Mark-to-Market: From David Hume to Adam Smith…From Ludwig von Mises to Hiroshima

Economics / Economic Theory Apr 19, 2012 - 09:40 AM GMTBy: Andrew_Butter

From Daniel James Sanchez of the Mises Institute (somewhat condensed):

From Daniel James Sanchez of the Mises Institute (somewhat condensed):

According to Ludwig von Mises, the notion of money as a measure of value is an artifact of the "classical economics" of Adam Smith, David Ricardo, and John Stuart Mill, who, by and large believed that value was an objective attribute of “goods”. Economic actors, according to classical theory, only exchanged goods if the respective values were equal.

Mises had another theory which he called the subjective-marginal-utility theory of value, where value is derived from utility and valuation is a matter of preferring one set of goods over another, according to the goods' respective utilities.

These days the musings of the philosophers distills down into the debate between “mark to market” and what is sometimes called “fundamental value” which is what International Valuation Standards calls “other than market value”…which is sometimes called “mark to fantasy”…which is another way of saying that such a valuation has little more than “subjective-marginal-utility”.

Mark to market is the cornerstone of modern accounting practice and is the preferred (realistically the only) method of valuation mandated by Basel II and Basel III and other banking regulators for working out capital adequacy. That is “classical economics” which says goods only exchange if their values are equal, or in other words that money paid for something, or something comparable, confirms its value.

That works great unless of course one person pays too much and another get’s paid too much and that transaction gets used as a benchmark by the marks, which is what happens when the Wall Street types take over, and they corrupt that idea into the quip, “value is what you can sell something for, to someone dumber than you”. But don’t worry, the economists have bolted on a caveat for that, they say that only happens when markets are in disequilibrium, which is something very rare.

They say that luckily, disequilibrium never lasts long because eventually markets revert to the mean, in fact some versions of efficient market hypothesis say markets revert to the mean in a blinding flash of light that is for all intensive purposes, instantaneous, and the chance of sighting one of those in a lifetime is as rare as the sighting of a Higgs Boson.

Of course the proponents of the theory of the blinding flash of light that magically makes markets efficiently benchmark true-value forgot all about the Scottish philosopher David Hume who both Adam Smith and Albert Einstein cited as an important influence for their thinking. He who once remarked (in 1751) that, “…a statement or question is only legitimate if there is some way to determine whether the statement is true or false.”

Put that another way, did anyone ever take a photograph of that blinding flash of light that magically causes markets to become efficient? Because if they didn’t, well according to Hume, who is rumored to be doing cartwheels in his grave as we speak, that would mean the theory is not “legitimate”.

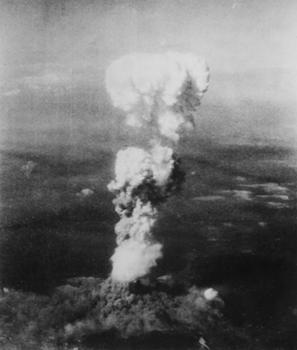

I looked on Google Images under…“Blinding Flash of Light Efficient Market”; this was the first image that came up:

All I can say about that is the Geeks-at-Google must be pretty darn good at their algorithms, plus it’s very reassuring to know someone took a photograph of the instantaneous return to equilibrium of the market-place…in a blinding flash of light, that proves beyond a shadow of a doubt that mark-to-market is always a prudent way to do a valuation.

But hang on a minute!! I think I’ve seen that photo before, I wonder where? It’s on the tip of my tongue…thinking now…I got it!!! Isn’t that a photo of the mushroom cloud after they dropped an atomic bomb on Hiroshima?!!

Well I’ll be darned!! Perhaps that proves that when regulators and market-participants fall slavishly in love with one version of efficient market theory or another, what you end up with is something catastrophic like Hiroshima?

Like the housing bubble-bust in America when mark-to-market valuations (they call them appraisals over there), were done to provide a basis for assessing the prudent LTV (Loan to Value) of houses prior to writing mortgages collateralized by the houses. The idea there was that in the event the borrower didn’t pay the money back (with interest), the lender could sell the house for more than what he had lent (with interest), and so his risk in the transaction was contained.

But there were two problems; the first was that no one specified that the valuation or appraisal should be an estimate of the minimum price the house could be expected to sell for at some indeterminate date in the future , as in knowing what you could have sold that must have-condo in Detroit five years ago is kind of academic after you got the keys back via jingle-mail; and second, there was no consideration of utility, as in the long-term, value should reflect utility, regardless of market shenanigans.

And what happened? Well, in the event, when push came to shove many houses couldn’t be sold for anything like what they had been valued for, five years before, and then in a blinding flash of light there was something which inflicted more damage on the economy of America that what would have happened if some deranged terrorists had dropped a hundred Hiroshima-type bombs.

In fact more, leaving aside the loss of life, which economically is a minimal cost arising from early cash-ins of insurance, by anyone who was insured; because if they had gone with the bombs rather than synthetic collateralized debt obligations and credit default swaps as their choice of instruments of economic mass-destruction, there would have been fewer houses and the prices of the remaining houses would have gone up. That’s one area where “classical economics” and the musings of Ludwig von Mises are totally aligned, if you halve the number of houses the utility of what’s left goes up, assuming of course that more people than houses survived; the classicists call that “supply and demand”.

There is no consideration of utility in a mark-to-market valuation, by the same token, if mark-to-market is not possible, in the absence of seller’s and/or buyers, then according to IASB and other accounting standards, the asset under consideration is considered “impaired”; which implies that “value” is impaired.

Which is nonsensical, a house or a piece of equipment that can’t be valued mark to market, still has whatever utility value it had prior to being classified as “impaired”.

De facto Mises didn’t agree with any of that, although he wasn’t very helpful coming up with a practical alternative. Outside of George Bernard Shaw’s quip on “the price of everything and the value of nothing” and Warren Buffet’s remark “price is what you pay, value is what you get”, the world had to wait until the Year 2000 for progress to be made in that department. That happened when International Valuation Standards re-invented or re-discovered the idea that there are two sorts of value, market value and other than market value.

Where broadly market value is mark-to-market, and other than market value is the “fundamental” utility value. And by definition, when those two values are the same the market is working properly, in other words mark to market returns a valid benchmark for the utility value.

I can’t help thinking that if the experts had listened a bit more to what Ludwig von Mises said, and tested their clever theories like David Hume said they should, to check if they were any more legitimate than a theory about how many angels you can fit on the end of a pin, then a lot of the recent nonsense might not have happened.

What disturbs me is that the new banking regulations which are supposed to help deliver the world from the bust that occurred when the old ones catastrophically failed to deliver, and herald a Brave New-New World Order of peace and prosperity, are even more in love with the ideas of mark-to-market and efficient market theories, than the previous ones were.

As in trying the same thing over again, and expecting a different result. Wasn’t it Albert Einstein who had some famous thought on the mental health of proponents of that idea?

All I can say on that is in my prayers these days I start off with, “Please God, forget about evil, deliver us from lunatics”.

By Andrew Butter

Twenty years doing market analysis and valuations for investors in the Middle East, USA, and Europe. Ex-Toxic-Asset assembly-line worker; lives in Dubai.

© 2012 Copyright Andrew Butter- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Andrew Butter Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.