Canola, the New Canadian Gold

Commodities / Agricultural Commodities Apr 30, 2012 - 10:12 AM GMTBy: Ned_W_Schmidt

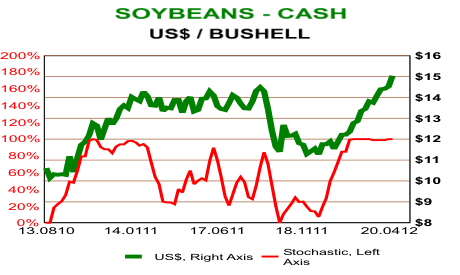

When last we visited on Agri-Foods, 2012 was declared Year of the Soybean. That certainly seems to be the way prices are acting. Since the beginning of 2012 the U.S. dollar price of soybeans has risen by near 28%, more than twice the performance of the S&P 500's 12%. Seems some farmers, particularly in the Midwestern U.S. soybean region, are beating the Street again. Importantly, such results are not an aberration. Since early 2007, a little more than five years ago, soybean prices are up more than a 100%, a quite favorable comparison to the S&P 500 being off by ~3%. Little wonder that Agri-Land prices have been so strong.

When last we visited on Agri-Foods, 2012 was declared Year of the Soybean. That certainly seems to be the way prices are acting. Since the beginning of 2012 the U.S. dollar price of soybeans has risen by near 28%, more than twice the performance of the S&P 500's 12%. Seems some farmers, particularly in the Midwestern U.S. soybean region, are beating the Street again. Importantly, such results are not an aberration. Since early 2007, a little more than five years ago, soybean prices are up more than a 100%, a quite favorable comparison to the S&P 500 being off by ~3%. Little wonder that Agri-Land prices have been so strong.

As the above chart portrays, soybean prices recently broke above US$15. That price represents a new 90-week high. In preparing that chart we were reminded of one of the older and more reliable technical indicators. In the days before computers hobbled technical analysis, we used graph paper to do our charts. When one came to the edge of the paper, the important decision was how to tape the new page to the old. How one did that was usually a good indicator of the future direction of price. When we "taped" the new page to the above chart, it was at the top.

Why have soybean prices broken out? In the remainder of this decade two of the more important shortages will be vegetable oils and meat. Soybeans are used to produce cooking oil and as feed for animals. In terms of consumption, soybean oil ranks number two in the world, second only to palm oil. Global demand for all edible oils has risen by 20% over the past four years.

The wonderful aspect of vegetable oil is price inelasticity for both demand and supply. Rising prices for cooking oil might make us grumble at the grocery store, but we will still buy it and use it as we have been. Anyone ready to substitute lard for oil on their salad or pasta?

More interesting may be that soybeans do not grow best just anywhere. Soybeans are grown in two lateral bands, one centered on the Midwestern U.S. in the Northern Hemisphere and another through Argentina and Brazil in the Southern Hemisphere. Those two bands provide the climatic conditions necessary for a full and happy soybean sex life. The land with adequate water and dirt in those two regions is limited. Higher demand for soybeans in the year ahead may lead to higher oilseed prices. However, in short and intermediate term those higher prices will have limited ability to increase supply.

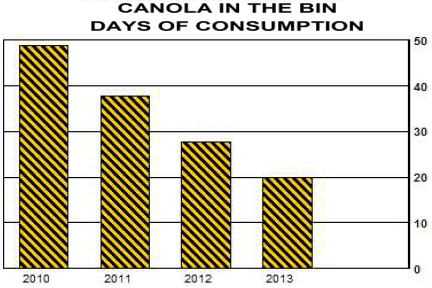

Alternatives to the common sources of edible oils simply do not exist in abundance. Support for soybean prices is also coming from growing inadequacies of supplies of alternative oil producing grains. One of those alternatives is canola. The above graph portrays the supply situation for canola in terms of days of consumption in the bins at the end of the crop year. While bountiful supplies of canola had been available, the production surplus has been consumed. As the short supply situation in canola continues to deteriorate the price of that grain cold rise dramatically, supporting the price of soybeans. Canola farmers in Canada are likely to experience some of their most profitable years ever.

Canola is grown north of the soybean band in the Northern Hemisphere. Canada is the largest national producer of canola. That production will increasingly be diverted to China to satisfy growing demand for edible oils and animal feed. Canola is quite likely to become the new Canadian Gold.

Rather than chasing land in the Midwestern U.S. at auctions, investors might want to consider Agri-Land in Canada. We do expect to see more canola farmers wintering here in Florida this fall after the harvest, with many driving their new Bentley. Agri-Food is a complex system composed of numerous commodities with both independent and interdependent relationships and opportunities. When the iPhone has faded from memories, China will still be importing canola from Canada.

By Ned W Schmidt CFA, CEBS

AGRI-FOOD THOUGHTS is from Ned W. Schmidt,CFA,CEBS, publisher of The Agri-Food Value View, a monthly exploration of the Agri-Food grand cycle being created by China, India, and Eco-energy. To contract Ned or to learn more, use this link: www.agrifoodvalueview.com.

Copyright © 2012 Ned W. Schmidt - All Rights Reserved

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.