The ABCs of Picking Mining Stocks

Companies / Metals & Mining May 01, 2012 - 03:23 AM GMTBy: Roger_Conrad

Stick to physical metals, avoid mining stocks. That’s the conventional wisdom in global stock markets in spring 2012.

Stick to physical metals, avoid mining stocks. That’s the conventional wisdom in global stock markets in spring 2012.

Mining companies’ stocks across the board have sunk to their biggest discount ever, to the price of the resources they produce. As many investors worry that slower growth in Asia could reduce demand for key minerals, these stocks could fall further.

This overall showing is in stark contrast to the performance of the metals these companies produce. For example, global steel demand remains robust, as is the price of the metallurgical (met) coal and iron ore used to produce it. However, Vale (NYSE: VALE), a major Brazilian producer of iron ore, is down nearly -28 percent over the last year. Teck Resources (NYSE: TCK) is off -31.5 percent, although it’s making more money producing and selling coking coal than ever before.

The price of gold, meanwhile, has risen nearly 9 percent over the past 12 months, even as the price of gold miner Newcrest Mining (ASX: NCM, OTC: NCMGF) has fallen more than -39 percent.

Moves in mining stocks have historically been more volatile than those of the metals themselves, for several reasons. First, miners’ earnings are inherently leveraged to prices. For example, if a company produces copper for a cost of $2 a pound and sells it for $3, it makes $1 per pound sold. A jump in copper prices to $4 a pound produces a 33.3 percent gain for holders of the metal. However, it will generate profits of $2 per pound for this mining company, or a double in earnings.

Second, with the exception of gold, the actual prices of most minerals are set by supply and demand. Investors may be bearish on copper prices, for example. But if there’s an unexpected lift in demand from China, the price will move up no matter how many bearish speculators are arrayed against it. If there are enough shorts in, the “squeeze” can move prices upward in a hurry.

By contrast, a majority of bears can keep a stock’s price in the dumps indefinitely. That’s not likely if earnings are consistently rising. But in a world where investors are afraid of getting caught in another 2008, it’s no great surprise many have sold their commodities stocks, mainly by unloading the exchange traded funds that own them. As we’ve seen again and again, selling often begets more selling, just as a rising share price attracts more buyers.

Forgotten is the fact that mining companies are at their core operating businesses. The price of what they produce is extremely important. However, investor returns over the long haul depend at least as much on how well management deploys its capital—i.e., whether it can grow the enterprise and maintain a healthy balance sheet so it can raise money cheaply.

For example, the prices of met coal, iron ore, industrial metals and other resources have waxed and waned over the past 20 years many times. However, Australia’s BHP Billiton (NYSE: BHP) has generated a 1,355.4 percent total return, as it continues to invest in new mines and grow global output. You can read my analysis of BHP here.

Stocks of even the best-run mining companies will rise and fall with perceptions of economic growth, just as the rest of the stock market. But just like the best companies in any industry, mining companies that manage their capital to consistently grow production and reserves, while controlling costs, always finish the cycle on higher ground, raising shareholder value.

Toward Price Stability

In my view, the economies of developing Asia—particularly China—are definitely undergoing a sea change. Gone are the days of double-digit economic growth that characterized the past couple decades. That’s partly because these economies are so much larger now, and it takes a lot to push the meter that fast. It’s also because governments are now interested in sustainable growth with moderate inflation, as internal consumer markets continue to develop.

As a result, we can look forward to more moderate growth in China and most other developing nations this year and beyond. But these countries are by no means headed off the cliff. In fact, Chinese growth is still likely to average well over 8 percent this year.

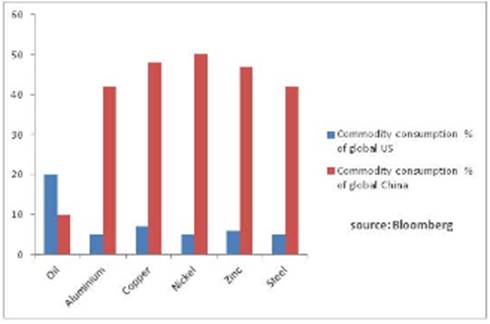

More important, even in the context of its current “slowdown,” China will still consume a greater share than ever of the world’s copper, met coal, iron ore and dozens of other resources. That’s born out in the chart below. And that’s coming off an already big number, because China accounts for 40 percent of global copper demand.

Investors are certain to fret in the near term about China’s exact gross domestic product (GDP) number this year and its impact on metals prices and stock prices. But we’ll continue to see new records set for consumption of vital resources in Asia in 2012 and well beyond.

Meanwhile, the US for the first time in several years has emerged as a force in demand for a range of resources including copper. The driver is a dramatic and unexpected recovery in manufacturing, thanks to the country’s growing competitive advantage of cheap energy, developed world infrastructure and moderating wages. US auto sales rose 13 percent in March, the best quarter for the industry since early 2008.

A resurgent US is far outweighing the negative impact of Europe’s continued economic troubles, demonstrating just how diversified demand has become for many resources, compared to even the 1990s when the US was the world’s biggest user of almost every key commodity.

The upshot is demand for vital resources is no longer in the boom/bust mode that’s characterized the post-World War II period to this point. Massive price increases will lift producer earnings at times. Equally, falling prices will cut in earnings.

