Governing Elite Fraud and Theft Will Continue Until Morale Improves

Politics / Social Issues May 07, 2012 - 12:36 PM GMTBy: James_Quinn

The BEA reported the latest figures for personal income, personal consumption expenditures and the savings rate last week. The government mouthpieces in the mainstream media obediently reported that personal income and expenditures reached an all-time high in March. The chart below shows the ever increasing level of expenditures by consumers since this supposed economic recovery began in the 4th quarter of 2009. All good Keynesian economists know that consumer spending is always good for America, no matter how it is achieved. We must be in a recovery if income and spending are reaching new highs, right? That is the fraudulent storyline being propagandized to the non-questioning lapdog public. A false storyline and data that has been massaged harder than a Secret Service agent by a Columbian hooker will not lead to a happy ending. Some critical thinking, a calculator, and some common sense reveal the depth of the fraud and expose the theft being committed by the avaricious governing elite at the expense of the prudent working middle class.

The BEA reported the latest figures for personal income, personal consumption expenditures and the savings rate last week. The government mouthpieces in the mainstream media obediently reported that personal income and expenditures reached an all-time high in March. The chart below shows the ever increasing level of expenditures by consumers since this supposed economic recovery began in the 4th quarter of 2009. All good Keynesian economists know that consumer spending is always good for America, no matter how it is achieved. We must be in a recovery if income and spending are reaching new highs, right? That is the fraudulent storyline being propagandized to the non-questioning lapdog public. A false storyline and data that has been massaged harder than a Secret Service agent by a Columbian hooker will not lead to a happy ending. Some critical thinking, a calculator, and some common sense reveal the depth of the fraud and expose the theft being committed by the avaricious governing elite at the expense of the prudent working middle class.

Digging into the data on the BEA website to arrive at my own conclusions, not those spoon fed to a willfully ignorant public by CNBC and the rest of the fawning Wall Street worshipping corporate media, is quite revealing. It divulges the extent to which Ben Bernanke and the politicians in Washington DC have gone to paint the U.S. economy with the appearance of recovery while wrecking the lives of senior citizens and judicious savers. Only a banker would bask in the glory of absconding with hundreds of billions from senior citizen savers and handing it over to criminal bankers. Only a government bureaucrat would classify trillions in entitlement transfers siphoned from the paychecks of the 58.4% of working age Americans with a job or borrowed from foreigner countries as personal income to the non-producing recipients. How can taking money from one person or borrowing it from future generations and dispensing it to another person be considered personal income? Only in the Delusional States of America.

If you really want to understand what has happened in this country over the last forty years, you need to analyze the data across the decades. This uncovers the trends over time that has led us to this sorry state of affairs. The chart below details the major components of personal income over time as a percentage of total personal income. It tells the story of a nation in decline and on an unsustainable path that will ultimately result in a monetary collapse.

It is always fascinating to compare data from 1970, prior to Nixon closing the gold window and allowing bankers and politicians to print and spend to their hearts delight, to present day. The chart above paints a picture of a nation of workers and savers descending into a nation of parasites and spenders. Any rational person knows that income comes from one of two methods: working or investing. A country can only grow by working, saving, investing and living within its means. Money taken from workers and investors and transferred to the non-working and spenders is NOT INCOME. It is just redistribution from producers to non-producers. The key takeaways from the chart are:

- Working at a job generated two-thirds of personal income in 1970 and barely half today. This explains why only half of Americans pay Federal taxes.

- One might wonder how we could be in the third year of a supposed economic recovery and wages and salaries as a percentage of total personal income is lower than pre-crisis and still falling.

- Government transfers have doubled as a proportion of “income” in the last forty years. The increase since 2000 has been accelerating, up 122% in 12 years versus the 55% increase in GDP. The slight drop since 2010 is the result of millions falling off the 99 week unemployment rolls.

