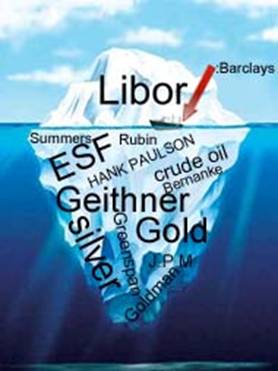

Libor Interest Rate Rigging: The Tip of the Market Manipulation Iceberg

Interest-Rates / Market Manipulation Jul 13, 2012 - 05:38 AM GMTBy: Rob_Kirby

GATA was born in the late 1990’s - primarily on the back of fundamental research by Frank Veneroso regarding Central Bank Gold Leasing. Veneroso’s intellectual curiosity was aroused after being fed detailed data re: gold leasing by the Bank of England’s Terry Smeeton.

GATA was born in the late 1990’s - primarily on the back of fundamental research by Frank Veneroso regarding Central Bank Gold Leasing. Veneroso’s intellectual curiosity was aroused after being fed detailed data re: gold leasing by the Bank of England’s Terry Smeeton.

The fact that gold prices and interest rates were so highly “inter-related” was first publicized in the alternative media by Reg Howe in 2001. Howe alerted the world to academic accounts of the special relationship between gold and interest rates. He highlighted the body of economic law and observation associated with “Gibson's Paradox” – something Lawrence Summers [later, U.S. Treasury Secretary and current senior economic advisor to Obama] wrote about with Robert Barsky while he was a professor at Harvard in the 1980’s.

The fact that gold prices and interest rates were so highly “inter-related” was first publicized in the alternative media by Reg Howe in 2001. Howe alerted the world to academic accounts of the special relationship between gold and interest rates. He highlighted the body of economic law and observation associated with “Gibson's Paradox” – something Lawrence Summers [later, U.S. Treasury Secretary and current senior economic advisor to Obama] wrote about with Robert Barsky while he was a professor at Harvard in the 1980’s.

The upshot of this Gibson’s Paradox economic theory goes something like this: real interest rates and the gold price are causal and inter-related with each other.

This is why Professor Lawrence Summers was summoned to Washington as assistant Secretary of Treasury under Robert Rubin [Clinton Admin. / 1993]. It was to implement HIS THEORETICAL WORK under the auspices of Treasury Secretary Robert Rubin’s mythical “Strong Dollar Policy”.

Conclusion: since 1994, the mythical Strong Dollar Policy had necessitated a two prong strategy: that of keeping rates low because weak currencies are typified by high interest rates; and the price of gold must be suppressed as it stands as an historical alternative settlement currency – and they don’t want the alternative to appear “strong”.

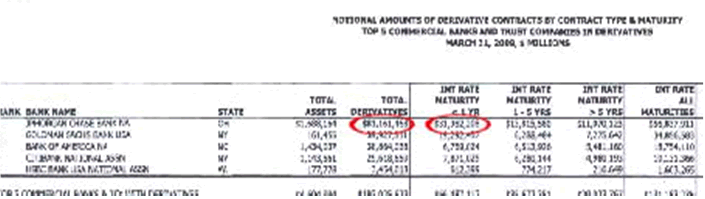

The interrelatedness of the gold price and interest rates helps to explain why – According to the Office of the Comptroller of the Currency - of the 302 Trillion in aggregate derivatives held by American Bank Holding Cos – 81 % of this is composed of interest rate products. This is due to the symbiosis that exists between gold and interest rates.

Libor – or the London Inter-Bank Offered Rate - is one of the lynch pins in setting [rigging] global U.S. Dollar interest rates. This is why a larger discussion needs to be had about the Libor rigging – it is not a London or Barclay’s centric story. It has EVERYTHING to do with making the American Dollar look viable as the world’s reserve currency.

When The Libor Story First Broke

It was Q3 2007 – post [Mar. 2007] Bear Stearns collapse – when credit markets “seized up” in response to the [Aug. 2007] sub-prime crisis, where triple-A-rated mortgaged bonded failed – stories first began circulating the mainstream financial press that “Libor” was “broken”.