However, successful investing in metals will increasingly rely on identifying the best-run companies that are deploying their capital successfully to expand production and reserves, feed key markets and control costs. That’s how to grow shareholder wealth in an environment where resource prices will stay high but may not make much headway from here.

As with oil and gas, the time has passed for cheap and easy-to-access copper, zinc, alumina, iron ore, and virtually every other vital metal, mineral and resource. Instead, getting the supplies the world needs requires producers to go ever further and dig ever-more deeply in ever-more dangerous territory.

A mine is no longer just a hole in the ground but an immense enterprise where raw material is extracted, processed and finally shipped to markets, often many thousands of miles away. Building a mine requires first utilizing the most advanced technology to locate and identify deposits, with no real guarantee of success. Assays and tests are performed with increasing intensity and focus to determine if they’re worth developing at expected selling prices.

Once a determination is made that drilling and development are feasible, producers must line up immense sums of capital to construct what in many cases are as much chemical plants as actual mines. Smelting facilities must be built, as well as electric power sources to run them. If the mine is in an undeveloped area, transportation networks must be built to insert equipment to build the mine, to transport fuel to power the facility—and finally to move out the finished product to markets for sale.

Because of the complexity of the task, the process of identifying a deposit, building a major mine and ramping it up to production typically takes years at the cost of hundreds of millions of dollars. That leaves plenty of time for a host government to demand a bigger cut, or in a worst case to nationalize the asset, long before the developer can recover its investment.

Numerous opportunities exist for failure, with no real recourse for the developers if that happens. That’s why only the best-managed and financially strongest companies wind up building wealth for investors.

The rest are short-term trades at best that can make a lot of money if resource prices rise enough, but which can just as easily disappear off the face of the earth when the cycle turns down again. Just ask anyone who loaded up on penny mining stocks at the top of the boom in 1987 and failed to get out quickly when things unraveled later that year.

Of course, we’ve yet to see anything approaching the penny stock boom of that era. As any developer will tell you, the typical progression these days for a successful mine includes a “lull” period between the initial raising of capital and when actual production starts. That’s when the original enthusiasm cools and the price comes down.

As long as there’s enough money to stick to development plans—and no major obstacles or negative surprises are encountered—the mine will move toward production. At that time, buyers will come back and the price will recover. Otherwise, selling will continue, development will eventually stall and investors will be left with nothing but a shell.

Until these “lull” periods disappear, it’s hard to compare this market for mining stocks with that of the 1980s—and the more reason to expect we’ve yet to see the top. That’s another reason to be bullish on the companies that already have mines on track and that are building new ones, and particularly at the prices we’re seeing now.

Here are my general criteria for picking mining stocks in early 2012.

* Sufficient Scale. Mining companies must have access to low-cost capital on a consistent basis. That’s a very tough nut to crack for smaller companies and it’s a major catalyst behind the wave of natural resource company mergers in recent years.

* Controlled Leverage. Debt is key to developing a mine and a certain level is appropriate for financing a successful facility, because it’s secured by a valuable asset. But having to refinance a slew of maturing debt all at once can dramatically ramp up a company’s interest costs under the wrong conditions. That in turn can end chances of successful mine development even when the price of the resource produced is high. If prices deteriorate enough, bankruptcy can ensue.

* Rising Production Profile. Mining companies must develop new reserves and production to grow over time. I look for companies with enough projects to lift their output over time, the means to put their plans into action and the demonstrated expertise to follow through.

* Controlled Exposure to Resource Nationalism. When the price of a resource rises enough, even generally pro-business host countries will be tempted to try to increase their share of the profits. There’s a huge difference, however, between raising a tax, imposing a fee or increasing pollution standards, as we’ve seen in countries like Canada and Australia, and the outright nationalization that’s occurred in countries like Argentina and some nations in sub-Saharan Africa.

The only way for a company to genuinely protect itself is with geographic diversification. That way, if it’s forced by resource nationalism to curtail activity in one country, it can redeploy the capital to make up the difference elsewhere. Companies with a heavy focus on politically stable countries like Australia and North America deserve a premium and generally earn it over time.

* Diversification of Resources. I sometimes recommend one-product miners, if the price is right, the mine secure, the balance sheet strong and the theater of operations politically steady. The more diverse a company’s resources mix, the steadier its earnings over the long haul and the more likely it will continue growing and adding shareholder value.

To learn more about the biggest trend in commodities today, check out Profits in the Shale Gas Revolution: An Investor’s Guide.

Roger Conrad is the preeminent financial advisor on utility stocks and income investing. He is the editor of Big Yield Hunting, Australian Edge, and Canadian Edge, as well as Utility Forecaster, the nation's leading advisory on electric, natural gas, telecommunications, water and foreign utility stocks, bonds and preferred stocks.

Mr. Conrad has a track record spanning three decades, delivering subscribers steady double-digit gains of 13.3% annually since 1990. And he’s done it all with a focus on capital preservation and risk minimization by investing in big dividend stocks including Canadian Income Trusts, high-yield REITs, MLP investments, among many others.

Mr. Conrad has a Bachelor of Arts degree from Emory University, a Master's of International Management degree from the American Graduate School of International Management (Thunderbird), and is the author of numerous books on the subject of investing in essential services, including Power Hungry: Strategic Investing in Telecommunications, Utilities and Other Essential Services

© 2012 Copyright Roger Conrad - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.