Gold Production Down Another 4% In South Africa - Total Mineral Production Up 4.2%

Commodities / Gold and Silver 2012 Aug 09, 2012 - 06:02 AM GMTBy: GoldCore

Today's AM fix was USD 1,612.75, EUR 1,307.46, and GBP 1,029.79 per ounce.

Today's AM fix was USD 1,612.75, EUR 1,307.46, and GBP 1,029.79 per ounce.

Yesterday’s AM fix was USD 1,607.00, EUR 1,298.90 and GBP 1,030.33 per ounce.

Silver is trading at $27.93/oz, €22.79/oz and £17.94/oz. Platinum is trading at $1,415.75/oz, palladium at $583.80/oz and rhodium at $1,060/oz.

Gold edged up $1.20 or 0.07% in New York yesterday and closed at $1,612.80/oz. Silver dipped to $27.70 then hit a high of $28.25, then retreated and finished with loss of 0.32%.

Gold has been up and down insignificantly in Asia maintaining a price near yesterday’s close in New York and is trading near $1,612/oz at the open in Europe.

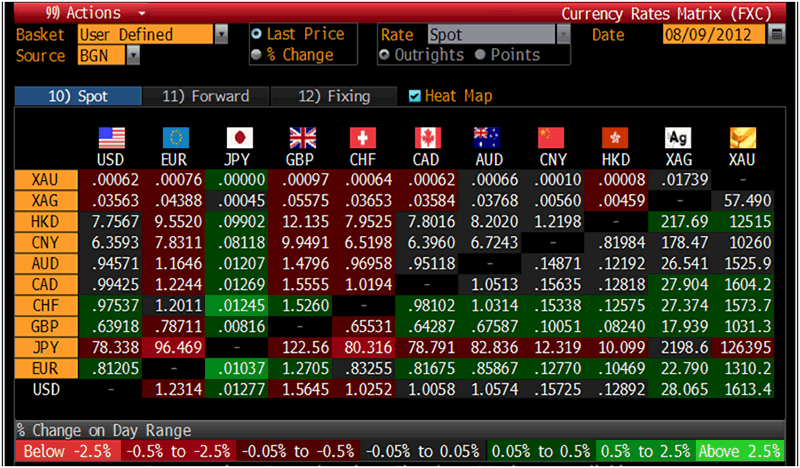

Cross Currency Table – (Bloomberg)

Gold edged up on Thursday after China's CPI slowed to a 30 month low of 1.8% in July, factory output plummeted to a 3 year low and these clues signal more QE from China in the near future.

China replaced India as the world's top gold consumer at the end of 2011. China’s gold inflows from Hong Kong increased 6 times for the first 2 quarters of 2012.

India's gold demand has been slow even during the festival season as rural buyers, who account for 60% of the gold demand from India, are holding their cash instead of buying the yellow metal. Since a lack of monsoon rains could damage their crops they are waiting on the sidelines.

The waiting game is still being played as investors are waiting for the Kansas City Fed’s annual economic symposium in Jackson Hole, Wyoming at the end of August.

Gold trading has been sluggish as many traders are waiting for more signals from central banks, many are off on holidays or enjoying watching the Olympics.

Gold futures volumes hit the 3rd day below 100,000 contracts, its lowest streak since December 2010. Open interest in gold futures hit its lowest level (388,254 contracts) since September 2009. When trading volume is very low, individual trades can have a large impact on determining gold prices as there are fewer players to accommodate the institutional order size.

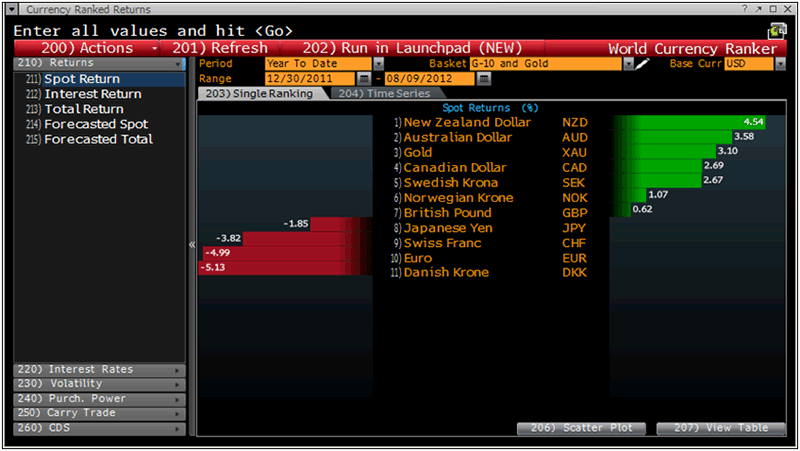

USD Currency Ranked Returns, 12/30/11-08/09/12 – (Bloomberg)

South African mining output rose by 4.2% in June, the most in 13 months, and yet South Africa's gold output fell by another 4%.

Further signs that geological constraints and peak gold production continues to take its toll on South African gold mining output.

Production of non-gold minerals was 5.3% higher, Statistics South Africa said. The increase in total South African mining output was aided by a 31% increase in iron-ore production, and a 24% gain in nickel.

Production of platinum group metals rose 4.8% in June – PGMs have the biggest weighting in the index at 27%.

Platinum’s price increase, the first increase in platinum production in a year may have been due to the nation’s biggest platinum mine ramping up production after a strike.

Impala Platinum Holdings Ltd., whose main Rustenburg mine was halted for six weeks at the start of the year by a battle for control between labor unions, said the operation averaged about 90 percent of capacity in June according to Bloomberg. The strike at the operation cost Impala, the second-biggest producer of the metal, more than 120,000 ounces of output, it said May 29.

Extremely rare and precious platinum, used in devices that cut car emissions and to make jewelry, retreated 18% in the last 12 months to $1,409/oz today.

South Africa has the world’s biggest reserves of the metal – well over 80% and resource nationalism could lead to higher platinum prices in the coming years.

Platinum is a tiny, tiny market vis-à-vis the gold market and especially vis-à-vis equity, bond and currency markets and even a little allocation by international investors to platinum could result in markedly higher prices.

Dennis Gartman has done another about turn and is again bullish on gold but nervous about the short term (see news). We agree with Dennis with regard to being bullish on gold in the medium and long term and are nervous about one last sell off prior to a resumption of the secular bull market.

Where we differ from Gartman is that we do not believe that the majority of investors (and even speculators) can profit from speculating on short term price movements and from trading in and out of positions.

Indeed, we believe that the costs to buy and sell and risk of being out of position when prices are rising means that prudent investors should adopt a "buy and hold" approach to owning gold and should own the safety of physical gold coins and bars (1 ounce format is best for divisibility and liquidity reasons) rather than derivatives, ETFs or futures.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.