How to Think Like a Mad Man, Find your Edge & Risk Little for Lots

InvestorEducation / Learning to Invest Mar 26, 2012 - 01:52 AM GMTBy: Aftab_Singh

The enigma that is eccentricity can be unravelled by grasping of this single statement; that which you perceive is both a matter of the object of your perception (in this case; the eccentric person) and your apparatus of perception. Eccentricity, then, is as much a quirk of the popular mind as it is of a particular person. So with the assumption that you seek creativeness and intrigue — here’s how to think eccentrically, find your edge and risk little for lots.

The enigma that is eccentricity can be unravelled by grasping of this single statement; that which you perceive is both a matter of the object of your perception (in this case; the eccentric person) and your apparatus of perception. Eccentricity, then, is as much a quirk of the popular mind as it is of a particular person. So with the assumption that you seek creativeness and intrigue — here’s how to think eccentrically, find your edge and risk little for lots.

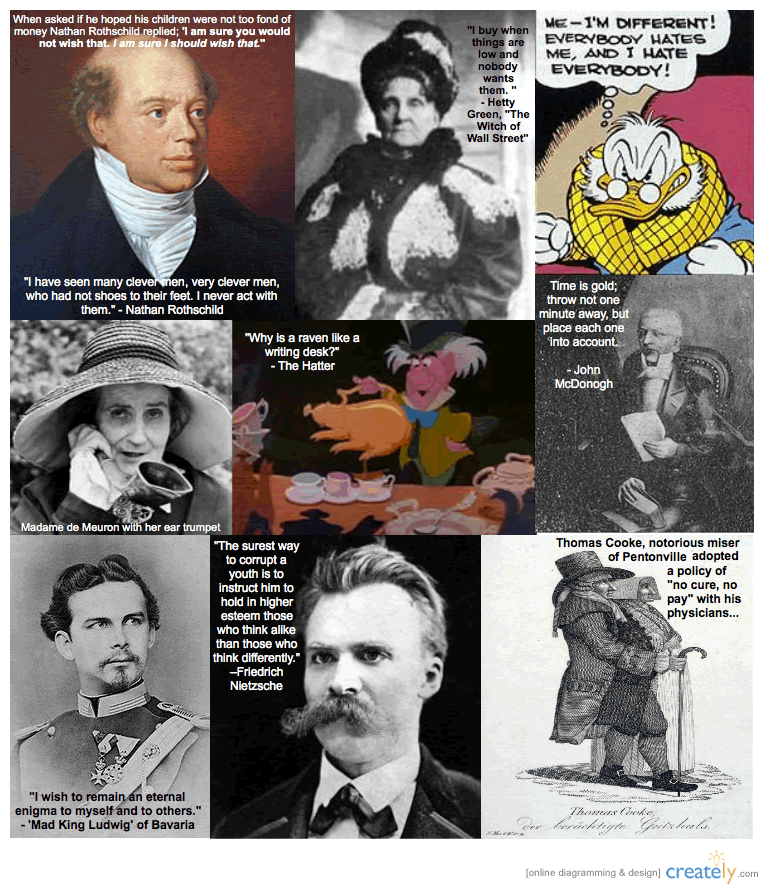

Eccentricity over the ages.

‘How to think’:

It may sound peculiar that contrary thinking is required to achieve creative thoughts… This, however, becomes self-evident when we realize that thinking the way someone else thinks results in mimicry — a “copy-cat” requires the minimum of creative thought… Therefore, the inference is that to achieve any creativeness, some change has to be made. From this, it stands to reason that the optimum in creativeness must approach the maximum change… and the maximum change must be close to the opposite.

— Zuce Kogan, Founder of the Creative Thinking Institute

-

Rid Yourself of Nebulous Terms – Define, Redefine & Refine.

Unless you’re an orator or something it’s highly likely that nebulosity is your enemy. If you speak and think in vague terms, then simple, logical deductions are likely to evade you. But since life involves doing one thing or another, chances are that you’ll default to linking concepts in the ‘default’ way — the way suggested by the crowd. In that case it is likely that the succession of vague, emotive images will govern your action.

The power of words is bound up with the images they evoke, and is quite independent of their real significance. Words whose sense is the most ill-defined are sometimes those that possess the most influence. Such, for example, are the terms democracy, socialism, equality, liberty, etc. whose meaning is so vague that bulky volumes do not suffice to precisely fix it. Yet it is certain that a truly magical power is attached to those short syllables, as if they contained the solution of all problems. They synthesise the most diverse unconscious aspirations and the hope of their realisation.

— Gustave Le Bon, The Crowd, A Study of the Popular Mind

Since eccentricity involves a capacity to deal with reality in a supposedly ‘odd’ manner and since the crowd deals mainly in vague images, one clear way to surpass them is simply to define the terms in which you speak and think.

This can seem daunting — especially at first. However, since the crowd remains ever-ponderous and dogmatic, it takes but a very small amount of clarity to achieve oversized gains. One need not plan out the redefinition of one’s entire vocabulary — just start with one concept that you use a lot in your daily life. I expect that the incentive gleaned from the initial reward will be enough to prompt further redefinitions and refinements.

