UK Interest Rate 2008 Forecast Cuts to 4.75% by September 2008

Interest-Rates / US Interest Rates Jan 24, 2008 - 01:56 AM GMTBy: Nadeem_Walayat

The US Fed's emergency 0.75% interest rate cut to 3.5% following the global stock market plunge on fears of a looming US recession now increases the probability of a near certain cut in UK interest rates at the February MPC Meeting, rather than at the originally forecast March MPC meeting. Whilst the US has made deep cuts in interest rates from a peak of 5.25% to 3.5%, the UK has only cut rates by 0.25% from a peak of 5.75% to 5.50% with the expected February cut to take rates to 5.25%.

The US Fed's emergency 0.75% interest rate cut to 3.5% following the global stock market plunge on fears of a looming US recession now increases the probability of a near certain cut in UK interest rates at the February MPC Meeting, rather than at the originally forecast March MPC meeting. Whilst the US has made deep cuts in interest rates from a peak of 5.25% to 3.5%, the UK has only cut rates by 0.25% from a peak of 5.75% to 5.50% with the expected February cut to take rates to 5.25%.

The Market Oracle forecast as of August 07 and Sept 07 is for UK interest rates to fall to 5% by September 2008, with interest rates about to reach 5.25% by February 08, would now suggest that the original 5% target could be breached by September 2008. However some economists suggesting much deeper rate cuts on par with the US cuts may be greatly disappointed as inflationary pressures persist which are further being exacerbated by a weakening British Pound that has fallen from a peak of $2.11 to $1.95 today.

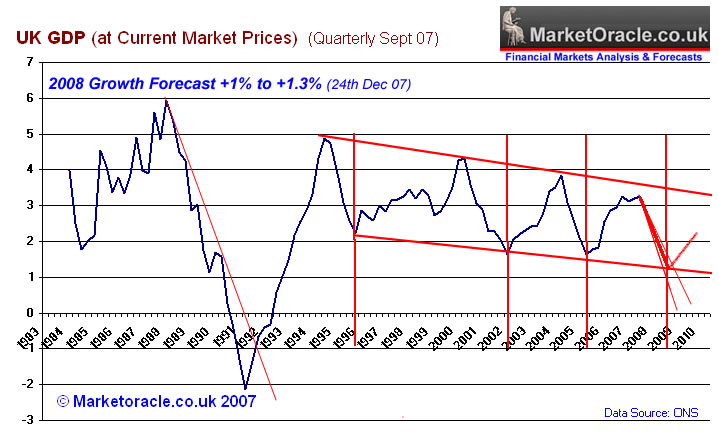

UK Economy

The forecast for UK GDP growth by the end of 2008 is for a an annualised growth rate of between 1% and 1.3%. Which suggests that despite much bad news on the economic front, the UK looks set to avoid a recession during 2008. The first half of the year will be much tougher in growth terms then the second half, which therefore suggests a pause in the rate cutting cycle as we move into the second half of 2008.

UK Inflation and Interest Rate Trend Forecasts

As forecast in November 2007 - UK Inflation Forecast 2008 (RPI and CPI), the current up tick in inflation is expected to terminate in Jan 08, and the trend is expected to resume lower, forecasting a sharper fall for the RPI than the CPI. RPI is forecasting a trend towards 3% and the CPI is forecasting a trend towards 1.9% by September 2008.

UK Money Supply M4

The anticipated trend in the UK's Money supply growth continues to moderate from the high levels of 14% plus towards a trend to below 10% as per the analysis of 18th Sept 07 . Money supply is an important contributory indicator for future inflation between 6 and 12 months forward. Hence money supply growth near 14% during mid 2007 was expected to result in higher inflation going into 2008 ( 22nd August 07 ).

The conclusion is that the Bank of England will take the drop in M4 to below 10% as a better indicator of future inflation 2 years forward, and therefore continue cutting UK interest rates that are now targeting a move to 4.75% by September 2008.

By Nadeem Walayat

Copyright © 2005-08 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of trading, analysing and forecasting the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 120 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.