Financial Tsunami Alert: Send in the Bond Squad

Interest-Rates / Global Debt Crisis 2012 Apr 27, 2012 - 02:20 AM GMTBy: Ty_Andros

An underwater earthquake has occurred in Spain and is quite possibly occurring now in Italy. Killer waves are now headed directly at the central banks and financial systems throughout the developed world and at Europe in Particular. How long until they hit and do the financial equivalent of Japan's recent tsunami? Socialist bureaucrats and progressives on both sides of the Atlantic are locked in death struggles with Mother Nature. THEY WILL LOSE.

An underwater earthquake has occurred in Spain and is quite possibly occurring now in Italy. Killer waves are now headed directly at the central banks and financial systems throughout the developed world and at Europe in Particular. How long until they hit and do the financial equivalent of Japan's recent tsunami? Socialist bureaucrats and progressives on both sides of the Atlantic are locked in death struggles with Mother Nature. THEY WILL LOSE.

Socialist public servants and banksters in Brussels and Washington are DESPERATELY trying to repeal the law of nature: You MUST produce more than you consume or PERISH. Economic systems which are predicated upon the consumption of wealth rather than the production of it are now on their deathbeds. The obscenity of counting consumption as production, as does Keynesian economics, is exposed for its fundamental flaw -- it counts wealth consumption and destruction as wealth production. How absurd.

The $5 Trillion plus borrowed in the United States since 2008 has been called GDP (Gross Domestic Product). It is nothing of the sort. It is a call on $5 trillion of wealth created by present and future generations and spent on CONSUMPTION and welfare for those in government, their bankster, crony capitalists and their something-for-nothing constituents. Think of what the GDP numbers would have been had this borrowing not been counted as production. This is wealth destruction pure and simple, implemented by RADICAL SOCIALISTS who are in power throughout the developed world. As Norman Thomas prophesized in 1944, it is now all true:

This prophecy is NOW OCCURRING as socialism's "MISERY SPREAD WIDELY" is in full bloom throughout the developed world. Furthermore, the ECONOMIC and SOCIETAL collapse from socialist policies and UNSOUND money is accelerating!

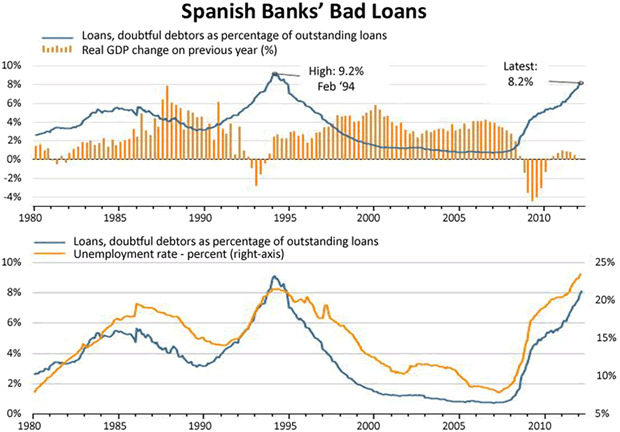

The next central chapter of the global financial crisis has now moved from Greece to Spain, with Italy set to join the Spanish implosion on SHORT notice. As SOCIALIST public servants and their central bankster masters DENY the meaning of current events, the message of the MARKETS is CLEAR: All confidence in sovereign and financial system solvency in SPAIN is now LOST. The HOT AIR of solvency and semi-normalcy coming from the ECB and Euro Zone Grandees shall soon be TESTED. Since there is NOTHING to SUPPORT their VIEWS, REALITY is set to INTRUDE. Bad loans are now nearing multi-decade highs and the economy is contracting with unemployment at depression levels:

