Gold is the Ultimate Safehaven as Mega Shift to Hard Assets Continues

Commodities / Gold & Silver Feb 04, 2008 - 03:18 PM GMTBy: Aden_Forecast

Gold Record Highs Keep Coming!

Gold Record Highs Keep Coming!

Gold surged above $850 to new record highs as the new year began. This is exciting but gold could become even more exciting now that it's in uncharted territory.

GOLD: The little known jewel...

Most investors haven't been paying much attention to gold. Even though it's gained 28% consistently each year on average since 2001, the mainstream generally hasn't noticed.

Last year was not an exception. Gold gained 33% in 2007, which was almost five times the gains in the Dow Industrials. But surprisingly, the majority are still focused on stocks. We think that's going to change, probably this year.

Record highs always attract attention. When this happens, the market will usually start getting more media attention, investors take note and they start asking questions.

Case in point… our mom isn't interested in the markets. But recently for the first time in years she asked us about gold hitting a new high because she read about it in the local newspaper.

...AND A STRONGER PHASE HAS BEGUN

This “mom” barometer is a good one and you can bet that others are now looking at gold too. New highs attract new buyers, propelling the market quickly higher. It's very likely that gold's upward momentum will now continue to build and if it does, it wouldn't be unusual for gold to approach $1000 in the current upmove.

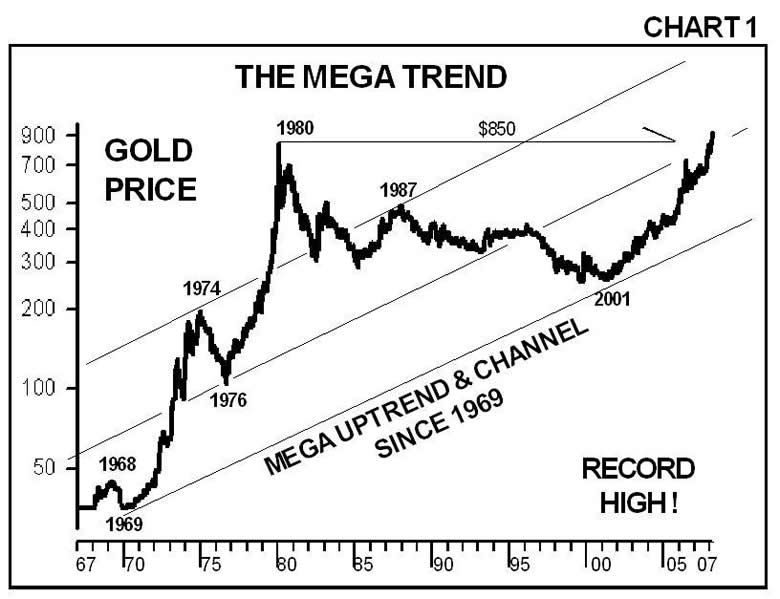

We'll see what happens. But as you can see on Chart 1 , by breaking above its 1980 high at $850, gold's potential is wide open. It's entering a stronger bull market phase and technically, gold could keep rising until it reaches the top of its nearly 40 year mega channel.

This of course could take time but that may end up being gold's ultimate upside target in this long-term, primary bull market, which has so far taken gold from $255 in 2001 to $930. And gold may go even higher if it breaks out of its channel like it did in 1980.

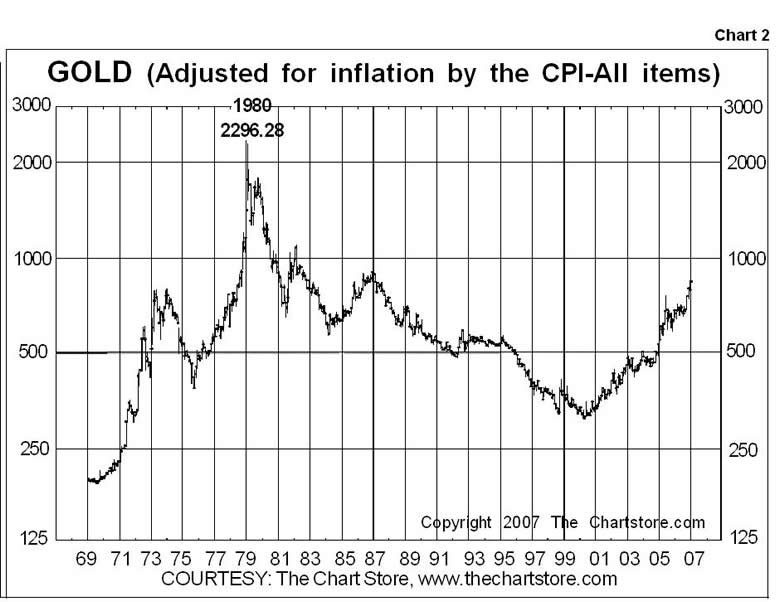

If that sounds crazy, it's not. Keep in mind that prices aren't what they used to be. In other words, gold would have to rise to about $2200 when adjusted for inflation to equal what $850 was in 1980 (see Chart 2 ). So it's all relative.

BULLISH BACKGROUND FOR GOLD

The main factors driving gold higher has been the record high oil price, along with the huge rises in food and other commodities.

