Signs of Gold Bulls Cracking, A Glimpse of Gold Capitulation?

Commodities / Gold and Silver 2012 Jul 08, 2012 - 05:02 PM GMT Looking around it seems we finally have some clues to the bulls cracking and throwing in the towel, yet I have been telling members that Gold or Silver is not a buy as the trend has been down since the Feb 2012 highs. Staying under $1641 on Gold has been key for us and try as they like the Gold bulls have failed at every attempt, although the usual crackpot excuses are coming out, like JPM made the markets lower and the markets are rigged etc.

Looking around it seems we finally have some clues to the bulls cracking and throwing in the towel, yet I have been telling members that Gold or Silver is not a buy as the trend has been down since the Feb 2012 highs. Staying under $1641 on Gold has been key for us and try as they like the Gold bulls have failed at every attempt, although the usual crackpot excuses are coming out, like JPM made the markets lower and the markets are rigged etc.

The best one I have seen was the mysterious "London trader from the pits."

Give me a break with the conspiracy theories, if you are going to trade the markets, at least stand up and admit you were wrong, looking to blame others is a poor excuse for being wrong. The great thing about price and patterns is I don't need to go looking for excuses, as I know where I am wrong on an idea before I even take the trade.

I don't need to know what JPM is going or anyone else; all I am interested in is what price is doing.

I am not concerned that the world is going into hyper-inflation in 1 year or 10 yrs, I trade here and now, I can assure you I am not going to wait for the end of the world as some are.

Many newsletter writers and commentators need to look at themselves in the mirror, as If that is all that they have to sell you, ask yourselves is it really worth the $$$ you are paying?

Well I have a confession to tell you, the markets are rigged, they have been for years, ever since I have traded the markets we have seen insiders trading, the fact remains if you can't accept that stay well away from the markets, as you will always have an unfair advantage if you are trying to justify trading the precious metal markets using "Da Funnymentals".

With Elliott Wave we have fixed stops for the patterns and we respect those stops, no excuses.

Decide if you are interested in making money as we are, or are you interested in following the usual crack pot crowd preparing for the end of the world.

I am very bullish on Gold from a daily perspective pattern, but there is a right time to buy as there is a right time to sell. There is also a time to stand aside, as I have advised members that never wanted to short the precious metals is hold on to their $$ and wait for the buying opportunity.

We have not been buying all the way down over the last few months. We simply respected the trend and as long as the trend remained under our key resistance areas, the trend remains down, it's that simple.

The markets are not hard to trade if you can remain focused on the actual trend.

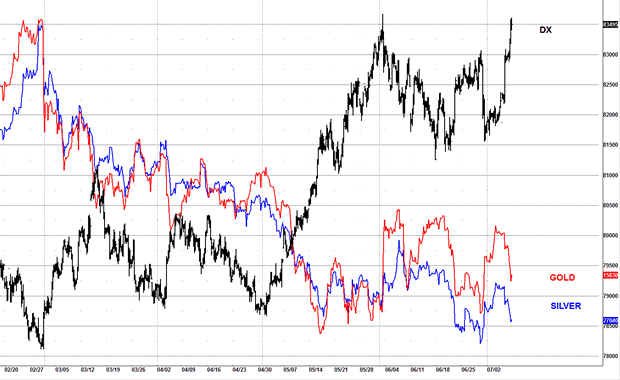

DX VS Gold & Silver

The clues are staring most traders in the face, yet I suspect many have not even bothered to notice that since Feb 2012 the correlation has been strong between the US$ and the precious metals.

There will be those that say it don't always work, and they are correct, but for now it's working.

The chart says it all, simply put, if you know what the US$ is doing, then you will have a far more solid idea as to what Gold and Silver are doing.

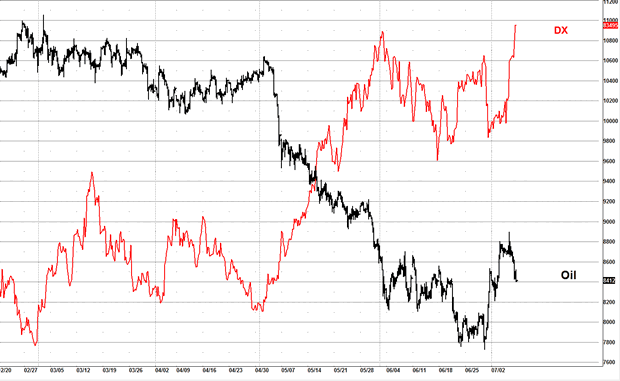

Maybe it's as simple someone needs to sell commodities such as Oil, Gold and Silver to cover margin calls. A fund or bank is short the US$ and is on the wrong side of the trade, so takes a loss and has to sell some assets to meet the margin call.

Wow!! Can it be that easy?, you bet it can, and all for the all the excuses I read about commodities going lower, just one chart will shut those commentators up. The chart below says it all.

Perma Gold newsletter writers and commentators are bullish all the time, they remind me of the Perma bull stock commentators in the media, and there is never a time to sell Gold just like there is never a time to sell stocks.

Q: Why is that?

A: It's because it's in their interests to sucker you in and simply tell you what you want to hear. Whilst we were getting out of long side trades near the Feb 2011 highs, I bet many were getting in and those traders are stuck and hurting really bad atm. Yet our patterns from the Dec 2011 suggested that it was a good time to get out.