Source: Thomson Reuters Datastream, Bank of Spain

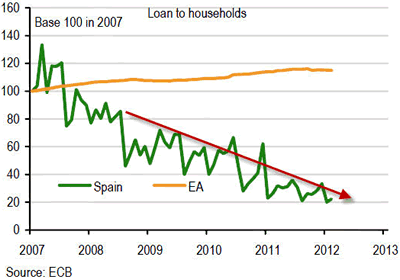

Youth unemployment (not shown) is now almost 50%. As this trend has accelerated since 2008 loans to the private sector have collapsed:

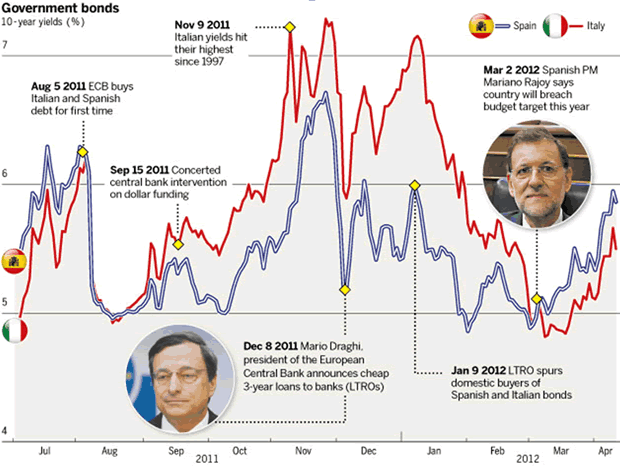

In Italy and Spain, yields are blowing out (blow outs equal blow ups for insolvent borrowers) and Spain had a bond auction FAILURE last week as bidders were absent and the issue was not fully subscribed.

Events are moving fast; long-term (10-year) interest rates in Spain are now about 6.00% and in Italy they are bumping up to 6% (higher than this illustration from LAST WEEK). In both cases technical objectives are now active and you can expect immediate moves higher of almost 75 to 100 basis points. In today's auctions of short-term Notes both Italy and Spain had blowouts in yield compared to post-LTRO (ECB long term repo operation in February).

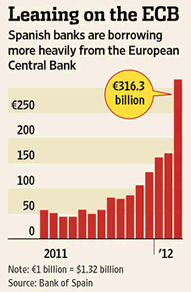

In a late Friday release, the ECB announced that Spain's banks use of the discount window DOUBLED in the last reporting period from approximately 150 Billion Euros to over 300. Let's take a look:

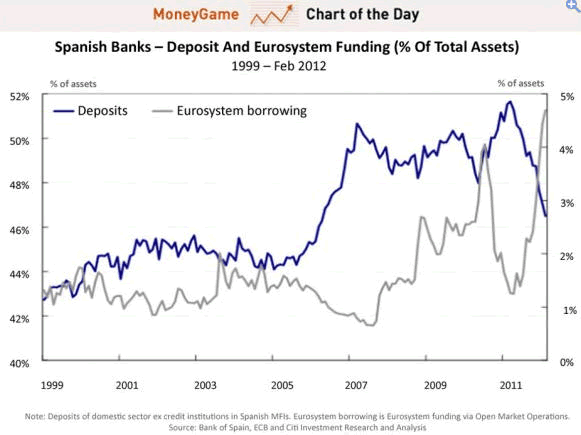

It doubled in 1 month illustrating that the Spanish financial system is CUT OFF from unsecured, overnight funding. OVER 67 BILLION EUROS left the Spanish banking system in March. And a classic RUN on the SPANISH BANKS is in full bloom underwritten by the European Central Bank:

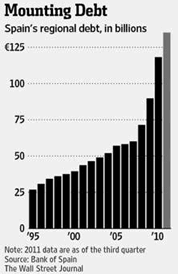

Let's not forget the HUGE debts PILING up in the region, almost doubling since 2008:

