Silver Forming Head and Shoulders Bottom Pattern

Commodities / Gold and Silver 2012 Apr 02, 2012 - 02:16 AM GMTBy: Clive_Maund

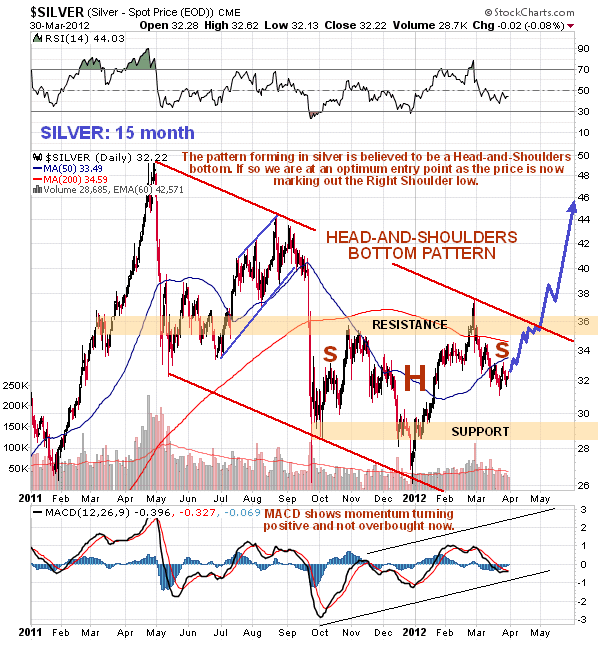

Silver is marking out a Head-and-Shoulders pattern that parallels the one forming in gold, but whereas the one in gold is classified as a Head-and-Shoulders continuation pattern, the one in silver is classified as a Head-and-Shoulders bottom. The reason for this difference is that the pattern in gold has formed not very far beneath the highs, and thus comparatively does not have much of a loss to reverse, whereas the pattern in silver has got quite a lot to reverse, as can be seen by comparing the 15-month chart for silver shown here with the 1-year charts for gold presented in the Gold Market update.

Silver is marking out a Head-and-Shoulders pattern that parallels the one forming in gold, but whereas the one in gold is classified as a Head-and-Shoulders continuation pattern, the one in silver is classified as a Head-and-Shoulders bottom. The reason for this difference is that the pattern in gold has formed not very far beneath the highs, and thus comparatively does not have much of a loss to reverse, whereas the pattern in silver has got quite a lot to reverse, as can be seen by comparing the 15-month chart for silver shown here with the 1-year charts for gold presented in the Gold Market update.

On its 15-month chart we can see that although silver did not succeed in breaking out of its downtrend on the rally in February, which is thus still in force, its action at that time was nevertheless bullish, as it climbed well above its highs of last November, which is taken to signify a potential change of trend from down to neutral, so that the pattern that has formed from the September panic lows to the present looks very much like a Head-and-Shoulders bottom, with the price having dropped down in March to form the Right Shoulder low of the pattern. Thus it is obvious that if this interpretation is correct we are at a highly advantageous entry point here from a price/time perspective, as the price is likely to advance soon from here to complete the Right Shoulder of the pattern, before breaking out upside from it to embark on the next major upleg, as indicated on the chart.

This is quite a potent setup for silver here as it has dropped back through a steadily rising 50-day moving average, which indicates a high probability of price recovery, especially as the MACD indicator is currently towards the lower boundary of its newly established uptrend. Although the still falling 200-day moving average is a negative influence, other factors point to an advance and breakout soon that will quickly result in a bullish moving average cross and to moving averages swiftly swinging into bullish alignment.

A breakout from the Head-and-Shoulders bottom soon will also involve a breakout from the downtrend shown at about the same time, which will be a doubly bullish development that should usher in the next major uptrend. This expected development is probably only weeks away, at most.

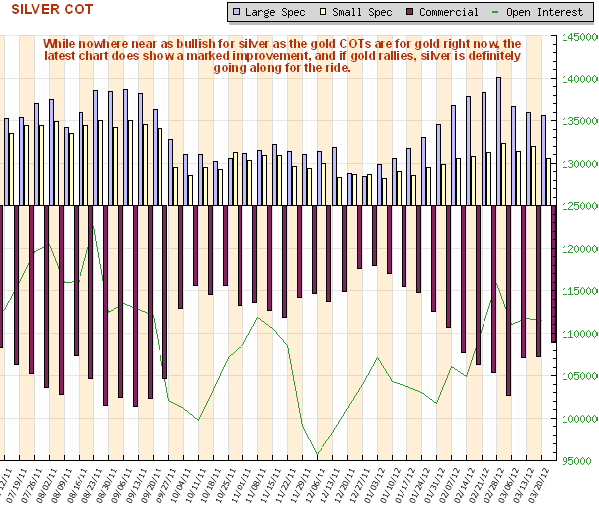

While the latest silver COT chart is nowhere near as bullish for silver as the latest gold COT is for gold, the latest chart does show a marked improvement, meaning a drop in Commercials short positions and Large and Small Spec long positions, which is positive, and if gold rallies, as its COT certainly suggests is likely soon, then silver is definitely going along for the ride.

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2012 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.