-

Allocate All of Your Available Resources Contrarily.

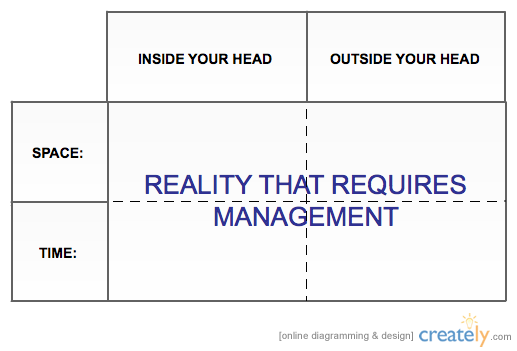

Contrary allocation of capital seems to be well-acknowledged as a key to success in certain investment and entrepreneurial communities. However, it also seems to remain compartmentalized as a theory about allocating capital and capital only – I say that if you wish to reach the honourable status of the ‘Mad Man’, it is prudent to apply this theory to all of the resources at your disposal:

Everything that should be managed lies here.

The truth is that you should allow your mind ruminate contrarily for more than just your money – but also for your time, energy and your attention. The integrated eccentric is he who doesn’t give up in any of these fields.

Whenever you are next faced with a seemingly trivial matter (such as whether or not to read a newspaper, take a taxi or express interest in an uninteresting matter) allow yourself to consider what the ‘common way’ is and just try the opposite.

-

Adopt a Kantian Distaste for Intellectual Discussion & Stop Checking with Others.

Sometimes, if not most of the time, it is quite unnecessary to acquire the opinions of others before you act. Yet nevertheless I see a strong tendency for people to check and verify trivial and non-trivial matters with one another. This brings about two serious hindrances to the wannabe wacko; 1) it forces you to adapt your language to that of someone that is probably confused and using nebulous terms and 2) it will likely introduce unneeded emotions into your mind.

In order to acquire a sense of creativity I suggest that you act before you tell others about your actions and – in particular – adopt a Kantian distaste for intellectual discussion:

By and large Kant, unlike Socrates, avoided the company of philosophers and philosophically minded fellow citizens. He did this not because of any conviction that philosophers as a breed are inevitably frivolous or consumed by the need to prattle on about their most recent publications; some are, to be sure, and these one would seek to avoid in any case. He was certainly aware that in his field of study there existed colleagues with whom he could talk about bank accounts, ball games or battle plans. But philosophyers tend to talk about philosophy. And even if such talk is motivated by infinite charity and fraternal goodwill, it provokes some response, comment or counter-arguement to the ideas and theories presented. In print the same arguments have quite a different impact; they can be simply registered without requiring an immediate response, or can be interpreted to suit one’s frame of mind, and as a last resort a page can be turned and a book can be closed. But in conversaation courtesy demands that the addressee react and relate himself. And this, in Kant’s view, is a dangeerous exercise and one that certainly lacks the productive element that Socrates may have found in it. Philosophyers, or so Kant thought, work best in isloation…

-

Test Your Revelations in Small Ways. Proceed to Fail Small & Win Big.

So by now hopefully you’ve defined at least one term that has significance to your life, considered allocating your time, attention and money contrarily and considered doing something big without checking with anyone at all. Chances are that you may have thought of something interesting. The default consensual reaction is to elaborate a plan in a manner that requires significant resources (be that money, time, energy, attention or whatever else). I urge you to take a step back and consider how you might test it in the smallest possible way. I’m always astounded by the degree to which people attempt to impose the property of permanence upon themselves. [facepalm] Why oh why? [/facepalm] Permanence through life is most frequently a large and onerous speculation — and indeed a type of speculation that is likely to be unattainable due to the ever-changing nature of each and every living individual. I suggest that if you wish to maintain your newfound eccentric temperament and demeanour, then risk little, lots rather than lots, little. If you risk little, lots you will not suffer the emotional turmoil that accompanies a large drawdown – and if you’re thinking contrarily you’ll likely be risking little for lots.

-

Acquire Refined Senses of Ignorance & Stubbornness

The final step to eternal quirkdom is to maintain both a refined sense of ignorance and a refined sense of stubbornness. In the first instance, I should define my terms:

By ignorance, I mean a lack of knowledge. By stubbornness I mean an unwillingness to move from one’s intellectual position.

The former ‘sense of ignorance’ is merely a sustained application of point 2) about properly allocating all of your resources. By carefully selecting what enters your mind, you can maintain a temperament where you decide the content of your ignorance (or more precisely the content of your non-ignorance). This term – most commonly used as an insult – is in this sense quite neutral. We all must be lacking in knowledge (since we are not beings of perfect intelligence). Acquiring a refined sense of ignorance is merely rejecting the notion that the crowd should determine what you are not to ignore (and to be sure that determination is perilously nebulous anyhow!).

The latter ‘sense of stubbornness’ is merely the unwillingness to forego logic for the vague images of the crowd. Once again – it is a rejection of the crowd’s vague concept of when you should and should not give up your intellectual positions.

Aftab Singh is an independent analyst. He writes about markets & political economy at http://greshams-law.com .

© 2012 Copyright Aftab Singh - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.