher than the stock price

Similarly a rise in the stock price will have the opposite effect.

This relationship between the sensitivity of the movement of interest rate and the stock price can be measured with the Greek symbol Rho (ρ). If an option has a Rho value of 0.15, then a 1 % increase in the interest rate will raise the price of the option by $0.15.

5. Cash Dividends, Stock Dividends and Stock Splits

When a corporation declares a dividend, it establishes a record date. This record date will be used to record the owners of the stock on that date so that they will be entitled to the dividend. Since a normal transaction in the security industry requires 5 working days to complete, naturally the transaction need to be carried out 5 days before the record date. So, it is essential to establish that stocks had to be purchased 5 working days before the record date so as to qualify for the dividend and it is called the ‘ex-dividend date’.

Cash Dividends have the effect of reducing the price of the stock on the ex-date. The stock price will go down in relation to the amount of dividend declared. This will invariably have effect on the Option price.

For those who bought Call options, this will be bad news as the price of the option will also had to be calibrate downwards so as to reflect the changes in the stock price.

Whereas for those who bought Put options, then it will be good news to them as the decrease in the stock price will add up to their profits. Since by buying a Put option, you are hoping for the underlying stock price to go down.

Stock Dividends (or Bonus Issue) will greatly affect the terms of the options contract. Say if AAPL stock trading at $400 a share declares a Stock Dividend of 50%. What happened next is that each shareholder will receive extra 50 share for every 100 they owned. The amount of shares is also adjusted in this case from 100 shares to 150 due the extra 50 shares from the dividend. But then the price of the share will also need to be adjusted to reflect the additional new shares.

Hence the new price of the share will be $400/150, which is $266.67. This exercise, can be shown by the following.

1 AAPL Jan 400 Call becomes

- AAPL Jan 266.75 Call

Stock Splits will also works the same, with adjustment to the number of Shares and its price.

Options Trading Strategies

There are various strategies that can be employed using options to counter different market conditions. Equity Options can be used as a hedge and also speculate on the underlying securities. For example if an investor thinks that underlying security is getting bearish in the coming weeks. He can counter the downturn with the following moves.

- Sell a call option

- Buy a put option

If he is bullish on the underlying security then he may employ the following moves.

- Buy a call option

- Sell a put option

However there are more complex strategies that are available in trading options and it is not suitable for many investors.

Straddles

A Straddle is made up of one put and one call option on one underlying security that is having the same strike price and expiry. So in a straddle, the investor buys or sells two identical options except one is put and the other is call. The investor can either have a long or short straddle.

Long Straddle

After studying the volume accumulation of IBM and its price patterns, the investor feels that IBM is going to make a move but not sure whether up or down. What she can do is the following.

Buy 1 IBM Aug 130 Call - Premium 10

Buy 1 IBM Aug 130 Put - Premium 7

By this, it means that she will be participating in either an upward or downward movement of IBM. Please note that the total premium she paid was 17 points, and his initial investment is $1700 (10x100 shares + 7x100 shares).

So by August, IBM shares must be between 147 (130+17) for the call or 113 (130-17) for the put options for a break even. So the beauty about this strategy is that if the IBM stock goes above 147 or below 113, then it will start generating a profit. This represents an unlimited gain versus limited loss, which is the premium of $1700. However, the investor seldom loses all of the premium because the investor can cut loss in between.

Short Straddle

A short straddle is exactly the opposite. What she can do is the following.

Sell 1 IBM Aug 130 Call - Premium 10

Sell 1 IBM Aug 130 Put - Premium 7

Instead of paying for the premium, an investor who sells an option receives the premium. So, as long as the stock price hovers between 147 (130+17) for the call or 113 (130-17), the investor will retain some of the premium as profit. However the risk and reward for the investor who sells a straddle is different from the person who buys a straddle. This is because the maximum profit of the person who sold the above straddle is equivalent to $1700, but he will assume unlimited risk if say the stock price goes above 130.

