Gold Cycles Will Soon Forecast Where Prices Are Headed

Commodities / Gold and Silver 2012 Jul 12, 2012 - 05:09 AM GMTBy: Chris_Vermeulen

Gold and stock market forecaster have been using cycles in price that repeat every certain amount of trading days to help them spot key reversal areas in the financial market. Almost everything in life seems to go in cycles and commodity prices and the stock market are no different.

Gold and stock market forecaster have been using cycles in price that repeat every certain amount of trading days to help them spot key reversal areas in the financial market. Almost everything in life seems to go in cycles and commodity prices and the stock market are no different.

As we all know the market is very difficult to forecast when using only one set of analysis like cycles. Analyzing price action, volume, market sentiment, market breadth, trends and inter-market analysis are the other key areas which one must understand before they can be in the zone (ZEN) with the financial market and properly forecast future prices.

This report will show you just how well cycles work if applied and traded properly.

How to Buy Dips and Sell Rips in Gold Using Cycle Analysis

The chart below is of gold and shows its short term trading cycles. I will admit this chart is hard on the eyes and as ugly as they get to bear with me.

Three different cycles have been applied to the chart using a short, intermediate and long term cycle wave length. The general idea here is that you want to trade with the underlying trend, then use these short term cycles to profit from weekly price swings.

Gold has been in a down trend for a year so the focus should be on shorting the bounces. Focusing on selling short gold during a time with 2 or more cycles are topping as you stand a great chance of the price moving in your favor within 1-3 days.

Once the price starts to move in your favor you want to scalp to profits once the short term (green) cycle drops near a reversal level. Once this takes place I always tighten my stops to breakeven, lock in some profits and continue to wait for another cycle to reach the bottom at which point I take more profit off the table and tighten my protective stop once again.

As you can see this is not the perfect system but it makes money, and if you apply more analysis to the market you can lock in more of these moves using intraday charts, volume, and sentiment levels.

Gold Market Cycles

How to Find Market Cycles

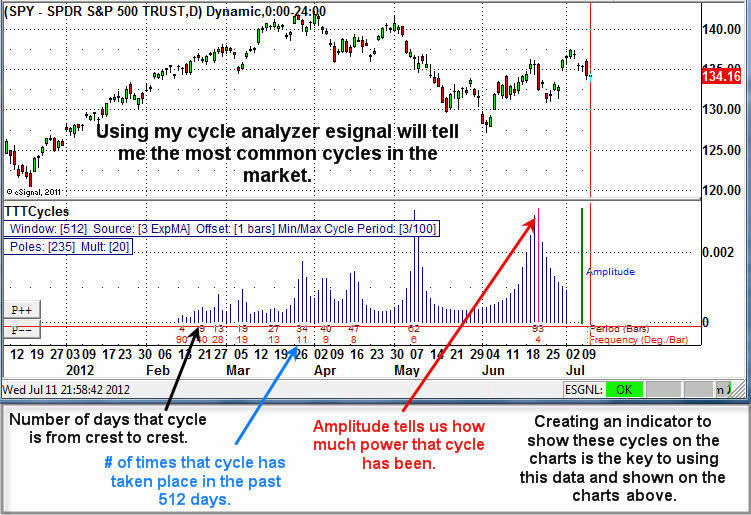

You must have an analysis tool that can read the market and find cycles within it. Once you know how many days the most frequent cycles are occurring you can then use a custom cycle indicator to overlay them on the charts as seen in the gold chart above. The visual overlay is the key to spotting market reversals and areas to add to a position or trim profits. Look at the chart below for a visual of how I find my cycles.

Market Forecast Cycles

Gold Cycle Forecast Conclusion:

In short, gold overall remains in a down trend. But from looking at the gold chart and its short term cycles I have a feeling we will be seeing price trade sideways this week and a bounce next week.

The next week will be very interesting as these cycles will actually give us an early warning if the overall gold market is about to bounce or sell off. The question is what the cycles do in the next few days while gold flirts with support…

If you would like to receive my free weekly analysis like this, be sure to opt-in to my list: http://www.thegoldandoilguy.com/free-preview.php

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.