Institutional Selling Goes Opposite to Stock Market Direction

Stock-Markets / US Stock Markets Jan 25, 2008 - 11:23 AM GMTBy: Marty_Chenard

Every day, on our paid subscriber website, we show and rate 9 underlying fundamental conditions that are critical relative to rallies and corrections.

This morning, we will share one of them with you ... The rate and trend in Selling by Institutional Investors.

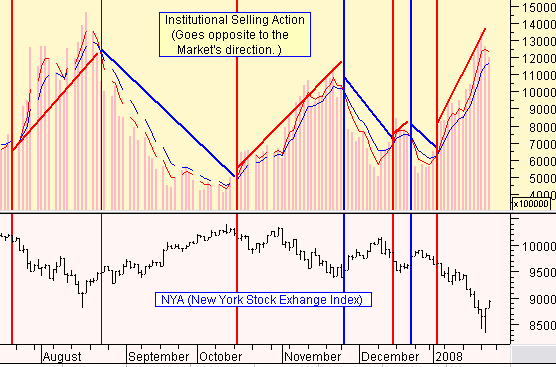

Today's chart is below, and it shows the periods when Institutional Selling was trending UP, or trending DOWN. (Be aware, that Institutional Selling trends move opposite to the market's movement.) If Selling is trending up, then the market moves down. If Selling is trending down (decreasing), then the market moves up. This happens because Institutions are responsible for over 50% of the stock market's trading volume.

Current Update : On January 3rd, the trend of Institutional Selling shifted up , and the market lost its ability to move up any further ... and started a downtrend as seen on the chart.

The Institutional Selling trend has remained in an up trend since January 3rd ., therefore the market has been moving down. If you look at the rose colored bars, the Institutional Selling has lessened in the past two days ... but not yet enough to reverse the Selling into a down trend. What it does in the next two to three trading days will be an important event for our subscribers to watch for.

If you find this kind of data empowering and important relative to understanding where the market truly is , then why not consider joining us as one of our paid subscribers?

By Marty Chenard

http://www.stocktiming.com/

Please Note: We do not issue Buy or Sell timing recommendations on these Free daily update pages . I hope you understand, that in fairness, our Buy/Sell recommendations and advanced market Models are only available to our paid subscribers on a password required basis. Membership information

Marty Chenard is the Author and Teacher of two Seminar Courses on "Advanced Technical Analysis Investing", Mr. Chenard has been investing for over 30 years. In 2001 when the NASDAQ dropped 24.5%, his personal investment performance for the year was a gain of 57.428%. He is an Advanced Stock Market Technical Analyst that has developed his own proprietary analytical tools. As a result, he was out of the market two weeks before the 1987 Crash in the most recent Bear Market he faxed his Members in March 2000 telling them all to SELL. He is an advanced technical analyst and not an investment advisor, nor a securities broker.

Marty Chenard Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.