SPY Bounced, XLF and FXE Not So High

Stock-Markets / Stock Markets 2012 May 22, 2012 - 05:58 AM GMT This is just to give you a perspective on “why the bounce?” SPY bounced of yet another Orthodox Broadening Top trendline, just above daily Mid-Cycle support at 128.41. The current Broadening Formation has been forming since mid-February. Each of these formations attest to the pumping of liquidity on each downside breakout. Unfortunately for the Fed and its minions, this break-down has gone further than the others and now the previous formations offer resistance to any attempts to resume the uptrend.

This is just to give you a perspective on “why the bounce?” SPY bounced of yet another Orthodox Broadening Top trendline, just above daily Mid-Cycle support at 128.41. The current Broadening Formation has been forming since mid-February. Each of these formations attest to the pumping of liquidity on each downside breakout. Unfortunately for the Fed and its minions, this break-down has gone further than the others and now the previous formations offer resistance to any attempts to resume the uptrend.

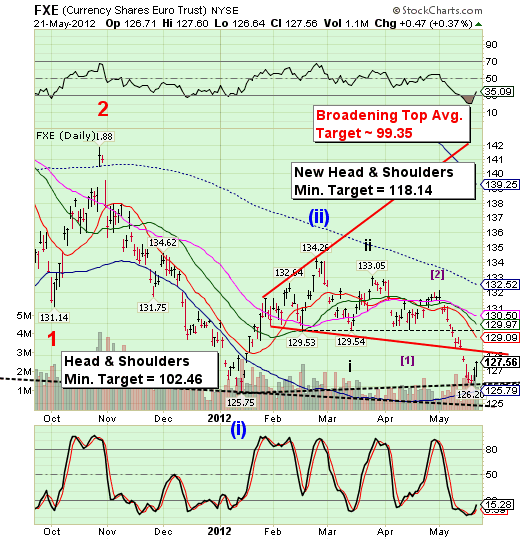

The bounce may already be over and a drop below the Crash Trigger gives us a potential Head & Shoulders minimum target of 116.97,an average Fibonacci target of 112.11 and a new Orthodox Broadening Top average target of 99.33.

ZeroHedge writes, “Something different today. A dip was bought and kept a little momentum - aided and abetted by some late-afternoon desperation EUR buying correlation-help which dragged the Dow back over the magical 12,500 level.”

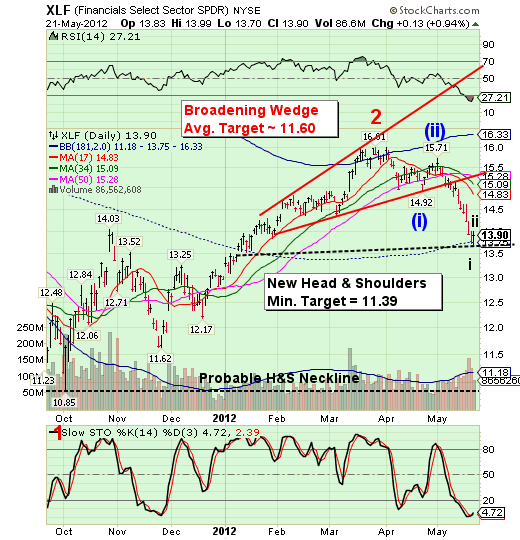

XLF tested its Mid-Cycle support at 13.25 and may have left us with a new Head & Shoulders neckline with a target that seems to agree with the Broadening Wedge formation. In addition, the minimum target may be beneath the Wave 1 low and yet another H&S neckline at 10.85. Once the lower neckline is triggered, the minimum target is 5.69. The question is, how quickly will this happen? The first pivot low may be as early as Thursday/Friday of this week. The second may happen near June 8.

I’m switching to an hourly chart to show that VIX did a very nice retest of its Head & Shoulders neckline today. It appears that the retest is over, or nearly so. This puts VIX in a position to rally 34% or more to its minimum H&S target. A rule of thumb is generally when the VIX rallies over 25, the market crashes, so this may be a confirmation of a pickup in the momentum of the decline.

FXI merely made a 17.5% retracement today. It also left us with a new Head & Shoulders neckline (still on the right shoulder of its massive H&S pattern). It almost seems pointless to put the new H&S neckline there, since it is so close to the larger one. However, it seems appropriate to know that there are multiple confirmations of the general trend.

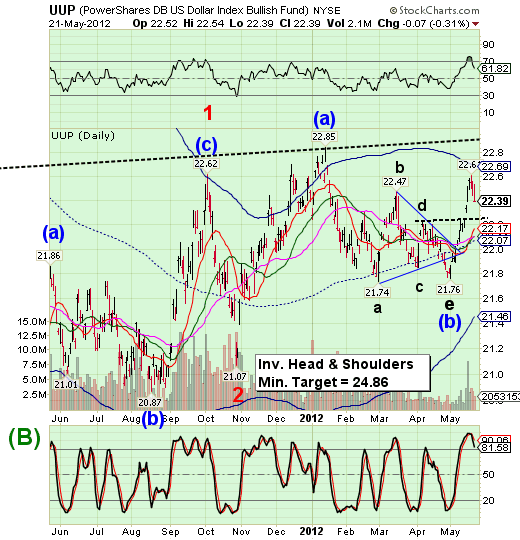

UUP corrected after making a 5-wave impulse from its April 30 low. My suspicion is that the correction will be short-lived, since UUP is due for a Primary Cycle high on Friday.

Last week GLD made an early Trading Cycle pivot low. I had expected to see a low today. Instead, today’s pivot is at a high, so the way is now clear for a decline in GLD that could last through mid-June. A break of the Head & Shoulders neckline will erase all illusions about the uptrend in GLD.

Good luck and good trading!

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.