Spain, the Land of Magical Financial Realism

Politics / Eurozone Debt Crisis Apr 19, 2012 - 02:13 AM GMT

These days when I read about Spain I'm wondering more and more how and why it is that the country has any access at all left to international finance markets. The bond auction this week was even sort of bearable, even as yields rose. I'm guessing that either investors have a hard time reading the news or they're going double or nothing in a risk-on bet that Germany and the IMF (China?!) will come to the rescue.

There's certainly a lot of humor in the stories. Which defy even the most imaginative minds; and don't try telling me you could have made this up. Pater Tenebrarum at the Acting Man blog has a few choice bits:

Miserere Nobis – More Pain In Spain

[..] every time a bank merger is consummated, it turns out that the losses of the weaker banks are far greater than was previously assumed (or rather, admitted to). As a result, Spain's deposit guarantee fund (DGF) has run out of money.

The solution to this particular problem the authorities have hit upon is comparable to the most recent exercises in financial creativity in Greece (it is the extent of creativity that is comparable). The government doesn't want to contribute anything to the fund in order to be able to meet its deficit target, or rather, not miss it too badly. So the banks are going to lend the fund €24 billion, with their individual contributions graded by their market share (initially, €12 billion will be disbursed).

If you're still with us, the short version is that the banks are going to lend the fund that is supposed to bail out the banks the money to bail them out. As Exane's bank analyst Santiago Lopez Diaz notes, although the loan is a true contingent liability, it won't (at least at first) be influencing earnings statements – except perhaps positively, as the banks will book interest on it! As he notes, this is simply astounding financial alchemy.

The Spanish banks are lending their own government the money it needs to bail out... the Spanish banks. That may seem absurd at first glance, but wait till you see where those banks get the money to lend to their own government. From earlier in the same article (which seems to miss this point a bit):

Spain's banking system continues to make waves and unwelcome headlines. On Friday it became known that the banks have borrowed a record €316.3 billion from the ECB as of March, up from €169.8 billion in February – 28% of the gross borrowings of all banks in the euro area (in terms of borrowings from the ECB, it represent an even bigger percentage). This means Spain's banks have little to no access to the interbank market or other private funding and have evidently made maximum use of the second LTRO.

Oh lordy. The Spanish sovereign is being propped up by its own defunct banks. Which get the money to do the propping up from the ECB (re: Germany). That’ll go over well in Berlin once it's fully understood.

Not all of the €316.3 billion the banks borrowed as of March goes to the state and its bankrupt bank bailout fund, however. Quite a bit also is used to buy Spanish government bonds. Which is a sort of official goal of the LTRO, so Berlin can't say much about it:

Here's more from Yalman Onaran for Bloomberg on this strange circular magically realistic "logic":

Spain Banks Buying Bonds Shift Risk to Taxpayer

Spanish, Italian and Portuguese banks are loading up on bonds issued by their own governments, a move that shifts more of the risk of sovereign default to European taxpayers from private creditors.

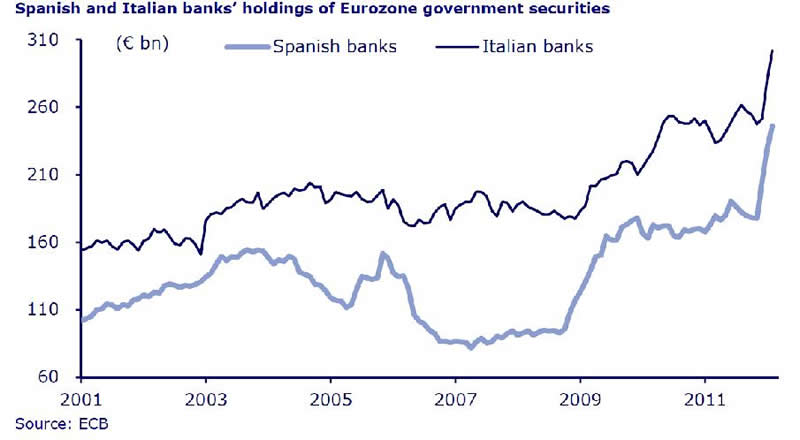

Holdings of Spanish government debt by lenders based in the country jumped 26 percent in two months, to 220 billion euros ($289 billion) at the end of January, data from Spain’s treasury show. Italian banks increased ownership of their nation’s sovereign bonds by 31 percent to 267 billion euros in the three months ended in February, according to Bank of Italy data.

German and French banks, meanwhile, have cut holdings of those countries’ bonds, as well as Irish and Greek debt, by as much as 50 percent since 2010 in some cases. That leaves domestic firms on the hook for a restructuring such as Greece’s last month and their main financier, the European Central Bank, facing losses. Like Greece, governments would have to rescue their lenders with funds borrowed from the European Union.

