Large Cap Gold Miners Underperforming the Juniors and Silver Stocks

Commodities / Gold & Silver Stocks Apr 27, 2012 - 05:48 AM GMTBy: Jordan_Roy_Byrne

While the precious metals sector has consolidated and struggled to find a bottom, an important development has taken place. First, lets harken back to 2007-2008. Large cap mining stocks peaked in March 2008, yet the speculative sides of the sector "gave out" far earlier. The juniors and silver stocks actually peaked in April 2007. That was about a full year ahead of the large gold stocks. As the 2007-2008 crisis unfolded, juniors and silver stocks led the way down and displayed extreme relative weakness even as metals prices were firm.

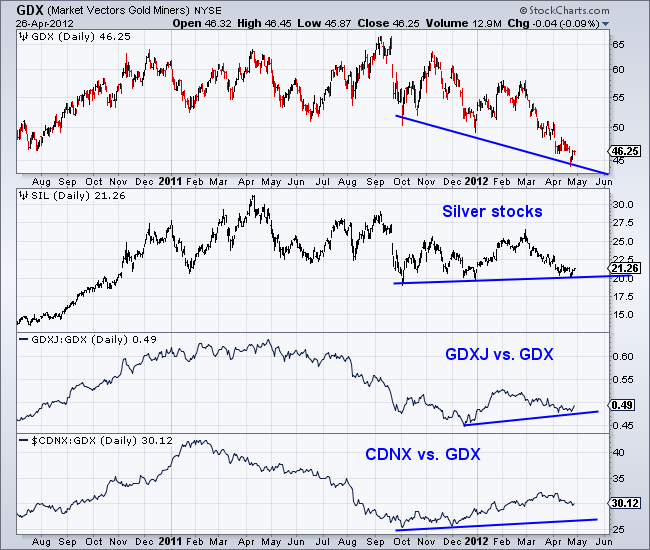

Today, we have an entirely different and bullish development. As you can see in the chart below, the speculative areas of the sector have been outperforming the large gold producers (GDX). If this were really an end to the bull market or another collapse, the juniors and silver stocks would not be showing this kind of relative strength. In fact, the silver stocks have actually managed to hold near their 2010-2011 lows even as gold stocks have broken to new lows. We also see that the CDNX has been outperforming GDX since October while GDXJ has been outperforming since December.

Given the recovery of the past few days, we are likely witnessing the start of the next cyclical bull market for the gold and silver stocks which have essentially been in a cyclical bear or correction since December 2010. The above analysis implies that the more speculative areas of the sector, the juniors and silver stocks will be the leaders.

The reemergence of the bull market will mark the inception of the third and final phase of this bull market. The stealth phase took place from 2001 to 2007 while the wall of worry phase has been in place since 2007. The wall of worry phase consists of muted gains, subdued sentiment and improving valuations resulting from rising profits but stagnant stock performance. During its final phase, a bull market experiences widespread participation, increasing valuations and increasing speculation. The current relative strength in the speculative areas of the sector (juniors and silver stocks) is a harbinger of things to come.

The reasons for such outperformance are simple. As a bull market progresses, speculation will naturally increase. A move in Gold above $1900 will increase the appeal of Silver which always outperforms during an uptrend. Moreover, many producers are generating record cash flow and profits. Given the market's desire for growth and the current values in quality exploration and development companies, it is only a matter of time until we see increased takeovers and mergers and acquisitions. Such action would obviously ignite the junior space.

We personally continue to focus on 1) producers with strong development projects that can become mines and 2) exploration companies with strong capital structures operating in the best jurisdictions.

If you'd like professional guidance in this endeavour then we invite you to learn more about our premium service.

Good Luck!

Jordan Roy-Byrne, CMT

Trendsman@Trendsman.com

Subscription Service

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.