Aside from oil, the price of wheat and soybeans, for instance, nearly doubled in 2007. This has fueled inflation concerns, which pushed gold higher because it's the ultimate, historical inflation hedge.

The turmoil in the credit markets has also been bullish for gold. Since it's widely expected that this will result in even lower interest rates to help boost the economy, it'll mean an ongoing U.S. dollar decline. And since gold and the dollar move in opposite directions, the declining dollar has been a big plus for gold.

GOLD IS THE ULTIMATE SAFE HAVEN...

Gold has also risen due to its safe haven status in reaction to growing international uncertainty and tensions, especially in the Middle East . But there's more, and we believe these new factors could also be important in fueling gold's bull market rise this year and beyond.

First, are the new developments in China , which has just become the world's second largest gold consumer. That is, Chinese demand is growing and in recent years we've seen what's happened to many markets when Chinese demand intensifies… they soar.

Plus, China just opened up gold futures trading and the exchange is prepared for big demand. With the Chinese stock market softening, one top fund manager expects China 's wealthiest investors will pour into the gold market, driving the price much higher.

...AND DEMAND IS GROWING

If gold ETFs are any indication, this could very well happen. streetTRACKS Gold (GLD), for instance, now has the eighth largest gold holdings in the world. And in the third quarter of 2007, ETFs bought 15% of all the gold produced.

Plus, inflows into these ETFs surged over 600% compared to a year earlier. That's very impressive and it's also establishing a solid foundation for gold's bull market.

MEGA SHIFT TO HARD ASSETS UNDERWAY

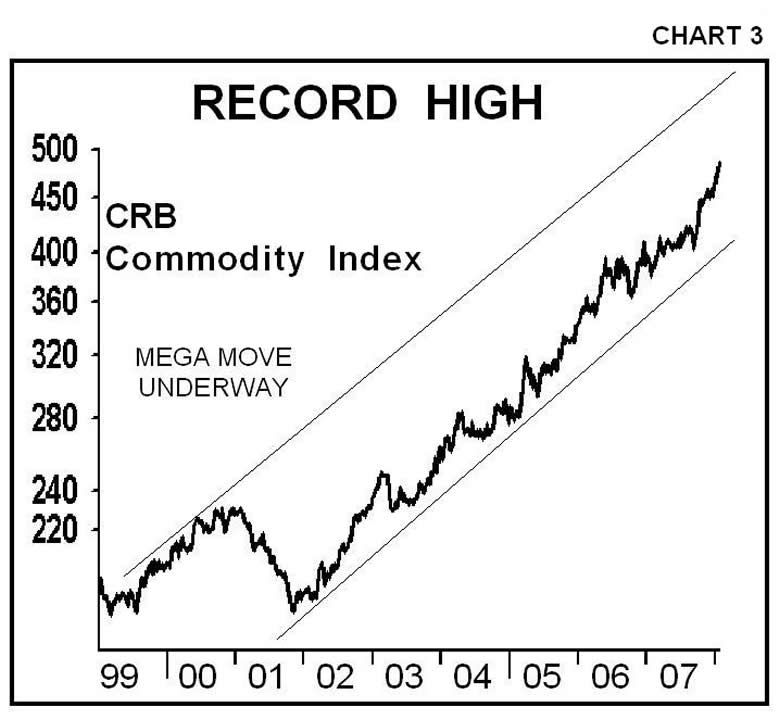

The rise in gold is part of a larger phenomenon that's been sweeping the globe. It involves a mega shift that happened in 2000 from financial assets like stocks, to hard assets like gold, other metals and commodities. These mega shifts are rare. They don't happen often and they tend to last about 20 years.

As you know, the rise in commodities has primarily been driven by the booming growth in China and other emerging nations in recent years. This has fueled massive demand for all commodities.

As these countries continue growing and expanding their infrastructure, it's going to keep pushing these markets higher in the years ahead and we believe that'll be the main factor behind this mega, multi-decade upmove in commodities, which in turn will keep upward pressure on gold.

CLIMATE CHANGE: An influence

Another factor is climate change. This too well likely become increasingly important in the years ahead, especially driving food prices higher.

The year 2007 again broke records for natural disasters, which have become more common over the past decade or so. Unfortunately, the world has been very slow to take action on global warming, despite all the evidence and emerging facts.

Last year, for instance, England had it hottest April in nearly 350 years and there were droughts in Asia , Australia , Africa , the U.S. and Europe . Dry weather pushed soybeans to a 34 year high, and it drove up the price of corn and other commodities (see Chart 3 ). Again, we'll likely be seeing more of this in the upcoming years.

The point is, gold has been a super, consistently profitable investment for years. It's in a long-term bull market rise. The major trend is clearly up and it's strong. The fundamentals are solid, the technicals look great and as long as that's the case, gold is headed much higher.

By Mary Anne & Pamela Aden

Mary Anne & Pamela Aden are well known analysts and editors of The Aden Forecast, a market newsletter providing specific forecasts and recommendations on gold, stocks, interest rates and the other major markets. For more information, go to www.adenforecast.com

Aden_Forecast Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.