A True Stock Investor’s Most Important Performance Measurement

InvestorEducation / Learning to Invest Apr 17, 2012 - 01:15 AM GMT Although most people either fail to realize it, or simply refused to accept it, every stock portfolio has two separate and distinct performances. The first, and in my opinion, the least important, is stock price movement. If you buy a stock at $10 a share and it goes to $15 a share it’s a good stock. In contrast, if you buy a stock at $15 a share and it goes to$10 a share it’s a bad stock. Meanwhile, the operating performance (earnings results) is mostly ignored while often irrational price gyrations are excessively fixated upon. Of course, I understand why people behave this way, but I still can’t help but be very frustrated by this behavior.

Although most people either fail to realize it, or simply refused to accept it, every stock portfolio has two separate and distinct performances. The first, and in my opinion, the least important, is stock price movement. If you buy a stock at $10 a share and it goes to $15 a share it’s a good stock. In contrast, if you buy a stock at $15 a share and it goes to$10 a share it’s a bad stock. Meanwhile, the operating performance (earnings results) is mostly ignored while often irrational price gyrations are excessively fixated upon. Of course, I understand why people behave this way, but I still can’t help but be very frustrated by this behavior.

Early in my career, I had the good fortune to study the philosophies and investing strategies of many of the greatest investors of all time. Perhaps the most important thing I learned by doing this, was how much common ground that the great investors all shared. But even more importantly, was their willingness to share their principles and axioms with the rest of us, at least the rest of us that were willing to listen. The following is a series of axioms and quotes from some of my favorite great investors of all time, with some clarification interjected by me to support the thesis of this article.

Peter Lynch

Here Peter is telling us that price movement is not the true indication of a company’s True Worth.

"Just because you buy a stock and it goes up does not mean you are right. Just because you buy a stock and it goes down does not mean you are wrong." Peter Lynch 'One Up On Wall Street”

With this quote, Peter is validating my thesis that the success of the business is more important than short-term gyrations in stock price.

"What makes stocks valuable in the long run isn't the market. It's the profitability of the shares in the companies you own. As corporate profits increase, corporations become more valuable and sooner or later, their shares will sell for a higher price." Peter Lynch, Worth Magazine, September 1995 “

Warren Buffett

This first Warren Buffett quote shows that he recognizes that stock prices do not always reflect a company’s true value. Sometimes, and more often than we like to admit, the market gets price wrong.

"Great investment opportunities come around when excellent companies are surrounded by unusual circumstances that cause the stock to be misappraised. It's only when the tide goes out that you learn who's been swimming naked. Warren Buffett”

Warren buys the business, not the stock; therefore, he doesn’t even care if they close the market. His focus is on how well the business is performing.

“I never attempt to make money on the stock market. I buy on the assumption that they could close the market the next day and not reopen it for five years. Warren Buffett”

Ben Graham

Ben believes that true investors can take advantage of market pricing errors by focusing on the company’s dividends and business success.

“Basically, price fluctuations have only one significant meaning for the true investor. They provide him with an opportunity to buy wisely when prices fall sharply and to sell wisely when they advance a great deal. At other times he will do better if he forgets about the stock market and pays attention to his dividend returns and to the operating results of his companies. Ben Graham”

Here Mr. Graham tells us that true investors base their buy and sell decisions on the value of the business behind the stock. Moreover, he suggests that investors recognize the miss-appraisals of the market when they occur, and are therefore empowered to behave accordingly.

“The most realistic distinction between the investor and the speculator is found in their attitude toward stock-market movements. The speculator's primary interest lies in anticipating and profiting from market fluctuations. The investor's primary interest lies in acquiring and holding suitable securities at suitable prices. Market movements are important to him in a practical sense, because they alternately create low price levels at which he would be wise to buy and high price levels at which he certainly should refrain from buying and probably would be wise to sell. Ben Graham”

Philip Fisher

The great Philip Fisher clearly understood that the value of the business was more important than its current price. This article is based on focusing on the value of the business, instead of only thinking about the price of the stock.