At WPT we don't do that, we tell it as it is, if we see a bearish chart, we tell you it's a bearish chart, so you don't go chainsaw catching and cut off your arms and fingers.

To a skilled Elliottician he/she will already be thinking ideas within minutes of looking at this chart, and I have no doubt come up with a plan. In fact it's a basic pattern on the DX that anyone with the minimum of Elliott Wave knowledge should understand.

So if you are reading this and subscribed to another service, ask them are they following this chart?

Where I stand it's pretty obvious that the metals are trading the inverse to the US$, and I have an outstanding target at 84.20 on the DX which if hit, suggests we see my long standing targets lower on Gold and Silver, which members have known for months/weeks, if we have a completed Elliott Wave pattern then we can look to buy the precious metals with a low risk entry.

Hopefully by then many newsletter writers will be bearish and the majority of Gold bugs throwing their toys out of the pram in disgust, that would be the ideal conditions, just like the Dec 2011 lows.

Which I called virtually to the tick, and I want to see the same disgust with the metals as back then.

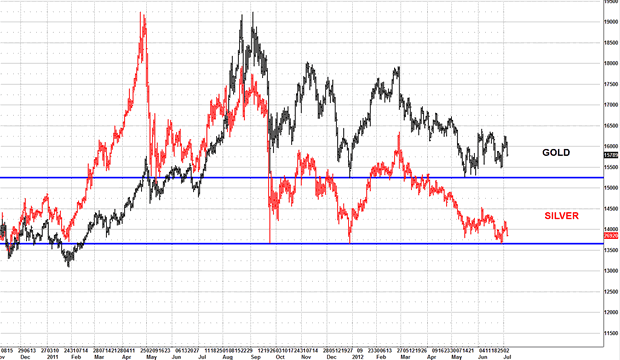

Slowly we are coming back to test important support on Silver and Gold, and the bounces off the support areas are getting weaker and weaker.

From a bullish perspective I would really like to see those areas broken and run those stops that are sitting underneath those support areas.

It's what you want to see, capitulation from the bulls and a strong spike reversal.

Those areas simply stick out, I am sure a big player is eyeing up the same idea and run the markets lower to trigger a bunch of stops. That's what I would do as if I was the head of a prop firm or investment bank, so if I am thinking it, you can bet some big guns are looking at it.

If you have stops sitting at those areas, I think the odds favor they are likely going to get triggered. So if we get to see a strong reversal from a break of support, and run the stops and then a strong move back above, that's a strong bullish sign.

Oil

Many are looking for the low in Oil, but I still have outstanding targets at $75 that never got filled on the last move lower. If I am looking higher in the US$ and lower in Gold and Silver, then the odds favor Oil to break lower and we might finally see that $75 target hit.

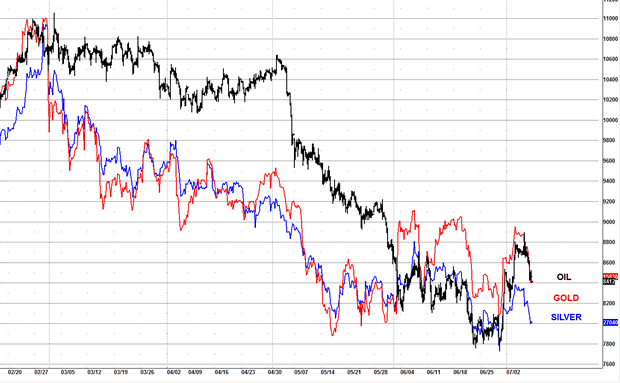

The wave counts in Gold, Silver and Oil all align well with the DX hitting my target at 84.20 although that is going to subject to final adjustments.

The chart is showing you that all 3 major commodities are in sync with the US$, so find the high in the US$ then you find the low in Oil, Gold and Silver.

It can be that easy, I assure you.

Come and join us if you want to actually have some clues as to what the markets are doing and not 2nd guess. If you are serious about trading, investing and making $$ you have come to the right place.

Elliott Wave used properly makes sense.

Until next time.

Have a profitable week ahead.

Click here to become a member

You can also follow us on twitter

What do we offer?

Short and long term analysis on US and European markets, various major FX pairs, commodities from Gold and silver to markets like natural gas.

Daily analysis on where I think the market is going with key support and resistance areas, we move and adjust as the market adjusts.

A chat room where members can discuss ideas with me or other members.

Members get to know who is moving the markets in the S&P pits*

*I have permission to post comments from the audio I hear from the S&P pits.

If you looking for quality analysis from someone that actually looks at multiple charts and works hard at providing members information to stay on the right side of the trends and making $$$, why not give the site a trial.

If any of the readers want to see this article in a PDF format.

Please send an e-mail to Enquires@wavepatterntraders.com

Please put in the header PDF, or make it known that you want to be added to the mailing list for any future articles.

Or if you have any questions about becoming a member, please use the email address above.

If you like what you see, or want to see more of my work, then please sign up for the 4 week trial.

This article is just a small portion of the markets I follow.

I cover many markets, from FX to US equities, right the way through to commodities.

If I have the data I am more than willing to offer requests to members.

Currently new members can sign up for a 4 week free trial to test drive the site, and see if my work can help in your trading and if it meets your requirements.

If you don't like what you see, then drop me an email within the 1st 4 weeks from when you join, and ask for a no questions refund.

You simply have nothing to lose.

By Jason Soni AKA Nouf

© 2012 Copyright Jason Soni AKA Nouf - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.