Euro-zone Economic Crisis Black Swan or Hidden Lion?

Economics / Eurozone Debt Crisis Jul 23, 2012 - 06:22 AM GMTBy: John_Mauldin

"In the economic sphere an act, a habit, an institution, a law produces not only one effect, but a series of effects. Of these effects, the first alone is immediate; it appears simultaneously with its cause; it is seen. The other effects emerge only subsequently; they are not seen; we are fortunate if we foresee them.

"In the economic sphere an act, a habit, an institution, a law produces not only one effect, but a series of effects. Of these effects, the first alone is immediate; it appears simultaneously with its cause; it is seen. The other effects emerge only subsequently; they are not seen; we are fortunate if we foresee them.

"There is only one difference between a bad economist and a good one: the bad economist confines himself to the visible effect; the good economist takes into account both the effect that can be seen and those effects that must be foreseen.

"Yet this difference is tremendous; for it almost always happens that when the immediate consequence is favorable, the later consequences are disastrous, and vice versa. Whence it follows that the bad economist pursues a small present good that will be followed by a great evil to come, while the good economist pursues a great good to come, at the risk of a small present evil."

- From an essay by Frédéric Bastiat in 1850, "That Which Is Seen and That Which Is Unseen"

I have been captivated by the concept of the seen and the unseen in economics since I was first introduced to the idea. It is a seminal part of my understanding of economics, at least the small part I do grasp. The idea was first written about by Frédéric Bastiat, who was a French classical liberal theorist, political economist, and member of the French assembly. He was notable for developing the important economic concept of opportunity cost. He was a strong influence on von Mises, Murray Rothbard, Henry Hazlitt, and even my friend Ron Paul. He was a strong proponent of limited government and free trade, but he also advocated that subsidies (read, stimulus?) should be available for those in need, "... for urgent cases, the State should set aside some resources to assist certain unfortunate people, to help them adjust to changing conditions."

Today we'll explore a few things we can see and then try to foresee a few things that are not so obvious. This is a condensation of a speech I gave earlier this afternoon in Singapore for OCBC Bank, called "The Lion in the Grass." The simple premise is that it is not the lions we can see that are the problem; but rather, in trying to avoid them, it is often the lions hidden in the grass that we stumble upon that become the unwelcome surprise.

When I was discussing this concept with Rob Arnott (of Research Affiliates and the creator of Fundamental Indexes) in Tuscany a few weeks ago, he mentioned the following photo, which he took on the savannah in Tanzania a few years ago. I think it is a perfect way to start out our discussion of the Lions in the Grass. In today's letter I will briefly mention a few "lions" we might not be seeing, and perhaps in later letters we can go into more depth, if you like. (I should note that this letter will print longer as there are lots of charts and pictures.) So, here's Rob's photo:

And before we plunge into the tall grass, let me note that I have written a Special Report on a new mutual fund that focuses on managed futures, but with a significant twist. As it happens, that twist is something I have been suggesting for over 15 years. My friends and partners have put this fund together as a regular 40 Act mutual fund, so it is available to all US investors and not just accredited investors. That also means I do not have to limit the distribution. All you have to do to get a copy is fill out a very simple form at http://www.altegris.com/Landing-Pages/Mauldin-EVO.

For those of you who are looking for a way to diversify and would like to have managed futures in your portfolio, but want the ease and liquidity of a mutual fund, I am very pleased that this option is available. I have been a proponent of managed futures for a long time, for a number of reasons (including diversification), and I think this is something you should investigate. (In this regards, I am president of and a registered representative of Millennium Wave Securities, LLC, member FINRA.) And now, into the grass.

The Lion in the Grass

Let's go back and look at Bastiat's first sentence:

"In the economic sphere an act, a habit, an institution, a law produces not only one effect, but a series of effects. Of these effects, the first alone is immediate; it appears simultaneously with its cause; it is seen. The other effects emerge only subsequently; they are not seen; we are fortunate if we foresee them."

I really can't remember when I first began to ponder the concept of the Lion in the Grass, although I have never used it in a letter. But during my Tuscany escape I thought about it a great deal, and I think it is a very useful analogy for today's world, and in the light of Bastiat's insight some 162 years ago.

It is natural to the human condition to focus on the apparent dangers in front of us. That is part of our evolutionary heritage from the time when humans were first dodging lions and chasing antelopes on the very African savannah in Rob's picture. But we soon learned that if we were to survive it was not enough to walk away from and around the lions we could see. We also had to make sure we didn't walk into a lion hidden in the grass. It is the hidden lions that can spring on us suddenly and take an arm or a leg.

