The World's Safest Stocks On Track for Near 10 Percent Annual Earnings Growth

Companies / Water Sector Jul 13, 2012 - 02:50 AM GMTBy: Roger_Conrad

No natural resource is as vital to human life as water. But that doesn’t mean it’s always a profitable investment.

No natural resource is as vital to human life as water. But that doesn’t mean it’s always a profitable investment.

Time and again, water investors have been tripped up by myriad factors, from changing weather patterns to volatile politics. Growing populations and industry degrade watersheds, wetlands, rivers, lakes and other areas critical to safe drinking water supplies.

Then there’s the impact on water from drilling for oil and gas in shale--hydraulic fracturing--and steady degradation of water system infrastructure.

Under the Obama administration the Environmental Protection Agency has systematically tightened regulations for a range of chemicals found in water supplies. And given potential public health consequences that policy won’t change in 2013 no matter who is president.

The upshot is that water utility stocks face ever-higher costs for water treatment and processing.

Energy costs too are an increasing challenge. Black & Veatch’s 2012 survey of large and small, municipally and privately owned water and wastewater providers throughout the US found 30 percent of water costs are energy related. And this share is on the rise.

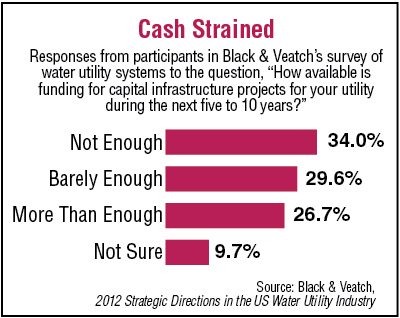

Meanwhile, 34 percent of the Black & Veatch survey respondents projected their funding would be inadequate to meet system needs for the next five years. Another 29.6 percent warned they’d have barely enough financing. That’s in part because rate increases are unpopular.

But municipalities still run systems that provide 80 percent of US water, and most are strapped for cash.

Risks investing in water are even greater outside the US. The British Virgin Islands basically nationalized Consolidated Water Co Ltd’s (NSDQ: CWCO) investment on Tortola. Regulators in the UK triggered industry-wide dividend cuts in 2009 by slashing allowed returns.

And collecting on water treatment and infrastructure contracts has become increasingly problematic in many countries, as governments have struggled for funds.

So where are the opportunities in water now?

Select investor-owned regulated water utilities in the US offer generous, growing and recession-proof yields by executing invest-to-grow strategies.

Niche technology companies focused on treatment and metering still have a solid industry-related market. And a handful of non-US regulated utilities are positioned to produce strong returns the next few years.

In the words of one industry executive, investor-owned US water utilities are somewhat like collector cars: There was never that many in the first place, as they only serve 10 percent of the US population. And their ranks continue to diminish from mergers as well as government takeovers.

On Jan. 26, 2012, for example, the City of Nashua, New Hampshire, bought out Pennichuck Corp at a hefty premium, capping a nearly decade-long takeover battle.

Scarcity alone has built a premium into these stocks relative to other utilities. But the real appeal is a recession-proof business model coupled with a still massive and low-risk growth opportunity: absorbing smaller private and municipal-owned systems in the US that can’t meet the rising cost of running water systems.

American Water Works Co Inc (NYSE: AWK) and Aqua America Inc (NYSE: WTR) are the best equipped to capitalize on this opportunity.

Aqua CEO Nick DeBenedictis expects his company will make 15 to 20 acquisitions this year, while American has added new systems as well as management contracts for entities that still want to own their water. The pair has also swapped systems in several states, increasing scale for operating efficiencies as well as reach for more growth.

Coupled with a steady stream of system investment and rate increases to pay for it, both companies appear on track for near 10 percent annual earnings growth and upper-single-digit annual dividend growth, and both companies are on my list of top dividend investments.

Neither has significant exposure to volatile credit markets, and both largely own their water supplies. Even regulatory risk is controlled by geographic diversification.

Mr. Conrad has a Bachelor of Arts degree from Emory University, a Master's of International Management degree from the American Graduate School of International Management (Thunderbird), and is the author of numerous books on the subject of investing in essential services, including Power Hungry: Strategic Investing in Telecommunications, Utilities and Other Essential Services

© 2012 Copyright Roger Conrad - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.