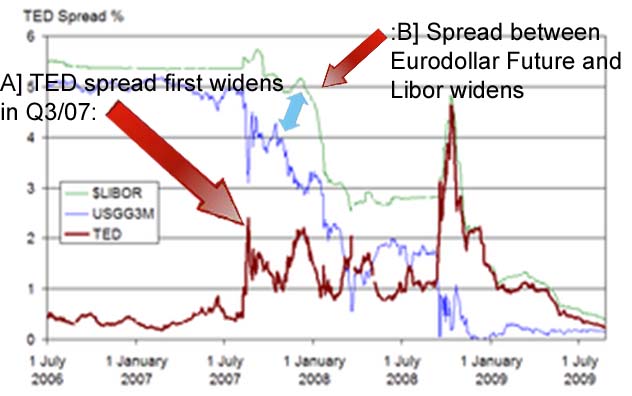

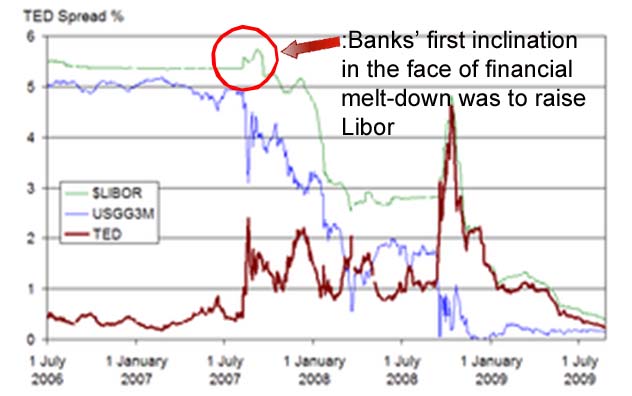

The “tell-tale” that things were not right was A] the widening of the TED Spread [3 month Eurodollar future vs. 3 month U.S. T-Bill] – expressed in basis points, and B] the growing spread between Libor and the Eurodollar future – again, expressed in basis points:

Historically, a widening TED Spread has been referred to in credit terms as a “flight to quality”. It demonstrates how investors are more willing to buy sovereign 3 month government T-bills at ever decreasing yield relative to higher yielding products that do not carry sovereign guarantees. It is reasoned in cases like this that return of capital becomes more important to investors than return on capital.

But there are some problems with this conventional thinking.

With the U.S. Dollar Index collapsing, taking out major support levels and the dollar being abandoned – there was no “flight to quality”.

So what was really happening???

We get our clue from the widening disparity [in basis points] between the 3 month Eurodollar Futures contract and 3 month Libor. These two measures are proxies for one another and typically they trade virtually tic-for-tic with each other in terms of yield. Notice how the spread widened at the beginning of Q3/07 and then contracted at the conclusion of Q4/07:

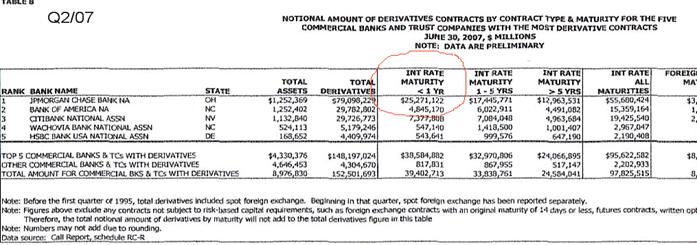

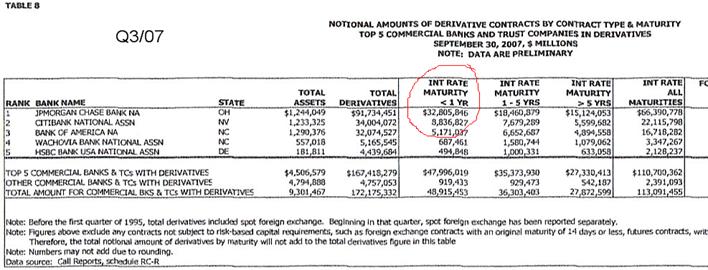

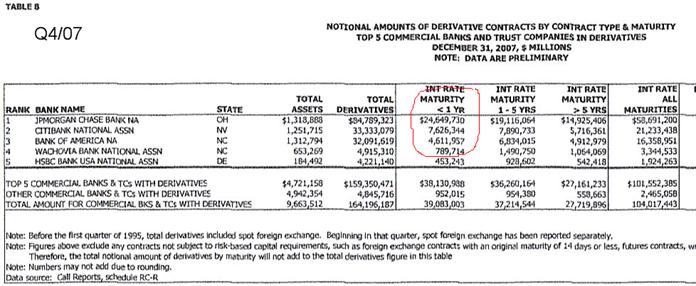

The aberration first manifested itself as a Q3/07 trading phenomena. We get a clue as to what the underlying is when we examine the composition of J.P. Morgan’s derivatives book from a control period – Q2/07 – through to Q4/07:

Here we see the less than 1 year Swap component of Morgan’s book grow from 25.2 Trillion in Q2/07 to 32.8 Trillion in Q3/07 before reverting back to 24.7 Trillion in Q4/07. The 7.5 Trillion “bloat” in Morgan’s book – coupled with the plunge in rates and failing U.S. Dollar Index - in Q3/07 tells us the J.P. Morgan was a MASSIVE PLAYER in the very “short end” of the curve [centered on 3 month credit space]. We can discern that Morgan was an ENORMOUS purchaser of 3 month U.S. T-bills [likely as hedges for trades being conducted with the ESF brokered through the N.Y. Fed trading desk] – this is what caused the “blow-out” in the TED Spread as well as the Eurodollar Future/Libor spread and put the brakes on a major break down of the U.S. Dollar Index. Their book “re-coiled” 3 months later when these positions matured.

At the onset, commercial Banks – fearing a financial market meltdown – immediately became extremely risk averse and actually started to raise rates:

But the “Free Markets” were overwhelmed by J.P. Morgan’s rate rigging / defense of the dollar.

Ladies and gentlemen, 7.5 Trillion dollar interventions into the 3 month credit markets are not and never will be the work of Commercial Banks or Bank Holding Companies. Interventions of this kind are EXCLUSIVELY the work of National Treasuries / Central Banks.

The late 2007 dichotomy between Libor [Eurodollar Futures] and 3 month U.S. T-bills was brought on – not because Libor was “broken” – but by the U.S. Treasury’s Exchange Stabilization Fund [ESF] pursuing/inflicting Imperialist U.S. monetary policy – brokered through the N.Y. Federal Reserve - on the world through the trading desk of J.P. Morgan Chase.

Moving Forward to the Barclays Libor Rigging Scandal

Much of the recent guffaw about Libor fixing has centered on London based, Barclays Bank Plc. The gist of the allegations against Barclays being – in the aftermath of Lehman Bros. collapse in the fall of 2008 – Barclays consistently posted higher Libor rates than competing banks who are also polled daily by the British Bankers Association [BBA] for their Libor rates. It has been said by some, like Zerohedge, that Barclays was attempting to influence [rig] rates higher than they otherwise should have been:

Source: Zerohedge

Perhaps it is true that Barclays began setting their “Libor” rates higher in the aftermath of Lehman’s collapse – but that’s not the whole story – not by a long shot.

If you look closely at the Zerohedge chart above – you will notice that Barclays actually began posting higher Libor rates “BEFORE” the collapse at Lehman.

Reason: Barclays was the last bank to see the books of Lehman as they were at one point – in the late stages of the 2008 financial crisis - figured to be a likely acquirer of Lehman. When Barclays saw the state of Lehman’s books – they acted intuitively CORRECT – one might argue – and began raising rates, not wanting to lend, to preserve their capital.

Additionally, in the wake of the failed Barclays/Lehman arranged marriage – there was a “small issue” with a $138 Billion Post-Bankruptcy JP Morgan Advance to Lehman; At Least $87 B Repaid by Fed:

“Lehman Brothers Holdings Inc., the securities firm that filed the biggest bankruptcy in history yesterday, was advanced $138 billion this week by JPMorgan Chase & Co. to settle Lehman trades and keep financial markets stable, according to a court filing.

One advance of $87 billion was made on Sept. 15 after the pre-dawn filing, and another of $51 billion was made the following day, according to a bankruptcy court documents posted today. Both were made to settle securities transactions with customers of Lehman and its clearance parties, the filings said.

The advances were necessary “to avoid a disruption of the financial markets,” Lehman said in the filing.