Below, I have once again reproduced Rob's picture. I even knew there was a hidden lion and could not find it. But after it was pointed out to me, it is now the first thing I see. And there is a direct analogy there, to both economics and investing.

So, before you look on the next page I suggest you go back and look one more time to see if you can spot it. Just for fun.

I showed this to a friend who is a hunter, and he spotted it almost immediately. But then he has taught himself over the years to look for the hidden game. And as Bastiat noted, it is the skilled economist who looks for the effects that are hidden, the surprises that are unseen. It should be a habit to look at the potential second- and third-order consequences of what we can see happening before our eyes. That way, we not only avoid the lurking lions, we also turn what would hunt us and do us harm into the hunted. Sometimes, the dangers themselves can be turned into a very nice trophy indeed, if you can see and respond in time.

But as I noted, that hidden lion is now the first thing I see. And that is the way with economic lions in the grass. Once someone points one out, it's obvious. So obvious, that we soon convince ourselves that we would have seen the lion without help. How many people told you they "knew" all along that subprime debt was going to end in tears, or that the housing market was a bubble? Or that we would be plunged into the Great Recession?

I remember, in the fall of 2006 I was beginning to talk about the probability of a recession, in this letter, in speeches, and in numerous media interviews. (There is one such episode still up on YouTube.) I was told I was ignoring what the market was telling us, and indeed the market proceeded to go up for another six months. Being early is lonely. Me and Nouriel. ;-)

Today there are a lot of people who tell us they knew there was a recession coming, all along. In fact, the farther we get from 2006, the greater the number of people who remember making that call. It now seems I had no reason to feel so lonely out there on that limb. In retrospect, it seems the limb was rather crowded.

So, with that in mind, let me show you where the other lion is. Then go back and look at the first picture. After a few times you will see the hidden lion almost before you see the two more visible ones. (I just showed it to the stewardess on the plane from Singapore. She spotted it immediately. Oh well.)

Black Swan or Hidden Lion?

I should note that a Lion in the Grass is different from a Black Swan. A Black Swan is a random event, something that takes us all by surprise. Economic Black Swans are actually quite rare. 9/11 and the aftermath was a true Black Swan. Other than Nostradamus some 500 years ago, who saw it coming?

The last recession and the credit crisis were not true Black Swans. There were those who saw it all coming, but few paid attention. They were dancing right along with Chuck Prince to the rousing music of a bull market and swelling profits.

As we know now, a lot of people saw the subprime crisis coming and a few made huge fortunes. Sadly, it generally required one to risk a small fortune to play in that game. But it's different with hidden lions. If you can spot one, and figure out how to stalk it, there can be large profits betting on that which is unseen by the markets.

So, now let's quickly look at a few lions we can see and then try to spot a few that are hidden close by.

The Lions of Europe

Everyone now knows that there are lions roaming all over Europe. When I (and a fast-swelling group of other observers) started writing about Greece, we were at first told that developed countries simply could not default in the modern era. Indeed, European banking regulators had allowed (implicitly encouraged?) European banks to buy peripheral-country bonds and required them to post no reserves against those bonds. It was "free money" to the banks. You could pay a few points on deposits and then leverage them up to 40 times, getting up to 3-4% carry, depending on how far out the yield curve you wanted to go. 100% risk-free returns on your capital. Who wouldn't go for that? And it had to be risk-free, because the regulators said so.

And when Endgame came out in the spring of 2011, we got a lot of pushback for saying that Spain would get in serious trouble and have to "restructure" its debt. How could that be? By that time one had to admit that it was possible Greece might have problems. But Spain? We were told that Spain was a "real country." Real countries did not default. (Forget that Greece, only a few years earlier, had been considered real enough to be admitted to the eurozone.) Spain was different.

I totally guarantee you that Spanish Prime Minister Rajoy will give you a 100% dead-certain guarantee that Spain will never default. Right up until the time it does. Just like he said that Spanish banks were fine and needed no help from Europe, only a week before they asked for help.

(You have to feel sorry for the guy. He is sincere, but he is doggedly riding a very ailing horse as he tilts at the debt windmill. Cue the song "To Dream the Impossible Dream." The line "To fight the unbeatable foe" comes to mind. There is just too much Spanish debt, and the requirement to keep cutting the deficit will just make that hole deeper and the foe even more fearsome when the final battle lines are drawn.)