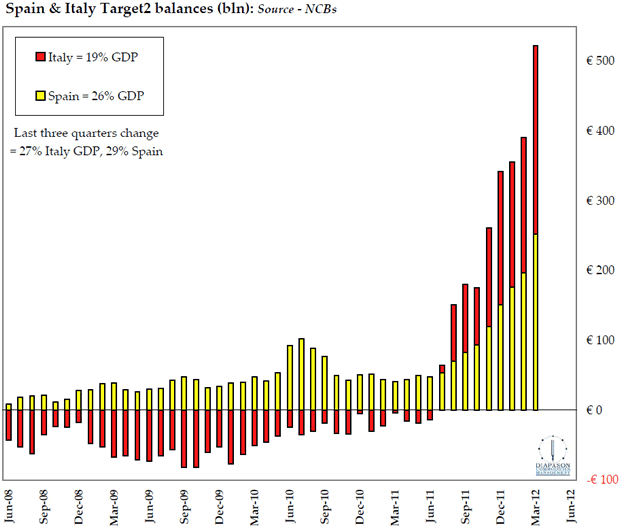

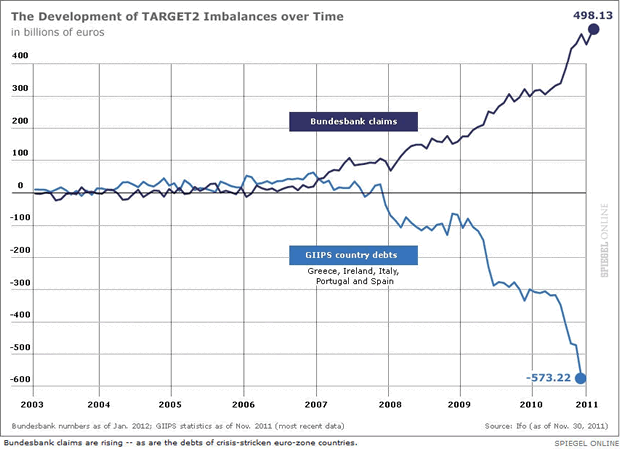

Do you think Spain's economy has had any growth since 2008 while these debts have mushroomed? NO. Now let's look at TARGET 2 internal CENTRAL BANK balance sheet flows to Spain and Italy (and from the perspective of Germany):

This is how much MONEY has flowed from creditor nations to these DEBTORS; good luck seeing any of it back. Now let's look at the SUCKING sound at the Bundesbank:

As you can see, GERMANY has UNREALIZED losses of almost $700 Billion because that money will NEVER be repaid, and these numbers DO NOT include 2012 so the BAD debt is mushrooming. I just received an update for the chart above; it is now UP almost another 150 Billion Euro's since the end of 2011. In the Telegraph today, Ambrose Evans Pritchard reports that the actual number of debts Germany ultimately GUARANTEES or has lent is OVER $2 Trillion, which is approximately the size of the German GDP (http://www.telegraph.co.uk/finance/financialcrisis/9215232/German-tempers-boil-over-back-door-euro-rescues.html ).

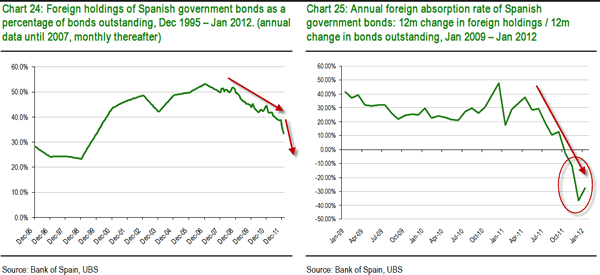

The Spanish government is REAPING the CONSEQUENCES of the GREEK bailout as FOREIGN bondholders GET OUT while the getting is good, aka before the EUROPEAN Commission, IMF and European Central Bank SCREW them. Take a look at capital flight in its FULL, GORY GLORY:

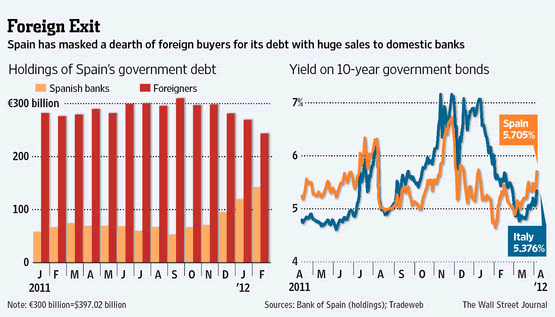

Talk about a REVERSAL of FORTUNE, this is it. This chart DOES not include February and March, so the picture NOW is far UGLIER. Now let's look at who is picking up the slack as foreigners EXIT:

Look closely at the chart on the left, just as bank balance sheets explode with toxic Spanish sovereign debt, foreigners are either liquidating or not ROLLING existing holdings. This is only rational, self-preservation as political promises are demonstrably WORTHLESS. The longer you hold this toxic trash, whether sovereign or bank debt, the more you will LOSE.

As the age-old adage goes: Fool me once, shame on you; fool me twice, shame on me. These are not fools OR speculators they are INVESTORS seeking shelter. Institutions, the private sector and pensions are saying NO MAS.

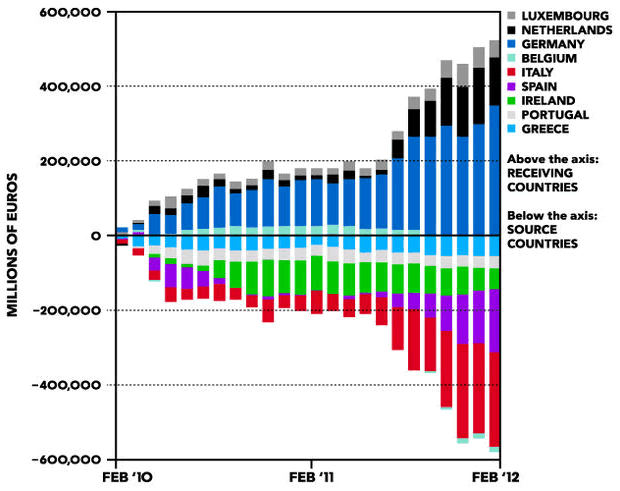

So now the un-payable and inextinguishable debt RESIDES in the financial system in SPAIN and probably Italy. The Collective Action clauses and the screwing of private lenders through subordination in the Greek debacle have done their mischief and the now unsecured creditors are JUMPING ship rather than RELYING on the worthless promises of European public servants. They KNOW that if they stick around the authorities will STICK it to them. Look at the CAPITAL FLEEING (600 Billion Euros and counting) from the PIIGS to the PERCEIVED safety of the north:

The LTRO money has now been USED up BUYING the sovereign debt of the Spanish and Italian governments. Initially the bid from the LTRO drove those markets higher (they overpaid to buy them), now those positions are deeply into losses.

As Moody's gets ready to DOWNGRADE the biggest banks in the Euro Zone by 1 to 3 notches, another round of LOSSES on BANK debt can be counted upon. Since they levered up to boost the return from the SUPPOSEDLY RISK-free carry, MARGIN CALLS LOOM for cash-strapped domestic Spanish and Italian BANKS (government bonds held to maturity are risk free as per central bank and financial system regulators so they require NO RESERVES against future losses).

Just today, credit default swaps place the following odds of bankruptcy in the next ten years: Spain at 49%, Italy at 45%, France at 26% and Germany at 13%. These levels are over 100% higher than three years ago. The odds of Too-BIG-to-fail banks failing are: Bank of America at 33%, Citi at 32%, Goldman at 34%, Morgan Stanley at 42%, Unicredit at 45%, Nomura at 42%, BNP Paribas at 30%, Deutsche Bank at 25% and UBS at 25%. To look at these prices you would have to believe we are in the depths of the crisis rather than on the mend as reported by the main stream media. The hidden insolvency of the Bundesbank through TARGET 2 loans to the European periphery is OVER 500 Billion Euros, as that LENDING will NEVER BE REPAID. Add to this all the GUARANTEES they have made for the various bailouts.

