Stock Market Retracement Rally is Nearly Over

Stock-Markets / Stock Markets 2012 May 22, 2012 - 12:39 PM GMT SPY (132.14) is putting the final touches on its bounce as it tests the underside of its prior Orthodox Broadening Top. A new decline beneath 129.50 will trigger both a new Orthodox Broadening Top with an average target of 99.33 and a new Head & Shoulders pattern with a minimum target of 116.97.

SPY (132.14) is putting the final touches on its bounce as it tests the underside of its prior Orthodox Broadening Top. A new decline beneath 129.50 will trigger both a new Orthodox Broadening Top with an average target of 99.33 and a new Head & Shoulders pattern with a minimum target of 116.97.

The prior Head & Shoulders pattern nearly met its target of 129.31, so I would call it a near miss. Although Head & Shoulders patterns are very reliable (94% success rate), approximately 63% meet or exceed their minimum targets. The balance of them will often decline for a portion of the target, then bounce on a significant support area.

My model suggest that the most powerful decline is just ahead of us, so I don’t expect SPY to linger at this level.

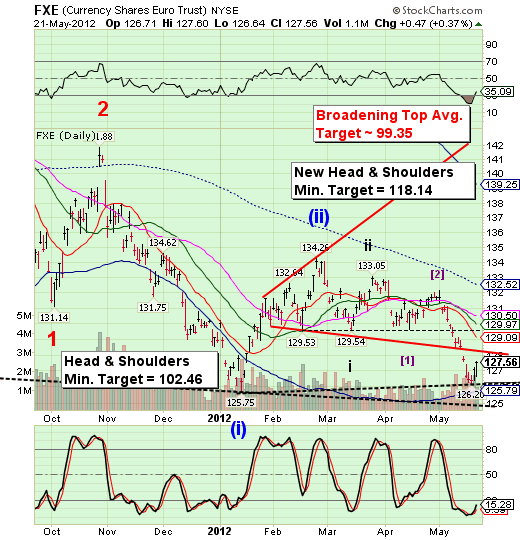

FXE (126.83) is declining this morning toward its lesser Head & Shoulders neckline at 126.20. We will be monitoring the two necklines to observe the wave behavior. In a third wave, FXE may decline through both with little trouble or delay.

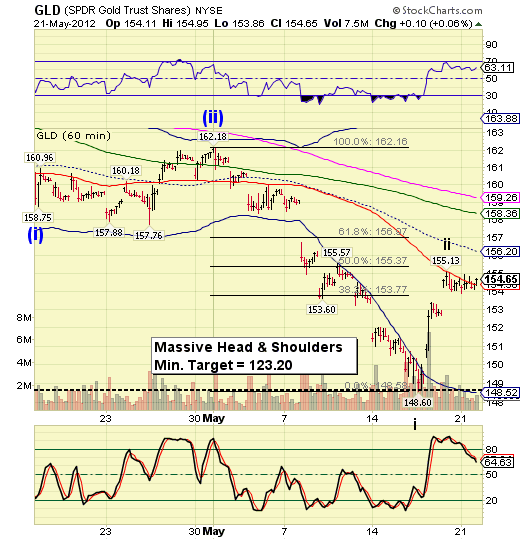

GLD (153.23) has declined from a sideways consolidation this morning. Usually a sideways consolidation is resolved with a resumption of the directional move prior to the consolidation. Although the rally to short-term resistance at 155.13 appears complete, I would be wary of one more surge to Mid-Cycle resistance at 156.20 before the decline resumes.

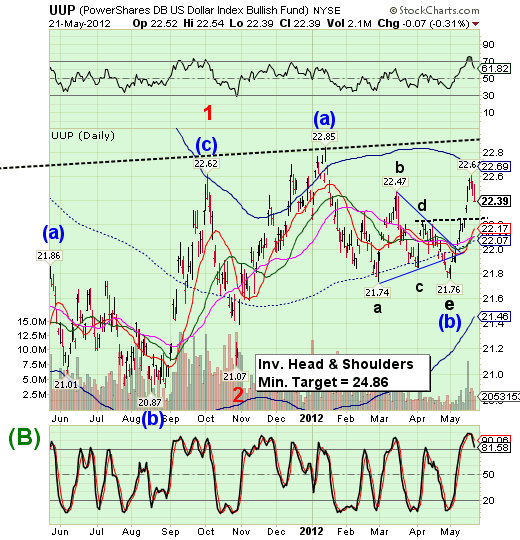

UUP (22.51) may still be in a correction phase with the intent of declining to its minor Head & Shoulders neckline near 22.25. The decline may not last long, so be on the alert for an entry later this morning.

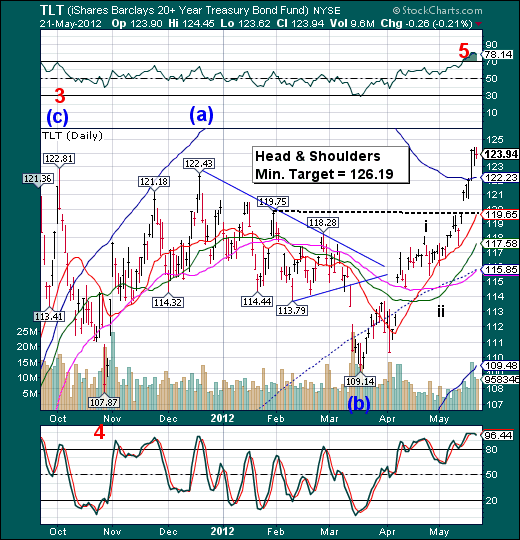

TLT (122.77) is eased back toward its Cycle Top support at 122.23. This correction also may not last through the morning. It is not necessary for TLT to retest its Head & Shoulders neckline. Approximately 45% of all Head & Shoulders patterns do so, according to Thomas Bulkowski’s Encyclopedia of Chart Patterns, p. 290.

In fact, not doing so would confirm that TLT is in a wave iii of (c) formation.

Good luck and good trading!

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.