Draghi Set to Unleash SMP Program Whilst Gold and Markets Await Fed

Commodities / Gold and Silver 2012 Jul 31, 2012 - 07:35 AM GMTBy: GoldCore

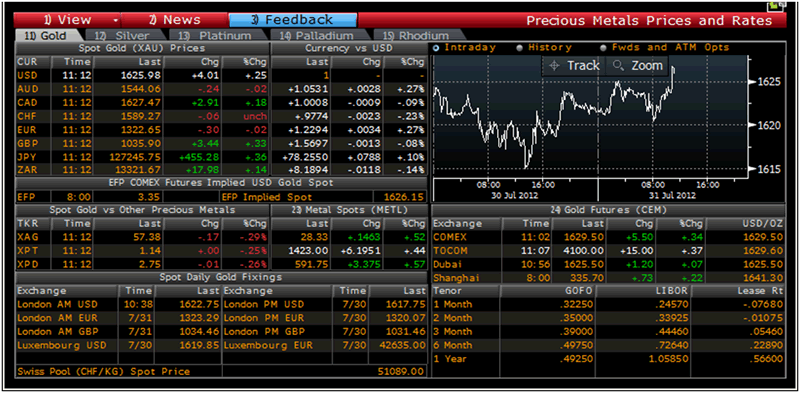

Today's AM fix was USD 1,622.75, EUR 1,323.29, and GBP 1,034.46 per ounce.

Today's AM fix was USD 1,622.75, EUR 1,323.29, and GBP 1,034.46 per ounce.

Yesterday’s AM fix was USD 1,616.50, EUR 1,317.87 and GBP 1,029.75 per ounce.

Silver is trading at $28.21/oz, €23.06/oz and £18.06/oz. Platinum is trading at $1,429.20/oz, palladium at $585.80/oz and rhodium at $1,100/oz.

Gold fell $1.30 or 0.08% in New York yesterday and closed at $1,622.10/oz. Silver pulled back to $27.53 in Asia, but then it hit a high of $28.23 in New York and ended with a gain of 1.55%.

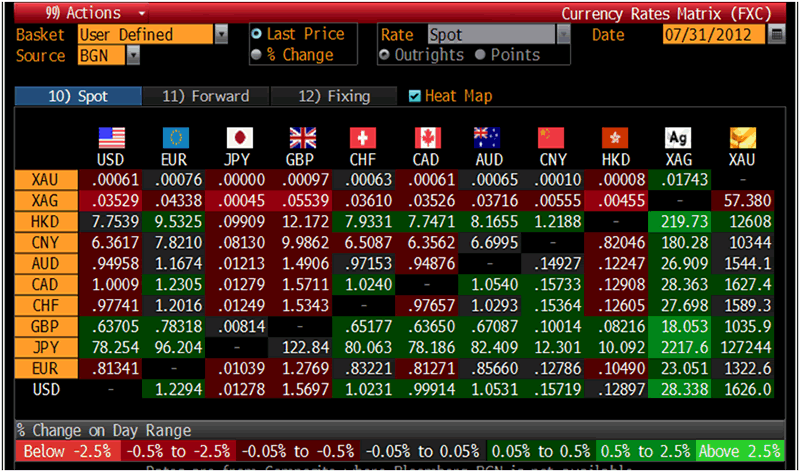

Cross Currency Table – (Bloomberg)

Gold is flat on Tuesday ahead of the US Federal Reserve's policy meeting later today where investors hope to receive some hints on the bank’s position on quantitative easing. Many analysts are not expecting large policy moves.

The US Federal Reserve Bank of Kansas City has its Jackson Hole Economic Symposium scheduled at the end of August, which will be significant for determining policy expectations ahead of the September 13th FOMC meeting. Attendees include prominent central bankers, finance ministers, academics, and financial market participants from around the world.

The European Central Bank has its policy meeting this Thursday, and because of Mario Draghi’s comments last week, some action is expected. Draghi is set to come out with a plan that involves employing the SMP (securities market program) bond-buying program coupled with EFSF/ESM purchases of Spanish and Italian bonds on primary markets. The main plan, was also confirmed by Eurogroup president Jean-Claude Juncker according to Spanish daily El Pais.

Gold Prices/Rates/Fixes /Volumes – (Bloomberg)

Today UBS analyst, Edel Tully, increased her short term gold bullion price targets. One month target $1,550 increases to $1,700 and three month target from $1,600 to $1,750. Factors for the increase include hints of action from Fed post the August Economic symposium, the next 3 months are historically the strongest for gold over the last 36 years and finally a boost from the ECB policy statement could lift the price as recently gold has been tracking the euro.

Spot silver surged to $28.28, its highest in nearly 4 weeks, before easing to $28.12. Spot palladium hit $590.75, also its highest price since the 5th of July.

In Greece, politicians in their ruling coalition are not able to reach agreement over the austerity plan and they will seek an extension of the bailout hoping to spread the cuts over a longer period. Troika officials signalled this is not acceptable. Therefore officials from the troika (European Commission, the International Monetary Fund, and the European Central Bank will stay on later than expected until a deal is finalized.

In a piece from the daily Gartman Letter, editor Dennis Gartman says, The Fed “must act at this meeting or it cannot act at all.” He mentions that this week is basically it before the looming November election in the US.

The Wall Street Journal quoted the following from Gartman’s Letter: We fear that no matter what the Fed does at the next two-day meeting its effect will be non-existent upon the economy. That is, even aggressive easing…and we do not think that likely…share have the most marginal of effects excepts perhaps upon equities prices, but we do fear that doing nothing at all shall have a detrimental effect. Thus, the Fed likely shall err upon further monetary stimulus and shall comment openly upon that fact, but it knows in its heart-of-monetary hearts that very little shall come of it.

In an uncertain world where central banks are grasping with a massive global economic contraction the value of money is in question. Quantitative easing is having less and less effect, soon inflation will take hold and when it undermines the real economy and alters consumer behaviour the only solution will be a rapid rise in interest rates.

Gold has shown time and time again that it is an essential element in an investor’s arsenal. The men in dark suits and their spin doctors will, no doubt, conjure up a series of statements exuding their confidence in the system, reasserting that their unorthodox monetary policies will deliver. The market grows weary, banks are consolidating back to their home countries, and credit is again being tightened.

Until a new order in global monetary policy is agreed upon, say a Bretton Woods II, we will continue to treat the symptoms of this imbalanced global trade model and not its causes. Gold remains a solid and independent hedge against the devaluation of fiat (paper) money and its effects.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.