- Luckily it is increasingly easy to leave unemployment and go on the dole for life. The number of people being added to the SSDI program has surged by 2.2 million since mid-2010, an 8.5% increase to 28.2 million people. Applications are swelling with disabilities like muscle pain, obesity, migraine headaches, mental illness (43% of all claims) and depression. Our leaders have set such a good example of how to commit fraud on such a grand scale that everyone wants to get a piece of the action. It’s like hitting the jackpot, as 99% of those accepted into the SSDI program (costing $132 billion per year) never go back to work. I’ve got a nasty hangnail. I wonder if I qualify. I’d love to get one of those convenient handicapped parking spaces. Once I get into the SSDI program I would automatically qualify for food stamps, a “free” government iPhone, “free” government cable and a 7 year 0% Ally Financial (85% owned by Timmy Geithner) auto loan for a new Cadillac Escalade. The SSDI program is now projected to go broke in 2016. I wonder why?

- A nation that rewarded and encouraged savings in 1970 degenerated into a country that penalizes savers and encourages consumption. The government, mainstream media, and NYT liberal award winning Ivy League economists encourage borrowing and spending as the way to build a strong nation. Americans have been convinced that borrowing to appear successful is the same as saving and investing to actually achieve economic success.

- Americans saved 7% to 12% of their income from 1960 through 1980. As Wall Street convinced delusional Boomers that stock and house appreciation would fund their luxurious retirements, savings plunged to below 0% in 2005. Why save when your house doubled in price every three years? Americans rationally began to save again in 2009 but Bernanke’s zero interest rate policy put an end to that silliness. Why save when you are being paid .15%? Buying Apple stock at $560 (can’t miss) and getting in on the Facebook IPO (PE ratio of 99) is a much better bet. The national savings rate of 3.8% is back to early 2008 levels. I wonder what happens next?

- The proportional distribution between interest and dividends which had been in the 3 to 4 range for decades is now virtually 1 to 1, as Ben Bernanke has devastated the lives of millions of poor senior citizen savers while continuing to subsidize his wealthy stock investors buddies on Wall Street.

Now for the bad news. The Baby Boom generation has just begun to retire en masse. Government transfers will automatically accelerate over the next decade as Social Security and Medicare transfer payments balloon. Government transfer payments have already increased by 3,250% since 1970, while wages and salaries have increased by 1,250%. The non-existent inflation touted by Ben Bernanke accounts for 590% of this increase. We have passed a point of no return. As the number of Americans receiving a government EBT into their bank account grows by the day and the number of working Americans remains stagnant, the chances of a politician showing the courage to address our un-payable entitlement liabilities is near zero. Americans choose to deal with problems in a reactive manner rather than a proactive manner. Until the next inescapable crisis, the fraud and looting will continue until morale improves.

A Few Evil Men

“Every effort has been made by the Federal Reserve Board to conceal its powers, but the truth is the FED has usurped the government. It controls everything here (in Congress) and controls all our foreign relations. It makes and breaks governments at will… When the FED was passed, the people of the United States did not perceive that a world system was being set up here… A super-state controlled by international bankers, and international industrialists acting together to enslave the world for their own pleasure!” - Rep. Louis T. McFadden

The largest fraud and theft being committed in this country is being perpetrated by the Central Bank of the United States; its Wall Street owners; and the politicians beholden to these evil men. The fraud and theft is being committed through the insidious use of inflation and manipulation of interest rates. The biggest shame of our government run public education system is their inability or unwillingness to teach even the most basic of financial concepts to our children. It’s almost as if they don’t want the average person to understand the truth about inflation and how it has slowly and silently destroyed their livelihood while enriching the few who create it. Converting the chart above into inflation adjusted figures reveals a different picture than the one sold to the general public on a daily basis. Even using the government manipulated CPI figures from the BLS, the ravages of inflation are easy to recognize.

