Comparing Gold's Current Price Crash to the One in 2008

Commodities / Gold and Silver 2012 May 23, 2012 - 04:02 AM GMTBy: Simit_Patel

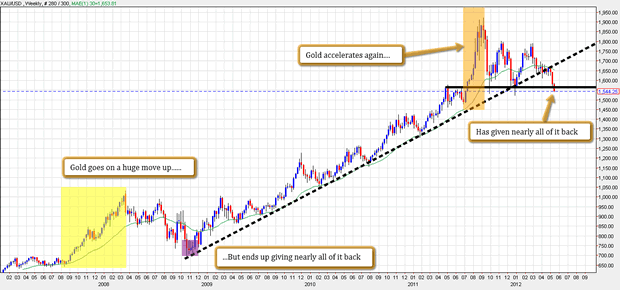

The chart below tells the story. I think gold is simply repeating what happened in 2008.

The chart below tells the story. I think gold is simply repeating what happened in 2008.

From this perspective, I think we're coming close to the conclusion of the retracement. I don't think we'll go past $1520; I think there will be many bids defending $1500-$1520.

I do think we will see more moves like this -- meaning more rallies that accelerate too quickly and then correct severely. However, I think there is a good chance we are going to get one move that is going to be much bigger than the previous moves -- one that may be strong enough to quickly take gold several thousand dollars higher.

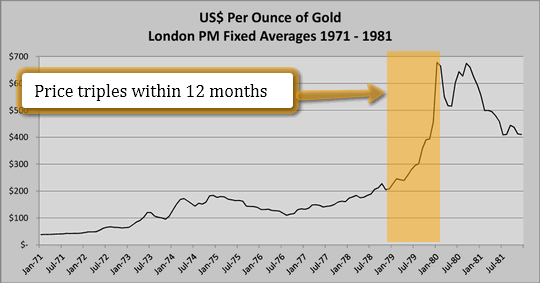

Consider, for instance, gold's performance in 1979 -- a time in which the price of gold more than tripled within 12 months (see the chart below). I think another such move could occur, and that it may be even more volatile and explosive to the upside. That's what I'm waiting for and what I think many other gold bugs are waiting for as well.

In terms of when the bull market will really be coming to an end, there are a few guidelines I try to abide by:

1. If price doubles within six months, that's a red flag that it may be time to sell. So far, we have not come anywhere near such an event. Even in 2011's run up, we only went from $1,500 to $1,900 before the market started to cool off.

2. I expect gold stocks to go through a mania similar to what we saw in the 1970s. It is worth noting that during gold's bull market in the '70s, mining stocks peaked AFTER bullion did. Once mining stocks really start to take off and grab the attention of mainstream media, it may be time to sell.

3. Of course it is only time to sell if there is something else to buy. And what could this "something else" be? If the much cited Dow/Gold ratio falls below 2:1, it could mean equities at large. If there is a new international monetary agreement, it could mean whatever is regarded as the new world reserve currency -- or, if the new reserve currency is restricted to central banks only, whatever would be a proxy for it. For instance, the idea has been put forth that Special Drawing Rights, a currency issued by the IMF, will become the new reserve currency -- and that it will only be traded by central banks of nation-states and supranational regions. As Special Drawing Rights are simply a composite of currencies, individuals could create a proxy for them by creating their own basket of currencies.

As for the time being, though, it seems as though gold's current correction is nothing out of the ordinary as it is quite consistent with previous corrections -- as the chart comparing showing gold's correction in 2008 illustrates. From this perspective, investors will benefit from using this as an opportunity to accumulate for when gold truly goes parabolic. I believe we are still several years and at least several thousand dollars away from a top in gold.

By Simit Patel

http://www.informedtrades.com

InformedTrades is an online community dedicated to helping individuals

learn to trade the world's financial markets. Members earn prizes for

sharing their knowledge, and the best contributions are compiled into

InformedTrades University, the largest collection of free organized

learning material for traders on the web.

© 2012 Copyright Simit Patel - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.