“The stock market is filled with individuals who know the price of everything, but the value of nothing” – Philip Fisher”

Philip Fischer believed in owning fine businesses that he thoroughly researched over very long periods of time. Therefore, he was willing to accept the occasional short-term erroneous pricing behavior of the marketplace.

“If the job has been correctly done when a common stock is purchased, the time to sell it is almost never.” – Philip Fisher”

Bernard Baruch

Here Mr. Baruch is warning us that timing the market is impossible.

“Don't try to buy at the bottom and sell at the top. It can't be done except by liars.” BernardBaruch

I believe that with this quip Baruch is pointing out that there is a difference between being a shareholder in a business and a trader of stocks.

“I made my money by selling too soon.” Bernard Baruch

Martin J. Whitman

I will end my sharing of the wisdom of investing greats with one final tidbit from the venerable Marty J. Whitman. To paraphrase Marty’s wisdom in more everyday terms, he is saying that it’s easier to value a business based on analyzing its fundamentals than it is to try and guess where the price of the stock may go over the short to intermediate term.

"I remain impressed with how much easier it is for us, and everybody else who has modicum of training, to determine what a business is worth, and what the dynamics of the business might be, compared with estimating the prices at which a non-arbitrage security will sell in near-term markets." Martin J. Whitman, Chairman of the Board, Third Avenue Value Fund

The Price versus Value Conundrum

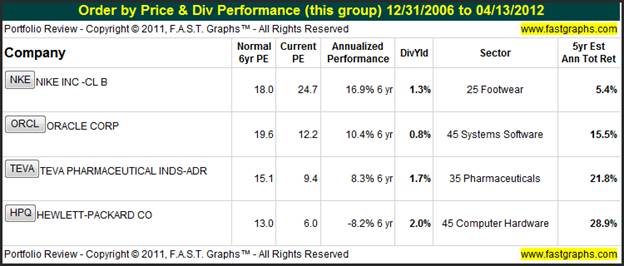

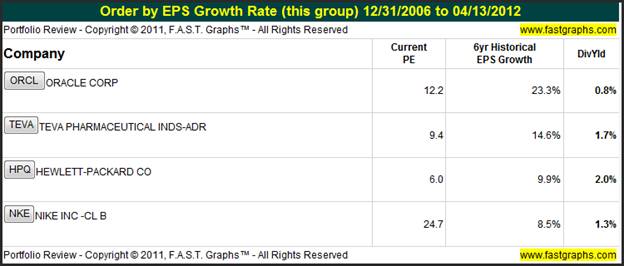

To illustrate the validity of the thesis behind this article, I offer five well-known companies and list them in the following table by order of price performance highest to the lowest since calendar year 2006. Note that this time frame includes the great recession of 2008. Following the table I provide an expanded view of each of these companies’ performance based on price movement and dividend income since 2006.

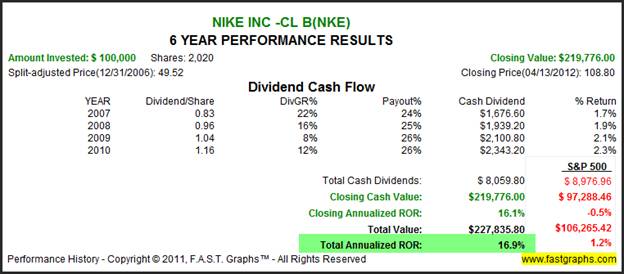

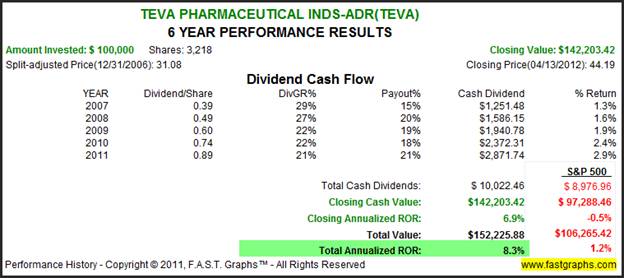

An Expanded View of Total Return Price Performance Plus Dividend Income

Nike Inc. (NKE)

Oracle Corp (ORCL)

TEVA Pharmaceutical (TEVA)

Hewlett-Packard Co. (HPQ)

The Best Five Business Results

With this next table I list the same five companies, only this time I list them by order of best business results (earnings growth) from highest to lowest. Notice how this reverses the order dramatically as Nike goes from first place to last place. With this next set of graphs I am focusing on what I consider to be the most important performance measurement, the business results of each company.

