Buy This Gold Dip As $2,000/oz Possible

Commodities / Gold and Silver 2012 Mar 22, 2012 - 07:23 AM GMTBy: GoldCore

Gold’s London AM fix this morning was USD 1,636.00, EUR 1,243.16, and GBP 1,035.97 per ounce. Yesterday's AM fix was USD 1,656.00, EUR 1,248.21 and GBP 1,042.95 per ounce.

Gold’s London AM fix this morning was USD 1,636.00, EUR 1,243.16, and GBP 1,035.97 per ounce. Yesterday's AM fix was USD 1,656.00, EUR 1,248.21 and GBP 1,042.95 per ounce.

Silver is trading at $31.80/oz, €24.17/oz and £20.14/oz. Platinum is trading at $1,617.50/oz, palladium at $669.75/oz and rhodium at $1,425/oz.

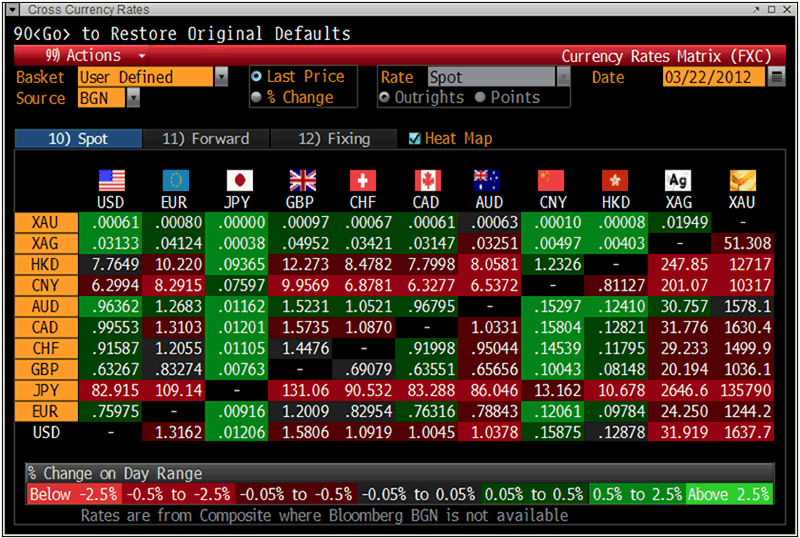

Cross Currency Table – (Bloomberg)

Gold rose 0.08% or $1.40 in New York yesterday and closed at $1,649.30/oz. Gold traded flat in Asia overnight and fell in European trading which now has gold now trading at $1,638.23/oz.

Gold has broken below recent support at $1,640/oz and reached as low as $1,632.45/oz this morning - below its recent low and its lowest price since January 16. Gold looks like it will go lower on technical weakness and the next level of support is $1,600/oz. Below that again support is at $1,523/oz - the low seen December 29.

Gold 1 Year - (Bloomberg)

Gold may be supported at these levels as demand in India is expected to increase due to the 5 day closure of jewelry shops which has led to pent up demand on the sub continent.

Gold is also likely to be supported by inflation pressures. Fed Chairman Ben Bernanke said before congress that rising oil prices could lead to “short-term inflation pressures”. Retail-gasoline prices have skyrocketed 18% this year to a 10 month high of $3.864/gallon.

Higher fuel costs “act as a tax on household purchasing power and reduce consumption spending, and that also is a drag on the economy”, the Fed chief said to the House Committee on Oversight and Government Reform.

Bernake also warned that Europe must further support its banks, and warns its financial and economic situation ‘‘remains difficult,’’ even as stresses have declined.

The global economy remains on shaky ground. China’s manufacturing activity contracted for its 5th straight month, the US recovery is still very early to call, and the euro zone debt crisis may not be finished. Eurozone PMI data is due later today which will show how the economy is doing after Greece averted default earlier this month.

Thomson Reuters GFMS have said that gold at $2,000/oz is possible - possibly in late 2012 or early 2013.

Thomson Reuters GFMS Global Head of metals analytics, Philip Klapwijk, featured on Insider this morning and advised investors to "buy this gold dip”.

Gold should be bought on this correction especially if we go lower still as we may need a shake-out of "less-committed investors."

Klapwijk suggested that a brief dip below $1,600 is on the cards but the global macro environment still favours investment, notably zero-to-negative real interest rates and he would not rule out further easing by either the ECB or the Fed before year end.

The Osborne gold comments were gold friendly despite the UK Treasury denying that the UK has any plans to rebuild their gold reserves.

Osborne was obviously scoring cheap political and economic points at his predecessor Gordon Brown and the opposition Labour party. However, the comments underlined the increasing importance of gold reserves to all nations - especially one's whose credit ratings are at risk due to appalling fiscal situations.

While the UK adding to its gold reserves seems a remote possibility now it is a possibility as gold reserves would help protect sterling from a currency crisis. Also, most of the UK's current foreign exchange reserves are in fiat currencies which also face the risk of devaluation in the coming years.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.