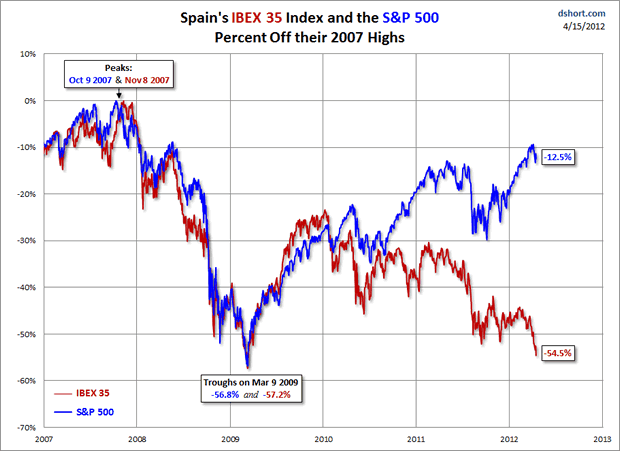

The IMF is now FAILING in its role of LENDER OF LAST RESORT, established in Breton Woods I, but last week's meetings cashed them up to almost $1 Trillion (about 4 or 5 month's worth of can kicking). Helicopter Ben was explicit last week in his emphasis of FINANCIAL system stability (US banks are inextricably linked to Europe) in his role as INFLATION fighter and with his full-employment responsibilities. Remember, politicians HATE markets because they expose them for the LIARS they are. Let's look at the most recent Spanish stock action versus the S&P 500, courtesy of www.dshort.com :

This is a picture of: 1. Spanish stock market collapse. 2. Spanish economic collapse. 3. S&P 500 stock market manipulation. 5. A divergence that will be resolved. 6. All of the above. The answer is 6. The Spanish stock market is predicting an economic KNOCK OUT as it is firmly below the 2009 bottom (not shown, it happened today). Long term trend lines going back 15 years have also fallen, so a SIGNIFICANT TOP is IN PLACE. Depression has arrived and the stock market is SIGNALING more PAIN to come.

We are waiting for the ANNOUNCEMENT of the Spanish banking system BAILOUT, followed closely by a sovereign bailout. The dominoes keep falling and will continue to until they topple the kings such as GERMANY, the US and the UK, swallowed up in BLACK holes of INSOLVENCY.

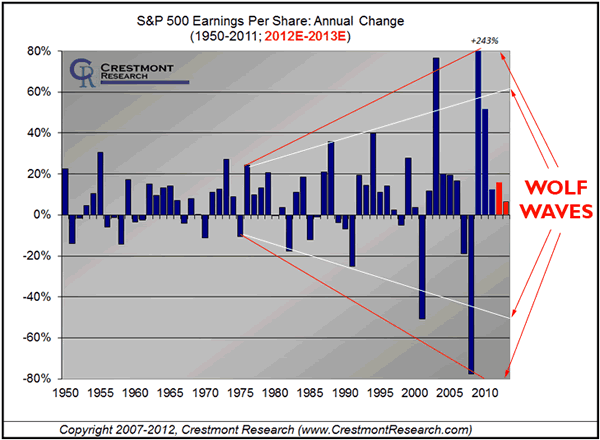

Wolfe Wave

What is a Wolfe wave? It is a megaphone formation increasing in amplitude. It is a formation that denotes instability and which is INCREASINGLY UNSTABLE. In this case, the instability wave BEGAN in August of 1971 when Breton Woods II SEVERED all the US dollar ties to gold. Since that time, unsound money and the central bank's ability to print it out of thin air became boundless.

So now MONEY CREATION is either too hot or too cold, creating huge and INCREASING oscillations. It denotes the same instability we see in the global economy and financial systems. Wolf Waves typically happen at TOPS in markets and in this case the US economy. Whether in physics or markets, Wolfe Waves are PICTURES of INSTABILITY.