In other words she is selling (writing in option lingo) an uncovered call in this case. So by selling a straddle, she will be exposed to limited profits but unlimited losses.

# If you are not familiar with options, it will better limit yourself, to buying and not selling options because the risk is too high.

Strip

If the investor feels that the market direction is bearish for IBM, instead of buying a straddle she can buy a strip. A strip consists of 2 puts and one call. An example will be the following.

Buy 1 IBM Aug 130 Call - Premium 10

Buy 2 IBM Aug 130 Put - Premium 7

So if IBM were to go down, the investor will have a bigger profit. Say if IBM dropped to 110, then there will be a profit of 40 points (2 put options x 20 points). The total premium paid is 24 points (1 call x 10 + 2 puts x 7). So the net profit gained will be 40 points – 24 points premium = 16 points.

It will be a different story if the stock price rose. The investor need at lease a 24 points gain in IBM stock to cover its premium so that she will be break even. In other words, IBM stock will need to rise to at least 154 so that so can exercise her call at 130 and sell the stock at 154.

Strap

If the investor feels that the market direction is bullish for IBM, instead of buying a straddle she can buy a strap. A strap consists of 2 puts and one call. An example will be the following.

Buy 2 IBM Aug 130 Call - Premium 10

Buy 1 IBM Aug 130 Put - Premium 7

So if IBM were to go up, the investor will have a bigger profit. The effect will be the opposite of our strip strategy earlier. These are different forms of straddle but varying the degree of puts and calls by capitalizing on the market condition whether it is bullish or bearish.

Combination

A combination will be an event where the underlying stock is the same but the strike price or the expiration date is different. An example of a straddle with a different strike price is shown below.

Buy 1 IBM Aug 135 Call - Premium 10

Buy 1 IBM Aug 130 Put - Premium 7

As you can see, the strike price for the call is 135, whereas the put is 130. To achieve a break even, the stock price had to be at least 152 for the call option or 113 for the put option. Anything above 152 and below 113 will represent ‘additional profits’. However if the stock price is exactly 135 or 130 then the investor will lose all of her premium of $1700. However, this is a highly unlikely scenario.

An example of a straddle with a different expiry date is shown below.

Buy 1 IBM Aug 130 Call - Premium 10

Buy 1 IBM Sep 130 Put - Premium 9

In this case, the strike price is the same at 130, but the expiry date is different. Call on August and Put on September. The extra month of expiry of the Put will raise the premium to 9. In this case the extra risk involve will be the extra month for the Put to expiry. If it is let uncovered, what happen when the stock price go up to 180 in September? The investor will have to bear the losses of 50 points (180-130). So the potential losses in this case will be unlimited.

Other Strategies

There are other more sophisticated strategies, which I think should reserve for professional options traders.

Some of them are dealing in more than 3 options at one time. An example will be the butterfly spreads whereby it involves buying 1 low price call option, 1 higher price call option and selling 2 call options with a price in between the buy call options.

It can be illustrated below.

Buy 1 IBM Aug 130 Call - Premium 10

Buy 1 IBM Aug 150 Call - Premium 12

Sell 2 IBM Aug 140 Call - Premium 9

In this case an investor will only make a profit if the stock price is trading in between 130 and 150. The premium paid by the investor is 10×(2x9) = 4 points. So if the stock price, move out of this range, then the maximum the investor can lose is 4 points. Other strategies include the following.

- Spreads which can be divided to Bull, Bear, Butterfly, Calendar and Diagonal

- Iron Condor when an investor believes the stock will trade in a range until expiry

- Collar is used when an investor already own a stock but looking to,

- increase return by writing call option

- minimize downside by buying put option

- Guts used when bullish in volatility. Buy 2 calls , one with higher strike price

Alright, that basically sums up our Trading Strategies and next we will look into how Big Money and Insiders manipulate the Stock Market using Options

BIG money and Insider manipulate stock market

The stock market has always been in the influence of Big Money and Insiders. Most of the trades and volumes, generated in most stock exchanges around the world, are done by either by quantitative or high frequency traders. It is estimated that more than 75% of all trades in New York, 60% of all trades in Europe and 50% of all trades in Asia are generated by Quantitative or High Frequency Traders.