"The more banks stop cross-border lending, the more the ECB steps in to do the financing," said Guntram Wolff, deputy director of Bruegel, a Brussels-based research institute. "So the exposure of the core countries to the periphery is shifting from the private to the public sector."

The jump in sovereign-debt holdings by Spanish and Italian banks has been fueled by the ECB’s 1 trillion-euro long-term refinancing operation, or LTRO, initiated in December, to provide liquidity to the region’s lenders. Encouraged by their governments to take the money and buy bonds, banks borrowed 489 billion euros on Dec. 21 and 530 billion euros on Feb. 29.

For lenders in so-called peripheral countries -- Spain, Portugal, Ireland, Greece and Italy -- profit also was an inducement: They could borrow at 1 percent to buy government bonds yielding between 6 percent and 13 percent.

Lenders in those five countries have taken about 715 billion euros from the ECB through emergency programs, including the LTRO, according to the most recent data provided by the central banks of those nations. Irish and Greek lenders have borrowed an additional 83 billion euros from their central banks, using collateral that isn’t accepted by the ECB.

Bank saves sovereign saves bank saves sovereign. Bank saves sovereign with ECB money, and sovereigns rescue their lenders with funds borrowed from the European Union. The Spanish zombie stalks the Madrid and Barcelona midnight streets bleeding German euro's. Magical realism at its best.

Of course, the banks need some of the ECB money for themselves too. As the Acting Man article (let’s go back there for a moment) explains through a "Portuguese detour":

"Fitch Ratings-London-11 April 2012: Fitch Ratings says in a new report that performance indicators for Portuguese mortgage loans securitised in RMBS transactions are misleading, as originating banks' support for borrowers is masking the true extent of past underperformance.

In addition, house price indices that are typically quoted as indicators of the health of the market significantly understate the value declines witnessed on properties sold under 'forced' circumstances. This hides the full extent of future risks for Portuguese RMBS transactions.

Fitch expects the pressure on macroeconomic fundamentals – especially increased unemployment – to translate into weaker performance of mortgage loans. However, the weakness of the Portuguese mortgage market is not yet fully visible in the reported performance of RMBS transactions.

"The true extent of loan underperformance continues to be masked by support from the originating banks, through a combination of loan modifications, substitutions and repurchases," says Gioia Dominedo, Senior Director in Fitch's European Structured Finance team.

"On average, 11% of the collateral backing RMBS transactions has been affected by loan modifications, but this figure is as high as 50% in certain cases. In addition, an average of 12% of loans has been repurchased or substituted. This intervention makes estimating the real risks associated with the underlying mortgages far more challenging."

We mention this because the same thing is happening in Spain. [..] Spain's banks make ample use of conduits (i.e., the very SIV's that became so infamous during the US mortgage credit crisis). The risk from these conduits is considerable, as similar to how this scheme worked in the US, the banks are the guarantors of the conduits' funding and liquidity.

Moreover, as we have frequently mentioned, officially quoted real estate prices as per the price indexes used by the banks and approved by the Bank of Spain are a complete sham. It's not only the fact that the biggest appraisers are an oligopoly owned by the banks. As a friend pointed out to us, the real estate market is basically dead, so the majority of transactions that does take place involves banks repurchasing properties from clients at artificially inflated levels.

If these properties were appraised correctly, then the banks would have to take the losses from previously purchased properties and/or loans collateralized by such properties. One reason why it is well known that the valuations are not credible is that the banks refuse to create new mortgages based on these appraisals, unless they are for properties on their books.

Alphaville recently reported on Fitch taking a closer look at over 8,000 properties that were repossessed in RMBS it has rated in Spain. It remarks precisely on the practices described above, whereby the banks shuffle properties around, often within the same banking group, for the sole purpose of creating the artificially inflated prices that can then be used to carry on with this particular extend & pretend scheme.

"What Fitch is noting here is that the properties fell a lot more from their original valuation than what an official house price index says it should have fallen by at this point in Spain’s post-bubble economy. This difference pops out first when these properties were repossessed, and then, even more so when they were sold at a forced price."

[…] properties managed and serviced by Catalunya Banc/CX have the lowest recorded depreciation rates (20%) of all transactions in this analysis; however, this level is maintained artificially low due to a large volume of sales to intra-group companies at above-market prices. Elsewhere, properties managed and serviced by EdT/BBVA have higher depreciation rates (58%), driven by a commercial strategy that results in one of the shortest time-for-sale ratios (11 months) when compared to other transactions.