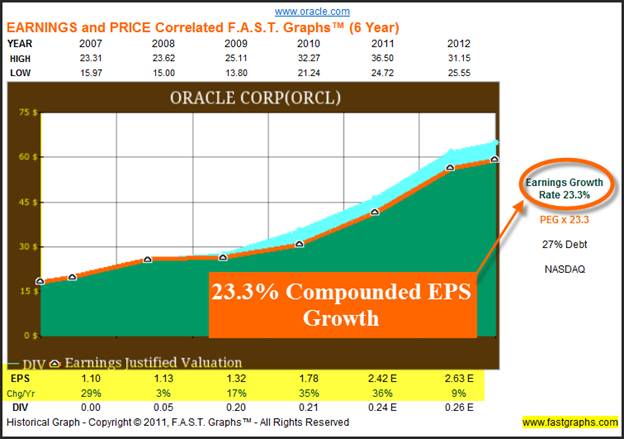

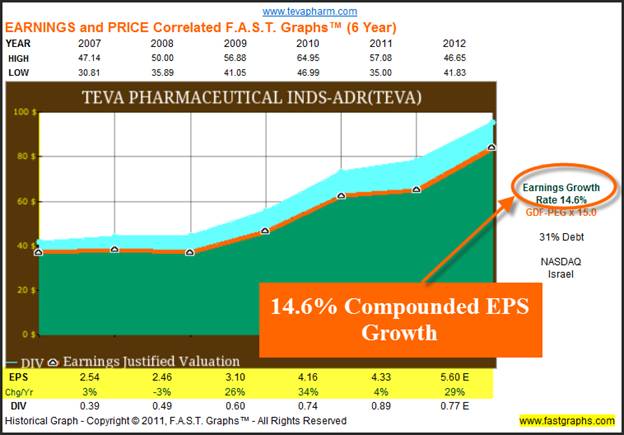

Earnings Growth the True Measure of Business Performance

These next graphs plot the earnings performance of each of our sample companies listed in order of best performance to worst. I’ve highlighted each year’s earnings to include the rate of change of earnings growth between each year at the bottom of each graph.

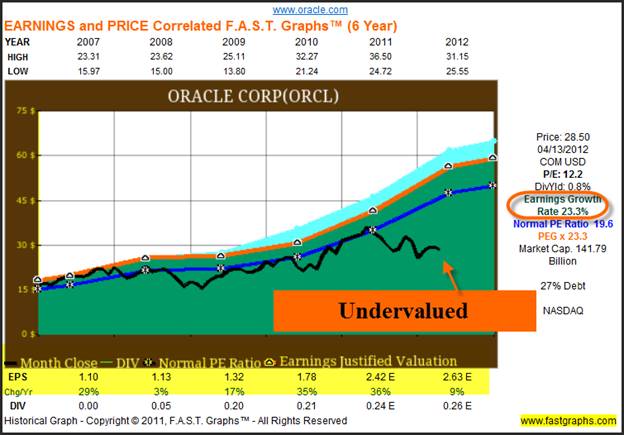

Oracle Corp (ORCL)

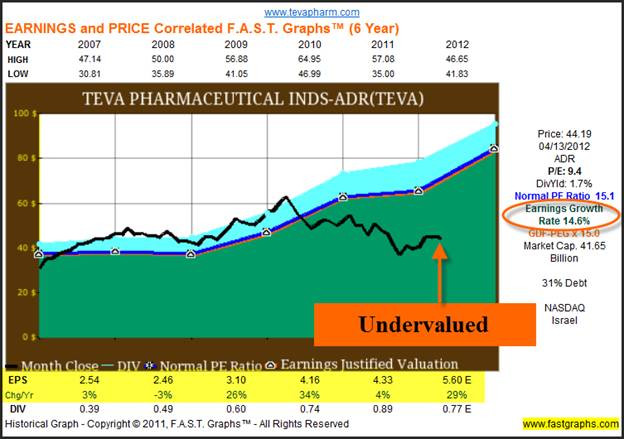

TEVA Pharmaceutical (TEVA)