We can all see the lions, large and small, of Greece, Portugal, Ireland, Spain, Italy, and now Cypress and Malta. The fear of contagion is what keeps European leaders up at night, trying to figure out how to keep Spain afloat. Because if Spain sinks, the focus immediately turns to Italy.

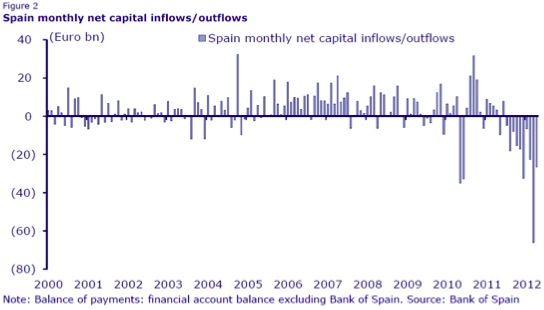

The woes of Greece, Spain, et al. have been chronicled in this letter and indeed almost everywhere. So let's just look at one chart and then move on. This is from my friend Chris Wood, writing in GREED and fear. Notice how much capital is leaving Spain each month. The outflows are now massive.

Chris writes rather pointedly:

"The above suggests that conditions are continuing to deteriorate in Spain which is a further reminder that this is the country most likely to trigger more Eurozone tremors in the short term. The same message is given by the Spanish 10-year bond yield which is back above 7%. Meanwhile, a glance at the Bank of Spain's official statistics shows a record €122bn of capital outflow in the first four months of this year, which is another sign of growing macroeconomic stresses. Clearly, a macroeconomic adjustment is now well under way with Prime Minister Mariano Rajoy announcing further tax hikes last week. Thus, Rajoy announced on 11 July new austerity measures totalling €65bn, including raising the sales tax from 18% to 21%. And, clearly, if Spain is willing to take its medicine in the context of a fixed exchange rate system it can make the necessary adjustment, just like Hong Kong post 1997 or the Baltic states of Latvia and Estonia in recent years. But the question is, of course, whether the society and the politics can take the strain. GREED & fear has severe doubts. The proposal to write off retail investors' holdings of Spanish banks' subordinated debt remains politically explosive not to mention the Bankia IPO, which in terms of sheer cynicism was more egregious in GREED & fear's view than any of the scandals exposed by the US housing crisis."

But enough of the lions we can see. Don't look now, but the lion that lies hidden in the grass is France. Yes, the France that is supposedly a big part of the solution to eurozone woes and Germany's stalwart partner in guaranteeing all that debt. AAA France. Rated that way by the same people who turned the nuclear waste of subprime CDO squareds, composed 100% of the worst sort of BBB junk, into gold.

Now, the rating agencies are using the same alchemical Philosopher's Stone to transmute French debt into ... fool's gold.

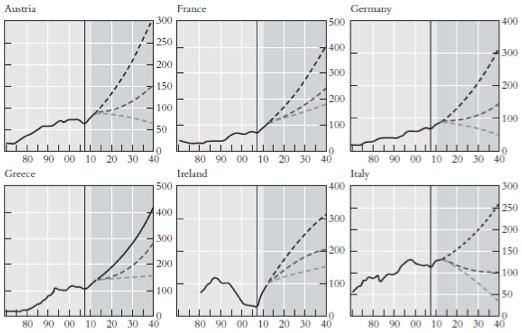

France deserves (and will soon get) its own full letter. But while you are waiting, let me highlight a few thoughts. First, let's look at this chart from the IMF, examining the debt prospects of six countries (The entire study was of 18 countries.) The dotted lines are three paths that the debt-to-GDP ratio can follow. The top line is the trajectory without any actions by the individual governments. The middle dotted line is what the debt trajectory would look like with mild reforms to entitlements, and the bottom line is the debt trajectory if very draconian measures are taken. See if you can spot the hidden lion by guessing which country's debt situation looks most like France's.

Yes, the country most like France is Greece. Yes, THAT Greece. The one that just defaulted. The one that everyone agrees is dysfunctional. Also notice that if Greece were to follow the suggested draconian path, it could stabilize its debt. And then notice that if France were to make the same level of draconian cuts, its debt-to-GDP ratio would merely rise to almost 200% within 25 years. Oops.

So, what has been the response of the new French government? It has decided to double down on what was already an irresponsible path. Do you think the average German understands just how bad off their "partner" is? For that matter, do you think the average French politician understands how bad off France is? Certainly not the majority of them, and it is doubtful that their counterparts in Germany do, either. This is going to be a train wreck of truely biblical proportions. Think 12 plagues, not the run of the mill 10.

