Never Catch a Falling Knife, Gold Market Bottom Only In Hindsight

Commodities / Gold and Silver 2012 Jun 25, 2012 - 12:28 PM GMTBy: John_Lee

The last 18 months have been gut-wrenching for mining equity investors.

The last 18 months have been gut-wrenching for mining equity investors.

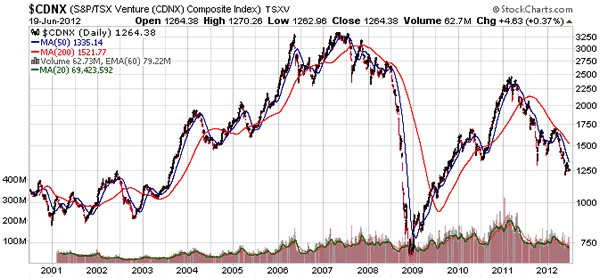

As the above chart demonstrates, the TSX Venture Composite Index, a fair representation of the junior mining sector, has come back down to levels seen in 2002, when gold first broke out of $300/oz.

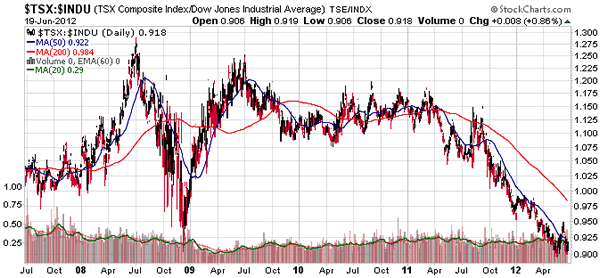

While the TSX Venture Composite Index is still well above its 2008 low, the pain is just as pronounced now as it was then, as the TSX Composite Index, relative to the Dow, is now trading below 2009 levels. The following chart indicates a flight out of Canadian markets into the U.S. markets.

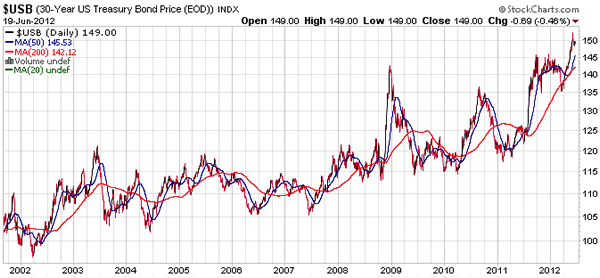

With emerging markets, such as China, struggling and the Eurozone in outright crisis mode, global investors not only have been pouring money into U.S. stocks but have also driven U.S. bonds into an all-time high, ignoring the fact that the bonds are sporting negative real interest.

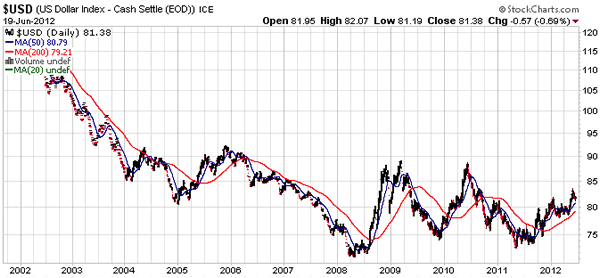

While this represents an extreme flight to perceived "safety", the U.S. dollar index has failed to break out of its 2009 high, indicating the fundamental weakness of the U.S. dollar.

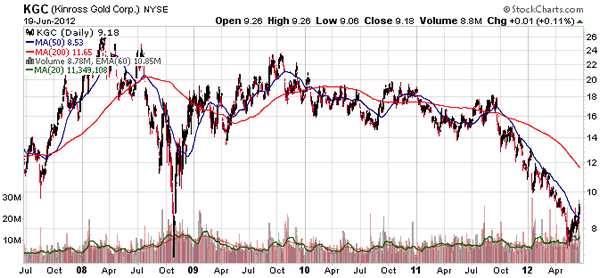

Focusing back on the gold sector, the severe correction is not just felt by the juniors, but senior producers as well. Kinross, for example, is now back to its 2008 low, when gold was below $1,000/oz.

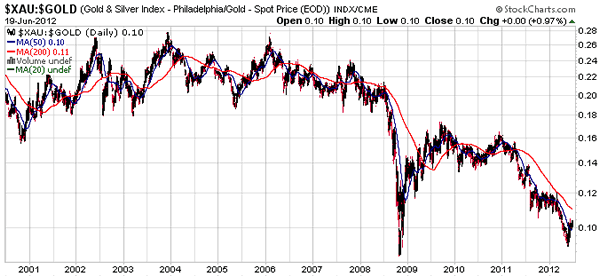

Overall, gold producers, relative to the price of gold have indeed reverted back to the 2009 level as the following chart indicates.

Despite the financial crisis worldwide, gold has held up very well in the last 23 months, currently ($1,600/oz) trading comfortably above the 2008 crisis level ($900). This clearly shows that gold is gaining momentum as the safe haven and reserve currency in the time of crisis.

Also notice, post 2008 crisis, gold doubled from $800/oz level to peak at more than $1,900/oz in less than 3 years. In 2008, the U.S. Federal Reserve embarked on unprecedented quantitative easing, creating trillions of dollars to revive the banks, and the equity and housing markets. Such inflationary measures had a direct positive impact on gold.

As we seemingly come out of the Euro crisis and with world governments eager to again embark on unlimited monetary easing, there are reasons to be again bullish on gold as it completes the current 18 months consolidation.

My conclusion is that the degree of flight to safety today and risk aversion is no less than the case in 2008. The dollar and U.S. bonds were the main beneficiary during the 2008 crisis and as they are in the current crisis.

Post 2008 crisis, gold and gold equities were the big winner, registering triple digit gains. There are preliminary signs of gold and gold equity market bottoms if one considers the bottoming ratios of TSX to Dow and gold equity to gold, and the blow off of U.S. bonds.

I am reminded of two old famous adages: never catch the falling knife, and a market bottom is only known in hindsight. For me, successful investing means buying 20% from the bottom and selling 20% from the top. If we are not currently 20% from the bottom, I'd say we are darn near.

John Lee

Chairman and Interim CEO of Prophecy Platinum

http://www.prophecyplatinum.com/

Disclaimer: The views expressed herein are those of the author and may not reflect those of Prophecy Platinum Corp. or Prophecy Coal Corp. The information herein is provided for information purposes only, and is in no way to be construed as advice or solicitation to make any exchange in precious metal products, commodities, securities or other financial instruments. No warranty expressed or implied exists between the author of this article and the reader as to the accuracy of the information herein provided. The information contained herein is based on sources, which the author believes to be reliable, but is not guaranteed to be accurate, and does not purport to be a complete statement or summary of the available information. Readers are encouraged to conduct their own research and due diligence, and/or obtain professional advice. Any opinions expressed are subject to change without notice. Prophecy Platinum Corp., Prophecy Coal Corp. and the author of this article do not accept culpability for losses and/or damages arising from the use of this article.

John Lee Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.