This Wolf Wave is making another prediction as to the future course of the US economy and EARNINGS for the S&P 500. The last time we were in this position it forecast the economic and stock market crash of 2008. Now it is PEAKING again and is, or is about to, ROLL OVER. Courtesy of www.dshort.com and www.crestmontresearch.com ):

Look closely as I have drawn in two sets of Wolfe Waves, one is bounded by white lines and another in red. See how the highs and lows are expanding outside the original Wolfe Wave pattern? That is SIGNALING additional instability in the economy and financial system commencing with the CRASH of 2001. In 2001, Greenspan PRINTED money and dropped rates like the madman he was. The bounces were equally prodigious, and then in 2009 Bernanke DID the SAME, expanding the fed's balance sheet by 300%.

This is signaling that the recovery off of the 2009 lows (where earning actually approached zero for the S&P 500) have now reached their apogee. Looking closely at previous highs would suggest a trip back to the lows signaling the next wave of insolvency rocking the economy and financial system.

I got this chart back in 2008 and wrote a Tedbits at that time PREDICTING a crash in earnings and the ECONOMY into the 2008 election. Check out my archives. I am doing so again, now in this commentary. Three to five quarters from now we will be VISITING the lows in earnings and the economy. Wolves eat things, this time will be no different; unfortunately this time it will be eating economic growth. The next wave of INSOLVENCY will be GREATER than the last two CRASHES (2000-2001, 2008-2009) as the insolvencies have only GROWN.

What could possibly SPAWN this radical turn of events?

Economic Murder

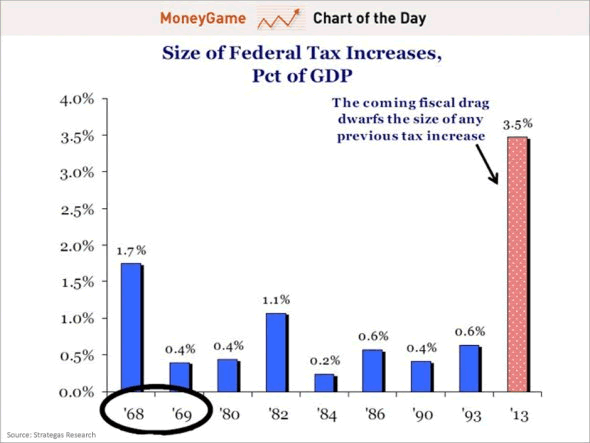

How about a tax increase 518% GREATER than the average (.675% of 1 percent) tax increase since 1968? This is about to hit the US economy like the BRICK it is: A wholesale transfer of 3.8% of GDP from the private sector to the public servants. To put that into monetary perspective that is approximately $525 BILLION in one year. No one dares TALK about this FISCAL SLEDGEHAMMER BEFORE the ELECTION as BOTH sides of the aisle want the money to SPEND, SPEND, SPEND. Or should I use the latest weasel words: INVEST in the FUTURE of LEVIATHAN GOVERNMENT as it attempts to SWALLOW the remains of the private sector it has not already devoured.

Do you think this might impact the economy and jobs when it goes into effect? This is a withering BLOW to CONSUMERS and the PRIVATE sector. Ob@ma and the CORRUPT, PROGRESSIVE, legislative SUPERMAJORITY of 2009-2010 scheduled these taxes to KICK in after the 2012 election campaign to FOOL the public about the COSTS of the stimulus, Ob@m@care and Dodd-Frank; the bills for which are about to be DUE and PAYABLE.

This is the recipe that Socialists in the beltway have implemented to DESTROY growth and the economy ala the Cloward-Piven strategy so they can implement and seize MORE power as the collapse and CHAOS unfolds. As Rahm said "A crisis is a terrible thing to waste." So they are brewing one on top of all the other problems we have.