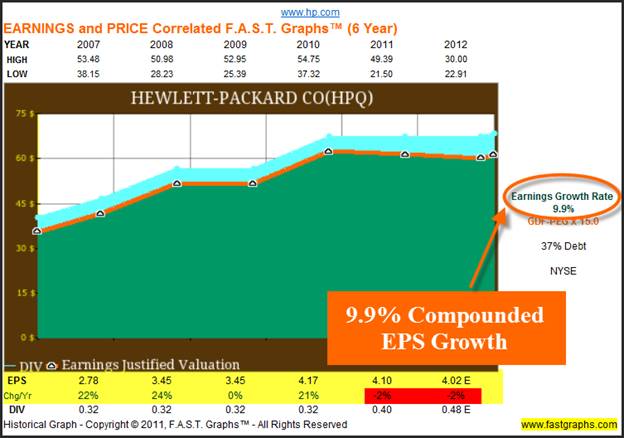

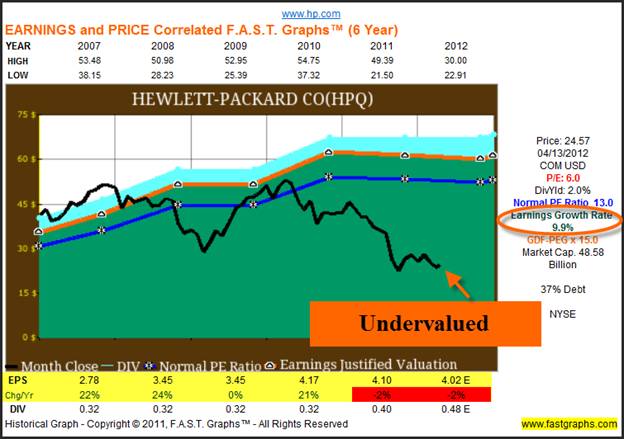

Hewlett-Packard Co. (HPQ)

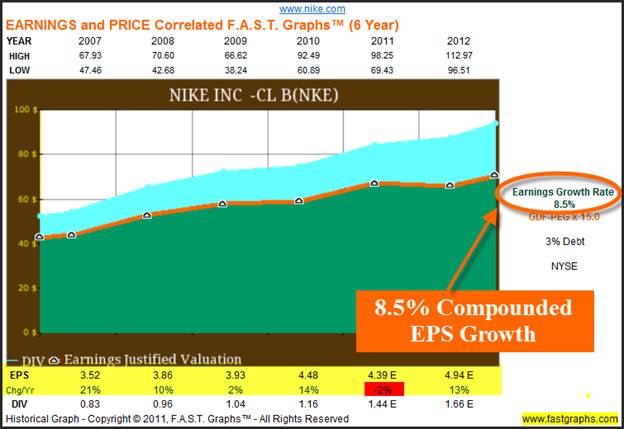

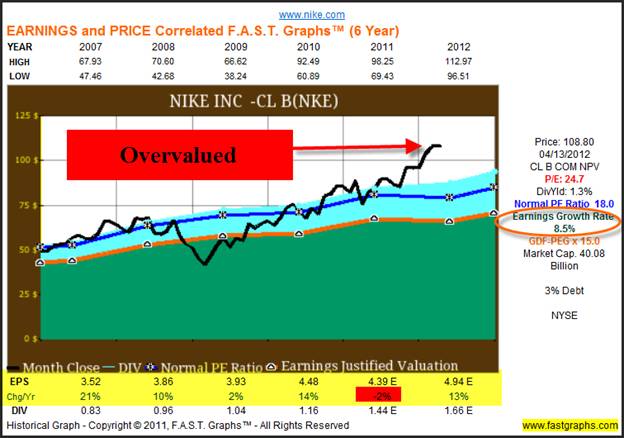

Nike Inc. (NKE)

The Earnings and Price Correlation as a Measurement of Valuation

With this final set of graphics I bring in monthly closing stock prices and correlate them to earnings. As I stated earlier, one of the primary reasons I chose these specific examples was because all of them were more or less reasonably valued at the beginning of calendar year 2007. Therefore, there was very little overvaluation bias built into their stock price performance. Moreover, at the end of this time period three of our four examples are undervalued, with only Nike currently being valued above its earnings justified valuation level by Mr. Market.