Hollande evidently has very good political instincts and knows how to work the system. Unfortunately, he has the economic understanding that God gave a goose. Someone should sit him down and make him read all of Bastiat's essays. (It might just be too much to ask a French Socialist politician to read an English or Austrian economist who actually understood how things work.)

Let's look at what Hollande has done in his first month. He lowered the retirement age from the 62 that Sarkozy was barely able to get it up to, back to the ripe old age of 60. He has raised the taxes on those making over €1 million to 75%. He is raising the wealth tax on those whose have a net worth of over €4 million to double what they were expecting. This is called the contribution exceptionnelle sur la fortune. No translation is needed. You think a few people might decide to move to Spain? Or Switzerland? Capital will go to where it is loved and wanted. And those with a little wealth cannot be feeling a lot of love, if they are in France.

Note that the contribution exceptionnelle is on net worth, not on income. But the politicians promise it is just for the current emergency. It can go back down when the crisis is over. Except that France is getting ready to enter a permanent crisis. Can you see which direction this is heading? Can you see which direction the wealthier French citizen is headed? You can get a reservation in a good French bistro these days if you live in London. Just saying...

The newly appointed, radical, and Orwellian-named Minister of Productive Recovery is calling every company that plans to reduce its payroll to avoid losses and telling it that it must negotiate with labor and figure out how to keep losing money. The unions are in the streets. Oh, and large corporations will also have to pay more taxes. And don't even think about moving "French jobs" out of the country.

They raised the minimum wage. Can you find one serious study that suggests that is a way to increase the number of workers?

The list goes on. This flies in the face of the IMF study (and many others) that shows France is at the edge of a fiscal cliff with its entitlement programs. And taxes already consume 50% of GDP. Deficits are high and rising, and raising taxes even more will not result in actually collecting more taxes. Ask England how much they got when the passed a tax surcharge on the wealthy: tax revenues from the rich went down. An increase of only a few percent, and at some point the rich vote with their feet. Ask Maryland.

Germany has almost got its head around the fact that it will have to bail out Spain. Does anyone think German voters will go along with bailing out the French? What happens when the markets realize that France is essentially bankrupt and cannot print its own currency? And that all the policies that this new government wants to enact will only make things worse? And that Hollande will be in power for at least four years?

It won't be this year or even in 2013 (I think), but within a few years we will be writing about France in the same way we are writing about Greece and Spain, et al., today. And French banks are massively larger than French GDP (some four times, or so I seem to recall). France cannot backstop its banks any more than Spain can.

Andy Xie, the irascible Chinese economist who was on the program with me in Singapore, said that when Germany signed the Maastricht Treaty, they thought the rest of Europe would become like Germany. They did not realize that the only solution is for the Germans to become more like the French. (If that happens, I wonder if you will be able to find a good German restaurant in London.)

We will explore this idea in future letters, but I would suggest that if France becomes an economic problem on the order of Spain, it will be very disruptive. Bailing out France may be a bridge too far, even for a stolid europhile like Merkel. Let's quickly move on.

What If the US Trade Balance Became a Surplus?

We can all see that shale oil is a growing business. US oil production is rising, even as consumption is dropping due to more efficient use of oil. You can easily find projections that within 10 years the US could be energy-independent. And if we get some policies that allow more wells to be drilled (which could create another 1 million jobs) it could happen even sooner!

That will narrow the trade deficit but not eliminate it. But...

What if we find a way to take our huge natural gas supply and send it abroad? Natural gas is about $2 today. There are supposedly 10,000 wells that have been capped and very few new wells are being drilled. Natural gas is just too cheap in the US. But it was recently $17 in Japan, and almost that in Europe. Even I can see an arbitrage there. There is certainly enough global demand to allow the US to sell enough natural gas to further reduce or even eliminate the trade deficit (again, depending on the national policies we set).

That is the lion we can see. But what happens if we stop sending our "surplus" dollars into the world? A growing world will need more dollars to finance global trade. And to buy our exports. The lion that is hidden is that the dollar would become seriously strong. Today, everyone and his uncle is predicting the demise of the dollar (along with other fiat currencies). But what if we actually got our deficit act together and combined that with a real energy policy? That sounds rather Pollyannaish today, but it is totally within the realm of possibility.