Both Ob@macare and Dodd-Frank are 2,200 plus pages of POLITICAL CORRUPTION basically nationalizing the healthcare and financial industries. Written by Democratic special interests in backrooms and unread by those who voted for them (shouldn't this be illegal?). As they are implemented they are wrapping themselves around the economy like twin pythons and SQUEEZING the LIFE out of the US economy.

Just this week the Congressional Budget Office announced that less than 100 of the approximately 400 new rules for Dodd-Frank have been implemented and they require 24,000,000 man hours of compliance on the financial sectors. Now take that times three to complete the rule making. Add in the rush to publish NEW regulations (82,000 plus pages) BEFORE the end of the year when the Dems MAY FALL out of power over the bureaucracy and you have a recipe for the MURDER of the economy and private sector.

Oh and don't forget the delayed EPA regulations on coal-fired power plants (which supply almost 50% of the power in the US) which were POSTPONED until after the election as well, in order to prevent to wholesale closings of these electric powerhouses and to delay the next leg of spiraling prices in order to FOOL the public about their future energy costs under the current administration.

In a recent Gartman Newsletter (www.thegartmanletter.com ), Dennis cites historians, Will and Ariel Durant, on the decline of the Roman Empire.

Rome had its socialist interlude under Diocletian. Faced with increasing poverty and restlessness among the masses, and with the imminent danger of barbarian invasion, he issued in A.D. 3 an edictum de pretiis, which denounced monopolists for keeping goods from the market to raise prices, and set maximum prices and wages for all important articles and services. Extensive public works were undertaken to put the unemployed to work, and food was distributed gratis, or at reduced prices, to the poor.

The government - which already owned most mines, quarries, and salt deposits - brought nearly all major industries and guilds under detailed control. "In every large town," we are told, "the state became a powerful employer, standing head and shoulders above the private industrialists, who were in any case crushed by taxation." When businessmen predicted ruin, Diocletian explained that the barbarians were at the gate, and that individual liberty had to be shelved until collective liberty could be made secure. The socialism of Diocletian was a war economy, made possible by fear of foreign attack. Other factors equal, internal liberty varies inversely with external danger.

The task of controlling men in economic detail proved too much for Diocletian's expanding, expensive, and corrupt bureaucracy. To support this officialdom - the army, the courts, public works, and the dole - taxation rose to such heights that people lost the incentive to work or earn, and an erosive contest began between lawyers finding devices to evade taxes and lawyers formulating laws to prevent evasion. Thousands of Romans, to escape the tax gatherer, fled over the frontiers to seek refuge among the barbarians. Seeking to check this elusive mobility and to facilitate regulation and taxation, the government issued decrees binding the peasant to his field and the worker to his shop until all their debts and taxes had been paid. In this and other ways medieval serfdom began.

Thank you, Dennis. History may not repeat but it certainly rhymes. This quote is where we find ourselves today isn't it? In Europe this is in full bloom, and in America what hasn't happened will in the near future.

In closing, SPAIN is DONE! Put a fork in it. We are just waiting for the announcements. Confidence has been shattered internally and externally. In the United States profits, stocks and the economy are entering the resumption of the secular bear period as the recovery off of the March 2009 lows dies a slow death. Death, er.... Debt Spirals are in various stages of unfolding in every major developed country in the world.

The United States faces ENORMOUS and insurmountable OBSTACLES to growth in the next several months and years, most notably from its own POLITICAL CLASSES and central planners in Washington and state capitals. Washington REFUSES to address ANY of the issues. The preservation and growth of GOVERNMENT is the only policy being implemented. Washington DC and Brussels are driving their countries and constituents to their own demise and creating modern-day SERFS of their respective constituents -- supposedly to SAVE them.

As these things HIT the headlines the PRINTING PRESSES WILL ROLL! Over and over again, more waves of INSOLVENCY are at hand and will hit over the next 30 to 90 days. This will be a tsunami of FINANCIAL pain. The great default continues to unfold.

