Gold ‘Will Go To 3,000 Dollars Per Ounce’

Commodities / Gold and Silver 2012 May 11, 2012 - 10:59 AM GMTBy: GoldCore

Gold’s London AM fix this morning was USD 1,580.75, EUR 1,221.69 and GBP 980.98 per ounce.

Gold’s London AM fix this morning was USD 1,580.75, EUR 1,221.69 and GBP 980.98 per ounce.

Yesterday's AM fix was USD 1,590.00, EUR 1,228.37, and GBP 987.39 per ounce.

Gold rose $3.00 or 0.18% in New York yesterday and closed at $1,594.00/oz. Gold ticked lower in Asia and in Europe and breached yesterday’s intraday low of $1,580/oz.

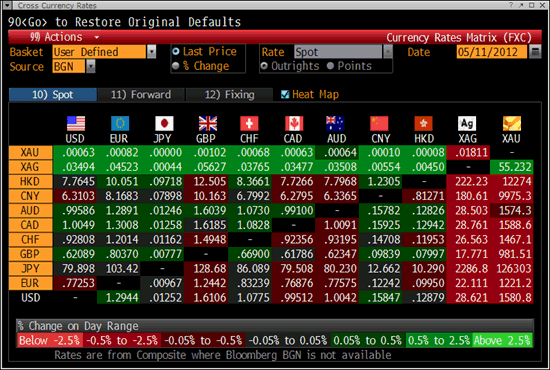

Cross Currency Table – (Bloomberg)

A close below $1,580/oz could see gold test support at $1,523/oz and $1,533/oz – the lows in December and September 2011 respectively.

Gold fell after shares in Asia were hit by JPMorgan's massive $2 billion loss, political turmoil in the euro zone and also by weak economic data from China. The JP Morgan loss may be higher than $2 billion and could lead to sharper sell offs in markets which could lead to further gold weakness.

However, the JP Morgan loss is gold positive as it shows how little reform there has been of Wall Street and the global financial system which continues to resemble a casino. It also shows that systemic risk remains.

Gold tracked equities lower despite the JP Morgan loss, deepening worries about Europe's debt crisis, Chinese economy concerns and their impact on global economic growth.

Safe haven gold is again showing short term correlation with risk assets, with sell offs seen across risk assets such as equities, industrial metals and oil this week. It seems likely that some more speculative players are again selling gold on the COMEX to cover losses suffered in other markets.

Gold is set to fall by more than 3% this week, the deepest drop since early March, however there are technical and fundamental factors that suggest we may be near an intermediate low.

There has been far less selling of physical bullion this week and indeed a small degree of buying the dip.

In the physical market, weaker prices led to buying from Thailand, Indonesia and also main consumer India. Reuters reports that premiums for gold bars in Singapore edged up to $1.10 to spot London prices from $1.0 quoted on Thursday.

While gold prices have had 11 consecutive years of price gains one would not know it from the lack of popular media coverage (and often unbalanced and uninformed), and lack of participation on behalf of the western public.

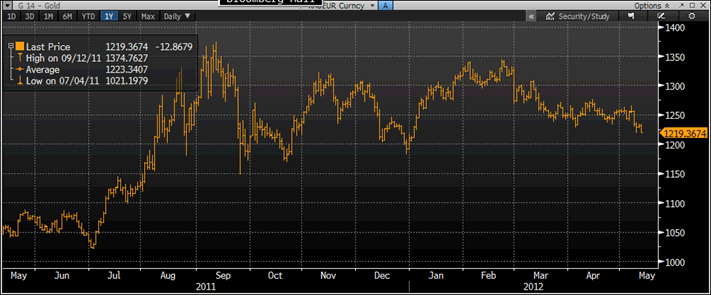

Gold in Euros – Daily (1 Year)

However gold is set for a 12th consecutive year of gains as investor demand is likely to be spurred by unfolding eurozone sovereign debt crisis, according to the World Gold Council (WGC).

"We believe this will be the 12th year of a bull run by the end of this year," Marcus Grubb, managing director for investment at the industry funded WGC, told a news briefing.

Gold ‘Will Go To $3,000/oz’ – David Rosenberg

Highly respected economist and strategist David Rosenberg has told the Financial Times in a video interview (see below) that gold “will go to $3,000 per ounce before this cycle is over.”

Markets are repeating the downturns of 2010 and 2011 and it is time to search for safety, David Rosenberg of Gluskin Sheff tells James Mackintosh, the FT Investment Editor.

Rosenberg sees a “very good opportunity in gold” as it has corrected and seems to be “off the radar screen right now”.

He sees gold as a currency and says the best way to value gold is in terms of money supply and “currency in circulation.”

As the “volume of dollars is going up as we get more quantitative easing” he sees gold at $3,000 per ounce.

Mackintosh says that Rosenberg’s view is a “pretty bearish view”.

To which Rosenberg responds that it is “bullish view on gold and gold mining stocks.” Mackintosh says that it is “bearish on everything else”.

Rosenberg says that it is not about being “bullish or bearish,” it is about “stating how you view the world” and he warns that the major central banks are all going to print more money and keep real interest rates negative “as far as the eye can see.”

This is “critical” as one of the key determinants of the gold price are real short term interest rates.

The longer they stay negative “the longer the bull market in gold is going to be.”

Rosenberg sums up that “this is not about being bullish or bearish, it is about how do we make money for our clients.”

The interesting interview can be watched here.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.