Total wages and salaries have risen by only 112% on an inflation adjusted basis over the last 42 years. This is with U.S. population growth from 203 million in 1970 to 313 million people today, a 54% increase. On a real per capita basis, wages and salaries rose from $16,079 in 1970 to $22,060 today, a mere 37% increase in 42 years. That is horrific and some perspective will reveal how bad it really is:

- The average new home price in 1970 was $26,600. The average new home price today is $291,200. On an inflation adjusted basis, home prices have risen 85%.

- The average cost of a new car in 1970 was $3,900. The average price of a new car today is $30,748. On an inflation adjusted basis, car prices have risen 33%.

- A gallon of gasoline cost 36 cents in 1970. A gallon of gas today costs $3.85. On an inflation adjusted basis, gas prices have risen 81%.

- The average price of a loaf of bread in 1970 was 25 cents. The average price of a loaf of bread today is $2.60. On an inflation adjusted basis, a loaf of bread has risen 76%.

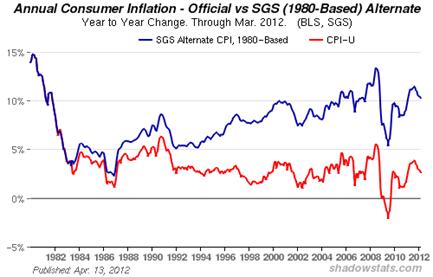

In most cases, the cost of things we need to live have risen at twice the rate of our income. This data is bad enough on its own, but it is actually far worse. The governing elite, led by Alan Greenspan, realized that accurately reporting inflation would reveal their scheme, so they have been committing fraud since the early 1980s by systematically under-reporting CPI as revealed by John Williams at www.shadowstats.com:

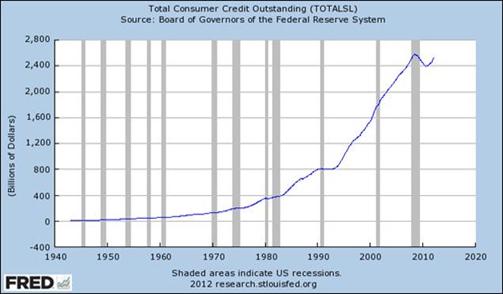

The truth is that real inflation has been running 5% higher than government reported propaganda over the last twenty years. This explains why families were forced to have both parents enter the workforce just to make ends meet, with the expected negative societal consequences clear to anyone with two eyes. The Federal Reserve created inflation also explains why Americans have increased their debt from $124 billion in 1970 to $2.522 trillion today, a 2000% increase. Wages and salaries only rose 1,250% over this same time frame. Living above your means for decades has implications.

The country, its leaders, its banks and the American people should have come to their senses after the 2008-2009 melt-down. Politicians should have used the crisis to address our oncoming long-term fiscal train wreck, the recklessly guilty Wall Street banks should have been liquidated and their shareholders and bondholders wiped out, the bad debt rampant throughout the financial system should have been purged, and American consumers should have reduced their debt induced consumption while saving for an uncertain cloudy future. These actions would have been painful and would have induced a violent agonizing recession. It would be over now. We would be in the midst of a solid economic recovery built upon reality. Iceland told bankers to screw themselves in 2008. They accepted the consequences of their actions and experienced a brutal two year recession.

The debt was purged, banks forced to accept their losses, and the citizens learned a hard lesson. Amazingly, their economy is now growing strongly. This is the lesson. Wall Street is not Main Street. Saving Wall Street banks and wealthy investors did not save the economy. Stealing savings from little old ladies and funneling it to psychopathic bankers is not the way to save our economic system. It’s the way to save bankers who made world destroying bets while committing fraud on an epic scale, and lost.