A strong dollar has all sorts of positive effects if it is accompanied by a trade surplus and a balanced budget. Can you imagine a world where the dollar is the reserve currency because it deserves to be, rather than by default because no other currency can step up to the plate?

But then that creates all sorts of problems when you combine it with the next Lion in the Grass.

The Bug that Roared

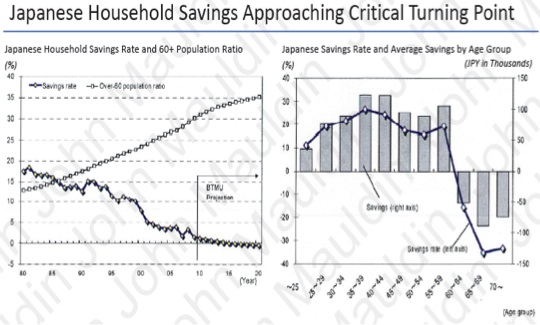

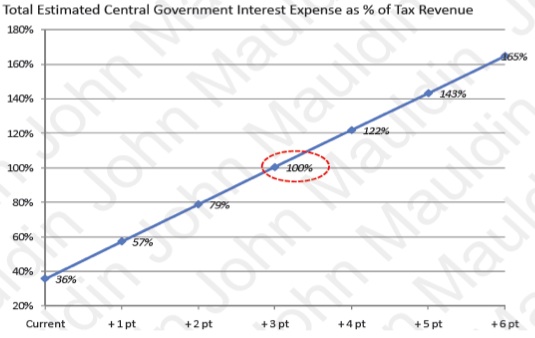

It has been said that you can't consider yourself a real global macro trader until you have lost money shorting Japanese bonds. Japan is a bug in search of a windshield – but it keeps dodging. Japan has a debt-to-GDP ratio that is approaching 230% (at a rate of increase of 8-10% a year!). The savings rate (see chart below, courtesy of Kyle Bass and team at Hayman Advisors) is declining rapidly and will soon go negative. At that point, the thought is, Japan will need to seek out foreign investors to buy its bonds. And who will buy a Japanese bond at 1% for ten years? If rates rise only 2%, then Japan would be spending almost 80% of tax revenues on just the interest on its bonds. I would submit that that is not a workable business model.

So traders keep shorting Japanese bonds (JGBs). And they keep losing money. But what if Japanese rates never rose? How could that be, you ask?

Given that Japan will collapse if interest rates rise, I would suggest that interest rates will not be allowed to rise. The Bank of Japan will fire up the printing press for their own version of Operation Twist, but on a scale that will make the other central bankers of the world jealous.

So then Japanese bonds don't revalue (on an internal basis). But the consequence is that the Japanese yen goes seriously south. Can you say 125 to the dollar? 150? 200? Do I hear 250?

At what point will you be able to buy a Lexus cheaper than you can buy a Kia? Think that will make Korea happy? Or any of Japan's Asian neighbors? Think the Japanese care? They will continue to churn out quality products made with robots that will compete very favorably with those of any industrial country. Japanese equities will soar in such an environment (in terms of a depreciating yen), which makes buying cutting-edge Japanese stocks and shorting the yen an interesting trade.

But that is the lion we can see. The lion we are missing is that this triggers a massive currency war, far more significant and costly than anything we have seen in our lifetimes. But that is a story for another day. For now, it is time to close.

Up in the Clouds, or How Do I Stay Connected?

I am asked all the time how I stay connected in all of my travels. I really am connected almost all the time from everywhere, as of late, which is a real productivity boost. Since I am here in Singapore, I thought I would just take a second to give you some details on our newest foray to upgrade my connectivity.

First, by now everyone has heard about cloud computing. I looked at if a few years ago, and it was still too new and expensive for a small company like mine. However, that has changed. We met a young man in Italy last summer (a friend of a business associate) who is with a firm called A3 that helps government organizations and businesses move their computing to the cloud. And what we found out is that we could upgrade everything we do for about the same as I was paying, but get far more service and security.

Our entire team of about seven people has "migrated" to the cloud. That means no more servers in my office and the support they need. All our data is now accessed from the cloud. We simply get online and sign in from whatever computer we are on, and the home page as we last accessed it pops up. And everything is backed up in the cloud (on multiple sites) in real time. I can access my information from my laptop, my iPad, or any other computer. Everything is there. All the software is basically in the cloud, although I do have some special adaptations to allow me to work offline in planes and where an internet connection is not immediately available. But as soon as I get online, everything is immediately and automatically backed up.

