Gold $900 and 2008 Forecast

Commodities / Gold & Silver Jan 15, 2008 - 08:08 AM GMTBy: Jordan_Roy_Byrne

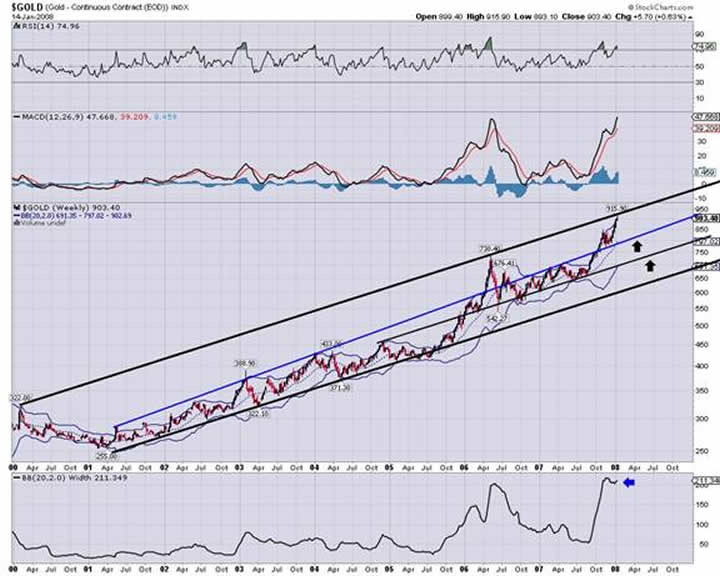

Not even a month into 2008 and Gold is stealing all headlines again. The ancient metal of kings has hit an all time nominal high while many other markets have struggled since August. Can gold go higher from here? Is this a top? Below is a long-term weekly chart of the aforementioned metal.

Not even a month into 2008 and Gold is stealing all headlines again. The ancient metal of kings has hit an all time nominal high while many other markets have struggled since August. Can gold go higher from here? Is this a top? Below is a long-term weekly chart of the aforementioned metal.

The various black trendlines all have the same slope and therefore form important channels. Gold has just hit long-term channel resistance. The Bollinger band width is very high, also implying a top could be at hand. The arrows show trendline support. The current risk outweighs the reward.

Most curious has been the underperformance of gold stocks and specifically the juniors in the face of $900 gold. The HUI/GOLD ratio peaked when Gold was trading around $420/oz. Gold has more than doubled since then yet the miners have underperformed.

We can't give away the specifics here, as that would be unfair to those who bought our 2008 Market Outlook. However, we do think we have found several answers and in the outlook we show the charts that help us understand why gold stocks have underperformed. Moreover, we analyze the current state of these charts and what it means for gold stocks going forward. It is a 43-page report that also analyzes many more markets other than gold. It can be purchased by visiting our website.

Shameless promotions aside, how do we see things now? We don't see the big crash and Depression that some expect in 2008. At least not yet. Having studied economics and markets for a long time, we find that things often take more time to play out than anticipated. While there is great turmoil in the markets now we feel things will improve by the end of the year. The US is too important to the global economy to be neglected. Someday soon that will change, but not in 2008. We continue to like the precious metals and expect gold to finish the year higher than it started. Its path will be interesting and volatile but ultimately up. We have a different view on the energy sector in 2008 than most. Most important, 2008 should be a great year for traders but not for most buy and hold investors.

By Jordan Roy-Byrne

trendsman@trendsman.com

Editor of Trendsman Newsletter

http://trendsman.com

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.