The first advance was repaid by the Federal Reserve Bank of New York, Lehman said. The bank didn’t say if the second amount was repaid. Both advances were “guaranteed by Lehman” through collateral of the firm’s holding company, the filing said. The advances were made at the request of Lehman and the Federal Reserve, according to the filing.

Lehman disclosed the advances in a motion seeking court permission to give JPMorgan’s claims special status in its attempts to recover any advances. Lehman said that if that status isn’t granted, JPMorgan may not be able to make future advances needed to clear and settle trades.

“The granting of the relief requested is in the best interests of the estate and its stakeholders and the public markets,” Lehman said, adding the advances would be “essential to Lehman’s customers.”

JPMorgan may make future advances at its sole discretion, all of which would be guaranteed by Lehman under its agreement to pledge collateral, Lehman said.

JPMorgan said in a statement in court documents that it has had a clearing agreement with Lehman since June 2000, and had pledged its collateral under an Aug. 26 guarantee.”

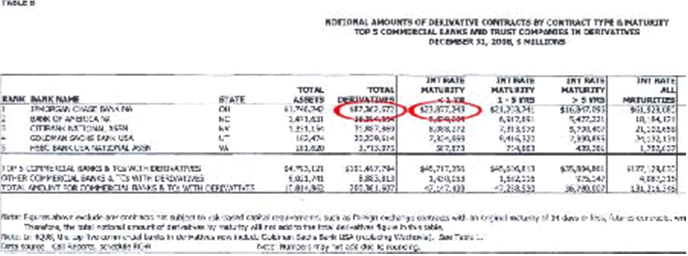

While no in-depth reason has ever been offered to explain the “advance” outlined above, a degree in rocket science is not needed to figure out what trades were being done to “keep markets stable [err, rigged]”. From the looks of J.P. Morgan’s derivatives book over the 2 quarters Q4/08 through Q1/09 we see ANOTHER 8 TRILLION dipsy-doodle in the less than 1 year swap constituent of J.P. Morgan’s derivatives book – this time in Q1/09, post Lehman collapse – where the inflated J.P. Morgan short term swap positions have since remained elevated. It should be noted that the less than 1 yr. swaps component of J.P. Morgue grew from 23.9 Trillion to 32.0 Trillion [Q4/08-Q1/09] while their overall book contracted from 87.4 Trillion to 81.2 Trillion in the same time period:

source: Office of the Comptroller of the Currency table 8

source: Office of the Comptroller of the Currency table 8

So, while Lehman was in the death-throws of collapsing – after Barclays couldn’t be induced to touch them with a “barge pole” - J.P. Morgan “advanced” 138 billion [collateral perhaps?] to Lehman so they could “perform/settle trades” –– mostly, if not all reimbursed/paid for by the Fed. While this “stabilizing trade” was being instituted – short term rates simultaneously careened down to zero from 200 basis points [2 %]. Then, in the immediate aftermath of the collapse – J.P. Morgan’s less than 1 yr. component of their swap book grows by 8 Trillion in one quarter while their overall book was contracting by more than 6 Trillion in notional???

I hope I haven’t lost anyone here because these facts are MUCH STRANGER AND HARDER TO BELIEVE THAN FICTION.

What appears to have happened here: J.P. Morgan did not want to be identifiable as the originator of 8 Trillion worth of less than 1 yr. Swap instruments – so they pre-funded Lehman to strap these positions on - positions they KNEW IN ADVANCE they would inherit once Lehman’s collapse was official. This way – no more unwanted attention would be drawn to J.P. Morgan [the Fed / U.S. Treasury in drag].

Barclays clearly knew how bad the whole situation was – being the last ones to see the horror that was Lehman’s books - and were likely the only counterparty in the proceedings who acted in an informed, financially responsible manner.

By Rob Kirby

http://www.kirbyanalytics.com/

Rob Kirby is proprietor of Kirbyanalytics.com and sales agent for Bullion Custodial Services. Subscribers to the Kirbyanalytics newsletter can look forward to a weekend publication analyzing many recent global geo-political events and more. Subscribe to Kirbyanalytics news letter here. Buy physical gold, silver or platinum bullion here.

Copyright © 2012 Rob Kirby - All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Rob Kirby Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.