Gold Rises and Silver Surges In Q1 2012 - Fiat Currency Devaluation Continues

Commodities / Gold and Silver 2012 Mar 30, 2012 - 06:20 AM GMTBy: GoldCore

Gold’s London AM fix this morning was USD 1,660.75, EUR 1,245.31, and GBP 1,038.68 per ounce. Yesterday's AM fix was USD 1,655.75, EUR 1,245.86 and GBP 1,041.22 per ounce.

Gold’s London AM fix this morning was USD 1,660.75, EUR 1,245.31, and GBP 1,038.68 per ounce. Yesterday's AM fix was USD 1,655.75, EUR 1,245.86 and GBP 1,041.22 per ounce.

Gold fell $3.00/oz or 0.18% in New York yesterday and closed at $1,660.10/oz. Gold traded sideways in Asia prior to seeing a slight climb to $1,665.55/oz in late Asian trading and is now trading in Europe near $1,662.65/oz.

Currency Ranked Returns - Q12012 (Bloomberg)

Gold has been trading in a tight box around $1,660/oz today, as eurozone finance ministers meet in Copenhagen to discuss the scale of the permanent “bailout fund” set for July.

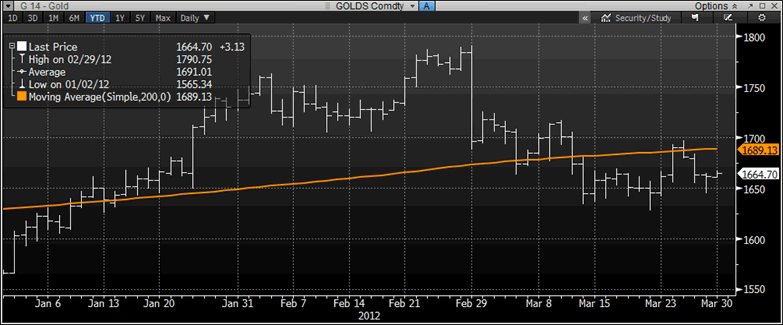

Gold has been stuck in range of roughly $1,630/oz to $1,700/oz in recent weeks as risk appetite has returned after the latest European debt “solution” which saw the battered can kicked down the shortening road once again.

Nothing has been solved with regard to the European debt crisis, and debt crises in Japan, the UK and the US now loom.

The misguided panacea of heaping debt upon debt and shifting debt onto government balance sheets, debt monetisation and currency debasement is leading to continuing currency devaluations internationally.

Despite this or maybe because of this - risk appetite returned with a vengeance as evidenced in equities internationally rising to multi-month and multi-year highs and the slight weakness in gold in March.

So far in 2012, gold has performed well and is set to end the first quarter in 2012 with gains in all major currencies.

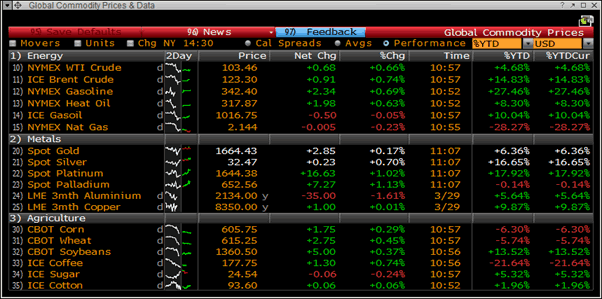

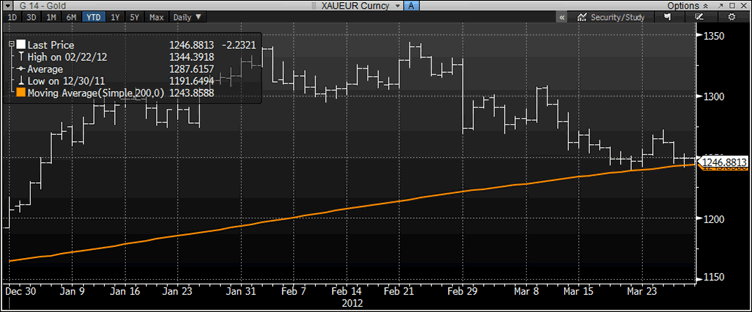

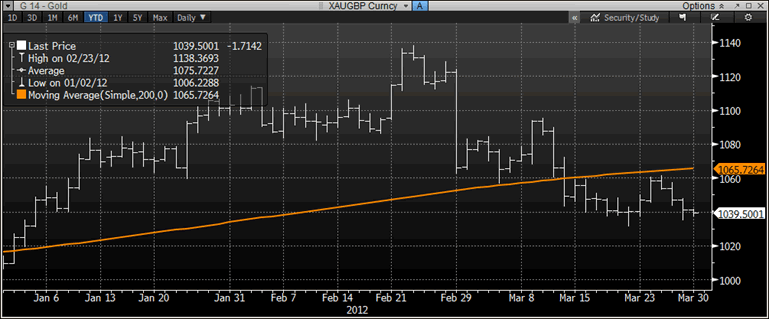

Gold is 6.3% higher in US dollars, 3.2% higher in euros, 3.1% higher in pounds, 2.25% higher in Swiss francs and 12% higher in Japanese yen which fell sharply in the quarter.

Gold YTD – (Bloomberg)

Silver outperformed gold to the upside and rose 16% in dollars and 12% in pounds and euros, 7% in Swiss francs and 20% in Japanese yen.

These currencies fell versus rare and finite gold and silver in the quarter and this trend looks set to continue in the coming months as negative real interest rates and currency debasement continue.

Global Commodity Prices & Data – (Bloomberg)

The strike in India has slowed the physical demand for gold but there are signs that the 14-day strike may soon end which could be the impetus for a bounce in gold.

Coin and bar demand in western markets has eased in Q1 as risk appetite returned and the public has again been lulled into a false sense of security.

XAU-EUR Currency – (Bloomberg)

Global ETF demand has remained robust in March and in Q1, with global ETFs holdings have increased by 1.5 million ounces. Much of this buying is likely to be hedge funds and institutions rather than retail.

Central bank demand is likely to have continued and there have been reports of many creditor nation central banks continuing to diversify their FX reserves. This trend will continue and there is also the possibility that some western central banks may also feel the need to diversify their meagre foreign exchange holdings into gold in order to protect against monetary risk and the real risk of a monetary or currency crisis.

XAU-GBP YTD – (Bloomberg)

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.