VIX Reflects Escalating Concerns About the Stock Market

Stock-Markets / Stock Markets 2012 May 15, 2012 - 04:05 PM GMTBy: Chris_Ciovacco

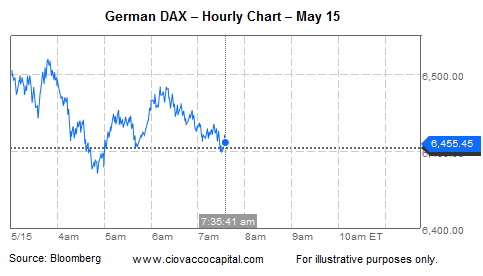

Prior to the open on May 7, we discussed concerns about Greece (GREK) and outlined evidence of slowing momentum in stocks. Since then, the S&P 500 has dropped 31 points. On the morning of May 15, some better than expected data came from Germany with GDP growing 0.5% in the first quarter versus expectations of 0.1%. As shown below, the German DAX Index (EWG) is having trouble holding on to its early morning gains (as of 7:35 a.m. EDT). If the DAX cannot rally on better than expected news, it is not a good sign for risk assets in general.

Prior to the open on May 7, we discussed concerns about Greece (GREK) and outlined evidence of slowing momentum in stocks. Since then, the S&P 500 has dropped 31 points. On the morning of May 15, some better than expected data came from Germany with GDP growing 0.5% in the first quarter versus expectations of 0.1%. As shown below, the German DAX Index (EWG) is having trouble holding on to its early morning gains (as of 7:35 a.m. EDT). If the DAX cannot rally on better than expected news, it is not a good sign for risk assets in general.

The serious and fragile nature of the situation in Greece is underscored in the excerpts below from a May 15 Bloomberg article:

“The euro (FXE) breakup story is gathering steam again,” Marchel Alexandrovich, a senior European economist at Jefferies International in London, said in a research note. “If Greece were to ever exit the euro, no amount of reassuring comments will convince investors that other countries won’t soon follow.”

“Greece needs to elect a pro-reform and pro-austerity parliament or I foresee big problems,” Dutch Finance Minister Jan Kees de Jager said. “There is no room to weaken the agreements by reforming less or reducing spending cuts.”

The chart below shows the performance of the VIX or “Fear Index” (VXX) relative to the S&P 500 (SPY). When the ratio is falling the acceptance of risk is stronger than fear or risk aversion. On the left side of the chart, fear began to increase in July 2011. The thin colored lines are moving averages, which are used to smooth out day-to-day volatility, allowing us to focus on trends. All three of the moving averages turned up last July (blue, red, and green lines), indicating escalating concerns by investors. Notice as of Monday’s close, all three moving averages have turned up for the first time since October 2011.

Still focusing on the chart above, fear now has a clearly defined uptrend relative to the S&P 500. The ratio broke the downward-sloping blue trendline (see green arrow) in April 2012. A higher low was made near the blue arrow. The ratio recently made a higher high to complete a change in trend (purple arrow). The right side of the chart above looks similar to the left side. Stocks did not perform well in late July/early August 2011, meaning it is prudent to keep a close eye on risk assets in the present day.

Today’s Wall Street Journal reminds us that even when some form of a resolution comes out of Greece, it is unlikely the markets will stop obsessing about the mountains of debt in Europe:

A Greek exit from the euro zone would exert more pressure on Portugal and Ireland. Portugal and Ireland are already expected to get fresh financial assistance of some form. Guntram Wolff, of Brussels think-tank Bruegel, believes that, should Greece exit the euro, the market will turn its attention to these two vulnerable countries.

The market’s concerns about further deflationary bond writedowns are encapsulated in the waning interest in commodities (DBC). Commodities, often used as an inflation hedge, have made a lower high (below blue arrow in chart below), and have violated a three-year old bullish trendline (red arrow).

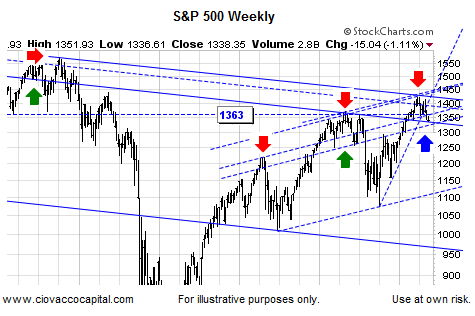

On the bullish side of the ledger, the weekly chart of the S&P 500 below is nearing the intersection of parallel trendlines that have acted as both support (green arrows) and resistance (red arrows). In a May 13 video, we highlighted a Tom DeMark (Market Studies, LLC) “buy setup” that may be in place as of Tuesday’s close on the S&P 500 futures. Several individual stocks and sectors have similar, and potentially bullish DeMark setups in place or forming.

The markets may be due for a bounce or multiple-week rally. However, based on the news from Europe and technical deterioration that has taken place, a rally may prove to be nothing more than a selling opportunity. We will keep an open mind, but the market needs to show us something in terms of technical strength - the bias remains down until proven otherwise.

-

Copyright (C) 2012 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.