However, there is one tool that escapes the attention of most traders (or rather amateurs) that professionals use, not only to reduce risk but also to influence trades in stock markets. The tool that they employ is Equity Options. How they use it to their advantage?

1. Block Trading

Block trading refers to the buying and selling of large number of shares in a particular security. It normally refers to hundreds of thousands or probably millions of shares and they are common in the security industry. That is why some brokers have a special department just to handle such trades because it is very profitable.

Take for example Broker Morgan Stanley (MS) receives an order from an investor to sell 500,000 shares of IBM at $100 a share. Their investor is not interested in staggered sales or selling by small amounts, which may take up to two months to dispose. The investor wants to get it done ‘all in one shot’. So, MS needs to call up other brokers if they are interested to take up 500,000 shares in IBM at $100 a share. Getting another investor to take up the offer is not easy. Say if they found someone who is interested in only buying 400,000 shares, so what is MS going to do with the remaining 100,000 shares?

MS will have the following options.

- Sell 400,000 shares to the client and 100,000 in the open market

- Sell 400,000 shares to the client and sell a call option on IBM

- Sell 400,000 shares to the client and buy a put option on IBM

Option A will force MS to sell 100,000 shares of IBM at $100 in the open market. By selling such a large block in the open market will tend to arouse attention among other investors and hence might push down the price of IBM shares to below $100. In this case, MS will incur a loss on itself, which is not a good strategy.

Option B will be a better strategy and MS may execute the following.

Sell 1000 IBM Aug 100 Call – Premium 5

So, what the above strategy does is Sell 1000 IBM Call Options, which is100,000 shares (1000 x 100 shares) and in this case there is no risk because MS had already in possession of 100,000 IBM shares from the investor. By selling the 1000 options, it is in a position to receive a 5 points premium, which is amounted to (100,000 x 5 = $500,000).

But in this case, there is a downside risk associated with selling a call option. If the stock price of IBM shares were to go down to below $100 then MS will incur a loss.

Option C will be to buy a put option on IBM, which can be illustrated below.

Buy 1000 IBM Aug 100 Put – Premium 3

Say if the IBM share is now trading at $95 then you will have a profit of $5 ($100 - $95) x 100,000 shares, which is equivalent to $500,000. Therefore, the Put option will be more valuable if the Stock price is decreasing and less valuable if the Exercise price is increasing because profit is equivalent to Exercise price – Stock Price. But buying a put, MS’s profit will be lesser because it has to pay a premium of $300,000 (1000 x 100 shares) x 3 points premium. So, MS profit will only be $200,000 but his risk in protected should IBM share price rise above $100.

But professionals are different from amateurs because they will rather take a risk and make a profit than to just receive a commission for doing the trade. So, professionals will rather go for Option B rather than the rest because it is their job to manage risk. Amateurs probably, will be better of by buying the put and pay the premium, because their risks are protected.

Similarly, block trades can be employed to facilitate large buy orders of shares in a company.

2. Acquiring large position in a company

Investors may use options to disguise their activities in the stock markets. If they are interested to acquire a large position in a company (AB) say 1 million shares, they may do so in the following methods.

- buy all of the shares in the open market

- buy half using call options of AB and the other half through open market

Option A. The investors will need to buy all of its 1 million shares in the open market. By purchasing such a large amount of shares, will lead to an appreciation in the price of the target company. Moreover, by buying such a large block in the open market will tend to arouse attention among other investors because it will increase its volume. Hence this will induce other investors to participate into buying the shares and will push up the price of the shares of the targeted company. This will make this exercise very expensive and difficult and hence is not a good strategy.

