Stock Market Striking Similarities Upon Us

Stock-Markets / Stock Markets 2012 May 03, 2012 - 08:46 AM GMTBy: Darah_Bazargan

I have this growing suspicion that many of you are making the subtle transition to a potential bullish outlook for the stock market. I'll need a minute or two of your time so that I can King Kong all of that nonsense.

I have this growing suspicion that many of you are making the subtle transition to a potential bullish outlook for the stock market. I'll need a minute or two of your time so that I can King Kong all of that nonsense.

If I must say, last week was full of distractions. Obviously the first, Apple's remarkable quarter was a surprise to many, especially given the five day sell-off prior to the actual news release. This outcome provided investors with relief, and the reassurance of knowing this bellwether did not actually stumble, but instead just underwent a retracement. Unfortunately, the leaders of the stock market, including Apple, have yet to clear their previous highs. This I can tell you has done very little to generate much renewed confidence among investors.

The second was of course, Mr. Ben Bernanke. It's unfortunate that investors still to this day are hoping for his long awaited bailout package. Folks, expecting this announcement prior to a sharp decline is nothing short of wishful thinking. QE3, or lets say another currency swap, will only occur during or after a liquidation process out of all asset classes of the stock market. At the moment, there is not enough political pressure on him to push the button especially since the market has generated a near thirty percent gain from the October lows.

Thirdly, the dismal GDP figures were released the morning after Spain's credit rating was downgraded to BBB+. At the exact timing of this actual data, the dollar took a plunge. It was a classic example of the inner workings of our government bond buying program on stand-by. The "plunge protection team" will manipulate the dollar lower in the face of a game-changing event that has negative consequences. This is done in effort to create a soft landing in stocks, but it cannot delay the inevitable correction coming. You see, the government can hold up the market with Operation Twist, but it does not have the ability to change the current trend of the market.

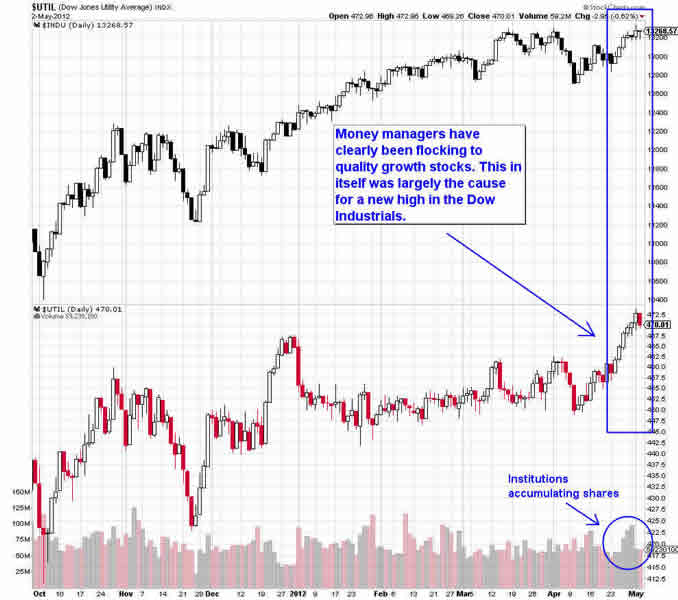

While the Dow Industrials reasserted its underlying strength by clearing above its previous minor high, the remaining market averages are telling us differently. Usually the first week of every month is the time when money managers allocate their clients fixed income into dividend growth stocks. This explains the money inflows into the utility sector and for the same reason that twenty nine out of thirty Dow stocks closed mildly positive in yesterday's session.

Utility Sector V. The Dow Industrials

The Dow Industrials- Daily Chart

The Russell 2000 Index- Daily Chart

The S&P 500- Daily Chart

Have a great day,

Darah

www.thecompletecoveragereport.blogspot.com

© 2012 Copyright Darah Bazargan - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.