Despite the assertion by the good doctor Krugman that there are very few Americans living on a fixed income being impacted by Bernanke’s zero interest rate policy, there are actually 40 million people over the age of 65 in this country that might disagree. There are another 60 million people between the ages of 50 and 64 years old rapidly approaching retirement age. We know 36 million people are receiving SS retirement benefits today. We know that 49 million people are already living below the poverty line, with 16% of those over 65 years old living in poverty. Do 0% interest rates benefit these people? Those over 50 years old are most risk averse, and they should be. Despite the propaganda touted by Wall Street shills and their CNBC mouthpieces, the fact is that the S&P 500 on an inflation adjusted basis is at the same level it was in 1996. Stock investors have gotten a 0% return for the last 16 years. The market is currently priced to deliver inflation adjusted returns of 2% over the next ten years, with the high likelihood of a large drop within the next year.

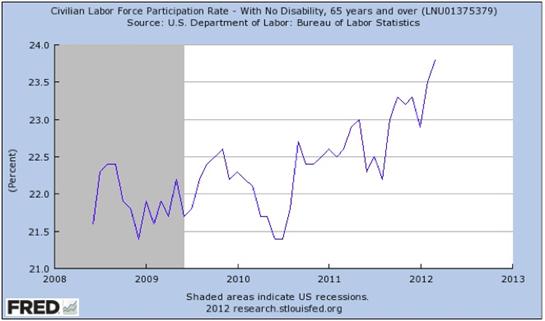

Ben Bernanke’s plan, fully supported by Tim Geithner, Barack Obama and virtually all corrupt politicians in Washington DC, is to force senior citizens and prudent savers into the stock market by manipulating interest rates and offering them no return on their savings. A fixed income senior citizen living off their meager $15,000 per year of Social Security and the $100,000 they’ve saved over their lifetimes was able to earn a risk free 5% in a money market fund in 2007, generating $5,000 or 25% of their annual living income. Today Ben is allowing them to earn $150 per year. From the BEA info in the chart above you can see that Ben’s ZIRP has stolen $400 billion of interest income from senior citizens and prudent savers and dropped it from helicopters on Wall Street. This might explain why old geezers are pouring back into the workforce at a record pace. Maybe Dr. Krugman has an alternative theory.

Another doctor, with a penchant for telling the truth, described in no uncertain terms the depth of the fraud and theft being perpetrated on the American people (aka Muppets) by Ben Bernanke, the Federal Reserve, their masters on Wall Street, and the puppets in Washington DC:

"We are not doing very well. The economy is just coming along at a snail's pace. The first quarter numbers that we just got last week were not very good at all. The GDP number was 2.2%. That was a disappointment, but you know, it was all automobiles. 1.6 out of the 2.2 was motor vehicle production. So, people were catching up after not being able to buy them the year before. So, this is a very weak economy... I think the real danger is that this is a bubble in the stock market created by low long-term interest rates that the Fed has engineered. The danger is, like all bubbles, it bursts at some point. Remember, Ben Bernanke told us in the summer of 2010 that he was going to do QE2 and then ultimately they did Operation Twist. The purpose of that was to make long-term bonds less attractive so that investors would buy into the stock market. That would raise wealth and higher wealth would lead to more consumption. It helped in the fourth quarter of 2010 and maybe that is what is helping to drive consumption during the first quarter of this year. But the danger is you get a market that is not with the reality of what is happening in the economy, which is, as I said a moment ago, is really not very good at all." – Martin Feldstein

The entire bogus recovery is again being driven by subprime auto loans being doled out by Ally Financial (85% owned by the U.S. government) and the other criminal Wall Street banks. The Federal Reserve and our government leaders will continue to steer the country on the same course of encouraging rampant speculation, deterring savings and investment, rewarding outrageous criminal behavior, purposefully generating inflation, and lying to the average American. It will work until we reach a tipping point. Dr. Krugman thinks another $4 trillion of debt and a debt to GDP ratio of 130% should get our economy back on track. When this charade is revealed to be the greatest fraud and theft in the history of mankind, Ben and Paul better have a backup plan, because there are going to be a few angry men looking for them.

Henry Ford knew what would happen if the people ever became educated about the true nature of the Federal Reserve:

"It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning."Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2012 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.