Gold COT Report, No Free Market for Speculators in Comex

Commodities / Gold and Silver 2012 May 07, 2012 - 02:24 AM GMTBy: Marshall_Swing

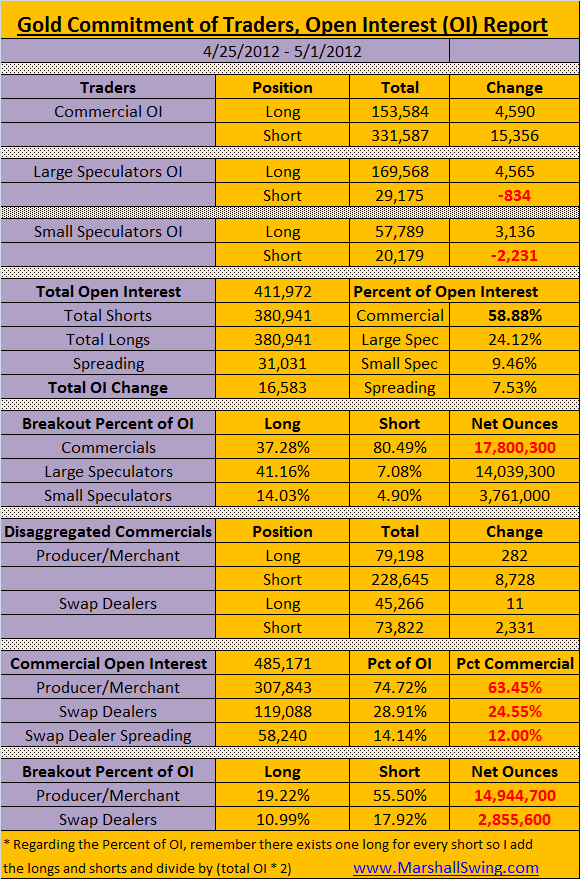

Commercials bought 4,590 longs and purchased a whopping 15,356 shorts to end the week with 58.88% of all open interest and now stand as a group at 17,800,300 ounces net short, an increase of over 1,000,000 ounces net short from the previous week. It is very important that you review last week's COT because in it, plus this last Wed - Fri trading days are the key to where the gold price is going and how it is going to get there.

Commercials bought 4,590 longs and purchased a whopping 15,356 shorts to end the week with 58.88% of all open interest and now stand as a group at 17,800,300 ounces net short, an increase of over 1,000,000 ounces net short from the previous week. It is very important that you review last week's COT because in it, plus this last Wed - Fri trading days are the key to where the gold price is going and how it is going to get there.

Large speculators jumped in on 4,565 new longs and covered a mere -834 shorts for a net long position of 14,039,300 ounces, an increase of almost 500,000 ounces from the prior week.

Small speculators jumped in for 3,136 longs and covered a huge -2,231 shorts for a net long position of 3,761,000 ounces an increase of over 500,000 ounces from the prior week.

The massive short positions accumulated by the commercials are not there for window dressing. See my review report early this week for the blow by blow of what happened after the COT period. If you are going to trade open interest or options against these commercials, you have to know these technical numbers in order to be successful.

Here is a key. Go back to the COT report from the previous period and see what the commercials did then in order to understand what they did this reporting period, how the speculators responded, and you can learn how to trade this coming week. Without knowing these technical numbers it is like throwing darts at a board blind folded.

Notice the disaggregated commercial's producer/merchant picked up 8,728 short positions. The swap dealers picked up 2,331 short positions. The longs they picked up tell the whole story.

Notice both the producer/merchant and the swap dealers are both short gold. There is a reason for that. Notice the silver COT report and that the producer/merchant is short and the swap dealer is long. There is also a reason for that.

The only way to be successful in these markets is to either think like a producer/merchant or buy long and stay long with liberal stops. If the speculators did that, they could win this battle as the producer merchant could get SHORT changed.

For your convenience, if you would like to contact the CFTC and express your views to them, I have provided you their phone numbers: http://www.cftc.gov/Contact/index.htm and email addresses as well:

GGensler@cftc.gov

MWetjen@cftc.gov

Bchilton@cftc.gov

Jsommers@cftc.gov

SOmalia@cftc.gov

How long must the there exist no free market for speculators in the COMEX metals? How much ill-gotten gain from speculators, at the hands of these producer/merchants, is enough for these commissioners to act and do their jobs to ensure a free market can counter their massive open interest monopolies?

The only way to beat the producer/merchants at their game is to go long and stay long. Easier said than done when you watch price drop significantly below your buy price, I know.

See you next week!

Marshall Swing

The Got Phyzz? Report

© 2012 Copyright Marshall Swing - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.