The question, to get our real point, being what happens next. Fitch already notes that some Spanish banks are unlikely to have the capital on their own to absorb defaulted loans much longer. But if they accelerate foreclosures, the price decline is huge. Fitch’s data set here strongly suggests this. Ultimately this plugs into the debate over Spain setting up a bad bank — in this case to take toxic loans to real estate developers from banks’ balance sheets. Discounts applied to loans in that operation could also be severe."

It's enough to make one feel dizzy.

The upshot of the above is that the markets have apparently become increasingly aware of the problem of late and are interpreting it to mean that Spain's government will end up in even bigger fiscal trouble than hitherto suspected, as it is easy to see that the banks will require much more support (we are by now assuming as a matter of course that the socialization of bank losses is official policy all over Europe). We repeat: although Spain's banks are well known for sweeping everything under the rug, they are now slowly but surely running out of rug.

More on the deteriorating position of Spanish banks, those saviors of the nation, from Charles Penty for Bloomberg:

Spain’s Surging Bad Loans Cast New Doubts on Bank Cleanup

Spain’s surging bad loans are spurring doubt on whether the government can persuade investors that it can clean up the country’s banks without further damaging public finances.

Non-performing loans as a proportion of total lending jumped to 7.91 percent in January, the highest level since 1994, from less than 1 percent in 2007, according to Bank of Spain data. [..]

Defaults are rising and credit is shrinking at a record pace as 24 percent unemployment corrodes the quality of loans built up in the country’s credit boom and saps the appetite of banks to make new ones. Doubts about the extent of Spain’s non- performing loans problem is hurting bank stocks and driving up the government’s borrowing costs on investor concern that the expense of propping up ailing lenders may add to the debt burden. [..]

"A lot of our doubts are based on the grounds that non- performing loans should increase," said Tobias Blattner, an economist at Daiwa Capital Markets in London, adding that he expects house prices still may fall by as much as 20 percent. "That could make a further hole in balance sheets of the banks."

Rajoy’s government announced plans in February to force banks to take their share of costs of 50 billion euros ($65.6 billion) for building provisions and capital to make them recognize losses on real estate piled up on their balance sheets during the country’s housing bust.

The Bank of Spain said late yesterday that lenders will take a total of 53.8 billion euros to meet the new requirements, including 29.1 billion euros in provisions and 15.6 billion euros to create capital buffers. The Bank of Spain said most companies would be able to comply "without major difficulty." [..]

The plan implies a loss ratio for those assets of about 25 percent based on the fact that banks have already made provisions of 50 billion euros against total real estate risk of 340 billion euros, said Daragh Quinn, an analyst at Nomura International in Madrid.

Depending on how much the economy contracts and asset prices fall, further provisions of as much as 40 billion euros may be needed, said Daiwa’s Blattner.

"In light of the bleak profitability outlook for the Spanish banking sector, we are concerned whether banks will be able to put aside the provisions the government has requested," he said.

So far the government’s efforts to bolster confidence in the banks has focused on making them recognize losses linked mainly to real estate. Banco Espanol de Credito SA (BTO), a Spanish consumer bank controlled by Banco Santander SA (SAN), said April 12 that first-quarter profit fell 88 percent as it made provisions to cover about half of the 1 billion euros in real estate charges the company must make this year to comply with the government’s order.

Still, Spain’s deteriorating economy means other classes of loans apart from those linked to real estate are also at risk of going sour, Blattner said.

The Bank of Spain, which says banks are burdened with about 176 billion euros of "troubled" real estate assets, lists about 21 percent of the 298 billion euros of loans linked to property developers as non-performing. The bad-loans ratio for industry excluding construction has jumped to 5.4 percent from 1 percent in 2007, according to the Bank of Spain.

Well, at least part of the picture becomes clear. I hope.

One more thing: most of what I see floating by in the news when it comes to Spain's real estate talks about the cajas, the small banks. But I don't believe for a moment that the big banks, like Santander and BBvA, were not involved in creating that behemoth bubble. Well over 10% of Spanish homes are reported to be empty. The country built more homes prior to the crisis than Germany, France and Britain did combined.

Santander then went on to acquire Alliance & Leicester, Bradford & Bingley and Abbey’s in Britain, as well as Sovereign Bancorp in the US and many other banks internationally. So I wonder sometimes if perhaps anyone in those countries ever asks themselves how safe those operations are today. If these guys can transfer overvalued bad loans and securities around between their Spanish affiliations, can they also do the same in their international branches?

Wouldn't that be interesting?

Ashvin Pandurangi, third year law student at George Mason University

Website: http://theautomaticearth.blogspot.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2012 Copyright Ashvin Pandurangi to - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.