An Ending Made For Gold

Commodities / Gold and Silver 2012 Jun 27, 2012 - 01:12 AM GMTBy: Frank_Holmes

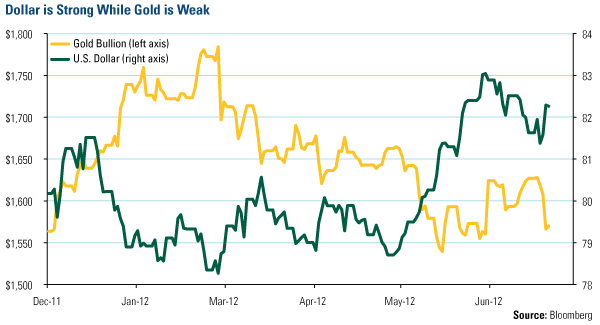

Over the past several months, the markets have tested investors' conviction to gold. Since February, the price of the yellow metal has steadily stepped lower, rallying somewhat in May before falling again when Ben Bernanke disappointed by not providing the U.S. with more stimulus. Meanwhile, the dollar gained ground as global investors fled the euro.

Over the past several months, the markets have tested investors' conviction to gold. Since February, the price of the yellow metal has steadily stepped lower, rallying somewhat in May before falling again when Ben Bernanke disappointed by not providing the U.S. with more stimulus. Meanwhile, the dollar gained ground as global investors fled the euro.

In the ongoing eurocrisis, we won't know the details of how Europe will clean up its debt mess for a while, but we're pretty confident the story ends well for gold.

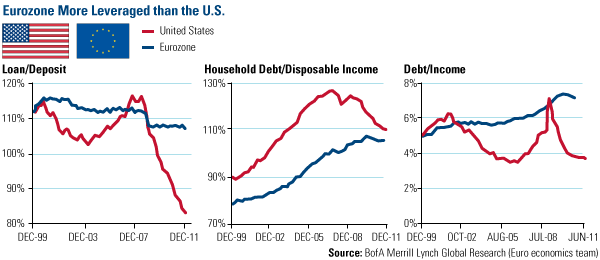

In one possible outcome presented by Bank of America-Merrill Lynch, austerity is "not the answer on its own" when it comes to restoring confidence in fiscal policies. Take a look at the levels of household and bank debt in the U.S. compared to Europe. Over the past few years, debt in the U.S. has decreased as the private sector has delevered.

In the eurozone, though, you'll see that banks and households have maintained status quo when it comes to their levels of debt. On all three measures, loan/deposit, household debt/disposable income and debt/income, ratios have remained around the same level, according to BofA.

BofA's economics team says that even though the long-term refinancing operation (LTRO) has helped in Europe, about 1.7 trillion euros are required to deleverage all the banks in the region. That means there's more work to be done for Europe via a major deleveraging process, which will undoubtedly weigh on economic growth. To keep the eurozone's head above water, more money will likely be needed, requiring the European Central Bank to start up its printing presses similar to what we saw in the U.S. over the past few years.

As gold bugs know, when central banks increase the supply of money, currencies become devalued and investors seek a better store of value. The excess liquidity in the market has historically found its way to riskier assets, benefiting gold.

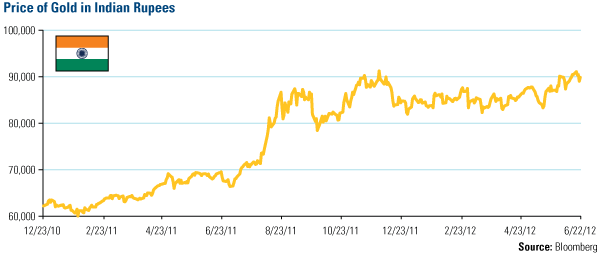

This currency devaluation is what we believe will eventually bring Indians back to gold. Take a look at what gold costs in rupees. India has seen ongoing weakness in its currency as its economy has slowed. This has kept gold near record highs, causing the Love Trade in India to stumble.

All's Well that Ends Well for Gold

The global easing binge from central banks around the world over recent months should have translated to higher commodity prices. This has not occurred: Not only has gold declined, but the price of oil has also decreased considerably, falling from a high of $110 to $78. Jefferies' David Zervos asked, "Shouldn't all this accommodative policy by the Fed, ECB, SNB, BoE and BOJ be sending commodities to the moon?"

He believes the answer is straightforward: Lower commodity prices should be a signal to central banks that they are not doing enough. "There is a hefty disinflation trend developing and given the amount of debt in the system--and the weakness of global aggregate demand--any signs of significant disinflation should be cause for grave concern. We cannot mix a lot of debt with a lot of deflation--that will be the end of us!" exclaims Zervos.

Zervos is betting that central bankers will choose to stimulate the economy. I agree: As I've said before, when push comes to shove, central banks, especially in Europe, will forgo austerity in favor of the printing presses.

In the meantime, hold tight to your convictions, gold investors. Review your allocation to gold and gold stocks to make sure it remains around 5 to 10 percent of your portfolio. That way the precious metal can act as a shock absorber to help protect from any unexpected bumps in the financial system.

For more updates on global investing from Frank and the rest of the U.S. Global Investors team, follow us on Twitter at www.twitter.com/USFunds or like us on Facebook at www.facebook.com/USFunds. You can also watch exclusive videos on what our research overseas has turned up on our YouTube channel at www.youtube.com/USFunds.

By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

U.S. Global Investors, Inc. is an investment management firm specializing in gold, natural resources, emerging markets and global infrastructure opportunities around the world. The company, headquartered in San Antonio, Texas, manages 13 no-load mutual funds in the U.S. Global Investors fund family, as well as funds for international clients.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.