My data is now more secure, and it is far harder to "hack" my computer. Crippling virus attacks, which used to occur with sad regularity, are now far, far more difficult to perpetrate. (I would have to be pretty stupid to get a virus now.)

We get 24-hour technical service and cheaper enterprise software, and my staff can now get online from anywhere. My problem now is trying to get them to stop working late at night! They are getting to be just like me – signing on "just to check in." And it doesn't matter whether they are at the office in my home or halfway around the world. The service can grow with me effortlessly – just set up another user.

As a help to the company and its people, let me introduce you. And whether you are very large or small, or if you decide to work with them or another group, you should check out migrating your work to the cloud. It is way cool up here. A3 has a short introductory video, and Andre would be glad to talk with you. Go to www.A3Cloud.

Newport, Gloucester, Denver, and Maine

This very moment I am on a rather bumpy airplane ride somewhere over India. In about 8-9 hours we land in Frankfurt, which is long enough for me to actually hit the send button and make my Chinese translator, Shadow, happy. (I rather like that name, and it is an analog of her Chinese name).

I will get in to NYC about noon and then go to the Loews Hotel and just enjoy a relaxing afternoon. Then tomorrow it will be a late brunch with some like-minded biotech investors. (Like me, except that some of the have been extremely successful. Your humble analyst is hopeful that something will rub off, just being around them.)

Then I am off to Newport for a week I have long been looking forward to. I am going to get to participate in something that I find both very exciting and a unique honor. I have had the privilege of getting to know Andrew Marshall over the last few years, first in small groups and then privately. Mr. Marshall runs something called the Office of Net Assessment for the US Defense Department, and reports to the Secretary of Defense. He was appointed by Nixon in 1973, and every Secretary of Defense and US President since then has reappointed him. He is now 90 years old and shows no sign of slowing down. A few hours with him will get you right up on your toes, as he has worked with such a long list of forward-looking thinkers over the decades that it boggles the mind. He recalls seemingly every conversation. (On the matter of aging and continuing to work and keeping your act together, he is my official hero.) In the futurist world he is legend. The institutional memory he carries with him is beyond value. Essentially, the ONA develops and coordinates net assessments of the standing, trends, and future prospects of US military capabilities and potential, in comparison with those of other countries or groups of countries, so as to identify emerging or future threats or opportunities for the United States. Think of it as an internal planning think tank for the Department of Defense.

Every now and then ONA gathers a small group of thinkers to present analysis on their personal fields of expertise, and then develop a paper based on their findings. This year I have been invited to attend and speak. I will be in Rhode Island for a very full week..

My only request of them was to be able to listen to the other presentations and interact with the presenters in the evenings. They said yes. How could I not go? What kind of idiot would I be to pass this up? I get to sit in one place and listen to experts from very diverse backgrounds, hand-picked by Andy Marshall, speak on topics that will affect the future in ways I have not yet even thought about (and some I have not even considered). We will also deal with the usual topics of all kinds of technologies, geopolitics, etc.; and in the afternoons and evenings we'll gather in small groups. I will be taking notes, and I'll see what it is OK to write about and let you know.

Friday night I travel up to Gloucester to spend the evening with Dr. Woody Brock at his summer home, before catching the plane on Saturday afternoon in Boston to return to Dallas. Somewhere along the line I will need to write this letter. And then it's Denver on Monday night for a conference with my friends at Altegris, run by our friends at Financial Advisor magazine, focusing on alternative investments. And then I'm back in Dallas for a night, before heading off with youngest son, Trey, to our annual fishing week with David Kotok and all our buddies. It is one week I really look forward to. It will be interesting to do it this year just drinking nonalcoholic beer. Sigh.

I got smiles while I was in Singapore from some of the staff. I have learned that most of the ladies who read me are quite aware of the skin crème I mention every now and then, which uses skin stem cells to help your skin come alive. I get letters, and people come up all the time and tell me their stories. I know it is odd for an economist to be talking about skin crème, but when something works for this 62-year-old guy, in the daily battle to stave off the ravages of aging, I just say what the heck and do it. And the staff at OCBC made this last trip to Singapore such a fabulous delight that giving them a few bottles just seemed the right thing to do to express my appreciation. (You can find out more at www.lifelineskincare.com/ahead-curve.)

I am now in the Frankfurt airport. It really is time to hit the send button. Have a great week, and we will spend some more time on our lion hunt in future letters. Hoped you liked this theme and that it resonated with you.

Your ready to go back to Africa analyst,

By John F. Mauldin

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2012 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.