The illogical nature of this anomalous pricing should be clearly evident. Nike had the worst operating performance, yet the best total return. Common sense dictates that the better a business does, the better rewarded their shareholders should be. However, since Nike’s business results are clearly the lowest of this group, it should logically follow that they had the weakest stock market results. Since this did not happen, it validates the position that stock price behavior cannot be trusted. Yet unfortunately, price behavior is what most stockholders focus upon.

Oracle Corp (ORCL)

TEVA Pharmaceutical (TEVA)

Hewlett-Packard Co. (HPQ)

Nike Inc. (NKE)

Summary and Conclusions

The real purpose behind this article was to illustrate as clearly as I possibly could how the market can often mislead investors. When the market is pricing a stock for more than it’s worth, investors emboldened by their good fortune tend to become overconfident in both their holding and their investing acumen. Consequently, they fail and/or even refuse to acknowledge the impending danger of continuing to hold onto an overvalued stock. Even worse, the more overvalued it gets, the more arrogant they become.

In contrast, when the market is pricing a stock for far less than it is worth, investors will typically panic and sell what they should be buying more of. The problem is, as Phil Fischer’s quote so aptly put it:

“The stock market is filled with individuals who know the price of everything, but the value of nothing” – Philip Fisher”

Consequently, I believe in investing in high-quality, well-run, profitable and growing businesses in contrast to playing the stock market. Over many years of doing this, I learned that the market will often place the wrong value on a business based on the emotional responses of so-called investors. Of course, we all know these emotions as either fear or greed. In my opinion, there is no place for the emotional response when dealing with something as important as your financial future.

As a business perspective investor, I am prepared to ignore the often irrational volatility of Mr. Market. I focus much more on the actual business results of the companies I own, and much less on whether the price is rising or falling in a wacky market. To be clear, if I am not intending to sell my stock today, then today’s price means very little to me. I like stocks because of the liquidity they provide. However, the price for liquidity is volatility.

Furthermore, there’s an interesting aside to all of this that I find fascinating and even curious. Whenever I see market pundits debating the merits of owning or selling a specific stock, they’re almost universally offering up their beliefs about why the business is going to be strong or weak in the future. Quite often, their views will be in total contradiction to the actual facts. However, when you read between the lines, their biases are always a function of recent price movement. If the price is rising they are very pro the business, if prices are falling they will posit about how and why the business is going to falter.

Finally, I would like to point out that what I’ve written here is all about being a long-term investor in quality businesses. To paraphrase what Ben Graham once said, investing is most intelligent when it is most business like. I only see the “stock market” as the place in which I shop to buy the great businesses that I’m interested in being an owner of. But most importantly, as long as the business remains strong, I worry very little about short-term market behavior. My policy is that it is never a good idea to sell a valuable asset for less than it’s worth just because someone offered me a ridiculously low price. Therefore, I spend most of my time and effort attempting to determine the value of my business regardless of its current price.

Disclosure: Long ORCL, TEVA and HPQ at the time of writing.

By Chuck Carnevale

Charles (Chuck) C. Carnevale is the creator of F.A.S.T. Graphs™. Chuck is also co-founder of an investment management firm. He has been working in the securities industry since 1970: he has been a partner with a private NYSE member firm, the President of a NASD firm, Vice President and Regional Marketing Director for a major AMEX listed company, and an Associate Vice President and Investment Consulting Services Coordinator for a major NYSE member firm.

Prior to forming his own investment firm, he was a partner in a 30-year-old established registered investment advisory in Tampa, Florida. Chuck holds a Bachelor of Science in Economics and Finance from the University of Tampa. Chuck is a sought-after public speaker who is very passionate about spreading the critical message of prudence in money management. Chuck is a Veteran of the Vietnam War and was awarded both the Bronze Star and the Vietnam Honor Medal.

© 2012 Copyright Charles (Chuck) C. Carnevale - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.