Option B will be a better strategy and the investors may execute the following.

Buy 5000 AB Aug 100 Calls – Premium 3

So, what the above strategy does is to buy 5000 AB Call Options, which is 500,000 shares (5000 x 100 shares) and pay a 3 points premium, which amounts to (500,000 x 3 = $1,500,000).

In this case, he can buy the shares in the stock exchange without arousing any attention to his activities. He can slowly take his time to accumulate his shares quietly in the stock market while at the same time he purchase 5000 AB Aug 100 Call options.

Since purchase of option is not reported as part of AB’s trading volume and hence other investor’s will not know of his intentions. Also, purchasing of options will not alter the daily trading volume of AB, it will be ‘easier to collect’ his required amount of shares.

Hence, the use of options helped the investors to accumulate their required amount of shares in a particular company, without arousing much attention of other investors, which might make it difficult for them to achieve their goal.

3. Insider Trading

Company Directors, Financial Controllers and Insiders, may use options to hide their activities in the stock markets. If they are in the know that there are good news pertaining to their company such as a larger than expected profit, a Merger or Acquisition activity, a large find of mineral reserve and etc. Instead of buying or accumulating of shares of their company in the open market, they may buy call options of their company.

When the good news is reported, they can cash in their call options. But they might be under the scrutiny of the Securities Commission, as call options is also known as stock equivalents. Since call options can be converted to shares, they may be subjected to insider trading. However, they can get around it by purchasing it under someone else name such as their relatives or some sort.

Similarly, this also applies when Insiders may use options to capitalize on the bad news of their company. If they know that their company will be reporting a larger than expected loss or the canceling of a Merger and Acquisition agreement, they can buy a Put Option. So when the bad news is announced, the price of the underlying security will go down and hence the price of options. So they just exercise their put option for a profit.

4. Hostile or Management Takeover

Due to the diverse amount of shareholders, the ownership of some companies are rather thinly distributed. Sometimes, a 5-10% ownership of the company shares is considered substantial. These companies are prime target for hostile or management takeovers. If an outsider wants to gain control of the company, all they need is to quietly purchase a 10% stake in the company. They can do it through the options market without arousing the attention of the management. By the time they have accumulated enough options, they can exercise it and they will automatically become a substantial shareholder.

When they have gain control of the company, then can blackmail the current management by threatening to discharge the whole management. So in order not lose their jobs and the perks that come with it, management had to conformed to their demand by buying back their shares at a higher price.

The SEC in trying to control such activities enacted Rule 13D, which requires any individual that owns 5% or more of a corporation stocks to file a report. Again, investors can get around it by purchasing the stake with different names.

5. Selling large Block of shares in thinly traded stocks

If an investor is holding a block of 500,000 units ABC shares, which only trades about 2000-3000 shares a day. How can he get rid of his shares in a short time period of say one week? Should he dispose the whole block of ABC shares in the open market, it will crash the share price of ABC. Say if the price of ABC shares is trading at $30. What strategy should the investor employ to sell the shares without hurting its share price?

The answer is the following.

Buy 5000 ABC Aug 31 put – Premium 2

By buying the put it will cost him a 2 points premium. Always remember you will receive the premium when you sell an option and vice versa. So when August arrives, he will exercise his option and deliver his 500,000 shares at the price of $31. After subtracting the premium, he is actually getting $29 for his block of shares. It will be much better selling it in the open market because by doing so he might drive the shares price below $29 and most probably to $25.

So, finally as you can see, there are many uses of options, not only to trade but also to maneuver your trading strategies in the market. Another use of options is to help Multinational Corporations to hedge their risk in their global operations. This will require another article, which I will later address on how Multinational Corporations use Currency Options, Forward Contracts and Currency Swaps to hedge their foreign exchange exposure in international markets.

by Sam Chee Kong

samcheekong.blogspot.com

cheekongsam@yahoo.com

© 2012 Copyright Sam Chee Kong - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.