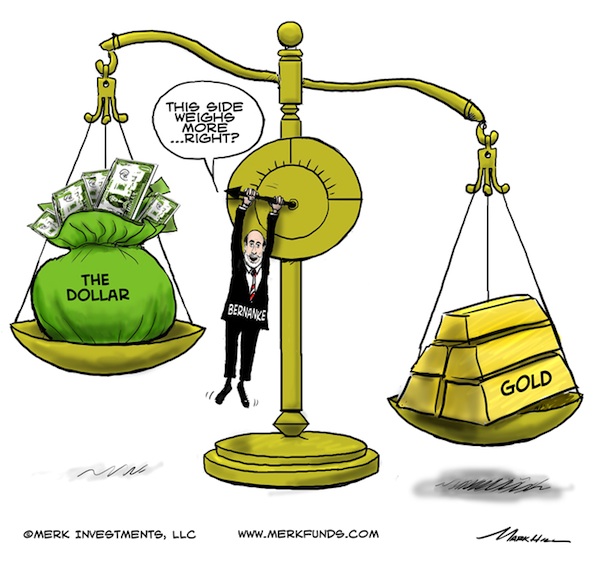

Bernanke's Problem with the Gold Standard

Commodities / Gold and Silver 2012 Mar 27, 2012 - 10:36 AM GMTBy: Axel_Merk

In his new lecture series, Federal Reserve (Fed) Chairman Ben Bernanke is going out of his way to discuss the "problems with the gold standard." To a central banker, the gold standard may be considered "competition," as their power would likely be greatly diminished if the U.S. were on a gold standard. The Fed, Bernanke argues, is the answer to the problems of the gold standard. We respectfully disagree. We disagree because the Fed ought to look at a different problem.

In his new lecture series, Federal Reserve (Fed) Chairman Ben Bernanke is going out of his way to discuss the "problems with the gold standard." To a central banker, the gold standard may be considered "competition," as their power would likely be greatly diminished if the U.S. were on a gold standard. The Fed, Bernanke argues, is the answer to the problems of the gold standard. We respectfully disagree. We disagree because the Fed ought to look at a different problem.

Bernanke lists price stability and financial stability as key objectives of the Fed. Focusing on the latter one first, the Fed was established to reduce the risk of financial panics. Bernanke points out:

A financial panic is possible in any situation where longer-term, illiquid assets are financed by short-term, liquid liabilities; and in which short-term lenders or depositors may lose confidence in the institution(s) they are financing or become worried that others may lose confidence."

Bernanke goes on to blame the gold standard for the panics. While he is certainly not alone in his view – indeed, his very lecture to students at George Washington University is promoting that view to a new generation of economists -, we beg to differ.

Banks - by definition - have a maturity mismatch, making long-term loans, taking short-term deposits. As such, banks are prone to financial panics as described by Bernanke. To mitigate the risk of financial panics, central banks can do what the Fed is doing, namely to be a lender of last resort. Alternatively, central banks can focus on the core issue, the structural "problem of banking." Following the Fed's approach, there are inherent moral hazard issues – incentives for financial institutions to increase leverage, to become too-big-to-fail. To address a panic that might happen anyway, the Fed would double down (provide more liquidity), potentially exacerbating future banking panics. After yet another crisis, new rules are introduced to regulate banks. The resulting financial system may not be safer, but it will increase barriers to entry, further bolstering the leadership position of existing, too-big-to-fail banks. With all the government guarantees and too-big-to-fail concerns, banks might then be regulated in an attempt to have them act more like utilities. Ultimately, that might make the financial system more stable, but will stifle economic growth. Financial institutions, as much as we have mixed feelings about their conduct, are vital to finance economic growth, as they facilitate risk taking and investment.

The problem of all financial panics is not the gold standard - otherwise, the panic of 2008 would not have happened. The problem of financial panics is - again - that "longer-term, illiquid assets are financed by short-term, liquid liabilities." Missing from Bernanke's definition is a key additional attribute, leverage. A maturity mismatch without leverage might cause a lender to go bust, but - in our interpretation - does not qualify as a panic when a limited number of depositors are affected. The "panic" and the "contagion" may occur when leverage is employed, as it creates a disproportionate number of creditors (including consumers with cash deposits).

