Gold and Silver Manipulation - Small Silver Speculators Trounced

Commodities / Gold and Silver 2012 Apr 25, 2012 - 03:56 AM GMTBy: Marshall_Swing

It looks like the small silver speculators were trounced in the action beginning about midnight Sunday through 9:00AM Monday.

It looks like the small silver speculators were trounced in the action beginning about midnight Sunday through 9:00AM Monday.

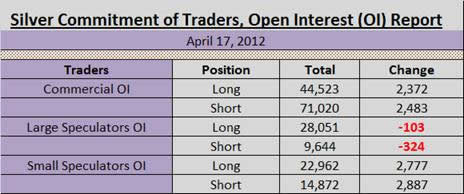

You might remember them from last week’s Commitment of Traders report. Full COT report here

Everyone was surprised by their huge buy in on both longs and shorts during the period of the 11th through the 17th.

Obviously, as seen above, the large speculators did not want any more of the game last week but the smalls thought they could outfox the commercials. They were probably wrong.

The following 10 day 1 hour bar chart shows the scenarios for smashing the small silver speculator’s longs and shorts accumulated the prior week.

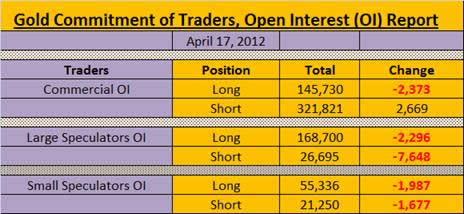

On the gold side of the house, the shakeout was the previous week.

Further actions were taken against gold but they were not as successful as price returned to the $1642 area. Some small and large speculator longs were probably shaken out since price was taken down almost $20 but they will be back since price did not stay down. They are resilient.

However, what probably happened is the commercials bought longs at the bottom around $1623, because they are the only ones who know where the bottom will be. They could have sold around and above $1642. There were approximately 23,000-30,000 contracts traded during that timeframe so let’s give the commercials their 60% of 26,000 contracts = 15,600 contracts = 1,560,000 ounces at a profit of let’s say $15 an ounce, given not selling precisely = a fairly cool $15 million for a day’s work, if in fact that was what happened. Looks like the most plausible scenario to me.

Play the futures game at your own risk!

Here’s the gold chart over 10 days with 1 hour bars.

Marshall Swing

The Got Phyzz? Report

© 2012 Copyright Marshall Swing - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.