LIBOR Manipulation Leads To Questions Regarding Gold Manipulation

Commodities / Market Manipulation Jul 11, 2012 - 03:36 PM GMTBy: GoldCore

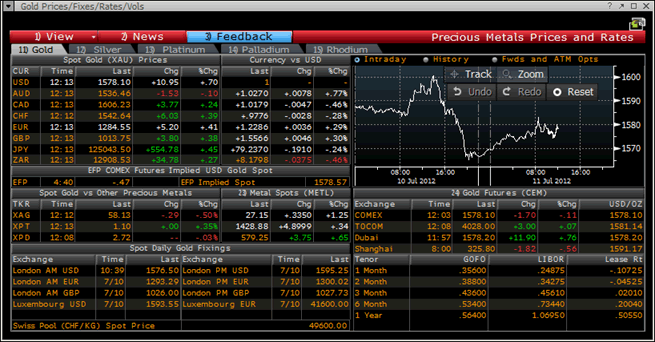

Today's AM fix was USD 1576.50, EUR 1284 and GBP 1012.91 per ounce.

Today's AM fix was USD 1576.50, EUR 1284 and GBP 1012.91 per ounce.

Yesterday’s AM fix was USD 1594.50, EUR 1293.29 and GBP 1026 per ounce.

Gold fell by $19.40 in New York yesterday and closed down 1.2% at $1,568.40/oz. Silver fell 1.8% or 50 cents to $26.84/oz.

Gold gradually ticked higher in Asian trading and has kept those gains and seen slight further gains in European trading.

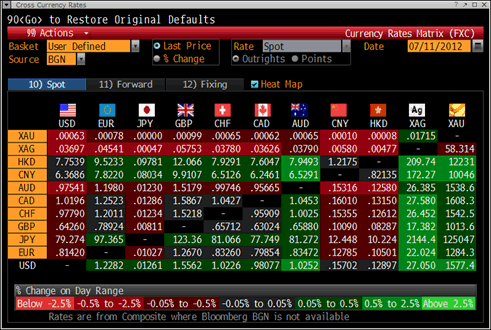

Cross Currency Table – (Bloomberg)

This latest price weakness is confusing many market participants and causing further jitters to some owners of gold.

Our conversations with people in the industry and our own experience makes us confident that this is another paper driven sell off drive primarily by speculative, leverage interests on the COMEX.

Bullion dealers and banks have not changed their long term outlook for gold and are ignoring the considerable “noise” of recent days suggesting that further falls are likely.

Further falls are indeed possible especially if those players with concentrated short positions continue to press their advantage and squeeze nervous hand longs.

However, the fundamentals remain very sound with broad based global demand coming from store of wealth buyers in European countries, in the Middle East and in Asia and particularly China.

There is also increasing demand from hedge funds (Soros, Einhorn etc) and institutions such as PIMCO and the Teacher Retirement System of Texas.

David Einhorn warned of inflation yesterday and was asked on CNBC “what we would do since it is going to be bad, how do we play that?”

Einhorn told CNBC that he “owns a lot of gold”.

Central banks are just one facet of this central bank demand and their demand remains very small when juxtaposed with the increase in global money supply in recent years and when compared to their foreign exchange reserves.

The notion that central bank demand is propping up the gold price is simplistic and misleading.

Similar theories were proposed in recent years – with some claiming when gold was at $1,000/oz that ETF demand or Indian demand was propping up the gold price.

Such analysis failed to appreciate the broad global based nature of demand for gold then and fails to appreciate the broad global based nature of demand today.

It also fails to appreciate that while gold demand has increased – it has increased from an extremely low base and remains tiny vis-à-vis the size of other capital (equities, bonds etc) and currency markets and remains infinitesimal vis-à-vis the multi trillion dollar derivative markets.

GoldCore like other bullion dealers internationally has seen a noted increase in demand for physical bullion coins and bars in recent days.

The ‘Liebor’ scandal is the latest scandal to befall Wall Street and City of London banks and official regulators and central banks. It is creating further mistrust of our already wounded financial and monetary system.

The Libor fixing scandal is amusing as everybody- all the talking heads and ‘experts’ are “shocked, shocked” to discover that this benchmark interest rate underlying trillions of dollars worth of financial transactions worldwide was being manipulated

This is despite more astute analysts such as Gillian Tett and others warning that rigging was taking place and LIBOR was a fiction as far back as in 2007.

A lack of transparency, a lack of enforcement of law and a compliant media which failed to ask the hard questions and do basic investigative journalism led to the price fixing continuing and the manipulation continuing unchecked on such a wide scale for so long - until it was exposed recently.

Similarly, the gold market has the appearance of a market that is a victim of “financial repression”.

Given the degree of risk in the world – it is arguable that gold prices should have surged in recent months and should be at much higher levels today.

The gold market has all the hallmarks of Libor manipulation but as usual all evidence is ignored until official sources acknowlege the truth.

However, like LIBOR the gold manipulation 'conspiracy theory' is likely to soon become conspiracy fact.

It will then – belatedly - become accepted wisdom among 'experts.' Experts who had never acknowledged it, failed to research and comment on it or had simply dismissed it as a “goldbug accusation.”

Financial repression means that most markets are manipulated today - especially bond and foreign exchange markets.

Many astute analysts are asking today (see Commentary) - why would the gold market be completely immune to such intervention and manipulation?

The last thing insolvent banks and governments want is a surging gold price.

Perverted and ‘unfree’ markets create profound risks financial systems and economies and for all investors and savers. They also present opportunities.

As ever, it is prudent to be on opposite side of official manipulation as ultimately the free market forces of supply and demand will always win out.

Smart money internationally remains short fiat currencies and long gold

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.