UNACCOUNTABLE Socialists in developed-world capitals continue to BATTLE their private sectors, PUSHING them ever deeper into TAX and credit slaves, and PRINTING MONEY to substitute for the economic and income growth their SOCIALIST/PROGRESSIVE policies have destroyed. The next episode of INSOLVENCY has engulfed Spain and has Italy firmly in its sights. The welfare states' economic model is DEAD, but the fight to prevent their demise will drag us all down with them. This is a CLASSIC currency and financial system extinction event as outlined by Von Mises.

(Author's note, THIS IS NOT GLOOM and DOOM; this has the potential to be the greatest opportunity in history. While this unfolds, VOLATILITY will explode as investors seek shelter from public servants' policies and the printing press. Volatility is opportunity for prepared investors who have absolute-return alternative investments as part of their portfolio -- investments which have the potential to thrive in up down and sideway market conditions. You must also learn to restore the functions of money to your FIAT currency. I am a specialist at this and I use professional managed futures managers to create custom-tailored portfolio diversification. If you have an interest, give me a call and I will call you personally CLICK HERE -- http://www.traderview.com/portfolio)

Try as they might to DENY it, the next round of Quantitative Easing (printing money, er... IOU's out of thin air) is BAKED in the CAKE. It's INFLATE or DIE until the ultimate FINANCIAL system failure. They know it and YOU know it. They will NEVER admit the scale of the problem, NEVER. With a MINIMUM of $3 Trillion short term (3 to 9 months) required.

Public servants and central bankers will always deny that more is coming until the markets POINT a GUN at their heads and they do as you or I would do. They DUCK, and let the public take the bullet for their poor policies as they always have. The $800 Million in IMF money is a squirt gun at a FOREST fire but will serve to kick the can a little further down the road.

The banksters, public servants and crony capitalists are psychopaths and sociopaths with NO CONSCIENCE about their actions and the impact on their constituents. Just like Lenin, Mao and Hitler, today's demagogues have no hesitation in how many they hurt and destroy as they pursue their dreams of domination. Millions and millions of people believe and have been taught they can have and are ENTITLED to something for nothing. These people (trade unions, crony capitalists, banksters, public servants, etc.) are the instruments of destruction of the productive sectors of the developed world. They are locusts and minions of megalomaniacs with no knowledge or regard for history. So it is repeating as it has throughout history. Only this time the episode is not regional, it is global, throughout the developed world, and the tragedy will be equally as LARGE. Enjoy the recent lull in the action courtesy of the Trillions of Dollars, Euros and Yen printed in the 4th quarter of 2011 and 1st quarter of 2012. Oh, did we forget to mention the $2 Trillion debt ceiling extension enacted in August 2011 RUNS out approximately 30 days BEFORE the election? CHAOS looms.

Mother Nature will keep applying PAIN until the illusion of SOMETHING-for-nothing is DESTROYED and until PRIVATE PROPERTY RIGHTS, incentives to produce, save, invest and behave prudently are all restored. Economic models of the welfare state and consuming more than you produce and borrowing the rest will be LAID TO REST and a return to rewarding wealth creation will begin again. Just ask China.

Don't miss the next edition of Tedbits. Subscriptions are free at Tedbits.com Global Macroeconomic Analysis Through the Austrian Lens.

Thank you for reading TedBits. If you enjoyed it...

Tedbits will be resuming a regular publication schedule going forward; subscribe for free at www.traderview.com/subscribe . We are also developing a relationship and collaboration with Gordon T Long, a brilliant technician and market analyst. Gordon’s most recent work can be found at: http://lcmgroupe.home.comcast.net/.. and I urge you to visit him.

By Ty Andros

TraderView

Copyright © 2012 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Adam, London

06 May 12, 06:56 |

Great article

Excellent and thought-provoking article, nearly ruined by MASSIVE OVERUSE of CAPITALS which is ACTUALLY really quite DISTRACTING. |