There's a better way. To avoid having financial institutions serve as “panic” incubators, regulation should address the core of the issue. Bernanke shouldn’t use gold, as a scapegoat for all that was wrong with the U.S. economy previously, to justify a license to print money. First, failure must be an option; individuals and businesses must be allowed to make mistakes and suffer the consequences. The role of the regulator, in our opinion, is to avoid an event where someone's mistake wrecks the entire system.

The easiest way to achieve a more stable financial system is to reduce incentives for leverage. A straightforward method is through mark-to-market accounting and a requirement to post collateral for leveraged transactions. The financial industry lobbies against this, arguing that holding a position to maturity renders mark-to-market accounting redundant. Consider the following example, which highlights the implication: assume a speculator before the financial crisis took a leveraged bet that oil prices - at the time trading at $80 a barrel - would go down to $40 a barrel. In the “ideal world” according to the banks, this speculator would not have been required to post collateral and would have been proven right when oil (briefly) dropped to $40 a barrel after the financial crisis. In reality however, as oil prices soared to $140 a barrel before declining, the typical speculator would have been forced to post an ever larger amount of collateral; likely, the speculator's brokerage firm would have closed out the position, as the speculator ran out of money. The speculator lost money because he was unable to meet a margin call; importantly, though, the system remained intact. The speculator might complain: the price ultimately fell to $40! But such whining is futile because the rules of engagement were known ahead of time. As such, the speculator had an incentive to use less (or no) leverage. The bank's attitude, in contrast, incubates panics. In this example, regulated exchanges exist. But even without regulated exchanges or easily priced securities, similar concepts can be developed.

Another way to make financial firms more panic prone is to require them to issue staggered subordinated debt. Rather than relying heavily on short-term funding (retail deposits or inter-bank funding markets), banks should be required to stagger the maturities of their own funding over years. If, say, each year 10% of their loan portfolio needs to be refinanced, then - in times of financial turmoil - it might become exorbitantly expensive for a bank to finance that 10% of their loan portfolio. A bank should be able to shrink its loan portfolio by 10% in a year in an orderly fashion, without jeopardizing the survival of the firm or spreading excessive risks throughout the financial system. Note that this is a market-based mechanism to police the financial system.

These concepts reduce leverage in the system. And that's the point, as leverage is the mother of all panics. The concepts presented above will not solve all the challenges of banking, but blaming "the problem of the gold standard" for financial panics is - in our analysis - premature.

Modern central banking is not the answer to mitigate the risk of financial panics because the cost for this perceived safety is enormous. As a result of responding to each potential panic with ever more "liquidity", entire governments are now put at risk when a crisis flares up.

Beyond that, central banks have done a horrible job in containing inflation. The wisdom of central banking is that 2% inflation is considered an environment of stable prices. At 2%, a level often touted as a “price stable environment”, the purchasing power of $100 is reduced to $55 over a 30-year period. It's a cruel tax on the public. What’s more, in practice, countries with a fiat currency system have generally been unable to keep long-term inflation below 2%.

Bernanke warns of deflation. To the saver, deflation is a gift. Not to the debtor. In a debt driven world, deflation strangles the economy. Governments don't like deflation as income taxes and capital gains taxes are eroded. In a deflationary world, governments would need to rely more on sales taxes (or value added taxes): gradually reduced revenue in a deflationary environment would be okay as the purchasing power of those tax revenues would increase. That assumes, of course, that the government carries a low debt burden -- deflation would be a good incentive to limit spending. Get the picture why governments don't like deflation?

With inflation, people have an "incentive" to work harder, to take on risks, just to retain their purchasing power, the status quo. What about the pursuit of happiness? The idea that if you earn money and save, you can retire and live off your savings? We consider it quite an imposition that unelected officials have such sway over our standard of living.

Bernanke also attacks the gold standard for causing havoc in the currency markets. Please subscribe to our newsletter to be informed as we provide food for thought about the relationship between gold and currencies. We will also discuss what investors may want to do in a world that has moved further and further away from the gold standard. Subscribe to Merk Insights by clicking here. Also, please click here to register for the Merk Webinar: Quarter 1 Update on the Economy and Currencies which will take place on Thursday, April 19th at 4:15pm EF / 1:15pm PT. We manage the Merk Funds, including the Merk Hard Currency Fund. To learn more about the Funds, please visit www.merkfunds.com.

By Axel Merk

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.