Europe: Big Problems Remain For Stock Markets

Stock-Markets / Stock Markets 2012 May 11, 2012 - 11:37 AM GMTBy: Chris_Ciovacco

In December 2011, the European Central Bank (ECB) attempted to paper over the debt crisis. As noted by the Wall Street Journal on April 18, “Europe’s bold program to defuse its financial crisis by injecting cash into the banking system is running out of steam”.

In December 2011, the European Central Bank (ECB) attempted to paper over the debt crisis. As noted by the Wall Street Journal on April 18, “Europe’s bold program to defuse its financial crisis by injecting cash into the banking system is running out of steam”.

Since the credit markets in Spain and Italy have shown renewed signs of strain, the timing for elections in France and Greece was less than ideal for policymakers. On Friday morning, there were rumblings from Europe giving some basis for optimism to the post-election situation in Greece.

From the BBC:

The leader of Greece’s main socialist party, Evangelos Venizelos, is holding a series of talks on forming a coalition to deal with the debt crisis. Mr Venizelos is the third party head to try and reach a deal since Sunday’s election produced a hung parliament. Earlier, observers said there was some hope of a deal after Mr Venizelos met the head of a smaller, left-wing party.

The political rhetoric in Greece has centered around the renegotiation of the country’s bailout terms. Just to make sure the story remains tense and unsettling for the markets, Germany weighed in on Friday, something that we knew was only a matter of time. From the Vancouver Sun:

Germany told Greece on Friday that staying in the euro zone was its own choice and that it must not stray from austerity if it expects to get international cash. In a speech to parliament, Foreign Minister Guido Westerwelle said Germany wanted to help Greece stay in the euro zone but made clear the EU-IMF loans needed to stave off bankruptcy hinged on continued spending cuts and tax hikes.

Our market risk model has moved out of bullish territory and firmly into neutral mode. The chart of the German stock market below highlights the weakening trends. The black line is the German stock index. The thin colored lines are moving averages, which are used to filter out volatility enabling us to more clearly see the underlying trend in stock prices.

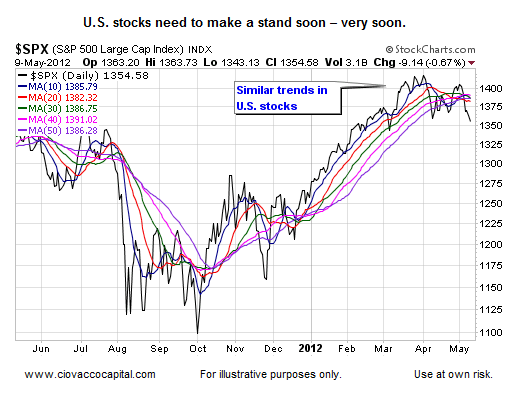

U.S. investors have taken note of renewed tensions in Europe, both in the credit markets and between Greece and Germany. As we noted before the open on May 7, stocks have very little room for error from a technical perspective (charts, trends, VIX, etc.).

This chart shows some areas we will be watching should the weakness in stock prices persist. While markets can reverse at any time, it is not hard to envision the S&P 500 revisiting 1,280 sometime in the coming weeks. We have a high cash position and we are not adverse to raising more cash should stocks be unable to regain their balance soon.

In terms of a possible buying opportunity, notice stocks established a strong uptrend after the ECB intervened in the credit markets with printed money. The ECB-induced reversal in December 2011 is not unlike the reversal in summer 2010 after Ben Bernanke’s Jackson Hole speech, in which the Fed Chairman signaled another round of money printing was on the way. If the markets continue to fall in the present day, the odds are good central bankers will crank up the printing presses again. A good risk-reward entry point may arise immediately after the central bankers tip their hand.

-

Copyright (C) 2012 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.